Navigating the world of life insurance can be challenging, especially for those with a history of cancer. This guide aims to shed light on the options available for cancer patients seeking life insurance. It will explore the various providers and policies tailored to meet their specific needs, ensuring they can find the right coverage to protect their loved ones and themselves. Understanding the unique considerations and benefits of these specialized insurance plans is crucial for making informed decisions.

What You'll Learn

- Affordable Options: Explore affordable life insurance plans for cancer patients with specialized coverage

- Specialized Providers: Identify insurance companies offering tailored policies for cancer survivors

- Underwriting Process: Understand the underwriting process for cancer patients to get approved

- Policy Benefits: Compare benefits and coverage options for cancer patients in life insurance

- Financial Planning: Plan for financial security with life insurance tailored to cancer patients' needs

Affordable Options: Explore affordable life insurance plans for cancer patients with specialized coverage

When it comes to finding life insurance for cancer patients, it's important to explore options that offer specialized coverage and are tailored to your unique needs. Cancer can significantly impact an individual's health and financial situation, making it crucial to find insurance plans that provide adequate protection. Here are some affordable and specialized life insurance options to consider:

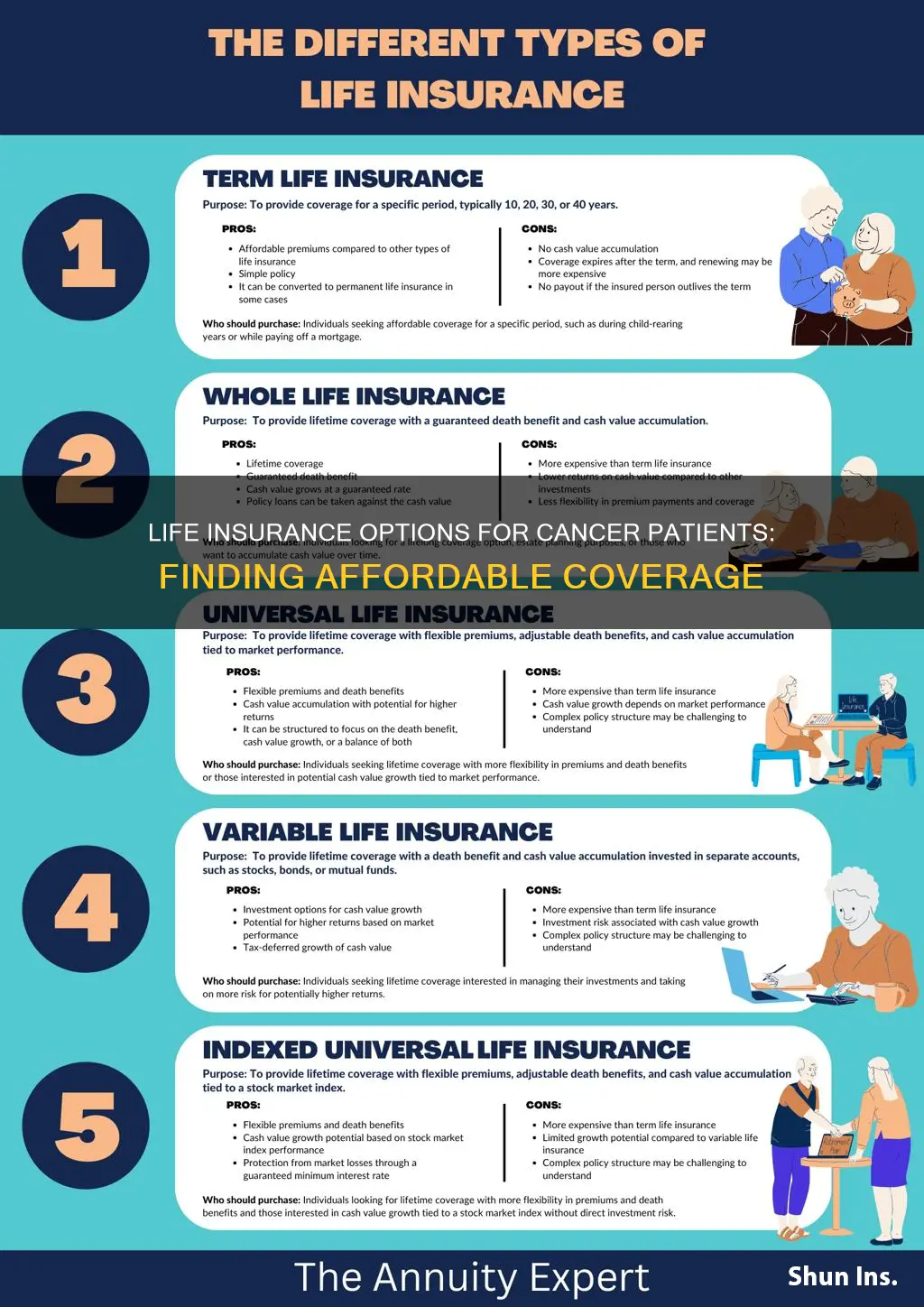

Term Life Insurance with Cancer Rider: One of the most affordable and comprehensive options is term life insurance with a cancer rider. This type of policy provides a standard term of coverage, typically 10, 20, or 30 years, and offers an additional benefit if the insured is diagnosed with cancer during the policy period. The cancer rider can provide financial security by ensuring that the policyholder receives a lump sum payment or ongoing income if cancer treatment is required. This option is particularly suitable for cancer patients who want a straightforward and cost-effective solution.

Whole Life Insurance with Cancer Endorsement: Whole life insurance offers permanent coverage, ensuring that the policy remains in force for the insured's entire life. By adding a cancer endorsement, you can customize the policy to include coverage specifically for cancer-related diagnoses. This type of insurance provides a guaranteed death benefit and can be tailored to meet your financial goals. While it may be more expensive than term life, the long-term coverage and specialized rider make it an attractive choice for cancer patients seeking affordable and comprehensive protection.

Graduate Life Insurance: This type of policy is designed for individuals with pre-existing conditions, including cancer. Graduate life insurance allows you to increase your coverage amount over time as your health improves. Initially, you may be offered a lower coverage amount at an affordable premium, and as your health status changes, you can graduate to a higher coverage level. This option provides flexibility and ensures that your insurance keeps up with your evolving needs and health improvements.

Specialized Cancer Insurance: Some insurance companies offer standalone cancer insurance policies, which provide coverage specifically for cancer-related treatments and diagnoses. This type of policy can be tailored to your individual needs and may offer more comprehensive coverage for cancer-related expenses. While it might be more expensive than standard life insurance, it provides specialized protection that can be invaluable during cancer treatment.

When exploring these options, it's essential to compare quotes from multiple insurance providers to find the most affordable and suitable plan. Additionally, consider consulting with a financial advisor or insurance specialist who can guide you through the process and help you make an informed decision based on your specific circumstances and budget. Remember, finding the right life insurance for cancer patients involves understanding your unique needs and choosing a plan that provides the necessary coverage at a price you can afford.

Whole Life Insurance: Breaking Even Reasonable?

You may want to see also

Specialized Providers: Identify insurance companies offering tailored policies for cancer survivors

When searching for life insurance options as a cancer survivor, it's crucial to explore specialized providers who understand the unique challenges and risks associated with your condition. These insurance companies offer tailored policies designed specifically for individuals with a cancer history, ensuring you receive the coverage you need with peace of mind. Here's how to identify and connect with these specialized providers:

Research and Online Search: Begin your journey by conducting an online search for "life insurance for cancer survivors." This initial step will provide you with a list of insurance companies that cater to this specific demographic. Look for companies that explicitly mention cancer survivors in their marketing materials or website content. Many reputable insurance providers now offer specialized policies to meet the demands of this growing market.

Specialized Insurance Companies: Several insurance companies specialize in providing coverage for individuals with pre-existing conditions, including cancer. These companies often have a deeper understanding of the medical complexities involved and can offer more comprehensive policies. Examples of such providers include [Company A], known for its comprehensive cancer survivor policies, and [Company B], which provides tailored coverage for various health conditions, including cancer. Their websites often feature detailed information about their cancer-specific policies.

Brokerage and Referral Services: Consider engaging the services of a life insurance broker or financial advisor who specializes in pre-existing condition coverage. These professionals have access to a wide range of insurance providers and can help you navigate the options available. They can also provide valuable advice on choosing the right policy based on your specific health history and needs. Many brokers have established relationships with specialized insurance companies, ensuring you receive the best possible advice and options.

Online Reviews and Testimonials: As you research, pay attention to online reviews and testimonials from cancer survivors who have utilized these specialized insurance policies. Real-life experiences can provide valuable insights into the quality of coverage, claims processing, and overall customer satisfaction. Positive reviews from cancer survivors can be a strong indicator of a reliable and reputable insurance provider.

Personalized Approach: Specialized insurance companies often take a personalized approach to underwriting, considering individual health histories and treatment plans. They may offer flexible policy terms, including extended coverage periods and customized benefit amounts. This tailored approach ensures that cancer survivors can access the financial protection they need during and after their treatment journey.

By focusing on these specialized providers, you can find life insurance policies that are not only affordable but also provide the necessary support and coverage for your specific circumstances as a cancer survivor. Remember, the key is to work with insurers who understand the unique challenges and risks associated with cancer, ensuring a more accurate assessment of your needs.

Understanding Life Insurance: A Comprehensive Guide to Its Benefits

You may want to see also

Underwriting Process: Understand the underwriting process for cancer patients to get approved

The underwriting process for life insurance can be particularly challenging for individuals with a history of cancer, as insurers need to carefully assess the risk associated with providing coverage. When applying for life insurance as a cancer survivor, it's essential to understand the steps involved in the underwriting process to increase your chances of approval. Here's a detailed breakdown:

Medical Information and History: The underwriting process begins with a thorough review of your medical history, especially if you've been diagnosed with cancer. Insurers will request detailed medical records, including diagnosis, treatment plans, surgeries, and any follow-up care. They may also ask for information about the type of cancer, stage at diagnosis, treatment duration, and any ongoing or past side effects. Providing accurate and up-to-date medical documentation is crucial to ensure a fair assessment.

Risk Assessment: Underwriters will evaluate the risk associated with your cancer history. They consider factors such as the type and stage of cancer, treatment success, and any residual health issues. For example, a survivor of early-stage breast cancer with no recurrence may be considered lower risk compared to someone with a more aggressive cancer or ongoing health complications. The underwriting team will also assess your overall health, including any current or past medical conditions, as these can impact the insurance company's decision.

Specialized Underwriting: Some insurance companies offer specialized underwriting for cancer survivors, recognizing the unique challenges and risks associated with this condition. These programs often provide tailored coverage options and may consider factors beyond just the cancer diagnosis. They might take into account your overall health, lifestyle, and any ongoing treatments. Specialized underwriting can result in more favorable terms and rates for cancer patients.

Waiting Periods and Restrictions: Depending on the insurance company and the extent of your cancer history, there may be waiting periods before full coverage is provided. During this time, you might have limited coverage or no coverage at all. Additionally, certain activities or hobbies that pose a higher risk, such as skydiving or extreme sports, may be restricted or prohibited during the waiting period. It's essential to disclose all relevant information to the insurer to ensure accurate underwriting.

Customized Quotes and Options: After the underwriting review, the insurance company will provide customized quotes based on your specific circumstances. The rates and coverage options will vary depending on the severity of your cancer history, overall health, and the insurer's underwriting guidelines. It's advisable to compare quotes from multiple insurers to find the best coverage and rates for your situation.

Partner Power: Kotak's Agency Partners Explained

You may want to see also

Policy Benefits: Compare benefits and coverage options for cancer patients in life insurance

When considering life insurance for cancer patients, it's essential to understand the unique benefits and coverage options available to ensure you make an informed decision. Here's a detailed breakdown of the policy advantages tailored for individuals with cancer:

Enhanced Coverage for Cancer Patients: Life insurance companies often recognize the specific health challenges faced by cancer patients. As a result, they offer specialized policies with higher coverage amounts. These policies typically provide a larger death benefit, ensuring that your loved ones receive adequate financial support in the event of your passing. The increased coverage can be particularly crucial for cancer patients, as medical expenses and treatment costs can be substantial.

Customized Premiums: Insurance providers may offer flexible premium structures to accommodate the varying financial situations of cancer patients. This flexibility can include the option to pay premiums monthly, quarterly, or annually, making it more manageable for individuals with limited financial resources. Additionally, some insurers might provide discounts or reduced rates for cancer survivors who have successfully completed treatment, encouraging long-term financial planning.

Accelerated Benefits for Cancer-Related Deaths: Certain life insurance policies designed for cancer patients offer accelerated benefits. This means that if the insured individual passes away due to cancer, the beneficiaries can receive a portion of the death benefit immediately. This provision provides financial support during a challenging time, allowing beneficiaries to cover immediate expenses and provide financial security for their loved ones.

Long-Term Support and Monitoring: Some insurance companies provide additional support and monitoring for cancer patients. This may include regular check-ins to assess your health and well-being, especially if you are in remission or have a history of cancer. The insurer might also offer resources and guidance on managing the financial implications of cancer treatment, ensuring that you have the necessary support throughout your journey.

Peace of Mind and Financial Security: Perhaps the most significant benefit is the peace of mind that comes with knowing your loved ones are financially protected. Cancer patients and their families can focus on recovery and quality of life, knowing that the insurance policy provides a safety net. This financial security can cover various expenses, including medical bills, funeral costs, and daily living expenses, ensuring that your loved ones are cared for even in your absence.

When comparing life insurance policies for cancer patients, it's crucial to review the terms and conditions, including any exclusions or limitations. Understanding the coverage options and benefits will enable you to choose a policy that best suits your needs and provides the necessary support for you and your family.

Lender-Offered Life Insurance: What You Need to Know

You may want to see also

Financial Planning: Plan for financial security with life insurance tailored to cancer patients' needs

When considering financial planning for cancer patients, life insurance is a crucial aspect to explore. It provides a safety net and peace of mind, ensuring that your loved ones are financially protected in the event of your passing. Here's a comprehensive guide to help you navigate the process:

Understanding Cancer-Specific Life Insurance:

Cancer patients often face unique challenges when applying for traditional life insurance. Standard policies may not adequately cover the specific risks associated with cancer, such as pre-existing conditions or potential treatment-related complications. Therefore, it's essential to look for specialized insurance options.

Research and Compare Options:

Start by researching insurance providers that offer coverage tailored to cancer patients. Many companies now provide life insurance policies designed to accommodate individuals with pre-existing health conditions, including cancer. Compare different providers and their offerings to find the best fit for your needs. Look for policies that consider your cancer type, treatment history, and overall health status.

Consultation and Medical Assessment:

Most insurance companies will require a medical assessment to evaluate your health and determine the appropriate coverage. Be transparent about your cancer history and current health status during this process. Some insurers may offer guaranteed acceptance for certain types of cancer, especially if the diagnosis is recent and treatment is ongoing.

Tailored Coverage:

When selecting a policy, consider the following:

- Death Benefit: Choose a death benefit that provides sufficient financial support for your family's needs, including mortgage payments, education expenses, and daily living costs.

- Policy Type: Decide between term life insurance (for a specific period) or permanent life insurance (with cash value accumulation). Term life is often more affordable for cancer patients and can be extended or converted to permanent coverage if needed.

- Additional Benefits: Some policies offer additional perks like critical illness coverage or disability insurance, providing extra financial support during and after cancer treatment.

Application Process:

The application process may involve providing detailed medical information, including cancer diagnosis, treatment plans, and any relevant medical records. Be prepared to answer questions about your health history accurately. Some insurers might offer simplified applications or guaranteed issue policies for cancer patients, making the process more accessible.

Regular Review:

Life insurance needs can change over time, especially for cancer survivors. Regularly review your policy to ensure it remains adequate. As you age or undergo significant health changes, you may need to adjust your coverage to maintain financial security.

By taking the time to research and understand the options available, you can secure life insurance that provides the necessary financial protection for yourself and your loved ones. Remember, early planning can make a significant difference in ensuring long-term financial security.

Life Insurance Options for People with Lung Cancer

You may want to see also

Frequently asked questions

Many insurance companies now offer specialized life insurance policies for individuals with a history of cancer. These policies are designed to provide coverage despite the pre-existing condition. You can explore options through independent insurance brokers or directly contact insurance providers that specialize in high-risk or pre-existing condition coverage.

Yes, insurance companies often have specific criteria and limitations for cancer patients. The type and stage of cancer, as well as the treatment history, can influence the terms and conditions. Some insurers may require a medical examination and may offer coverage with certain exclusions or limitations. It's important to disclose your cancer history and provide detailed medical information to get an accurate assessment and quote.

Getting competitive rates and comprehensive coverage may require some research and comparison shopping. Consider consulting with a financial advisor or insurance specialist who has experience in this area. They can help you understand your options, navigate the application process, and potentially find insurers who are more accommodating to your specific health situation. Additionally, maintaining a healthy lifestyle post-cancer treatment can also positively impact your insurance rates.