Life insurance is a financial protection tool that provides a safety net for individuals and their families in the event of the insured's death. It offers a way to secure financial stability and peace of mind by ensuring that loved ones are cared for and debts are covered. The concept of life insurance revolves around the idea of risk management, where an individual (the insured) pays a premium to an insurance company in exchange for a policy that promises a lump sum payment (the death benefit) to designated beneficiaries upon the insured's passing. This benefit can help cover various expenses, such as mortgage payments, funeral costs, and daily living expenses, ensuring that the family's financial obligations are met even if the primary breadwinner is no longer present. Understanding the different types of life insurance, such as term life and permanent life, is essential to choosing the right coverage for one's specific needs and circumstances.

What You'll Learn

- Definition: Life insurance is a contract between an insurer and an individual, providing financial protection for beneficiaries upon the insured's death

- Types: Term life, whole life, universal life, and variable life are common types of insurance policies

- Benefits: It offers financial security to dependents, covers final expenses, and can be used for estate planning

- Cost: Premiums are determined by age, health, lifestyle, and coverage amount

- Claims: The process involves submitting a death certificate and other documentation to the insurer for benefit payout

Definition: Life insurance is a contract between an insurer and an individual, providing financial protection for beneficiaries upon the insured's death

Life insurance is a financial safety net designed to provide financial security and peace of mind for individuals and their loved ones. It is a contract, or agreement, between an insurance company (the insurer) and a policyholder (the individual who purchases the insurance). This contract outlines the terms and conditions under which the insurer will provide financial protection to the policyholder's beneficiaries in the event of the policyholder's death.

The primary purpose of life insurance is to offer financial protection and support to those who depend on the insured individual. When the insured person passes away, the life insurance policy comes into effect, and the insurer pays out a predetermined sum of money, known as the death benefit, to the designated beneficiaries. These beneficiaries can be family members, partners, or any other individuals named in the policy. The death benefit can be used to cover various expenses and financial obligations that may arise following the insured's death, such as funeral costs, outstanding debts, mortgage payments, or the daily living expenses of dependent family members.

In this contract, the insurer assesses the risk associated with insuring the individual and sets a premium, which is the cost of the insurance policy. The premium is typically paid annually, monthly, or in other agreed-upon installments. The insurer considers factors such as the insured's age, health, lifestyle, and any pre-existing medical conditions when determining the premium. A higher risk profile may result in a higher premium, as the insurer needs to compensate for the increased likelihood of a claim.

Life insurance policies can be categorized into different types, including term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years, and is often chosen for its simplicity and affordability. On the other hand, permanent life insurance, also known as whole life or universal life insurance, offers lifelong coverage and includes a savings component, allowing the policy to accumulate cash value over time.

In summary, life insurance is a vital financial tool that ensures financial stability and security for individuals and their families during challenging times. It provides a safety net by offering a financial payout to beneficiaries when the insured individual passes away, helping to cover essential expenses and maintain the financial well-being of the loved ones left behind.

Life Insurance Termination: What You Need to Know

You may want to see also

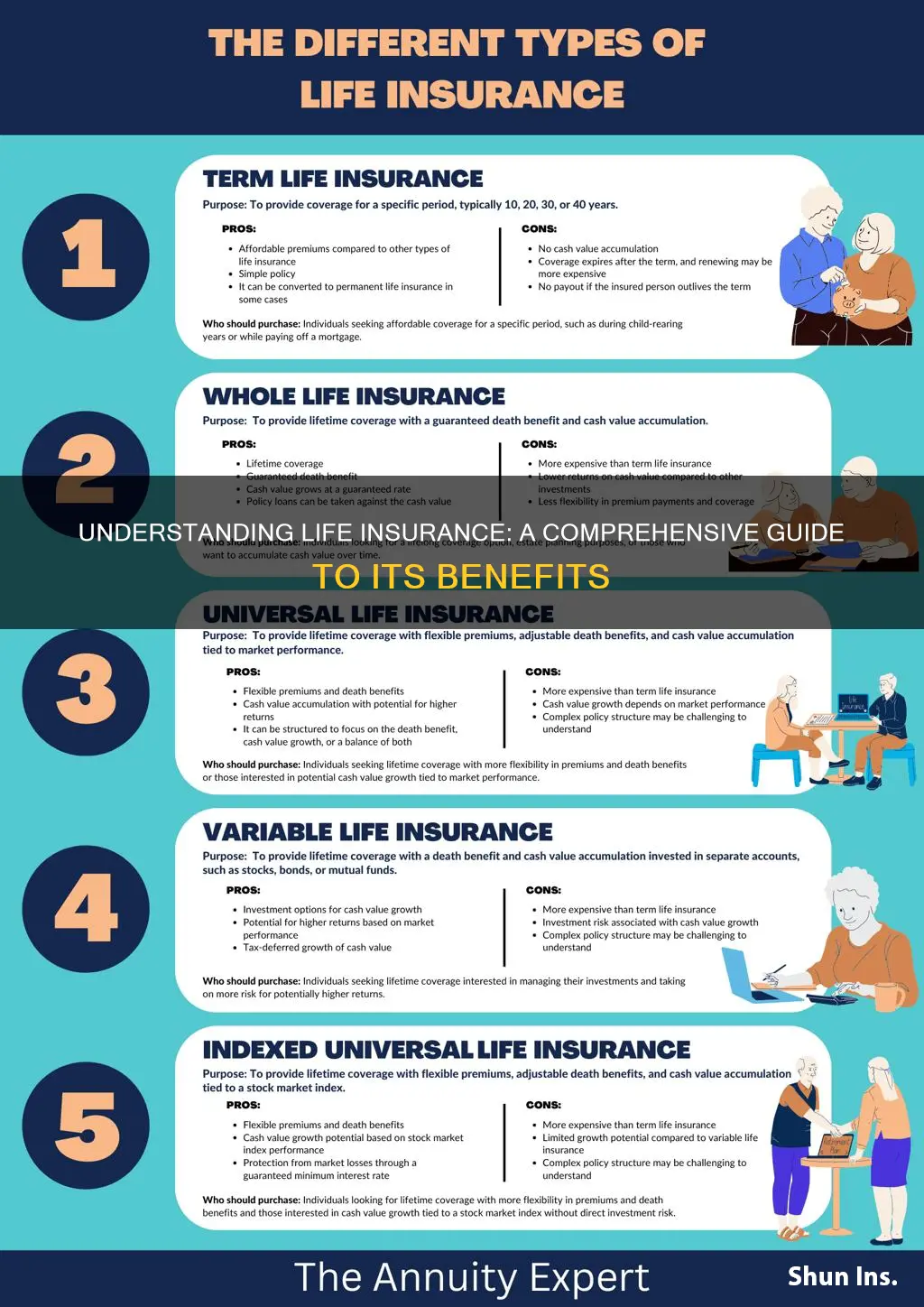

Types: Term life, whole life, universal life, and variable life are common types of insurance policies

Life insurance is a financial product designed to provide financial protection and peace of mind to individuals and their families. It is a contract between an insurance company and an individual, where the insurer promises to pay a designated beneficiary a sum of money upon the insured person's death. This coverage can help ensure that loved ones are financially secure in the event of the insured's passing. There are several types of life insurance policies, each with its own unique features and benefits. Understanding these types is essential for individuals to choose the right coverage that aligns with their financial goals and needs.

Term Life Insurance: This is a straightforward and affordable type of life insurance. It provides coverage for a specified term, typically 10, 20, or 30 years. During this period, the policyholder pays a fixed premium, and in return, the insurer guarantees a death benefit if the insured person passes away within the term. Term life insurance is ideal for those who want coverage for a specific period, such as until a child is financially independent or a mortgage is paid off. It offers a simple and cost-effective solution for temporary protection.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a guaranteed death benefit and accumulates cash value over time. Policyholders pay premiums that are typically higher than term life but remain consistent throughout the policy's duration. The cash value can be borrowed against or withdrawn, providing financial flexibility. Whole life insurance is suitable for those seeking long-term financial security and a consistent premium payment structure.

Universal Life Insurance: This type of policy offers flexibility in premium payments and death benefit amounts. Policyholders can adjust their premiums and death benefits within certain limits. Universal life insurance provides permanent coverage and also builds cash value, which can be borrowed against or used to increase the death benefit. It is well-suited for individuals who want the option to customize their coverage and potentially accumulate savings.

Variable Life Insurance: Variable life insurance combines the features of permanent coverage with an investment component. Policyholders can choose how to allocate their premiums between insurance protection and various investment options. The death benefit and cash value can fluctuate based on the performance of the investments. This type of policy is attractive to those who want to potentially earn higher returns on their premiums and have more investment control.

Each of these life insurance types caters to different financial needs and preferences. Term life is ideal for temporary coverage, while whole life provides permanent protection. Universal and variable life insurance offer flexibility and investment opportunities. When choosing a life insurance policy, it is crucial to consider factors such as the desired coverage period, financial goals, and the level of customization required. Consulting with a financial advisor can help individuals make an informed decision and select the most suitable type of life insurance to protect their loved ones and financial well-being.

Life Insurance Proceeds: Oklahoma's Tax Laws Explained

You may want to see also

Benefits: It offers financial security to dependents, covers final expenses, and can be used for estate planning

Life insurance is a crucial financial tool that provides a safety net for individuals and their loved ones. One of its primary benefits is offering financial security to dependents. When a person purchases life insurance, they essentially create a financial safety net for their family or beneficiaries. In the event of the insured individual's death, the life insurance policy pays out a death benefit, which can be a substantial sum of money. This financial support ensures that the dependents can maintain their standard of living, cover daily expenses, and even achieve long-term financial goals, such as sending children to college or purchasing a home. It provides peace of mind, knowing that the family's financial well-being is protected.

Moreover, life insurance is an excellent way to cover final expenses. When an individual passes away, there are often significant costs associated with funeral arrangements, burial or cremation services, and other end-of-life expenses. These costs can be overwhelming for the deceased's family, especially during an already emotionally challenging time. With life insurance, the policyholder can designate a portion of the death benefit to cover these final expenses, ensuring that the family is not burdened with additional financial strain. This aspect of life insurance provides a practical solution to a difficult situation.

In addition to financial security and covering final expenses, life insurance is a valuable asset for estate planning. It can be an essential component of a comprehensive financial strategy. By including life insurance in an estate plan, individuals can ensure that their assets are distributed according to their wishes. The death benefit can be used to pay off any debts or outstanding loans, and the remaining amount can be left to beneficiaries as part of the estate. This allows for a more efficient and controlled transfer of wealth, ensuring that the insured individual's intentions are met and reducing potential conflicts among heirs.

Life insurance also provides flexibility in estate planning. Policyholders can choose the amount of coverage and the beneficiaries, allowing for personalized planning. This flexibility enables individuals to adapt their life insurance strategy as their circumstances change, such as when starting a family, purchasing a home, or reaching retirement. Regularly reviewing and adjusting life insurance policies can ensure that they remain aligned with one's evolving financial goals and family structure.

In summary, life insurance is a powerful tool that offers financial security, covers essential final expenses, and facilitates effective estate planning. It provides a safety net for dependents, ensuring their financial well-being, and helps manage the practical and emotional challenges associated with the end of life. By incorporating life insurance into a comprehensive financial plan, individuals can achieve peace of mind and ensure a more secure future for their loved ones.

Life Insurance: Divorced Parents, Long-Term Kid Security

You may want to see also

Cost: Premiums are determined by age, health, lifestyle, and coverage amount

Life insurance is a financial product that provides protection and peace of mind for individuals and their families. When considering life insurance, it's essential to understand the various factors that influence its cost, specifically the premiums. These premiums are the regular payments made by the policyholder to the insurance company in exchange for the coverage provided.

The cost of life insurance premiums is primarily determined by several key factors. Firstly, age plays a significant role. Younger individuals typically pay lower premiums as they are considered less risky by insurance providers. This is because younger people have a longer life expectancy, and the likelihood of making a claim is lower. As individuals age, the risk of health issues and mortality increases, leading to higher premiums.

Health and lifestyle choices are also critical considerations. Insurance companies assess the overall health of potential policyholders, including medical history, current health conditions, and lifestyle habits. Non-smokers, for instance, may be offered more favorable rates compared to smokers, as smoking significantly increases the risk of various health issues. Additionally, individuals with a sedentary lifestyle or those who engage in dangerous activities may face higher premiums due to the associated health risks.

Another factor that influences premium costs is the coverage amount. The coverage amount refers to the financial benefit paid out by the insurance company upon the death of the insured individual. Higher coverage amounts result in higher premiums because the insurance company is taking on a more significant financial risk. For example, a policy with a coverage amount of $500,000 may have a different premium structure compared to a policy with a coverage amount of $100,000.

In summary, life insurance premiums are tailored to individual circumstances, with age, health, and lifestyle choices being key determinants. Additionally, the desired coverage amount directly impacts the cost. Understanding these factors allows individuals to make informed decisions when choosing life insurance, ensuring they receive appropriate coverage while managing their financial resources effectively.

Understanding Cash Value Life Insurance Payouts for the Insured

You may want to see also

Claims: The process involves submitting a death certificate and other documentation to the insurer for benefit payout

When a policyholder or their designated beneficiary files a claim with the insurance company, the process of receiving the death benefit can begin. This is a crucial step in honoring the financial commitments made by the policyholder to their loved ones. The first step in this process is to obtain and submit a death certificate. This document serves as official proof of the insured individual's passing and is a mandatory requirement for initiating the claim. It is essential to ensure that the death certificate is obtained from the appropriate authority, such as a local health department or a designated registrar, and that it includes all the necessary details, including the full name, date of birth, and date of death of the deceased.

Along with the death certificate, the insurer will typically require additional documentation to support the claim. This may include a copy of the insurance policy, which outlines the terms and conditions of coverage, and any relevant beneficiary information. In some cases, the insurer might also request a certified copy of the death certificate, which is a more formal and legally recognized version of the document. This additional layer of verification ensures that the claim is processed accurately and securely.

The documentation process is designed to be straightforward, but it is important to be thorough and organized. The insurer will provide guidance on the specific documents required, and it is the responsibility of the claimant to gather and submit these documents promptly. This step is crucial as it initiates the benefit payout process and ensures that the insurance company has all the necessary information to process the claim efficiently.

Once the required documents are submitted, the insurer will review the claim. They will verify the information provided, ensuring that it aligns with the policy terms and the death certificate. If the claim is approved, the insurer will proceed with the benefit payout, which can be received by the designated beneficiary or beneficiaries as per the policy's provisions. This entire process, from the submission of documents to the final payout, typically involves close collaboration between the insurer, the claimant, and sometimes, legal representatives, to ensure a smooth and fair settlement.

In summary, the claims process for life insurance involves a structured and documented approach to claiming the death benefit. It requires the submission of essential documentation, including a death certificate, to initiate the payout process. This process is designed to provide financial support to the insured individual's beneficiaries, ensuring that the policy's promises are fulfilled during a challenging time.

Protective Life Insurance: Exam-Free Option for Policyholders

You may want to see also

Frequently asked questions

Life insurance is a financial protection tool that provides a monetary benefit to the beneficiaries upon the insured individual's death. It offers financial security to the family or designated recipients, ensuring they receive a lump sum or regular payments to cover expenses, debts, or daily living costs.

When you purchase a life insurance policy, you agree to pay a premium to the insurance company. In return, the insurer promises to pay out a death benefit to your chosen beneficiaries when you pass away. The policy can be term life, providing coverage for a specific period, or permanent life, offering lifelong coverage with an investment component.

Term life insurance is a temporary policy that provides coverage for a set period, such as 10, 20, or 30 years. It offers high coverage amounts at lower premiums. Permanent life insurance, on the other hand, provides lifelong coverage and includes an investment component, allowing the policy to accumulate cash value over time.

Life insurance is beneficial for anyone who has financial responsibilities or dependents. It is especially important for those with a family to support, debts to pay off, or specific financial goals. Young adults starting their careers, parents, and individuals with long-term financial commitments often consider life insurance to ensure their loved ones' financial well-being.

Yes, it is possible to obtain life insurance even with pre-existing health conditions. However, the process may involve a medical examination and a more detailed health history review. Insurers may offer standard rates or rates based on the severity of the condition. Some companies also provide coverage for specific health issues or offer term life insurance without medical exams for shorter coverage periods.