With a life insurance license, you unlock a world of opportunities in the financial services industry. This license empowers you to offer a range of products and services, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Additionally, you can provide annuity products, retirement planning solutions, and investment advisory services. These products not only provide financial security for individuals and families but also offer the potential for significant earnings through commissions and residual income. This introduction sets the stage for exploring the various products and services that can be offered with a life insurance license, highlighting the potential for both financial security and professional success.

What You'll Learn

- Term Life Insurance: Protects against death during a specified term, offering affordable coverage

- Whole Life Insurance: Provides lifelong coverage, building cash value, and offering guaranteed death benefits

- Universal Life Insurance: Offers flexible premiums and death benefits, allowing policyholders to adjust coverage over time

- Variable Universal Life Insurance: Combines life insurance with investment options, allowing for potential higher returns

- Annuities: Tax-deferred savings vehicles offering guaranteed income for retirement or other financial goals

Term Life Insurance: Protects against death during a specified term, offering affordable coverage

Term life insurance is a popular and straightforward product that individuals can purchase to protect their loved ones in the event of their untimely passing. This type of insurance provides a financial safety net by offering a death benefit to the policyholder's beneficiaries if the insured individual dies during the specified term or period covered by the policy. The beauty of term life insurance lies in its simplicity and affordability, making it an attractive option for those seeking comprehensive coverage without breaking the bank.

When considering term life insurance, it's essential to understand the duration of coverage, which is a key differentiator from other life insurance products. The term can vary, typically ranging from 10 to 30 years, and even longer in some cases. During this specified term, the insurance company promises to pay out the predetermined death benefit if the insured individual passes away. This makes it an ideal choice for individuals who want to provide financial security for their families over a defined period, such as until their children finish college or until they reach a certain age.

One of the advantages of term life insurance is its cost-effectiveness compared to permanent life insurance policies. The premiums are generally lower because the coverage is limited to a specific period. This affordability factor allows individuals to purchase higher coverage amounts without straining their budgets. For instance, a 30-year-old purchasing a $500,000 term life insurance policy with a 20-year term might pay significantly lower premiums compared to a permanent policy with the same coverage amount.

The process of obtaining term life insurance is relatively straightforward. Individuals can work with an insurance agent or broker who specializes in life insurance products. During the application process, the insured individual will undergo a medical examination, which may include a physical exam, blood tests, and answering health-related questions. This assessment helps the insurance company determine the individual's risk profile and set an appropriate premium rate. Once approved, the policy is issued, and the individual becomes the beneficiary of the death benefit should any unfortunate events occur during the specified term.

In summary, term life insurance is a valuable product for anyone seeking to provide financial protection for their loved ones during a specific period. Its affordability, flexibility in coverage duration, and simplicity in the application process make it an excellent choice for individuals who want to ensure their family's financial well-being without incurring excessive costs. By understanding the benefits and features of term life insurance, you can effectively communicate its value to potential clients and help them make informed decisions about their insurance needs.

Dialysis and Life Insurance: What's the Connection?

You may want to see also

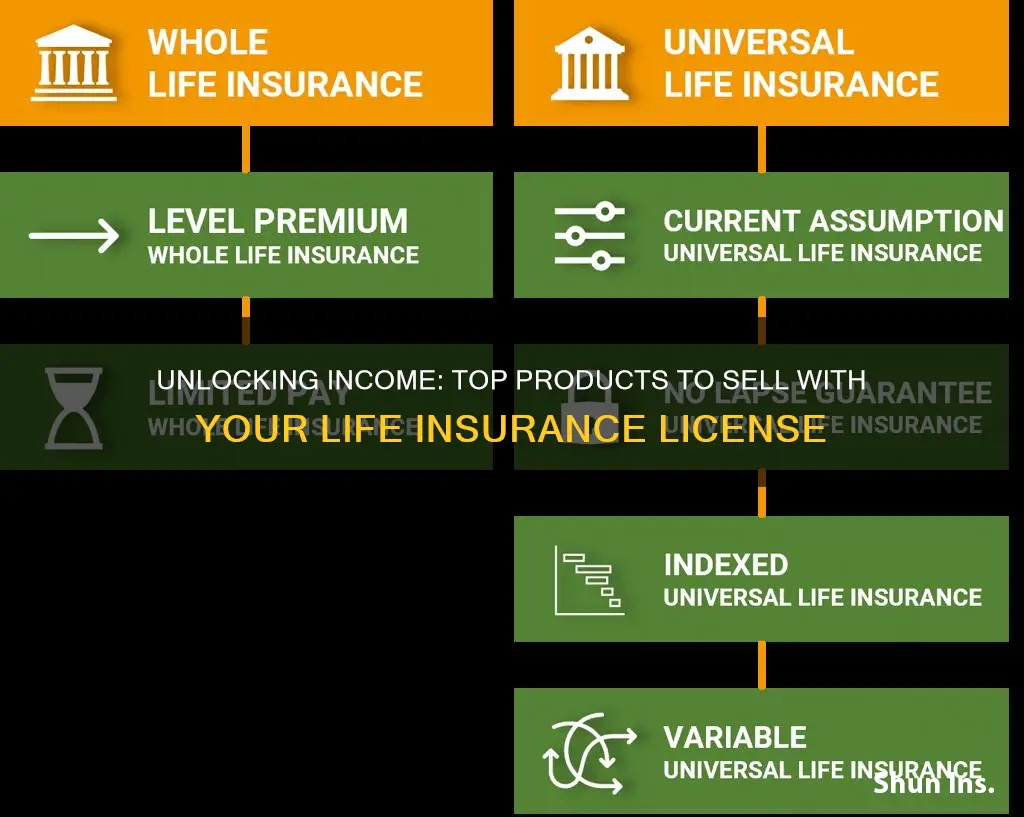

Whole Life Insurance: Provides lifelong coverage, building cash value, and offering guaranteed death benefits

Whole life insurance is a type of permanent life insurance that offers a range of benefits that make it a valuable product for individuals and their families. One of the key advantages of whole life insurance is that it provides lifelong coverage, ensuring that your loved ones are protected even in the long term. This is in contrast to term life insurance, which only provides coverage for a specified period. With whole life insurance, you can rest assured that your family will have financial security for the entire duration of your life.

Another significant feature of whole life insurance is its ability to build cash value over time. As you make regular premium payments, a portion of each payment goes towards building a cash reserve. This cash value can be borrowed against or withdrawn, providing you with a source of funds that can be used for various purposes, such as starting a business, funding education, or covering unexpected expenses. The cash value also grows tax-deferred, allowing it to accumulate over the years.

The guaranteed death benefit is a critical aspect of whole life insurance. When you pass away, the insurance company will pay out the death benefit amount to your designated beneficiaries. This guaranteed payout ensures that your family receives the financial support they need during a difficult time. The death benefit is typically fixed and agreed upon at the time of policy issuance, providing certainty and peace of mind.

Whole life insurance policies are designed to remain in force for the entire lifetime of the insured individual, hence the term "whole life." This means that as long as the premiums are paid, the coverage will continue, and the cash value will grow. Unlike term life insurance, which has a limited duration, whole life insurance offers long-term financial security and can be a valuable asset in your financial portfolio.

When considering whole life insurance, it's essential to evaluate your specific needs and financial goals. Consulting with a licensed insurance professional can help you understand the various options available and choose the policy that best suits your requirements. They can guide you through the process, ensuring that you select the appropriate coverage amount, rider options, and policy features to meet your objectives.

How to Cancel a Life Insurance Application

You may want to see also

Universal Life Insurance: Offers flexible premiums and death benefits, allowing policyholders to adjust coverage over time

Universal life insurance is a versatile and powerful financial tool that can be a valuable product for individuals seeking long-term financial security and flexibility. This type of insurance offers a unique advantage by providing policyholders with the ability to customize and adjust their insurance coverage throughout their lives.

One of the key features of universal life insurance is its flexibility in premium payments. Unlike traditional term life insurance, where premiums are fixed for the duration of the policy, universal life insurance allows policyholders to make payments at their discretion. This means that individuals can choose to pay higher premiums when they have more disposable income and lower amounts when their financial situation changes. For example, a young professional might opt for higher premiums to ensure comprehensive coverage during their earning years, while a retiree could adjust the payments to match their reduced income, ensuring the policy remains affordable.

The death benefit, another critical aspect of life insurance, is also highly customizable in universal policies. Policyholders can decide the amount of death benefit they want to provide for their beneficiaries. This flexibility allows individuals to tailor the coverage to their specific needs and financial goals. For instance, someone with a large family might want to increase the death benefit to ensure their loved ones' financial stability, while a single individual with no dependents may opt for a lower benefit to keep costs manageable.

Over time, universal life insurance policies can grow cash value, which can be borrowed against or withdrawn, providing additional financial flexibility. This feature is particularly useful for those who want to access the funds for various purposes, such as starting a business, investing in property, or funding education. The policyholder can utilize the cash value while still maintaining the insurance coverage, ensuring that the death benefit remains intact when needed.

In summary, universal life insurance provides a comprehensive solution for individuals who want to take control of their financial future. With the ability to adjust premiums and death benefits, policyholders can create a personalized insurance plan that evolves with their changing circumstances. This flexibility, combined with the potential for cash value accumulation, makes universal life insurance an attractive and adaptable product for those seeking long-term financial security.

AAA Life Insurance: Cash Value or Not?

You may want to see also

Variable Universal Life Insurance: Combines life insurance with investment options, allowing for potential higher returns

Variable Universal Life Insurance (VUL) is a versatile financial product that offers a unique blend of life insurance coverage and investment opportunities, making it an attractive option for those seeking both protection and potential growth. This type of insurance provides a safety net for individuals and their families while also allowing them to participate in the financial markets. Here's a detailed look at how VUL can be a valuable offering in your portfolio:

Combining Insurance and Investment: At its core, VUL is a life insurance policy with a twist. It provides a death benefit to your beneficiaries when you pass away, ensuring financial security for your loved ones. However, what sets it apart is the investment component. The policyholder can allocate a portion of their premium payments into various investment options, such as stocks, bonds, or mutual funds. This investment aspect is what distinguishes VUL from traditional whole life insurance, where the entire premium goes towards building cash value and the death benefit.

Flexibility and Customization: One of the key advantages of VUL is the flexibility it offers. Policyholders can customize their investment strategy based on their financial goals and risk tolerance. They can choose to invest a higher percentage of their premium in stocks for potential higher returns or opt for a more conservative approach with a larger bond allocation. This flexibility allows individuals to create a tailored investment plan that aligns with their financial objectives. Over time, the policy's cash value, which grows tax-deferred, can be used to pay premiums, providing long-term financial security.

Potential for Higher Returns: The investment options within VUL policies are designed to offer the potential for higher returns compared to traditional fixed-income investments. By investing in a diversified portfolio of stocks and bonds, policyholders can benefit from the power of compounding. This means that their investments can grow exponentially over time, potentially outpacing the growth of traditional savings accounts or fixed-income securities. The performance of the investment portfolio directly impacts the policy's cash value, which can be used to enhance the death benefit or take out loans, providing financial flexibility.

Tax Advantages: Another significant benefit of VUL is the tax-deferred growth of the cash value. The earnings within the policy grow tax-free, allowing your investments to compound more efficiently. This feature can be particularly advantageous for long-term wealth accumulation, as it provides a powerful tool to build a substantial financial nest egg. Additionally, the policy's death benefit is generally tax-free, ensuring that the proceeds are received by the beneficiaries without significant tax implications.

Long-Term Financial Planning: VUL is an excellent tool for long-term financial planning. It can serve as a cornerstone of a comprehensive financial strategy, providing both insurance coverage and investment growth. Policyholders can use the policy's features to create a financial safety net while also working towards their retirement goals or other long-term financial aspirations. The ability to customize the investment strategy and the potential for higher returns make VUL a compelling choice for those seeking to optimize their financial resources.

In summary, Variable Universal Life Insurance offers a unique combination of insurance and investment opportunities, providing policyholders with the potential for higher returns and a flexible financial strategy. It is a powerful tool for individuals looking to secure their family's future while also growing their wealth over time. By understanding the features and benefits of VUL, you can effectively communicate its value to potential clients and help them make informed decisions about their financial well-being.

Understanding Cash Value Life Insurance Payouts for the Insured

You may want to see also

Annuities: Tax-deferred savings vehicles offering guaranteed income for retirement or other financial goals

Annuities are a powerful financial tool that can be an attractive offering for individuals seeking tax-efficient savings and guaranteed income during retirement. These financial products are designed to provide a steady stream of income for policyholders, making them an excellent choice for those looking to secure their financial future. When considering what products to offer with a life insurance license, annuities stand out as a valuable addition to your portfolio.

In simple terms, an annuity is a contract between an investor and an insurance company. The investor makes regular or one-time payments to the insurance company, and in return, the company promises to pay the investor a fixed income at regular intervals for a specified period or even for life. This guaranteed income stream is a significant advantage, especially for retirees who want a reliable source of cash flow. The beauty of annuities lies in their tax-deferred nature, allowing investors to grow their savings without incurring immediate tax liabilities.

There are various types of annuities available, each catering to different financial goals and risk appetites. One common type is the fixed annuity, which offers a consistent interest rate over the investment period, providing a predictable income stream. Another variant is the variable annuity, which allows investors to allocate their funds across various investment options, potentially offering higher returns but with more risk. Annuities can also be tailored to meet specific needs, such as providing a lump sum payment at a later date or offering income for a joint policyholder's lifetime.

When selling annuities, it is essential to understand the various features and benefits they offer. For instance, some annuities provide inflation protection, ensuring that the income keeps pace with rising costs. Additionally, certain annuities offer death benefits, which means the remaining death benefit amount can be paid to the annuitant's beneficiaries if the annuitant passes away before the annuity term ends. This feature provides an added layer of security for the investor's loved ones.

In summary, annuities are a tax-efficient way to save for retirement or other financial goals, offering guaranteed income and various customization options. As a life insurance professional, promoting annuities can provide clients with a reliable and secure financial solution. By understanding the different types and features of annuities, you can effectively guide clients toward making informed decisions about their long-term financial well-being.

Borrowing on Veterans Group Life Insurance: Is It Possible?

You may want to see also

Frequently asked questions

With a life insurance license, you can sell various life insurance products, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. These policies provide financial protection and coverage for individuals and their families, ensuring that beneficiaries receive a death benefit in the event of the insured's passing.

Absolutely! Life insurance licenses often allow you to sell complementary insurance products. These may include disability insurance, which provides income replacement if the insured becomes unable to work due to illness or injury; long-term care insurance, which helps cover the costs of extended care services; and critical illness insurance, offering financial support for serious medical conditions.

Yes, depending on the jurisdiction and the specific license type, you might be able to offer investment products. These could include annuities, which provide a steady income stream during retirement, and investment-linked insurance policies that combine insurance coverage with investment components. However, the scope of these investments may vary, and additional licenses or certifications might be required for certain complex financial products.

While a life insurance license primarily focuses on life coverage, it may also allow you to sell health-related insurance products. This could include health insurance plans, which provide coverage for medical expenses, and dental or vision insurance, offering additional benefits for routine healthcare.

The target age group and demographics can vary depending on the specific products and regulations. For instance, term life insurance is often more affordable and suitable for younger individuals, while whole life insurance provides lifelong coverage and may be more expensive. Additionally, certain insurance products might be tailored to specific age groups or demographics, such as senior citizens or individuals with pre-existing health conditions.