Life insurance is an agreement between yourself and an insurance company where you pay a monthly rate (premium) in exchange for a lump-sum payment to your beneficiary upon your death. You can cancel your life insurance policy at any time, but the process varies depending on whether you have term or whole life insurance. Cancelling a term life policy is straightforward, whereas cancelling a whole life policy is more complex due to its investment component. In most cases, you won't receive a refund on the premiums you've already paid. However, insurers are legally required to offer a free look period, typically lasting 10-30 days, during which you can cancel without penalties and receive a full refund.

| Characteristics | Values |

|---|---|

| Can I cancel my life insurance policy? | Yes |

| Time limit to cancel | Limited, varies by state and insurer |

| Will I get my money back? | No, unless cancelled during the "free look period" |

| How to cancel term life insurance | Call insurer, write a letter, fill out a cancellation form, or stop paying premiums |

| How to cancel whole life insurance | Contact insurer, surrender policy, choose a reduced paid-up option, or sell the policy |

| What happens if I stop paying premiums? | Insurer will cancel coverage after the grace period |

| What if I can't afford my premiums? | Reduce coverage, take a new medical exam, borrow against the policy, or sell the policy as a life settlement |

| What is the cash surrender value? | The cash value of a permanent policy that can be collected if the policy is surrendered |

| Reasons to cancel | No longer have financial dependents, paid off all debt, can't afford premiums, want to invest money elsewhere, want to collect cash value portion of policy, health has improved and been offered a better rate |

| Can my life insurance company cancel my policy? | Yes, if premiums are unpaid or the applicant lied on their application |

What You'll Learn

Cancelling term life insurance

- Stop paying premiums: You can trigger the grace period on your insurance policy by stopping your premium payments. The grace period typically lasts for 30 days, during which you have the option to make up any missed payments and keep your policy active. If you don't make any payments during the grace period, your insurance coverage will automatically end.

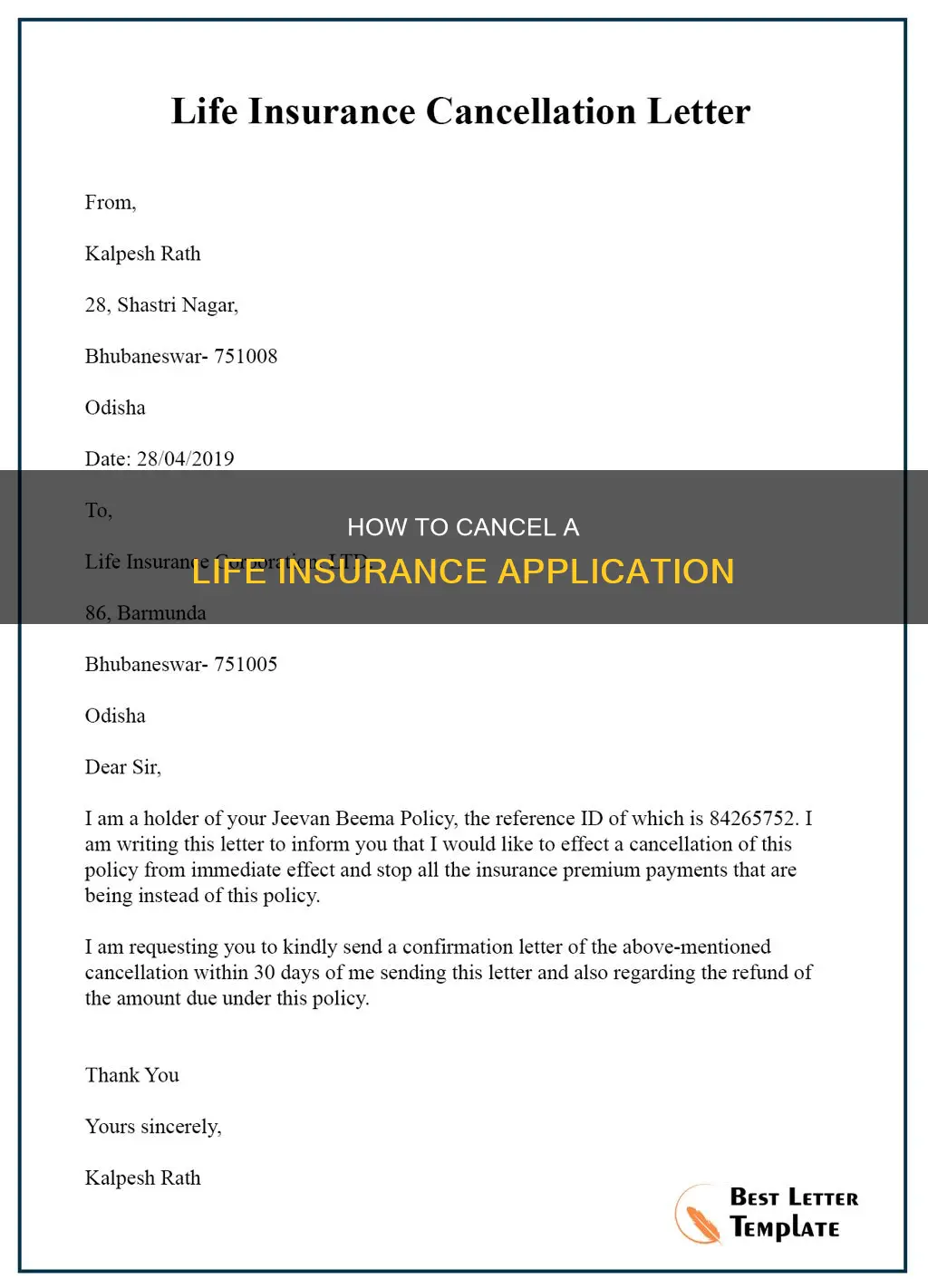

- Provide written notice: Although it is not required, you can send a letter to your insurance company notifying them of your cancellation. This can provide peace of mind and ensure a clear record of your intention to cancel.

- Contact your insurance provider: You can call your insurance company and inform them of your decision to cancel. Make sure to have your policy number handy so that an agent can guide you through the cancellation process.

It's important to note that cancelling term life insurance will result in a lapse of coverage, and you will no longer have the financial protection provided by the policy. If you're considering cancellation due to affordability or changing needs, there may be alternative options available, such as reducing the coverage amount or exploring different types of policies.

Dr. Scott Mosby: Sun Life Insurance Acceptance and Benefits

You may want to see also

Cancelling whole life insurance

Understanding Whole Life Insurance

Whole life insurance is a type of permanent life insurance that combines life insurance with an investment component. It provides lifelong coverage, with maximum coverage ages ranging from 95 to 121, and typically includes a cash value component. The cash value of the policy earns interest over time, and the policyholder can borrow against or withdraw from this cash value. However, it's important to note that borrowing against or withdrawing from the cash value can reduce the death benefit and may lead to additional fees and interest charges.

Reasons for Cancelling Whole Life Insurance

There are several reasons why an individual may consider cancelling their whole life insurance policy:

- Change in Financial Situation: An individual's financial circumstances may change, making the premiums no longer affordable. This could be due to job loss, increased expenses, or other financial obligations.

- Alternative Policies: The policyholder may have found a better policy that offers more favourable terms, such as lower premiums or additional benefits.

- Change in Life Stage: An individual may reach a stage in life where the coverage is no longer necessary. For example, if their family is grown, and their spouse or partner can manage financially without the death benefit.

- Investment Strategy: The policyholder may decide to change their investment strategy and redirect their funds to other financial vehicles, such as annuities or mutual funds, that offer higher returns.

Steps to Cancel Whole Life Insurance

- Review the Policy: Before making any decisions, carefully review the terms and conditions of your whole life insurance policy. Pay close attention to the guidelines regarding the surrender period, surrender fees, and any other applicable penalties.

- Contact the Insurance Company: Get in touch with your insurance company to discuss your intention to cancel the policy. They will guide you through their specific requirements and procedures.

- Evaluate the Cash Value and Surrender Fees: If your policy has accumulated cash value, find out the current value and how much of it you would receive after deducting any surrender fees or penalties. Surrender fees are typically higher for newer policies and may significantly reduce the cash surrender value.

- Complete the Necessary Forms: Your insurance company will likely require you to fill out surrender forms and provide supporting documentation to process the cancellation.

- Consider the Impact on Beneficiaries: Before finalizing the cancellation, carefully consider the impact on your beneficiaries. Even if your children have grown up, your spouse or other dependents may still rely on your income or pension.

- Explore Alternatives: Before making a final decision, explore alternative options such as reducing the coverage amount, using the cash value to cover premiums, or requesting a new medical exam to qualify for lower premiums.

Important Considerations

- Timing: The timing of your cancellation can impact the financial implications. Cancelling during the "free look" period, which typically lasts 10 to 30 days, allows you to receive a full refund of any premiums paid. Cancelling after this period may result in surrender fees and reduced cash value payouts.

- Fees and Penalties: Be mindful of any surrender fees, cancellation fees, and taxes that may apply when cancelling your whole life insurance policy. These fees can eat into a significant portion of the cash surrender value you receive.

- Loss of Coverage: Cancelling your whole life insurance policy will result in a loss of coverage for your beneficiaries. Carefully consider their needs and financial situation before making a decision.

- Future Insurance Needs: Keep in mind that cancelling your current policy may result in higher premiums if you decide to purchase life insurance again in the future, especially if your health conditions or lifestyle choices have changed.

Life Insurance Proceeds: Are LLCs Tax Exempt?

You may want to see also

Cancelling during the free look period

Life insurance policies typically have a free look period that lasts between 10 and 30 days after your policy goes into effect. During this time, you can cancel your policy without incurring any penalties and receive a full refund of your premiums. The free look period is a minimum of 10 days in all states, but it can be longer in some states or with certain insurance companies.

To cancel your policy during the free look period, you can contact your insurance company by phone, letter, or email. Be sure to include your full name, contact details, policy number, and the date you want to cancel your coverage. You should also cancel any automatic payments you have set up. If you don't receive a confirmation from your insurer within a few business days, be sure to follow up to ensure that your policy has been cancelled.

It's important to note that if you cancel your policy after the free look period, you may still be able to get a refund for any "unearned" premium. However, some insurance companies consider premiums "earned as received," so be sure to read the provisions of your policy carefully.

Whole Life Insurance: Taxable Distributions and Their Implications

You may want to see also

Cancelling after the surrender period

The surrender value of a life insurance policy is the amount of money you will receive from the insurance company if you cancel the policy. It is generally less than the cash value amount of the policy. Surrender value includes any surrender fees for the policy, which are taken from the cash value balance when you cancel the policy. It also consists of the amount of any outstanding loan balances on the policy. If you surrender the policy with an outstanding loan, the insurance company will usually repay the loan using your remaining cash value balance.

The surrender value of a life insurance policy is different from the cash value. Cash value is the current balance of your life insurance policy's cash value account and is based on the amount of premium you have paid. Surrender value is the amount of money you receive from the policy if you decide to cancel it. It equals the cash value balance minus any surrender fees on the policy.

If you have had the policy for 10-15 years, the surrender fees typically go away. However, if the cash value of your policy is higher than the amount you have paid into your policy, you will likely have to pay taxes on the difference.

Haven Life: Insurance Without the Medical Exam Hassle

You may want to see also

Cancelling without a refund

Cancelling your life insurance policy is a big decision that can have financial repercussions, and you will most likely not see a refund of the money you paid in premiums.

Cancelling Term Life Insurance

Cancelling term life insurance is pretty straightforward. You can simply stop making payments and your coverage will end. Alternatively, you can call or send a letter to your insurance company notifying them of the cancellation.

Cancelling Whole Life Insurance

Cancelling whole life insurance is more complex because these policies have an investment component. You will need to contact your insurer to understand your options, which may include:

- Surrendering the policy: You can collect any cash value that has accumulated, but you will likely have to pay surrender fees, especially if you cancel within the first 10 to 20 years of taking out the policy. Surrender fees are usually highest in the first two to three years and then reduce by an annual percentage over the first decade.

- Reduced paid-up insurance: You can stop paying premiums in exchange for a lower death benefit. Your beneficiaries will receive a lump sum if you die.

- Selling your policy: You can sell your policy to a third party for a one-time upfront payment. This is known as a life settlement, and the buyer becomes the beneficiary and owner of the policy, taking over premium payments. However, the payment you receive is usually less than the death benefit.

Free Look Period

By law, life insurance companies must offer a free look period, typically lasting 10 to 30 days, during which you can cancel your policy without penalties and receive a full refund of all premiums paid.

Term Life Insurance: Understanding Its Characterization

You may want to see also

Frequently asked questions

Yes, you can typically cancel your life insurance policy at any time. However, the process for cancelling a term life insurance policy and a whole/permanent life insurance policy differs. Cancelling a term life insurance policy is usually more straightforward, whereas cancelling a whole/permanent life insurance policy can be more complex and time-consuming due to their investment component.

To cancel your term life insurance policy, you can simply stop making payments, contact your insurance provider, or submit a written notice of cancellation. For whole/permanent life insurance policies, you will need to contact your insurance provider to discuss your options, which may include surrendering the policy, choosing a reduced paid-up option, or selling your policy.

In most cases, you will not receive a refund on the premiums you have paid. However, insurers are legally required to offer a free look or cooling-off period, typically lasting 10 to 30 days, during which you can cancel your policy without penalties and receive a full refund. After this period, you may still be able to get a refund for any "unearned" premium, but this varies depending on the insurer.

If you stop paying your premiums by the end of the grace period, which is usually 30 days from the premium's due date, your insurer will cancel your coverage. However, if you have a permanent/whole life insurance policy with accumulated cash value, you will lose it, so it is important to consider this before stopping payments.