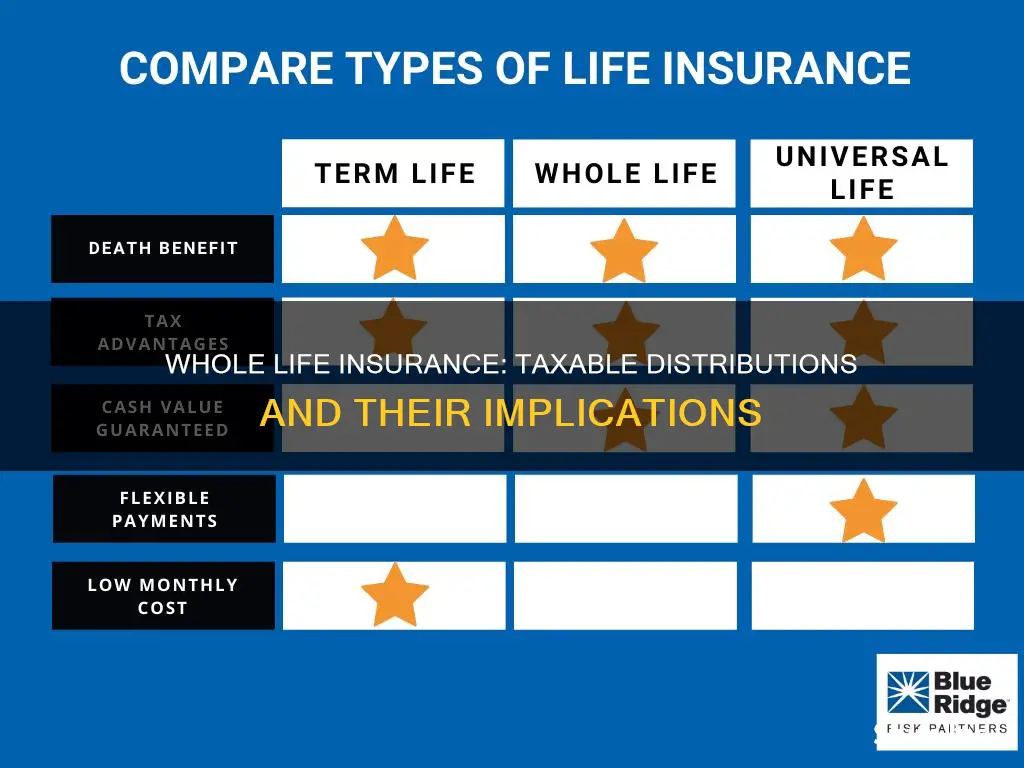

Whole life insurance policies have two components: the face value or death benefit, which is the amount of money your beneficiary will receive, and the cash value, which is a savings or investment account. This cash value component is what makes a cash-out option available to policyholders. Over time, you can build out this savings account on a tax-deferred basis. However, when you cash out a whole life insurance policy, you will not receive the face value. Instead, you receive the cash value, less any required fees. So, what are the tax implications of cashing out a whole life insurance policy?

What You'll Learn

Interest on death benefits

The death benefit is a tax-free payout to your heirs when you pass away. However, if the beneficiary chooses to delay or take the payout in installments, interest may accrue on the death benefit. This interest is considered taxable income.

It is important to note that the death benefit itself is not taxable. Only the interest that accrues on the death benefit if the payout is delayed or taken in installments is subject to taxation.

Additionally, the interest generated from whole life insurance policies is generally not taxed until the policy is cashed out. The cash value of a whole life insurance policy grows over time, and the growth is considered taxable income when the policy is surrendered or cancelled.

To avoid taxation on the interest, beneficiaries can choose to receive the death benefit as a lump sum payment as soon as possible after the death of the insured. This is the default option for most life insurance policies.

Freedom Life Insurance: Does It Exist?

You may want to see also

Interest on whole life insurance policies

Interest generated from whole life insurance policies is not taxed until the policy is cashed out. When a policyholder decides to cash out their whole life insurance policy, the amount they are taxed is the difference between the cash value received and the total amount paid in premiums during the time the policy was in force. For example, if they paid $100 per month for 20 years, or $24,000, and then cashed out the policy and received $30,000, the amount subject to taxes is $6,000.

Interest earned on life insurance dividends is also taxed as ordinary income. For instance, if the dividends are held in an interest-bearing account, the interest accrued can be taxed.

In the case of beneficiaries who receive a life insurance payout plus interest, the interest paid to the beneficiary may be taxed.

Moose Life Members: Insurance for Women?

You may want to see also

Surrendering a whole life insurance policy

There are two main reasons why someone might choose to surrender their whole life insurance policy. Firstly, the policyholder may be burdened with high premiums and decide that the policy is underperforming. Secondly, the policyholder's circumstances may change, meaning that the need for the policy is no longer there.

There are a few important things to consider before surrendering a whole life insurance policy. Firstly, if the policy is not very old, you may incur surrender fees, reducing the amount of cash you receive. Secondly, the gain on your policy will be taxed as income. Death benefits are tax-exempt, but the cash received from surrendering a policy is taxable. Finally, you may lose out on a significant amount of return on your investment in the policy.

If you are thinking about surrendering your whole life insurance policy, it is important to consult a tax professional first.

Finding Your Life Insurance License: Quick and Easy Steps

You may want to see also

Withdrawing from a whole life insurance policy

- Timing: Withdrawals from a whole life insurance policy are typically only available after the policy has been in force for a few years. Some policies may not allow withdrawals during the first two years.

- Tax implications: Withdrawing up to the amount of premiums paid into the policy is generally not considered taxable income. However, withdrawing more than this amount may result in taxable ordinary income. The additional amount withdrawn represents gains from interest or investment dividends, which are subject to income taxes.

- Impact on death benefit: Withdrawing from a whole life insurance policy will reduce the death benefit that your beneficiaries will receive. This reduction may be significant, depending on the amount withdrawn.

- Surrender charges: Withdrawing from a whole life insurance policy may incur surrender charges or early withdrawal penalties, especially if the withdrawal occurs within the first 5 to 15 years of the policy. These charges can reduce the cash payout received.

- Modified Endowment Contracts (MEC): If your policy is a MEC, different tax rules apply. Withdrawals from a MEC may be subject to the IRS's "rule of 59 ½", which treats withdrawals made before the age of 59 ½ as taxable income with an additional 10% tax rate.

- Consultation: It is recommended to consult with a financial professional or tax advisor before making any withdrawals from a whole life insurance policy. They can provide guidance on the specific tax implications and help you understand the potential impact on your policy and death benefit.

In addition to withdrawals, some whole life insurance policies may also allow policy loans, where you borrow against the cash value of the policy. Policy loans may have lower interest rates compared to other types of loans and do not require a credit check. However, any unpaid balance on the loan will reduce the death benefit, and interest charges may apply.

Midland Life Insurance: Accelerated Benefits and Their Availability

You may want to see also

Selling a whole life insurance policy

Life settlement providers seem to prefer term life policies over whole life policies because term life policies have no cash value and lower premium payments, making them more lucrative for the buyer. Permanent life insurance policies, on the other hand, have a built-in cash value that the insured can access, so a life settlement often doesn't make financial sense for the seller.

However, if you are older than 65, have a low life expectancy, and need cash to cover expenses such as long-term care, selling your whole life insurance policy may be a good option. In this case, you can expect to receive a lump-sum payment from the buyer, who will then take over premium payments and receive the death benefit when you pass away.

The process of selling your life insurance policy typically involves the following steps:

- Application: You complete an application and grant the settlement company permission to obtain information about your policy and health.

- Documentation: The settlement company underwriters gather information about your policy and request a copy of your medical records.

- Appraisal: Underwriters determine the market value of your policy based on its value and your health condition.

- Offer: The settlement company extends an offer, which you can choose to accept or decline.

- Closing: If you accept the offer, you review and sign the closing package, and the insurance provider is notified of the transaction. Ownership of the policy is transferred, and you receive the settlement funds.

It's important to note that selling a life insurance policy may have tax implications. While proceeds from a life settlement are generally not subject to income tax, a portion of the settlement may be considered taxable income. Consulting a tax professional is advisable to understand the specific tax consequences.

American Legion: Life Insurance Benefits and Coverage

You may want to see also

Frequently asked questions

Life insurance proceeds are typically not taxable as income, but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions.

Yes, if the life insurance policy goes into an estate, or if you choose to receive the death benefit as an annuity, you may have to pay taxes.

If you withdraw more than your cumulative premium payments, you may have to pay income taxes on the excess.

If the surrender proceeds exceed the cumulative premiums, the excess may be subject to income taxes.