Term life insurance is a popular choice among financial experts due to its straightforward and cost-effective nature. Unlike permanent life insurance, term policies offer coverage for a specific period, typically 10, 20, or 30 years, making them ideal for individuals seeking temporary protection during their working years. This type of insurance provides a fixed death benefit if the insured person passes away during the term, ensuring financial security for beneficiaries. Financial experts often recommend term life insurance because it allows individuals to secure their family's financial future without the long-term commitment and higher costs associated with permanent policies. Additionally, term life insurance can be more affordable, especially for younger and healthier individuals, making it an attractive option for those looking to maximize their insurance coverage within a limited budget.

What You'll Learn

- Affordability: Term life insurance is often more affordable than permanent life insurance, making it a cost-effective choice

- Flexibility: It offers flexibility in coverage duration, allowing experts to tailor policies to specific needs

- Simplicity: Term policies are straightforward, with no investment components, making them easier to understand

- Focus on Needs: Experts recommend term insurance to cover specific financial needs, like mortgage or children's education

- Long-Term Value: Despite lower premiums, term insurance provides valuable coverage for a defined period, ensuring financial security

Affordability: Term life insurance is often more affordable than permanent life insurance, making it a cost-effective choice

Term life insurance is a popular choice among financial experts for several compelling reasons, and one of the most significant advantages is its affordability. When comparing term life insurance to permanent life insurance, the former often comes at a much lower cost, making it an attractive option for those seeking cost-effective coverage. This affordability is primarily due to the nature of the policy itself. Term life insurance is designed to provide coverage for a specific period, typically 10, 20, or 30 years. During this term, the policyholder pays a fixed premium, which is generally lower than the premiums associated with permanent life insurance. This fixed-term nature allows insurance companies to offer more competitive rates, as they don't have to account for the long-term care and investment aspects that permanent policies entail.

The lower cost of term life insurance is particularly beneficial for individuals who want to protect their loved ones or secure their family's financial future without breaking the bank. For those on a tight budget, this type of insurance provides an excellent way to obtain substantial coverage without the financial burden often associated with permanent life insurance. By choosing a term policy, individuals can allocate their financial resources more efficiently, ensuring they have the necessary coverage during the years when it is most needed, such as when raising a family or during the early years of a career.

Furthermore, the affordability of term life insurance allows individuals to build a more comprehensive financial plan. With the lower premiums, policyholders can allocate more funds towards other financial goals, such as retirement savings, education funds, or investments. This flexibility enables people to create a well-rounded financial strategy, ensuring that their insurance needs are met while also working towards other important financial objectives.

In summary, the affordability of term life insurance is a key factor in its popularity among financial experts. The lower premiums and fixed-term nature of these policies make them a cost-effective solution for individuals seeking to protect their loved ones and secure their financial future without incurring excessive expenses. This affordability factor, combined with the ability to tailor coverage to specific needs, makes term life insurance an essential tool in any financial plan.

Life Insurance Misconceptions: The Surprising Truth About Coverage

You may want to see also

Flexibility: It offers flexibility in coverage duration, allowing experts to tailor policies to specific needs

Term life insurance is a popular choice among financial experts due to its inherent flexibility, which is a key advantage over other types of insurance. This flexibility lies in the ability to customize the coverage period, a feature that is highly valuable for experts when advising clients on their insurance needs.

In the financial industry, it is well-understood that different individuals and families have unique circumstances and requirements. For instance, a young professional starting their career might need long-term coverage to secure their family's financial future, while an older individual approaching retirement may require shorter-term insurance to cover specific obligations. This is where term life insurance shines. It provides a customizable solution, allowing experts to design policies that align perfectly with their clients' needs.

The coverage duration in term life insurance is typically fixed for a specific period, such as 10, 20, or 30 years. This predetermined timeframe ensures that the insurance policy is tailored to address the client's needs during a particular stage of their life. For example, a 30-year term policy can provide extensive coverage during the years when a family's financial responsibilities are at their highest, such as raising children and paying for education. Once these obligations are met, the policy can be adjusted or renewed, ensuring continued protection.

Financial experts appreciate the ability to choose the term length, as it enables them to create comprehensive financial plans for their clients. By selecting the appropriate term, experts can ensure that the insurance policy complements other financial instruments, such as savings or investments, to provide a robust financial safety net. This level of customization is a significant advantage, allowing experts to offer tailored advice and solutions that cater to the diverse financial goals and situations of their clients.

Furthermore, the flexibility of term life insurance allows experts to adapt policies as their clients' lives change. For instance, a policyholder might decide to extend the coverage term if their financial obligations or family circumstances evolve. This adaptability ensures that the insurance remains relevant and effective throughout the client's life, providing peace of mind and financial security. In summary, the flexibility in coverage duration is a powerful feature of term life insurance, enabling financial experts to create personalized insurance solutions that meet the unique and evolving needs of their clients.

Life Insurance in Islam: Halal or Haram?

You may want to see also

Simplicity: Term policies are straightforward, with no investment components, making them easier to understand

Term life insurance is a simple and direct financial tool that many experts recommend for its clarity and ease of understanding. Unlike permanent life insurance, which often includes investment components and complex features, term insurance is designed with a single, clear purpose: to provide a death benefit to the policyholder's beneficiaries if they pass away during the specified term period. This straightforward nature makes it easier for individuals to comprehend the value and purpose of their insurance policy.

The simplicity of term life insurance lies in its lack of investment elements. Permanent life insurance policies often incorporate investment accounts, which can be confusing for those who are not financially savvy. These investment components may offer potential returns, but they also introduce complexity and risk. In contrast, term insurance focuses solely on the insurance aspect, ensuring that the policyholder's loved ones receive a predetermined sum if the worst happens. This simplicity allows individuals to make informed decisions without the added pressure of understanding investment strategies.

Financial experts prefer term life insurance because it provides a clear and transparent solution for life coverage. The policy terms are defined and straightforward, with no hidden fees or complex calculations. When purchasing a term policy, individuals can easily understand the coverage they are receiving and the duration for which it will be in effect. This clarity enables people to make decisions based on their specific needs and financial goals without the confusion that might arise with more complex insurance products.

Moreover, the lack of investment components in term life insurance simplifies the overall insurance process. Without the need to navigate investment markets, individuals can focus on the essential aspect of protecting their loved ones. This simplicity can lead to faster decision-making and a more efficient process for obtaining the necessary coverage. As a result, term life insurance becomes an attractive option for those seeking a clear and understandable financial product.

In summary, the preference for term life insurance among financial experts is largely due to its simplicity and ease of understanding. By offering straightforward policies without investment components, term insurance provides a clear and transparent solution for life coverage. This simplicity empowers individuals to make informed decisions, ensuring that their loved ones are protected without the added complexity of other insurance products.

Kratom Users: Life Insurance Testing and You

You may want to see also

Focus on Needs: Experts recommend term insurance to cover specific financial needs, like mortgage or children's education

Term life insurance is a popular choice among financial experts for several compelling reasons, and its recommendation often revolves around addressing specific financial needs. One of the primary reasons is its ability to provide coverage for a defined period, typically aligning with significant financial commitments. For instance, when an individual takes out a mortgage, the loan is usually secured by the life of the borrower or a specific term. In this context, term life insurance acts as a safety net, ensuring that the mortgage is fully covered if the borrower were to pass away during the term of the loan. This is particularly crucial as it prevents the lender from seeking payment from the estate, which could potentially lead to the loss of the family's home.

Similarly, term insurance is often advised for covering the cost of children's education. Parents or guardians often want to ensure that their children's future education needs are met, even in the event of their untimely death. By taking out a term life policy, parents can secure a financial safety net that will provide a lump sum or regular payments to cover educational expenses, such as tuition fees, books, and living costs, for a specified period. This financial guarantee allows families to plan and budget with confidence, knowing that their children's educational goals will be financially protected.

The beauty of term life insurance in these scenarios is its affordability and simplicity. Unlike permanent life insurance, which provides coverage for the entire life of the insured, term insurance is designed for a specific period, often 10, 20, or 30 years. This shorter-term approach makes it more cost-effective, especially for individuals who only need coverage for a particular financial obligation. For example, a young professional taking out a 20-year term policy to cover a mortgage can ensure that the loan is protected without the long-term financial burden of a permanent policy.

In both cases, the focus is on meeting specific financial obligations. Experts recommend term insurance because it provides a precise and tailored solution to these needs. It ensures that financial commitments are met without the complexity and higher costs associated with permanent insurance. Moreover, term policies are often more accessible and less expensive, making them an attractive option for individuals seeking effective financial protection without breaking the bank.

In summary, term life insurance is favored by financial experts due to its ability to address particular financial needs, such as mortgage payments and children's education. Its affordability, simplicity, and targeted coverage make it an ideal tool for managing specific financial obligations, providing peace of mind and financial security during critical life events.

Life Insurance Payout Mechanics After Death

You may want to see also

Long-Term Value: Despite lower premiums, term insurance provides valuable coverage for a defined period, ensuring financial security

Term life insurance is a popular choice among financial experts for several compelling reasons, particularly when it comes to long-term value and financial security. While it may offer lower premiums compared to permanent life insurance, term insurance provides a focused and valuable coverage period, which is a key advantage for many individuals and families.

The primary benefit of term life insurance is its simplicity and cost-effectiveness. It is designed to provide coverage for a specific period, often 10, 20, or 30 years. During this term, the policyholder pays regular premiums, and in return, the insurance company promises to pay a death benefit to the policy's beneficiaries if the insured individual passes away within that term. This structured approach ensures that the insurance company can accurately assess and manage risk, resulting in more affordable premiums. For those who need coverage for a defined period, such as to secure a mortgage, provide for children's education, or cover business expenses, term insurance offers a precise and cost-efficient solution.

Despite the lower cost, term insurance provides a robust safety net for the insured individual's loved ones. It ensures that financial obligations and future expenses are covered, even if the primary breadwinner is no longer present. For example, if a family relies on the income of a primary earner to cover mortgage payments, term life insurance can provide the necessary financial support to keep the home in the family's name and avoid potential foreclosure. Similarly, it can help cover the costs of raising children, education, and other long-term commitments, ensuring that the family's financial stability is maintained even in the face of tragedy.

The defined coverage period of term life insurance also allows individuals to plan and manage their finances effectively. Knowing that the insurance will lapse at the end of the term encourages policyholders to review and potentially increase their coverage as their financial situation evolves. This flexibility enables individuals to adapt their insurance needs to changing circumstances, ensuring that they always have the appropriate level of protection. Moreover, the structured nature of term insurance encourages financial discipline, as policyholders are more likely to pay premiums regularly, ensuring continuous coverage.

In summary, term life insurance offers a long-term value proposition by providing valuable coverage for a specific period, ensuring financial security and peace of mind. Its affordability, combined with the defined coverage period, makes it an attractive option for individuals seeking to protect their loved ones and manage their finances effectively. Financial experts often recommend term insurance as a strategic tool to address short-term financial needs while keeping costs manageable.

Life Insurance Tax Benefits: Unlocking the Code for Savings

You may want to see also

Frequently asked questions

Term life insurance is a popular option among financial experts due to its simplicity and cost-effectiveness. It provides a fixed amount of coverage for a specified term, typically 10, 20, or 30 years. This term-based approach allows individuals to secure their loved ones' financial future during the years when they are most dependent on income, such as raising children or paying off a mortgage. The premiums are generally lower compared to permanent life insurance, making it an affordable way to build a safety net for one's family.

For individuals with a limited budget, term life insurance offers a practical solution. Since the coverage is only valid for a specific period, the premiums are calculated based on the duration of the policy. This means that the insurance company doesn't have to account for the long-term care and investment aspects associated with permanent life insurance. As a result, the cost of coverage is more affordable, allowing people to purchase a higher amount of insurance without straining their finances.

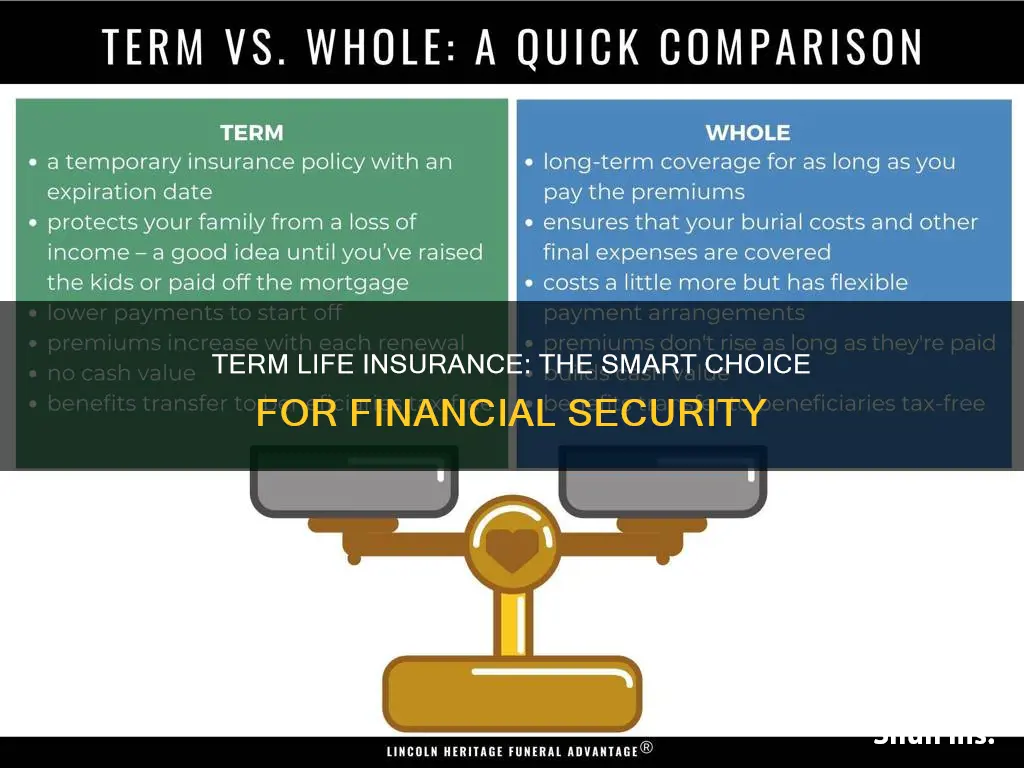

Financial experts often recommend term life insurance because it is a more straightforward and focused product. Permanent life insurance, such as whole life or universal life, offers lifelong coverage and includes an investment component. While this can be beneficial for long-term financial planning, it also increases the complexity and cost of the policy. Term life insurance, on the other hand, is designed solely for providing death benefit protection during a specific period, making it a more efficient and cost-efficient choice for those seeking pure insurance coverage.