Navigating life insurance options after retirement can be a crucial step in ensuring financial security and peace of mind. Many individuals consider life insurance as a means to provide financial protection for their loved ones, but the traditional options may not always be suitable for those in retirement. This paragraph will explore the various avenues available for obtaining life insurance during this life stage, including specialized retirement plans, term life insurance, and the potential for leveraging existing policies. By understanding these options, retirees can make informed decisions to maintain their financial well-being and leave a lasting legacy.

What You'll Learn

- Post-Retirement Options: Explore policies tailored for seniors, offering coverage despite age

- Medicare and Insurance: Understand how Medicare complements private life insurance for retirees

- Term Life vs. Permanent: Compare term life and permanent policies for post-retirement needs

- Online Resources: Utilize online platforms for comparing and purchasing retirement life insurance

- Financial Advisors: Consult advisors for tailored retirement insurance solutions and financial planning

Post-Retirement Options: Explore policies tailored for seniors, offering coverage despite age

As you approach retirement, the question of life insurance may not be at the top of your mind, but it's an important consideration for ensuring financial security in your later years. While traditional life insurance policies are often associated with younger individuals, there are indeed options available for seniors, offering much-needed coverage and peace of mind. Here's an exploration of the post-retirement life insurance landscape:

Understanding Senior Life Insurance:

When it comes to life insurance for seniors, the key is to recognize that options do exist, even if they differ from those available to younger individuals. Standard life insurance policies, such as term life or whole life, typically have age restrictions and may not be suitable for those in retirement. However, there are specialized policies designed specifically for seniors, catering to their unique needs. These policies often focus on providing coverage for a specific period, ensuring financial protection during retirement.

Exploring Tailored Policies:

- Guaranteed Acceptance Life Insurance: This type of policy is designed for individuals who may have been declined traditional life insurance due to age or health. It offers guaranteed acceptance, making it accessible to seniors. The coverage amount is usually lower compared to standard policies, but it provides a safety net for unexpected expenses.

- Final Expense Insurance: Also known as burial insurance, this policy is tailored to cover the costs associated with final arrangements and funeral expenses. It's an affordable option for seniors, ensuring that their loved ones won't bear the financial burden of these essential services.

- Whole Life or Universal Life Insurance for Seniors: While less common, some insurance companies offer modified versions of whole life or universal life policies for seniors. These policies provide lifelong coverage and can be tailored to fit the retiree's budget and needs.

Benefits of Post-Retirement Life Insurance:

Obtaining life insurance after retirement can offer several advantages. Firstly, it provides financial security for your loved ones, ensuring they have the means to cover any outstanding debts or expenses you may have left behind. Additionally, it can help with estate planning, allowing you to leave a legacy for your beneficiaries. For seniors, this coverage can be a valuable tool to address potential healthcare costs, which tend to increase with age.

Finding the Right Provider:

When exploring post-retirement life insurance options, it's crucial to research and compare different providers. Look for companies that specialize in senior policies and have a good reputation for customer service. Consider factors such as coverage amounts, premiums, and the flexibility to adjust policies as your needs change over time. Additionally, review the policy terms carefully to understand any limitations or exclusions.

In summary, while retirement may bring a sense of financial freedom, it's essential to consider the long-term implications, including life insurance. Exploring tailored policies for seniors can provide the necessary coverage and peace of mind, ensuring a more secure future despite age-related challenges. Remember, it's never too late to take control of your financial well-being and protect your loved ones.

Cashing in on Globe Life Insurance: A Step-by-Step Guide

You may want to see also

Medicare and Insurance: Understand how Medicare complements private life insurance for retirees

As you approach retirement, ensuring your financial security and well-being becomes increasingly important. While private life insurance is a popular choice for many, it's essential to understand how Medicare, the federal health insurance program for seniors, can complement your coverage. Here's a breakdown of how Medicare and private life insurance work together to provide comprehensive protection during retirement.

Medicare: A Foundation of Healthcare Coverage

Medicare is a federal program designed to provide healthcare coverage for individuals aged 65 and older. It consists of four parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage plans), and Part D (prescription drug coverage). For retirees, Medicare serves as a vital safety net, offering essential healthcare services and financial protection against medical expenses. Part A covers hospital stays, surgeries, and skilled nursing facility care, while Part B covers doctor visits, outpatient care, and preventive services. Understanding your Medicare coverage is crucial, as it forms the foundation of your healthcare security in retirement.

Private Life Insurance: Customized Financial Protection

Private life insurance, on the other hand, is a personalized financial tool. It provides a death benefit to your beneficiaries, ensuring financial support for your loved ones after your passing. This type of insurance can be tailored to your specific needs, offering various coverage options, policy terms, and riders. For retirees, private life insurance can serve multiple purposes, such as covering final expenses, providing income replacement, or funding long-term care. It offers flexibility and control over your coverage, allowing you to choose the policy that best aligns with your retirement goals and financial situation.

Complementing Medicare with Private Life Insurance

The relationship between Medicare and private life insurance is complementary. Medicare ensures you have access to essential healthcare services, while private life insurance provides financial security and peace of mind. Here's how they work together:

- Healthcare Coverage: Medicare covers a range of medical services, but it may not include all the specialized care or treatments you might need in retirement. Private life insurance can fill these gaps, offering additional coverage for specific health conditions or providing income replacement if you become unable to work due to illness or injury.

- Financial Security: Medicare has out-of-pocket costs, such as deductibles and copayments. Private life insurance can help offset these expenses, ensuring you have the financial resources to manage your healthcare costs effectively. Additionally, life insurance proceeds can be used to cover final expenses, such as funeral costs and burial expenses, providing relief to your loved ones during a difficult time.

- Long-Term Care: Medicare covers skilled nursing facility care, but it has limitations. Private long-term care insurance can supplement Medicare coverage, providing financial protection for extended periods of care in a nursing home or assisted living facility.

When considering your retirement planning, it's essential to evaluate your healthcare and financial needs. Medicare provides a solid healthcare foundation, while private life insurance offers customized financial protection. By understanding how these two components work together, you can make informed decisions to ensure a secure and comfortable retirement. Remember, consulting with insurance professionals and financial advisors can help you navigate the complexities of Medicare and private life insurance, ensuring you receive the best coverage for your retirement journey.

Renewal Time: Understanding Your Life Insurance License's Future

You may want to see also

Term Life vs. Permanent: Compare term life and permanent policies for post-retirement needs

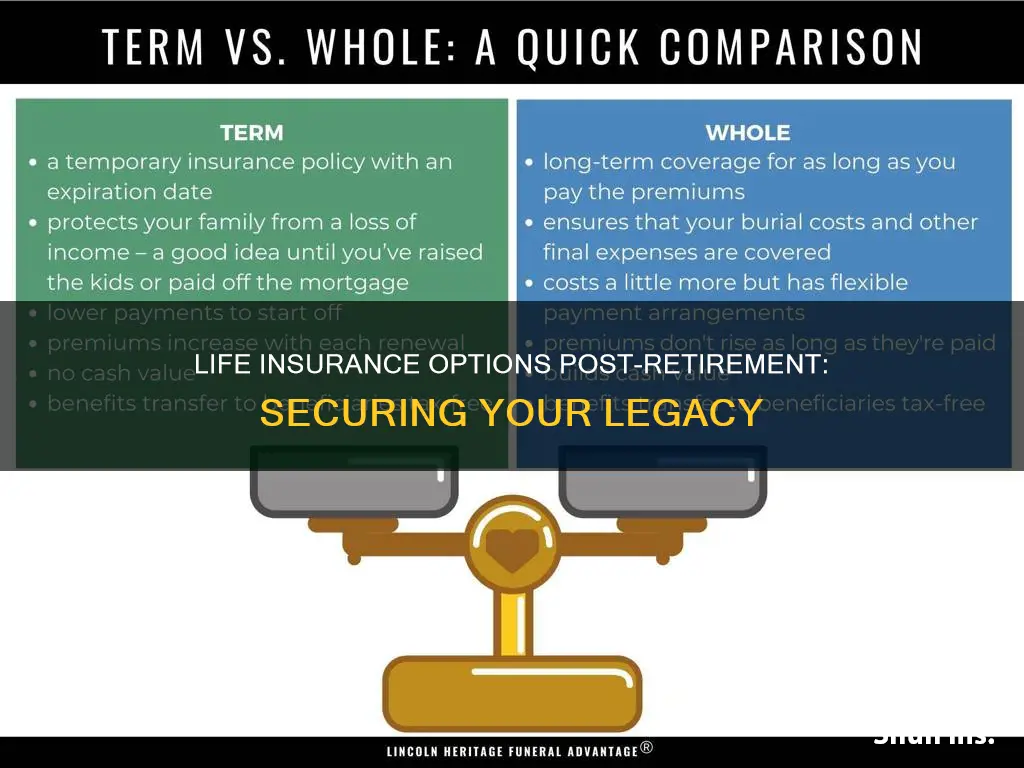

When considering life insurance options after retirement, it's essential to understand the differences between term life and permanent policies to make an informed decision. Both types of insurance have unique features and benefits that can cater to various financial needs during this life stage.

Term Life Insurance:

Term life insurance is a straightforward and cost-effective option for post-retirement coverage. It provides a fixed amount of coverage for a specified term, typically 10, 20, or 30 years. During this period, the policy offers a death benefit if the insured individual passes away. One of the key advantages is its affordability, making it an excellent choice for those on a fixed retirement income. After the term ends, the policy expires, and no further premiums are required. This feature is particularly useful for individuals who want coverage for a specific period, such as until their children are financially independent or a mortgage is paid off. However, term life insurance does not accumulate cash value, and the policy does not provide any benefits if the insured individual outlives the term.

Permanent Life Insurance:

Permanent life insurance, on the other hand, offers long-term coverage and additional benefits that make it an attractive option for post-retirement planning. This type of policy provides coverage for the insured's entire life, ensuring that beneficiaries receive a death benefit regardless of the insured's age or health status. Permanent policies have an investment component, allowing the policyholder to build cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility during retirement. One of the significant advantages is the potential for tax-deferred growth, as the cash value can grow tax-free. Additionally, permanent life insurance offers income benefits, allowing policyholders to take out loans or withdrawals to supplement their retirement income. This feature can be particularly valuable for those seeking a more comprehensive financial strategy.

Comparing the Two:

The choice between term life and permanent insurance depends on individual circumstances and retirement goals. Term life is ideal for those who need coverage for a specific period and want to keep costs low. It is a simple and direct solution for temporary needs. In contrast, permanent life insurance provides long-term security and the potential for tax-advantaged growth, making it suitable for those seeking a more comprehensive financial plan. Permanent policies offer the advantage of lifelong coverage, ensuring that beneficiaries are protected even in the later stages of retirement. However, the higher cost and complexity of permanent insurance should be considered, especially for those on a tight budget.

In summary, when deciding on life insurance after retirement, it is crucial to assess your financial situation, retirement goals, and the length of coverage needed. Term life insurance offers affordability and simplicity for specific periods, while permanent policies provide long-term security and potential financial benefits. Consulting with a financial advisor can help you navigate these options and choose the best fit for your retirement life insurance needs.

Life Insurance Beneficiary: Who Gets What and How

You may want to see also

Online Resources: Utilize online platforms for comparing and purchasing retirement life insurance

In today's digital age, the internet has become an invaluable tool for researching and purchasing various financial products, including retirement life insurance. Online platforms offer a convenient and efficient way to compare different policies, understand the options available, and make informed decisions. Here's how you can effectively utilize online resources to find and secure retirement life insurance:

Research and Comparison: Start by visiting reputable financial comparison websites that specialize in insurance products. These platforms often provide comprehensive information about various insurance providers and their offerings. You can compare different retirement life insurance plans side by side, examining factors such as coverage amounts, policy terms, premium costs, and additional benefits. Websites like [Insert Comparison Website 1] and [Insert Comparison Website 2] are excellent resources to begin your search. These sites often allow you to filter and sort policies based on your specific needs, making it easier to identify the best options.

Online Insurance Marketplaces: Many online marketplaces and insurance aggregators bring together multiple insurance companies, allowing you to compare and purchase policies in one place. These platforms often provide a user-friendly interface where you can input your requirements and receive customized quotes. By visiting these sites, you can explore various retirement life insurance options, read customer reviews, and make an informed decision. Some popular online marketplaces include [Marketplace Website 1] and [Marketplace Website 2], which offer a wide range of insurance products, including life insurance for retirees.

Insurance Company Websites: Directly visiting the websites of insurance companies is another effective strategy. Many insurers provide detailed information about their retirement life insurance products online. You can explore their policy offerings, read about the benefits and coverage details, and even request quotes. Insurance company websites often offer a more personalized experience, allowing you to communicate directly with their representatives if you have specific questions or concerns. Look for well-known and reputable insurers that have a strong online presence, such as [Insurance Company A] and [Insurance Company B].

Online Reviews and Forums: Online reviews and forums can provide valuable insights and experiences shared by other consumers. Websites like Trustpilot, Yelp, or dedicated insurance forums allow you to read reviews and ask questions about retirement life insurance. These platforms can help you understand the pros and cons of different policies, identify potential red flags, and make more informed choices. Engaging with online communities can also provide you with practical advice and recommendations from individuals who have gone through the retirement life insurance process.

When utilizing online resources, ensure that you verify the credibility and reliability of the information and websites you encounter. Look for secure and trusted platforms that prioritize data privacy and security. Additionally, always review the terms and conditions of any policy before making a purchase to ensure it aligns with your retirement goals and financial situation.

FEGLI Term Life Insurance: Is It Worth the Cost?

You may want to see also

Financial Advisors: Consult advisors for tailored retirement insurance solutions and financial planning

When considering life insurance after retirement, it's essential to consult with financial advisors who can provide tailored solutions to meet your specific needs. These professionals offer a wealth of knowledge and expertise in navigating the complex world of retirement planning and insurance. Here's why seeking their guidance is beneficial:

Financial advisors can help you understand the various types of life insurance available, especially those designed for retirees. They can explain the differences between term life, whole life, and universal life policies, ensuring you choose the right coverage for your retirement stage. For instance, term life insurance can provide temporary coverage during retirement, while whole life offers lifelong protection with an investment component.

Retirement often brings a shift in financial priorities and goals. Advisors can assist in assessing your current financial situation, including savings, investments, and pension plans. They will then create a comprehensive financial plan that incorporates life insurance as a strategic component. This plan might include strategies to optimize your retirement income, manage taxes, and ensure your loved ones' financial security.

One of the key advantages of consulting financial advisors is their ability to offer personalized advice. They will consider your unique circumstances, such as health status, retirement goals, and family situation. For example, if you have a large family or specific financial obligations, they can recommend appropriate coverage amounts and policy types. This tailored approach ensures that your life insurance aligns perfectly with your retirement vision.

Additionally, financial advisors can provide ongoing support and guidance as your retirement journey progresses. They can help you review and adjust your insurance policies as needed, ensuring they remain suitable over time. This long-term perspective is crucial for adapting to changing financial circumstances and ensuring your retirement plan stays on track.

In summary, engaging with financial advisors is a strategic step when exploring life insurance options after retirement. Their expertise in financial planning and insurance can lead to informed decisions, personalized strategies, and a more secure retirement. By seeking their counsel, you gain valuable insights that can help you navigate the complexities of retirement insurance and overall financial management.

Whole Life Insurance: Expensive Protection for Peace of Mind

You may want to see also

Frequently asked questions

Yes, absolutely! Life insurance is not limited to a specific age group or life stage. Many insurance companies offer policies tailored to retirees, providing financial security and peace of mind.

After retirement, life insurance can serve multiple purposes. It can help cover final expenses, such as funeral costs and outstanding debts, ensuring your loved ones are financially protected. Additionally, it can provide a tax-free income stream to supplement retirement savings and cover daily living expenses.

Insurance companies often consider various factors when assessing eligibility for retirees. These may include age, overall health, medical history, and lifestyle choices. Some companies offer guaranteed acceptance policies, making it easier for retirees to qualify. It's best to consult with an insurance advisor to understand the specific requirements and options available.

Yes, there are several types of life insurance policies that retirees can consider. Term life insurance provides coverage for a specific period, often at a lower cost. Permanent life insurance, such as whole life or universal life, offers lifelong coverage and potential cash value accumulation. Retirees can choose based on their financial goals and preferences.

Researching and comparing different insurance companies is essential. Look for providers with a strong reputation, financial stability, and a range of retirement-focused policies. Read reviews, understand the terms and conditions, and seek professional advice to ensure you make an informed decision that aligns with your retirement goals and budget.