Variable life insurance is a permanent life insurance product with a cash-value account that can be invested in stocks, bonds, equity funds, money market funds, and bond funds. The cash value of the policy varies based on the performance of these investments. Due to the investment risks, variable life insurance policies are considered securities contracts and are regulated by federal securities laws. This means that sales professionals must provide a prospectus of available investment products to potential buyers. Variable life insurance policies also have specific tax benefits, such as the tax-deferred accumulation of earnings. However, they are typically more expensive than other life insurance products and carry more risk.

| Characteristics | Values |

|---|---|

| Type of Insurance | Variable life insurance is a form of permanent life insurance |

| Investment Component | Yes, the cash-value account is invested, typically in mutual funds |

| Tax Benefits | Yes, tax-deferred accumulation of earnings |

| Regulated Under | Federal securities laws |

| Investment Risks | Yes, variable policies are considered securities contracts due to investment risks |

| Payout | Payout amounts are determined by the performance of the underlying securities |

| Complexity | Variable life insurance policies are complex and require more hands-on attention |

| Fees | Variable life insurance policies tend to have higher fees |

| Premium Flexibility | Yes, variable universal life insurance policies offer flexibility in premium payments |

What You'll Learn

- Variable life insurance is a permanent life insurance product with separate accounts

- It is considered a security contract because of investment risks

- Variable life insurance policies are regulated under federal securities laws

- They are more expensive than other life insurance products

- Variable life insurance has tax benefits

Variable life insurance is a permanent life insurance product with separate accounts

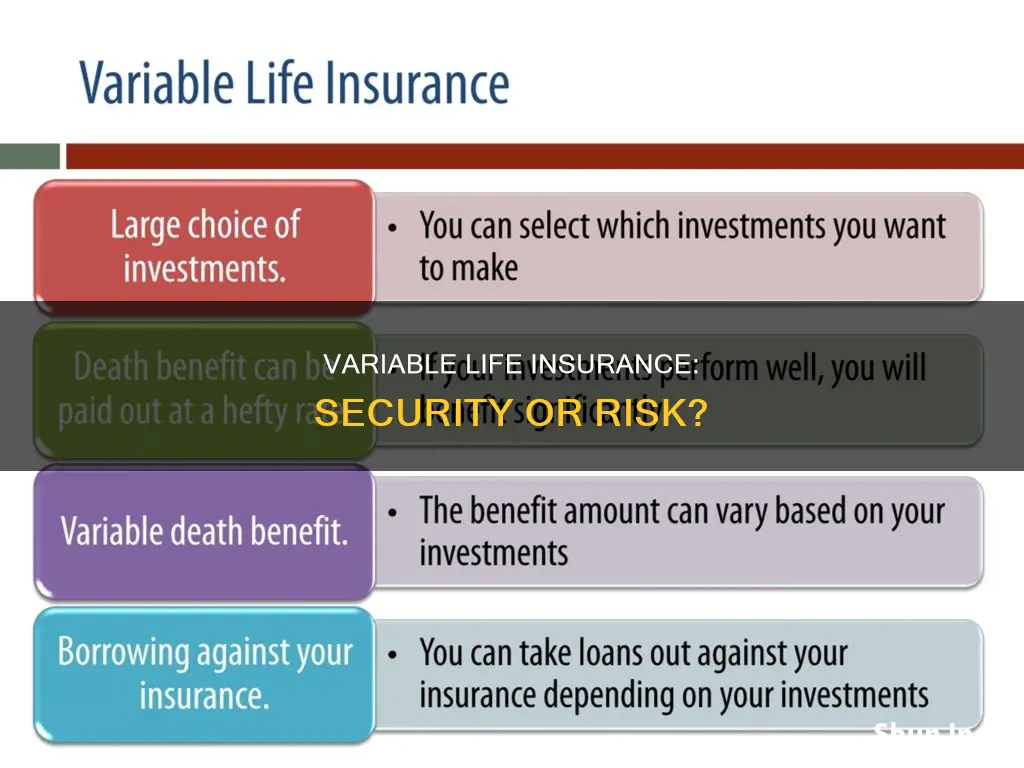

Variable life insurance is a permanent life insurance product that offers a death benefit and lifelong coverage. It is distinguished by its inclusion of a separate account, which serves as a cash-value investment component. This account is owned by the insured and offers a variety of investment options, such as mutual funds, stocks, bonds, and equity funds. The performance of these investments determines the cash value of the policy, which can be used to increase the death benefit, withdrawn as cash, or utilised as collateral for a loan.

The unique feature of variable life insurance is the level of flexibility it provides. Policyholders can adjust their premium payments within limits, choosing to pay more or less depending on their needs and investment goals. This flexibility also extends to the investment options, allowing policyholders to select from a range of conservative to aggressive strategies.

Due to the investment risks associated with variable life insurance, it is considered a securities contract and is regulated by federal securities laws. Sales professionals are required to provide a prospectus detailing all policy charges, fees, and investment options to potential buyers.

Variable life insurance policies typically come with higher fees and premiums than other life insurance products. These fees include mortality and expense risk charges, sales and administrative fees, and investment management fees. The policy's cash value is also subject to market performance, which can result in higher or lower returns compared to traditional life insurance policies.

Overall, variable life insurance is a complex product that requires hands-on attention and carries a higher level of risk. It is suitable for individuals with specific life insurance protection needs, investment goals, and tax planning objectives.

Life Insurance Cash Value: Safe from Government Seizure?

You may want to see also

It is considered a security contract because of investment risks

Variable life insurance is a permanent life insurance product with separate accounts made up of various instruments and investment funds, such as stocks, bonds, equity funds, money market funds, and bond funds. It is a contract between the policyholder and the insurance company, intended to meet specific insurance needs, investment goals, and tax planning objectives.

Variable life insurance policies are considered securities contracts because of the investment risks involved. The cash value component of these policies is invested in assets like mutual funds, meaning it may rise or fall in value. This is in contrast to other life insurance policies, where the insurance company guarantees a rate of return. As a result, variable life insurance policies carry more risk compared to standard life insurance policies and are considered more volatile.

Due to the investment risks, variable life insurance policies are regulated under federal securities laws. Sales professionals are required to provide a prospectus of available investment products to potential buyers, outlining all charges, fees, and sub-account expenses. The prospectus is available free of charge and is important for individuals to understand the risks involved.

The investment portion of variable life insurance receives favorable tax treatment. The growth of the cash value account is not taxable as ordinary income, and money can be drawn from these accounts later on, often through loans using the account as collateral, providing tax-free income. This is a unique feature of variable life insurance, offering flexibility and the potential for significant investment earnings.

In summary, variable life insurance policies are considered securities contracts due to the investment risks involved. These risks are emphasised by regulators, who require companies to clearly explain policy risks to individuals. The investment component of variable life insurance brings with it the potential for higher earnings but also the possibility of losing money, including the initial investment.

Life and Burial Insurance: Key Differences Explained

You may want to see also

Variable life insurance policies are regulated under federal securities laws

Variable life insurance is a permanent life insurance product with separate accounts made up of various instruments and investment funds, such as stocks, bonds, equity funds, money market funds, and bond funds. It is a form of whole life insurance that accumulates cash value on a tax-deferred basis.

Variable life insurance policies are considered securities contracts because of the investment risks involved. They are regulated under federal securities laws, and sales professionals must provide a prospectus of available investment products to potential buyers. The prospectus is available free of charge and contains important information about the policy, including fees, expenses, investment options, death benefits, and other features.

The cash value component of variable life insurance is invested in assets, which may rise or fall in value. This means that these policies carry more risk compared to other life insurance policies. Policyholders can allocate a portion of their premium to a fixed account, which guarantees a rate of return, to reduce the overall risk. The unique feature of variable life insurance is that its cash component can be invested in asset options, mainly mutual funds. The value of the account will depend on the premiums paid, the performance of investments, and associated fees and expenses.

Variable life insurance policies are considered more volatile than standard life insurance policies. They are often more expensive and have higher premiums than other life insurance products. The policies have a death benefit, which is a specified amount paid to beneficiaries upon the death of the insured. The death benefit may be linked to the performance of the separate account funds, which can offer increased financial protection to the beneficiary.

Time Life Insurance: What You Need to Know

You may want to see also

They are more expensive than other life insurance products

Variable life insurance is a permanent life insurance product with a cash-value account that is invested, typically in mutual funds. The cash value component of variable life insurance is invested in assets like stocks, bonds, equity funds, money market funds, and bond funds. The value of the account will depend on the premiums paid, the performance of the investments, and the associated fees and expenses.

Variable life insurance policies are considered more volatile than standard life insurance policies and are therefore more expensive. The fees and expenses associated with variable life insurance policies are generally higher than those of other life insurance policies. These fees include mortality and expense risk charges, sales and administrative fees, and investment management fees. The cash value of the policy is also usually not equal to its actual surrender value for the first 10 to 15 years of coverage.

Variable life insurance policies are considered securities contracts and are regulated under federal securities laws. Due to the investment risks involved, variable life insurance policies are considered more complex and require more hands-on attention than other life insurance products. The potential for higher returns through investing in the market comes with higher costs and more risk.

Variable life insurance policies are not suitable for everyone. They are more expensive and carry more risk than other life insurance policies. Individuals should carefully consider their financial situation and goals before purchasing a variable life insurance policy.

Strategies to Ace the Life Insurance Exam

You may want to see also

Variable life insurance has tax benefits

Variable life insurance has several tax benefits. Firstly, it allows for the tax-deferred accumulation of earnings. This means that the cash value of the policy can grow over time, tax-free, provided the policy remains in force. Policyholders can access this cash value via a tax-free loan, although any unpaid loans will reduce the death benefit. The death benefit itself is also not subject to federal income tax. Under certain circumstances, it may also not be subject to federal estate tax.

Another tax benefit of variable life insurance is that policyholders can take out loans from their policy without paying federal income taxes. However, if the policy terminates with an outstanding loan, federal income taxes may be owed on the loan.

Hypothyroidism and Life Insurance: What's the Impact?

You may want to see also

Frequently asked questions

Variable life insurance is a permanent life insurance policy with an investment component. The policy has a cash-value account that is invested, typically in mutual funds. The cash value component can be invested in asset options, mainly mutual funds, and can be accessed for other purposes.

Variable life insurance works similarly to a mutual fund. The insured pays premiums that go into a separate investment account owned by the insured. The cash value of the policy varies based on the performance of the investments. The unique feature of variable life insurance is that its cash component can be invested in asset options.

Variable life insurance offers flexibility in terms of premium remittance and cash value accumulation. It also provides tax advantages, such as tax-free income and the tax-deferred accumulation of earnings.