Passing the life insurance exam is a challenging but rewarding endeavour. Each state has its own exam, so the tests and requirements vary, but the overarching topics covered on the exam, as well as the passing scores, are similar for all states. The exam is a multiple-choice test, and there is no essay section. To pass, you will need to devote time to studying and understanding the material. Here are some steps to help you prepare for and pass the life insurance exam.

| Characteristics | Values |

|---|---|

| Exam Format | Timed, proctored, multiple-choice test |

| Number of Questions | 50-180 |

| Exam Topics | Types of life insurance, policy provisions, underwriting, state regulations, tax implications |

| Study Time | 35-40 hours |

| Study Techniques | Practice exams, pre-licensing courses, flashcards, teaching others |

| Exam Day Tips | Read questions carefully, answer confident questions first, guess answers if unsure |

What You'll Learn

Learn your state's requirements

To pass the life insurance exam, it's important to first learn your state's requirements, as these vary across the US. All insurance licenses are state-specific, and each state has its own insurance exams, so the tests and requirements differ. However, the overarching topics covered and the passing scores are similar for all states.

Some states require licensing candidates to complete pre-licensing education before taking the exam, so it's important to check this before signing up for the exam. You should also verify whether you need a sponsor to take the exam, as some states won't let you take it without one. The cost of the exam also varies from state to state, ranging from $32 to $150.

The types of exams also differ between states. Some states require separate health and life insurance licenses, while others offer a combined exam. Some states have a Personal Lines exam for agents selling only homeowner or auto insurance. It's important to learn which type of exam your state offers so you can prepare accordingly.

The state-specific section of the exam will test your knowledge of your state's rules and regulations, including requirements for contract language, disclosures, and rules pertaining to the insurance policy. It will also cover licensing requirements for brokers, limited representatives, and adjusters, as well as continuing education requirements and available professional organizations in your state.

To learn your state's requirements, check with your state's department of insurance. They will be able to provide you with the necessary information and outline of the exam.

Who Gets Notified: Life Insurance Beneficiaries and the Process

You may want to see also

Schedule your exam

Scheduling your exam is a crucial step in the process of obtaining your life insurance license. Here is a detailed guide to help you navigate this step effectively:

Choosing the Exam Date and Time

In most states, you have the flexibility to choose the date and time of your exam. It is recommended to schedule your exam at least two weeks in advance to ensure you have adequate time to prepare. This will also increase your chances of securing your preferred date and time.

Exam Scheduling Options

The scheduling options vary depending on the state. Most states offer online scheduling through their respective department of insurance websites. Alternatively, you may need to call the testing company, such as Pearson VUE or Prometric, which administers exams for many states.

Exam Fees

The cost of taking the life insurance exam differs from state to state, typically ranging from $40 to $150. Be sure to follow the payment instructions provided during the scheduling process. Exam fees are usually non-refundable if you cancel or reschedule less than 24 hours before your exam.

Background Check Requirements

Some states require you to undergo a background check before taking the exam. This may involve submitting your fingerprints to your state's department of insurance or a local law enforcement agency. Check your state's specific requirements and allow sufficient time for this process.

Identification Requirements

On the day of your exam, you will need to present a valid, government-issued photo ID, such as a driver's license or passport. This is a crucial step, as failing to provide proper identification may result in forfeiting your exam fee.

Exam Day Tips

Arrive at the exam centre at least 30 minutes early to allow time for check-in and ensure you have the necessary identification and any other required documents. You will be assigned a testing cubicle, and an employee will explain the expected conduct and rules during the exam.

By following these guidelines, you will be well-prepared for the exam scheduling process and ready to take your life insurance exam with confidence.

Finding Your Life Insurance License: Quick and Easy Steps

You may want to see also

Study smart

Studying smart is the key to passing the life insurance exam. Here are some tips to help you study effectively:

Know the Exam Format and Syllabus:

Firstly, understand the format of the exam. The life insurance exam is a timed, proctored multiple-choice test, consisting of around 50 to 180 questions. The exam is usually divided into a general life insurance section and a state-specific section. Each state has its own exam outline, which details the topics covered and their weightage. Download and review your state's exam outline to identify the key areas to focus on.

Create a Study Plan:

Develop a structured study plan that works for you. Block out specific time slots in your daily routine dedicated to studying. It is recommended to devote around 35 to 40 hours of study time for this exam. Spread out your preparation over several weeks to avoid cramming.

Choose the Right Study Materials:

Select reputable study materials that align with your learning style. You can opt for live classes, online courses, printed books, or a combination of these resources. Pre-licensing education courses are particularly helpful as they provide structured guidance and can enhance your understanding of the material.

Take Practice Exams:

Practice exams are an excellent way to prepare. They help you familiarise yourself with the exam format, manage your time effectively, and identify areas that require further revision. Attempt as many practice tests as possible, and use the results to guide your studies.

Eliminate Distractions:

Create a quiet and comfortable study environment. Remove distractions like phones, TV, or internet browsing, which can hinder your focus. Listen to soothing instrumental music if it helps you concentrate. Choose a suitable study location, such as a library, where you can study without interruptions.

Understand Core Concepts:

Focus on grasping the seven core principles of life insurance, such as the principle of utmost good faith, principle of insurable interest, principle of indemnity, and principle of contribution. Understanding thesesection, and the state-specific portion, which covers state-specific regulations, rules, and laws.

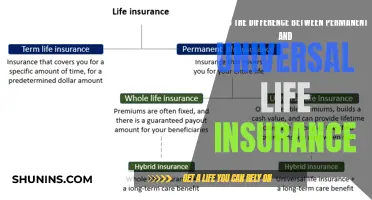

Study the Types of Life Insurance Policies:

Familiarise yourself with the various types of life insurance policies, including term life insurance, whole life insurance, and variable life insurance. Understand the guidelines, provisions, and riders associated with each type.

Learn the Underwriting Process:

Study how insurance providers calculate risk and determine quotes. Understand how factors like an individual's medical history and driving record impact the underwriting process and subsequent insurance quote.

Revise Tax Issues:

Tax implications are an important aspect of life insurance. Understand the tax laws related to life insurance policies, proceeds, and payouts. Be prepared to explain these to your future clients and how they can minimise their tax burden.

Irrevocable Life Insurance Trusts: Estate Liquidity and Protection

You may want to see also

Prepare and practice

Preparation and practice are key to passing the life insurance exam. Here are some tips to help you get ready:

- Take a prelicensing education course: While not all states require prelicensing education, it is highly recommended. Live classes, online courses, and printed study materials are all great options to help you prepare for the exam.

- Study the types of life insurance policies: Understand the different types of life insurance, such as term life insurance, whole life insurance, and variable life insurance. Know the guidelines and specifics of each type.

- Review life insurance contracts: Familiarize yourself with the important components of a life insurance contract, such as how beneficiaries are named, how premiums are established, and how provisions and riders are added.

- Learn the underwriting process: Understand how insurance providers calculate risk and come up with life insurance quotes. Know how specific risks, such as an individual's prescription drug history, can affect insurance quotes.

- Study tax issues: Many policyholders have concerns about taxes. Be sure to review tax laws that can impact clients, such as how life insurance proceeds are taxed and how to avoid excessive taxation.

- Take practice exams: Search for free life insurance practice exams online and take as many as possible. This will help you identify areas where you need further study and get you familiar with the exam structure.

- Eliminate distractions: Create a quiet and focused study environment. Turn off your phone, avoid social media, and choose a quiet study spot away from distractions.

Getting a Life Insurance License: Is It Worth the Effort?

You may want to see also

Know the exam centre process

Knowing the exam centre process is key to passing your life insurance exam. Here's what to expect:

Visit the Test Centre in Advance

Try to visit the test centre before your exam. This will help you to familiarise yourself with the testing area and the route to get there. This will help you feel more confident on the day of your exam.

Identification

Find out what forms of identification you need to take with you. Each state has its own requirements, so be sure to check in advance. You may need to bring two forms of ID, one of which must be a photo ID. Acceptable forms of ID include a driver's license, passport, or military ID. Your ID must be valid and in date.

Arrive Early

Plan to arrive at the test centre at least 30 minutes before your exam is due to start. This will give you time to get settled and ensure you have everything you need.

Belongings

You will be asked to store your belongings in a locker before you are assigned to a testing cubicle. Only take what you need with you to the test centre and leave any valuables at home.

Conduct

An employee will explain the expected conduct to you when you arrive at your assigned test spot.

Life Insurance: Haven's Easy Sign-In Process

You may want to see also