Understanding the differences between life insurance loans, dividends, and other financial products is crucial for making informed decisions about your financial well-being. Life insurance loans and dividends are two distinct financial instruments with unique characteristics and purposes. Life insurance loans, often offered by insurance companies, provide policyholders with a means to access funds from their life insurance policy. These loans typically have favorable terms, allowing policyholders to borrow against the cash value of their policy without selling it. On the other hand, dividends are a distribution of a company's profits to its shareholders. In the context of life insurance, dividends can be a source of additional income for policyholders, offering a potential return on their investment. This introduction sets the stage for a detailed exploration of these concepts, highlighting their significance in personal finance and insurance.

| Characteristics | Values |

|---|---|

| Definition | A life insurance loan is a type of loan that uses the policyholder's life insurance policy as collateral. Dividends, on the other hand, are a form of payment made by insurance companies to policyholders. |

| Purpose | Loans are typically used for various financial needs, such as covering expenses, debt consolidation, or starting a business. Dividends are a return on the investment made by policyholders in the insurance company. |

| Interest and Charges | Life insurance loans often come with interest rates and fees, which can vary. Dividends, however, are usually paid out as a fixed percentage of the policy's cash value. |

| Risk | Loans may involve risks if the policyholder defaults on payments, potentially leading to the loss of the policy. Dividends provide a guaranteed return on investment, reducing the risk for policyholders. |

| Tax Implications | Loan proceeds may be taxable, and interest payments can be tax-deductible in some cases. Dividends are generally tax-free, providing an advantage for investors. |

| Accessibility | Life insurance loans are accessible to policyholders with sufficient cash value in their policies. Dividends are available to policyholders who have invested in the company's products. |

| Flexibility | Loans offer flexibility in terms of repayment options. Dividends provide a consistent income stream, allowing policyholders to plan their finances accordingly. |

| Regulation | The regulations surrounding life insurance loans and dividends can vary by jurisdiction and insurance company policies. |

What You'll Learn

- Definition: Life insurance loans are personal loans, while dividends are a return on investment

- Purpose: Loans are for financial needs, dividends are profit-sharing

- Risk: Loans have interest, dividends are variable

- Taxation: Dividends are taxable, loans may be tax-deductible

- Access: Loans are accessible, dividends are distributed periodically

Definition: Life insurance loans are personal loans, while dividends are a return on investment

Life insurance loans and dividends are two distinct financial concepts that often require clarification for investors and individuals seeking financial products. Firstly, it's important to understand that life insurance loans are personal loans, whereas dividends represent a return on investment.

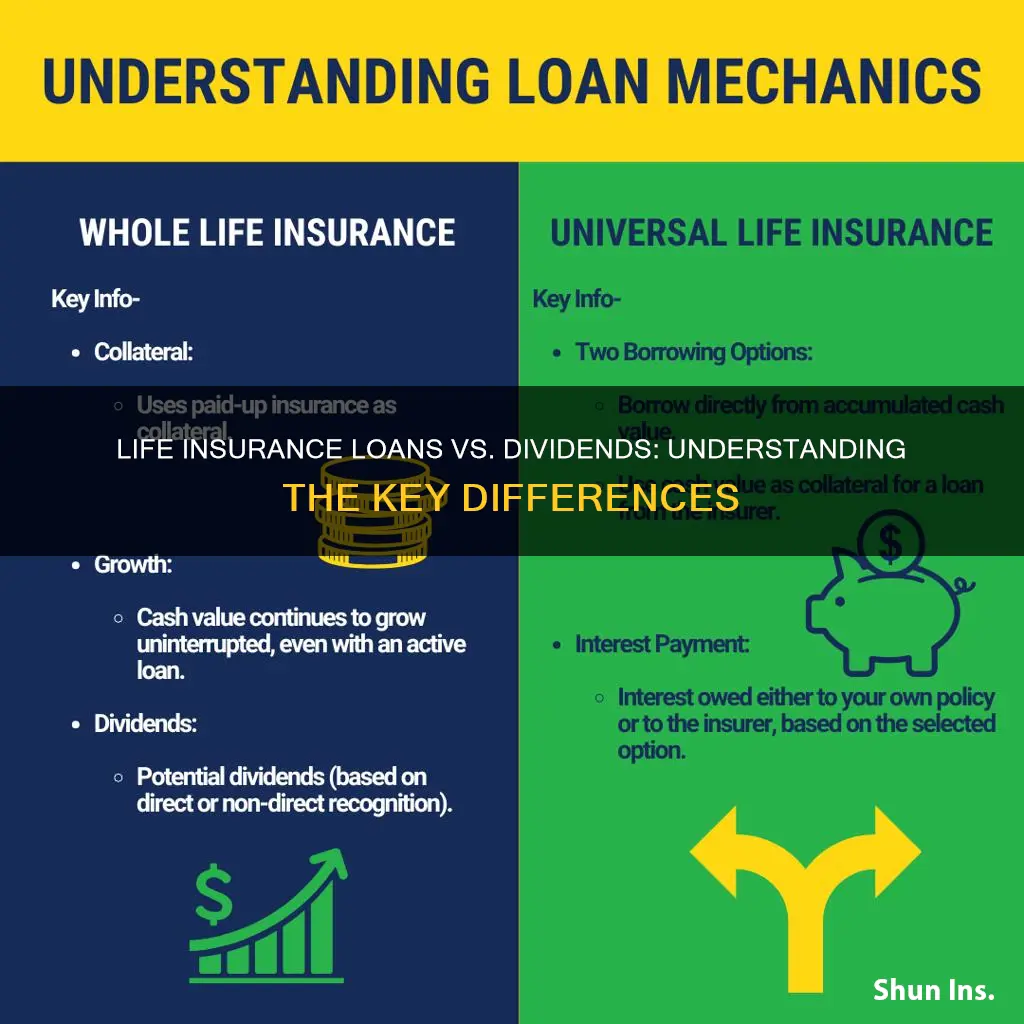

Life insurance loans, often referred to as 'life insurance policy loans,' are personal loans that policyholders can borrow against their life insurance policy. These loans are typically offered by insurance companies and allow policyholders to access a portion of the cash value of their policy. The loan amount is usually based on the policy's cash value, and the policyholder can repay the loan with interest over time. This type of loan is particularly useful for individuals who need immediate funds and want to utilize their life insurance policy as a financial asset.

On the other hand, dividends are a return on investment and are associated with various financial instruments, including stocks and mutual funds. When a company's profits exceed its operating costs, it may distribute a portion of those profits to shareholders in the form of dividends. Dividends are essentially a share of the company's profits, and they provide investors with a regular income stream. This is a crucial aspect of investing, as it offers a tangible benefit to shareholders, especially in the form of recurring income.

The key difference lies in their nature and purpose. Life insurance loans are personal financial tools that individuals can utilize to access funds, while dividends are a distribution of profits to shareholders, providing a return on their investment. Understanding these distinctions is essential for anyone navigating the complex world of personal finance and investing.

Dog Life Insurance: Is It Worth the Cost?

You may want to see also

Purpose: Loans are for financial needs, dividends are profit-sharing

Loans and dividends serve distinct purposes in the realm of personal finance and business operations. Firstly, loans are primarily designed to meet financial needs and provide individuals or entities with the necessary capital to cover short-term or long-term expenses. Whether it's a personal loan for education, a mortgage to purchase a home, or a business loan to expand operations, the primary objective is to facilitate financial transactions and support various financial requirements. These loans often come with interest rates and repayment schedules, ensuring that the borrowed amount is returned over time.

On the other hand, dividends represent a portion of a company's profits that is distributed to its shareholders. When a business generates profits, it can choose to reinvest those earnings or distribute a portion of them to its investors as dividends. This profit-sharing mechanism allows shareholders to benefit from the company's success and growth. Dividends are typically paid out periodically, such as quarterly or annually, and the amount received by each shareholder is proportional to their ownership stake in the company.

The key difference lies in their nature and purpose. Loans are typically used to address immediate financial needs or to facilitate specific purchases, while dividends are a way for companies to share their financial success with investors. Loans often require repayment with interest, ensuring the lender's return on investment, whereas dividends are a voluntary distribution of profits, allowing shareholders to benefit from the company's performance.

In the context of life insurance, loans and dividends can be related but distinct concepts. Life insurance companies may offer loan options to policyholders, allowing them to access a portion of their policy's cash value as a loan. This can be useful for various financial needs, such as covering educational expenses or starting a business. Dividends, in this context, might refer to the returns or interest earned on these loans, providing policyholders with an additional source of financial benefit.

Understanding the purpose and nature of loans and dividends is essential for making informed financial decisions. Loans provide immediate financial support, while dividends offer a share of a company's profits, promoting long-term financial growth.

Life Insurance and HIPAA: What's the Connection?

You may want to see also

Risk: Loans have interest, dividends are variable

When considering the financial aspects of life insurance, it's crucial to understand the differences between various investment options, such as loans and dividends. One significant aspect to consider is the risk associated with each.

Loans, particularly those related to life insurance, often come with a fixed interest rate. This means that the borrower will pay back the principal amount plus a predetermined interest over a specified period. While this provides a clear understanding of the financial commitment, it also means that the interest rate is not variable and can be a stable cost for the borrower. However, this stability can also be a risk factor. If interest rates drop significantly, the loan's interest payments may become relatively higher compared to other financial instruments, potentially impacting the borrower's financial health.

On the other hand, dividends from life insurance policies are variable and can fluctuate based on the performance of the underlying investments. Dividends are essentially a portion of the policy's earnings that are distributed to the policyholder. Unlike fixed interest payments, dividends are not guaranteed and can vary widely. This variability is both an advantage and a risk. While it provides an opportunity for higher returns, it also means that the policyholder's income from dividends is not predictable and can be affected by market conditions.

The key risk here is the uncertainty surrounding dividend payments. Policyholders should be aware that the amount of dividends received can change from year to year, and there is no guarantee that dividends will be paid at all. This variable nature of dividends can impact the overall financial planning and budgeting of individuals relying on these payments.

In summary, understanding the risk associated with loans and dividends is essential for making informed financial decisions. Loans offer a fixed interest rate, providing stability but also carrying the risk of higher interest payments if market conditions change. Dividends, while offering potential for higher returns, are variable and unpredictable, making them a riskier investment option compared to the consistent interest payments of loans.

Life Insurance and Blood Tests: What's Required?

You may want to see also

Taxation: Dividends are taxable, loans may be tax-deductible

Dividends and life insurance loans are two distinct financial instruments with different tax implications. When it comes to taxation, dividends are subject to taxation, while life insurance loans may offer tax advantages. Understanding these differences is crucial for individuals and businesses to make informed financial decisions.

Dividends are a form of income distributed by corporations to their shareholders. These payments represent a portion of the company's profits and are typically paid out regularly. As a source of income, dividends are taxable, meaning they are subject to income tax. The tax rate applied to dividends can vary depending on the jurisdiction and the recipient's tax bracket. For example, in many countries, dividends are taxed at a lower rate than other types of income, such as wages or interest. This preferential tax treatment is often a key factor in attracting investors to dividend-paying stocks.

On the other hand, life insurance loans, also known as policy loans or surrender loans, are a unique feature of life insurance policies. When an individual takes out a loan against their life insurance policy, the loan amount is typically tax-deductible. This means that the interest paid on the loan may be deductible from the policyholder's taxable income. The tax benefits of life insurance loans can be particularly advantageous for high-income earners or those in higher tax brackets. By deducting the loan interest, individuals can reduce their taxable income, potentially lowering their overall tax liability.

The key difference in taxation lies in the nature of these financial instruments. Dividends are a form of income derived from investments in stocks or mutual funds, and they are treated as ordinary income for tax purposes. In contrast, life insurance loans are a borrowing mechanism linked to a life insurance policy, and the tax treatment varies depending on the specific regulations in each jurisdiction.

It is essential to consult tax professionals or financial advisors to understand the specific tax implications in your region. They can provide tailored advice based on your individual circumstances, ensuring you maximize the benefits of these financial tools while adhering to tax laws.

Life Insurance After Termination: Can Group Coverage Continue?

You may want to see also

Access: Loans are accessible, dividends are distributed periodically

When it comes to accessing funds, life insurance loans and dividends offer distinct advantages. Firstly, life insurance loans provide immediate access to cash. If you own a life insurance policy with a cash value, you can borrow against it, allowing you to access the funds you've accumulated without having to sell the policy. This can be particularly useful for those who need quick access to money for various purposes, such as covering unexpected expenses or investing in business opportunities. The loan process is relatively straightforward, often requiring minimal paperwork and quick approval, making it a convenient option for those in need of immediate financial assistance.

On the other hand, dividends from life insurance policies are distributed periodically, providing a steady stream of income. Dividends are a portion of the policy's profits that are paid out to policyholders. These payments can be customized to fit individual needs, and they offer a consistent and reliable source of cash flow. Dividend distributions can be a valuable financial tool for those seeking regular income, especially for retirees or individuals looking to supplement their retirement savings. It's important to note that the frequency and amount of dividend payments can vary depending on the insurance company and the specific policy terms.

The accessibility of loans is a significant advantage, especially in times of financial crisis or when immediate funds are required. With a life insurance loan, you can access the cash value of your policy, which can be a valuable asset during challenging economic times or personal emergencies. This accessibility ensures that you have a financial safety net, providing peace of mind and the flexibility to manage your finances effectively.

In contrast, dividends offer a more structured and predictable approach to accessing funds. Policyholders can rely on regular dividend payments, which can be a consistent source of income. This is particularly beneficial for those who prefer a more predictable financial plan, as dividend distributions provide a steady stream of cash flow that can be used for various purposes, such as investing, saving for future goals, or simply as a regular income supplement.

Understanding the accessibility of both life insurance loans and dividends is crucial for making informed financial decisions. While loans provide immediate access to funds, dividends offer a more consistent and predictable income stream. By recognizing these differences, individuals can choose the most suitable option based on their financial goals, needs, and preferences.

Whole Life Insurance Dividends: Annual or Monthly Payouts?

You may want to see also

Frequently asked questions

A life insurance loan is a type of loan that uses the cash value of a life insurance policy as collateral. It allows policyholders to access funds while keeping the policy intact. Dividends, on the other hand, are a form of return on investment for policyholders. They are typically paid out of the policy's investment earnings and can vary from year to year.

When you take out a loan against your life insurance policy, you borrow a portion of the cash value accumulated in the policy. The loan is secured by the policy, and interest is charged. You can repay the loan with interest over time, and the policy remains in force. If the loan is not repaid, the policy's cash value may be reduced to cover the debt.

Dividends are a distribution of the policy's investment earnings to the policyholder. They are declared and paid annually or more frequently by mutual or participating life insurance companies. Dividends are not guaranteed and can fluctuate based on the company's investment performance and the policy's performance.

Yes, you can typically withdraw the loan amount as cash once the loan is fully paid off. This process is known as "surrendering" the policy. When you surrender, you receive the cash value minus any outstanding loan amounts and surrender charges (if applicable). It's important to consider the tax implications and potential loss of policy benefits when making such decisions.