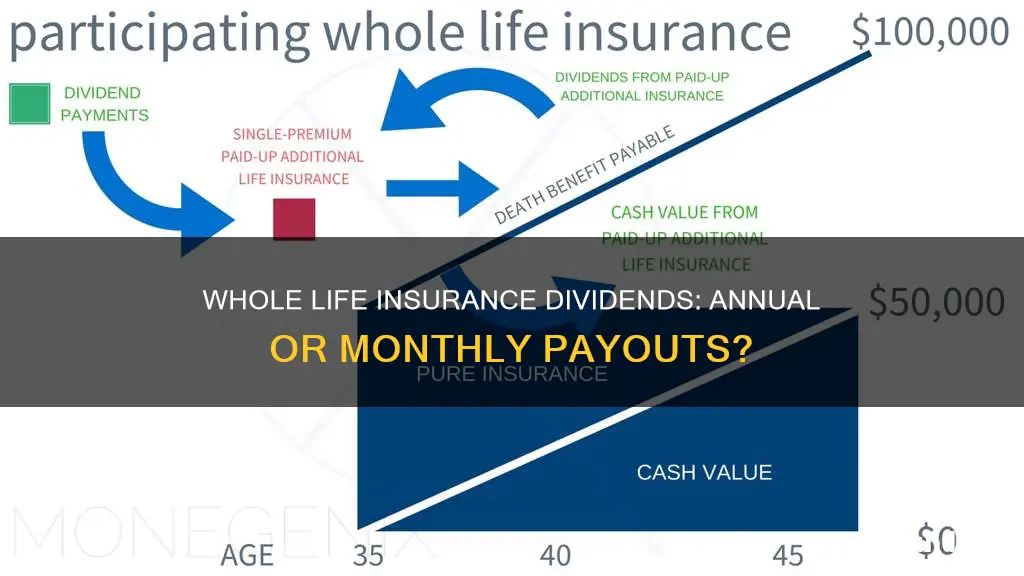

Whole life insurance is a type of permanent life insurance that offers lifelong coverage, a death benefit, and a cash value component. While term policies are usually the cheapest form of life insurance, whole life policies offer several benefits that policyholders may want to consider. These include a guaranteed death benefit, predictable premiums over time, and even dividends that can provide cash or help offset the cost of life insurance over time. Dividends are not guaranteed but are paid out if the insurer has a strong financial performance. Policyholders can receive dividends in cash or use them to reduce their future premiums.

What You'll Learn

Dividends are paid annually

The dividend amount is also tied to the price of the premiums paid by the policyholder. The higher the dividend, the more expensive the policy. For example, a policy worth $50,000 that offers a 3% dividend will pay a policyholder $1,500 for the year. If the policyholder contributes an additional $2,000 in value during the subsequent year, they will receive $60 more for a total of $1,560 for the year. Over time, these amounts can increase to sufficient levels to offset some costs associated with premium payments.

Policyholders can choose to receive their dividends as a check in the mail or use them to acquire additional insurance. They can also opt to put the dividend towards future premiums to offset the cost or leave the dividend with the insurance company to earn interest on the amount.

Islamic Perspective on Life Insurance: Halal or Haram?

You may want to see also

Dividends are optional payments from the insurer

Dividends are typically paid out by mutual insurance companies, which are owned by policyholders. These companies strive to pay dividends consistently to eligible participating policyholders. Policyholders who have been with the company longer and have larger death benefits will generally receive larger dividend payouts.

When an insurance company decides to pay dividends, there are several ways that policyholders can receive them. They can choose to receive a cash payment, usually in the form of a check or direct deposit. They can also use the dividend to reduce their future premium payments or leave it on deposit with the insurer to accumulate interest. Another option is to use the dividend to purchase additional whole life insurance coverage, which can increase the policy's death benefit and cash value.

It's important to note that dividends from a life insurance policy are generally not taxable unless they earn interest or exceed the amount the policyholder has paid in premiums. In most cases, the IRS treats dividend payouts as a refund of excess premiums paid.

Calculating Life Insurance: The Right Coverage for Peace of Mind

You may want to see also

Dividends are not guaranteed

Dividends are only paid by some insurance companies and aren't guaranteed each year. They are based on the insurance company's financial performance. If the company has a profitable year, they may pay out dividends, but this is not a guarantee.

The policy has to be "participating," meaning it has been designated by the insurance company as eligible to receive dividends. Not all policies are participating policies, and non-participating policies will not pay dividends, even if the insurance company makes a profit.

When deciding on a whole life insurance policy, it is important to carefully read through the plan's details. Policies that provide guaranteed dividends often have higher premiums to make up for the added risk to the insurance company. Policies that offer non-guaranteed dividends may have lower premiums, but there is a risk that there won't be any dividends in a given year.

It is also worth considering the insurance company's credit rating when determining how sustainable dividends are likely to be in the future. Most insurance companies are rated A or better by major credit agencies.

ACA and Pre-Existing Conditions: Life Insurance Impact

You may want to see also

Dividends are based on the insurer's financial performance

The amount of a dividend is tied to the price of the premiums paid by the policyholder. The higher the dividend, the more expensive the policy. Dividends can be distributed as cash, used to purchase additional paid-up insurance, or to reduce premiums due.

Many whole life insurance policies provide dividends that represent a portion of the insurance company's profits that are paid to policyholders. These dividends are similar to traditional investment dividends, which represent a public company's profit share.

The dividend amount often depends on the amount paid into the policy. For example, a policy worth $50,000 that offers a 3% dividend will pay a policyholder $1,500 for the year. If the policyholder contributes an additional $2,000 in value during the subsequent year, they will receive $60 more for a total of $1,560 for the next year. These amounts can increase over time and may eventually be sufficient to offset some costs associated with premium payments.

Whole life insurance dividends may be guaranteed or non-guaranteed, depending on the policy. Policies that provide guaranteed dividends often have higher premiums to make up for the added risk to the insurance company. Those that offer non-guaranteed dividends may have lower premiums, but there is a risk that no dividends will be paid in a given year.

When choosing a whole life insurance policy, it is important to consider the insurer's financial performance and credit rating to determine the likelihood of receiving dividends in the future.

Variable Life Insurance: Does It Expire?

You may want to see also

Dividends are not taxable

Dividends from whole life insurance policies are generally not subject to income tax. This is because the Internal Revenue Service (IRS) treats dividend payments as a refund for overpayment of the premium. In other words, they are considered a return of the premium paid by the policyholder. This favourable tax treatment means that the best option is usually to take the cash and reinvest it elsewhere to get a better return.

However, there are some rare cases where dividends from whole life insurance policies can be taxable. If the amount returned to the policyholder in cash exceeds the total amount they paid in premiums, the excess amount may be subject to tax. Additionally, if the policyholder chooses to have their dividends accumulate interest with the insurance company, the interest earned may also be taxable. Therefore, it is important to carefully consider how to use dividends to maximize their benefits and avoid unnecessary taxes.

It is worth noting that whole life insurance dividends are not guaranteed and depend on the insurer's financial performance. They are based on factors such as investment returns, mortality credits, and company expense debits. When evaluating insurance policies, individuals should investigate how dividends are calculated and whether they are guaranteed. Additionally, policyholders should consider the insurance company's credit rating to determine the sustainability of dividends in the future.

Military Spouses: Life Insurance Options and Entitlements

You may want to see also

Frequently asked questions

Dividends are paid out annually and are based on the insurance company's financial performance. They are not guaranteed but are usually paid out if the insurer performs well financially.

You can receive your dividends in several ways, including cash, cheque, or directly into your bank account. You can also use your dividends to pay for your policy or increase your coverage.

Dividends from a life insurance policy are generally not taxed if you receive them as a cash payment or apply them to your policy. However, if the dividends exceed the total amount of premiums you've paid into your policy, the additional amount may be taxed as income.