When considering the decision to cancel life insurance, it's important to understand the refund policy. Many people wonder if they will receive a refund when they cancel their life insurance policy. This paragraph aims to provide clarity on this question, offering insights into the refund process and the factors that determine whether you will get your money back.

| Characteristics | Values |

|---|---|

| Refund Policy | Most life insurance companies offer a refund of any unearned premiums if the policy is canceled within a certain period, often 30 days. |

| Pro-Rated Refund | If the cancellation occurs after the initial grace period, a pro-rated refund may be provided, considering the time the policy was in force. |

| Surrender Charge | Some policies, especially those with a cash value component, may have surrender charges or penalties for early cancellation, reducing the refund amount. |

| Medical Examination | In some cases, the insurance company might require a medical examination to assess the insured's health before processing a refund. |

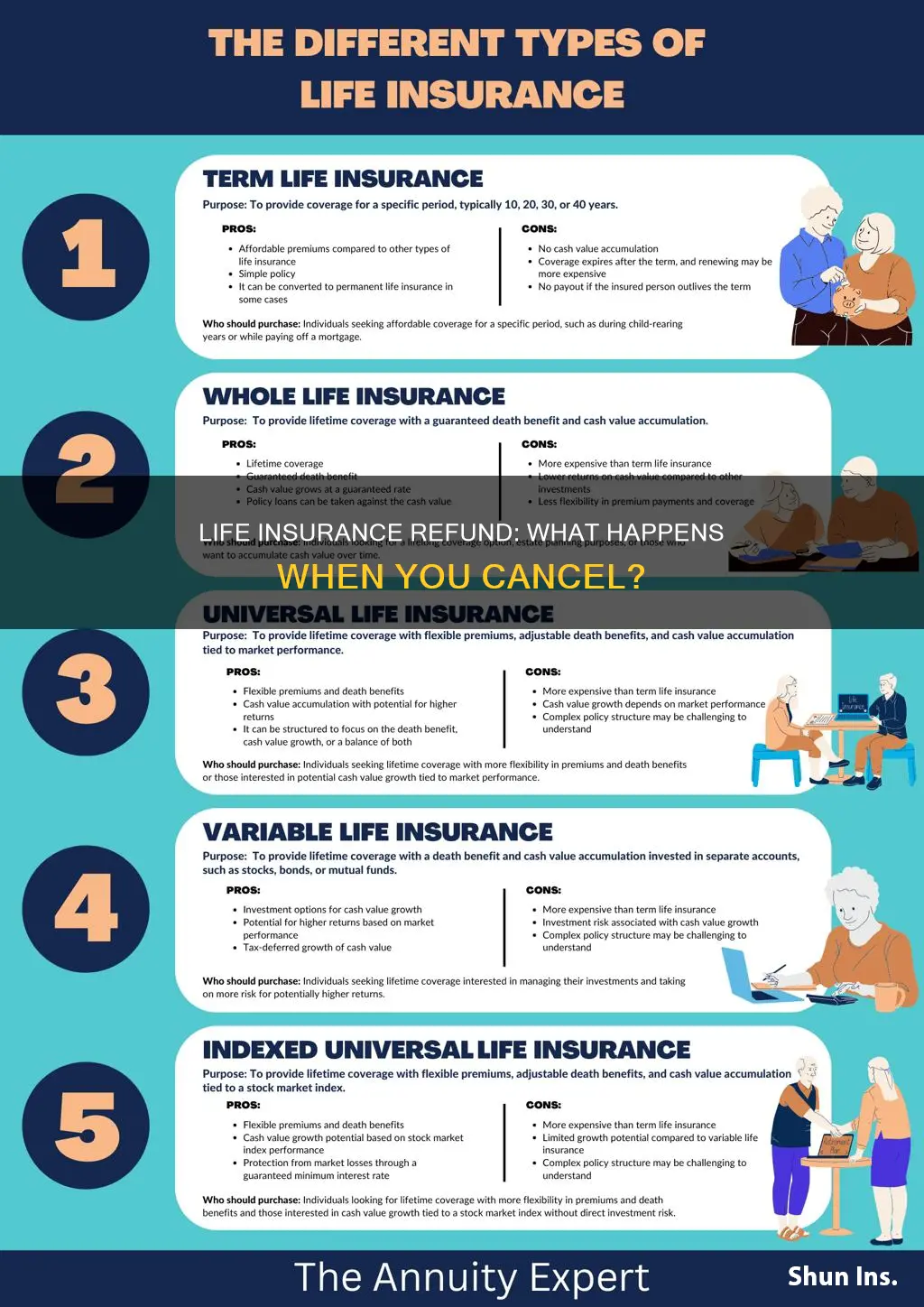

| Policy Type | Term life insurance policies often have more straightforward refund policies compared to permanent life insurance, which may have additional features and costs. |

| Grace Period | After the initial grace period, the refund amount may be reduced to cover administrative costs and any interest earned on the policy's cash value. |

| Refund Process | The refund process can vary; it may be in the form of a lump sum, partial payments, or a reduction in future premiums. |

| Reasons for Cancellation | Common reasons for canceling life insurance include finding a more affordable policy, changing personal circumstances, or realizing the coverage is not needed. |

| Impact on Beneficiaries | Canceling a life insurance policy may affect the beneficiaries' rights, especially if the policy has a built-in death benefit. |

What You'll Learn

- Refund Policy: Understand the refund process and terms when canceling life insurance

- Cancellation Fees: Learn about potential fees associated with canceling a policy

- Pro-Rata Refund: Discover how much you'll receive if you cancel mid-term

- Refund Timing: Explore how quickly you can expect your refund after cancellation

- Impact on Premiums: Understand how canceling affects future premium payments

Refund Policy: Understand the refund process and terms when canceling life insurance

When you decide to cancel your life insurance policy, it's important to understand the refund process and the terms associated with it. The refund policy can vary depending on the insurance company and the type of policy you have. Here's a detailed guide to help you navigate this process:

Refund Process:

- Return of Premiums: When you cancel a life insurance policy, the insurance company typically returns the premiums you've paid, minus any applicable fees or penalties. The refund amount is calculated based on the time of cancellation and the policy's terms. You should receive a refund for the unearned portion of the premiums, which is the amount you've paid for coverage that hasn't yet been utilized.

- Administrative Fees: Some insurance companies may deduct administrative fees or penalties for early cancellation. These fees are usually a percentage of the total premiums paid and can vary depending on the policy and the company's policies. It's essential to review your policy documents to understand the specific fees and their calculation.

- Pro-Rated Refunds: In some cases, the refund may be pro-rated, meaning it is calculated based on the time the policy was in effect. This is common for term life insurance policies, where the refund is a fraction of the total premiums paid, reflecting the time the policy was active.

Refund Terms and Considerations:

- Grace Period: Many insurance companies offer a grace period after cancellation during which you can reinstate the policy. If you change your mind within this period, you may be able to resume coverage without additional medical underwriting. However, this grace period varies, and it's crucial to know the specific timeframe provided by your insurer.

- Medical Examination: Depending on the policy and the time of cancellation, the insurance company might require a medical examination to assess your health and determine eligibility for a refund. This is more common if you cancel shortly after the policy inception or have an existing medical condition.

- Policy Type: The refund process can differ between term life insurance and permanent life insurance. Term life insurance policies typically have a defined term, and refunds are more straightforward. Permanent life insurance, on the other hand, may have cash value accumulation, and the refund process can be more complex, involving the surrender of the policy.

- Surrender Charges: For permanent life insurance, surrender charges may apply if you cancel within a certain period. These charges are typically a percentage of the policy's cash value and are designed to cover the insurance company's costs during the initial years of the policy.

Understanding the refund policy is crucial to ensure you receive the correct amount and avoid any unexpected fees. Always review your policy documents, and if in doubt, contact your insurance provider's customer service to clarify any refund-related queries. Being informed about the terms and conditions will help you make the best decision regarding your life insurance coverage.

Marijuana Use and Life Insurance: What's the Impact?

You may want to see also

Cancellation Fees: Learn about potential fees associated with canceling a policy

When considering the cancellation of a life insurance policy, it's important to understand the potential fees and implications involved. Many insurance providers charge cancellation fees when a policy is terminated before the initial term ends. These fees can vary depending on the insurance company and the specific policy details.

The primary reason for these fees is to cover the administrative costs incurred by the insurance provider when a policy is canceled. When you cancel, the company may have already allocated resources, such as underwriting and processing, to that particular policy. As a result, they may incur additional expenses to handle the cancellation and adjust their operations accordingly. These fees are often a way for insurance companies to recover some of the costs associated with providing the policy in the first place.

The amount of the cancellation fee can range from a small percentage of the premium to a substantial portion, depending on the policy and the time of cancellation. For instance, some policies may charge a fee equal to a certain number of months' worth of premiums, while others might have a flat fee. It's crucial to review the policy documents carefully to understand the specific terms and conditions regarding cancellation fees.

Additionally, it's worth noting that some insurance providers may offer a grace period during which you can cancel without incurring any fees. This grace period typically starts from the date of policy issuance and allows you to cancel within a specified timeframe without facing any financial penalties. However, this grace period can vary, and it's essential to be aware of the specific terms to avoid unexpected charges.

To avoid unnecessary fees, it is advisable to carefully review the policy documents and understand the cancellation policy before purchasing life insurance. If you have any doubts or concerns, it's best to consult with a financial advisor or insurance specialist who can provide personalized guidance based on your specific circumstances. Understanding the cancellation process and associated fees will help you make informed decisions regarding your life insurance policy.

Life Insurance Cash Value: Taxable When Distributed

You may want to see also

Pro-Rata Refund: Discover how much you'll receive if you cancel mid-term

When you decide to cancel your life insurance policy mid-term, understanding the refund process is crucial. The refund amount you receive is typically calculated on a pro-rata basis, which means you'll get a portion of the premium you've paid, proportional to the time elapsed since the policy inception. This is in contrast to a full refund, which would be the entire premium if the policy were canceled at the beginning.

The pro-rata refund is calculated by taking the total premiums paid and then subtracting any applicable fees or charges, such as administration fees or early cancellation penalties. The remaining amount is then divided by the number of days in the policy period to determine the daily premium. This daily premium is then multiplied by the number of days the policy has been in effect to arrive at the pro-rata refund.

For example, if you purchased a 10-year term life insurance policy and canceled it after 2 years, the refund would be calculated as follows: First, determine the total premiums paid over the 2-year period. Then, subtract any fees or penalties. The remaining amount is divided by 730 (the number of days in 2 years) to get the daily premium. Finally, multiply this daily premium by the number of days the policy was in effect (2 years x 365 days = 730 days) to find the total pro-rata refund.

It's important to note that the specific calculation can vary depending on the insurance company and the terms of your policy. Some companies may offer a higher refund to encourage policyholders to keep the policy for a longer duration, while others might have different fee structures. Always review your policy documents or consult with your insurance provider to understand the exact refund process and any potential fees associated with canceling the policy.

In summary, when canceling life insurance mid-term, you can expect a pro-rata refund, which is calculated based on the time the policy has been in effect. This refund ensures that you receive a fair portion of the premiums paid, taking into account any fees or charges. Understanding this process can help you make informed decisions regarding your insurance policy.

Bank Accounts and Retirement Insurance: Can They Be Seized?

You may want to see also

Refund Timing: Explore how quickly you can expect your refund after cancellation

When you decide to cancel your life insurance policy, understanding the refund process is crucial. The timing of your refund can vary depending on several factors, including the insurance company's policies and the specific terms of your contract. Here's an overview of what you can expect regarding the refund timing:

Immediate Cancellation and Initial Refund: If you cancel your life insurance policy immediately after purchasing it, you may be eligible for a full refund of your premium payments. This is because the policy is typically not active during the initial period, often referred to as the "cooling-off" period. During this time, you can return the policy without any penalties. The refund process usually begins once the insurance company receives your cancellation request, and the funds are returned to you within a few weeks, depending on the company's procedures.

Longer Cancellation Period: After the initial cooling-off period, the refund process might take a bit longer. Insurance companies often have specific grace periods or terms during which they allow policy cancellations. During this time, you may still receive a refund, but the amount could be subject to a pro-rated premium calculation. This means the refund will be based on the time the policy was in effect, and you might not get the full premium back. It's essential to review your policy documents to understand the specific terms and conditions regarding cancellation and refunds.

Refund Processing Time: Once your cancellation is approved, the insurance company will initiate the refund process. The time it takes for the refund to reach your account can vary. Some companies may process refunds within a few days to a week, while others might take longer, especially if they require additional verification or paperwork. It's advisable to inquire about the expected refund timeline with your insurance provider to ensure you have accurate information.

Factors Affecting Refund Speed: Several factors can influence how quickly you receive your refund. Firstly, the insurance company's policies and procedures play a significant role. Some companies may have faster refund processes, while others might have more stringent requirements. Additionally, the method of payment can impact the refund timeline. If you paid by check, the refund might be issued in the form of a check, which could take a few days to process and arrive in your mailbox. Electronic payments may result in faster refund processing and disbursement.

Understanding the refund timing is essential to manage your expectations when canceling a life insurance policy. By being aware of the potential refund amounts and processing times, you can make informed decisions and plan accordingly. Remember to review your policy documents and communicate with your insurance provider to ensure a smooth cancellation process and timely refund.

Survivorship Life Insurance: Smart Investment or Money Pit?

You may want to see also

Impact on Premiums: Understand how canceling affects future premium payments

When you cancel a life insurance policy, the impact on future premium payments is an important consideration for policyholders. The decision to cancel should be made after a thorough understanding of the implications, as it can significantly affect your financial obligations. Here's a detailed breakdown of how canceling life insurance can influence your premium payments:

Refund of Unpaid Premiums: One of the primary concerns when canceling life insurance is the refund of any unpaid premiums. Insurance companies typically offer a grace period after which the policy becomes inactive if premiums are not paid. If you cancel the policy during this grace period, you may receive a refund for the remaining unearned premiums. However, the refund amount is usually calculated based on the time the policy was in effect and the premiums already paid. This means that the longer you keep the policy active before canceling, the less you might get back.

No Further Premium Obligations: After canceling the policy, you will no longer be required to make any premium payments. This can be a significant financial relief, especially if you were paying substantial amounts regularly. Once the cancellation is processed, the insurance company's obligation to provide coverage for your beneficiary ends. It's essential to understand that this relief from premium payments is immediate and permanent, as the policy is terminated.

Impact on Future Premiums: The act of canceling life insurance can have a lasting impact on your future premium payments. When you cancel, the insurance company may view you as a higher-risk individual, especially if the cancellation was not due to a policyholder's death. This perception can lead to increased premiums if you decide to purchase another life insurance policy in the future. Insurance providers often consider factors like age, health, and lifestyle when calculating premiums, and a cancellation might be seen as a negative indicator. As a result, you may face higher costs for future coverage.

Long-term Financial Planning: Understanding the impact of cancellation on premiums is crucial for long-term financial planning. If you have a substantial amount of life insurance coverage and decide to cancel, it could result in a significant reduction in your overall insurance costs. However, this decision should not be made impulsively, as it may affect your financial security in the event of an unforeseen tragedy. It is advisable to review your policy regularly and consider your life circumstances, such as changes in family status or financial goals, before making any cancellation decisions.

In summary, canceling a life insurance policy can have both immediate and long-term effects on your premium payments. While it may provide financial relief in the short term, it could also impact your future insurance costs. Policyholders should carefully weigh the pros and cons, considering their personal circumstances and financial goals, before making a decision that may have lasting consequences.

Uncovering Your Mom's Legacy: Life Insurance Discovery

You may want to see also

Frequently asked questions

Yes, you can typically get a refund if you cancel your life insurance policy. The amount you receive as a refund depends on the type of policy and how long you've had it. Generally, you'll get back a portion of the premiums you've paid, minus any fees or penalties.

The refund calculation can vary, but it often involves a pro-rata basis. This means you'll receive a percentage of the total premiums paid, based on how much time has passed since the policy was taken out. For instance, if you cancel a year after purchasing, you might get back around 1/12th of the total premiums.

Yes, insurance companies often have cancellation fees or penalties to cover administrative costs. These fees can vary and may be a percentage of the total premiums or a flat fee. It's important to review the policy documents to understand any potential charges.

If you cancel your life insurance and then decide to re-insure, your new policy may be more expensive, or you might not qualify for the same terms as before. Insurance companies consider your health and lifestyle when assessing risk, and canceling a policy can impact your future insurance rates and coverage options.