Life insurance is a crucial financial product that provides peace of mind and security for individuals and their loved ones. One of the key advantages of life insurance is that it ensures proceeds are protected from creditors. This protection is facilitated by a spendthrift clause within the policy, which restricts the beneficiary's ability to assign benefits to others. This means that the death benefit is safeguarded and cannot be seized by creditors, ensuring the beneficiary receives the full amount as intended. This feature is especially important for beneficiaries who may be facing financial challenges or have outstanding debts, as it provides them with a layer of protection and financial stability during difficult times.

| Characteristics | Values |

|---|---|

| Ensures proceeds of a life insurance policy are free from attachment or seizure by the beneficiary's creditors | Spendthrift Clause |

What You'll Learn

The death benefit is usually tax-free

The death benefit from a life insurance policy is usually not subject to federal income tax. This means that the beneficiaries of the policy will not have to pay income tax on the money they receive. This is a major advantage of life insurance, as it ensures that the full amount of the benefit is available to the beneficiaries without any tax deductions.

In addition to federal income tax, life insurance proceeds are also generally exempt from estate taxes. This can be especially beneficial for wealthy individuals, who may use permanent life insurance to avoid estate taxes and preserve the value of their estate for their heirs.

It is important to note that there may be some tax implications for life insurance proceeds in certain situations. For example, if the beneficiary of a life insurance policy dies from the same accident as the insured, the insurance company will proceed as if the insured outlived the beneficiary. In this case, the proceeds may be subject to estate taxes. Additionally, if the beneficiary of a life insurance policy is a creditor of the insured, the insurance company will pay the proceeds to the insured's estate, and the proceeds may be subject to estate taxes.

It is also worth mentioning that while the death benefit itself is typically tax-free, any interest earned on the benefit may be taxable. This is something to keep in mind if the beneficiary chooses to have the proceeds remain with the insurer and earn interest.

Overall, the tax-free nature of life insurance proceeds is a significant benefit that can provide financial support and security to beneficiaries during a difficult time.

Tom Cruise's Life Insurance: Does He Need It?

You may want to see also

The beneficiary will receive the proceeds

Life insurance is a contract between an insurance company and a policy owner, where the insurer guarantees to pay a sum of money to the named beneficiary when the insured person dies. The beneficiary is the person who will receive the life insurance policy's death benefit. The death benefit is the amount stated on the face of the policy that will be paid in the case of death or when the policyowner receives payment at surrender or maturity.

The beneficiary of a life insurance policy is generally able to receive the death benefit proceeds income tax-free. This is considered a major tax advantage of life insurance. The death benefit of a life insurance policy is usually tax-free, and it may be subject to estate taxes. The beneficiary designation form, when properly completed, means that insurance proceeds do not go through probate.

The beneficiary of a life insurance policy can be any individual(s) or entity, such as a trust. Anyone can be named as a beneficiary. A trust may be a prudent beneficiary choice if a surviving spouse would not be able to manage a large sum of money wisely. In this case, trustees would take charge of managing, investing, and disbursing the policy proceeds for the benefit of the surviving spouse.

It is important to name contingent or secondary beneficiaries for your life insurance policy. This ensures that if the primary beneficiary has passed away, the insurance proceeds will go to an individual or trust. If there are no surviving beneficiaries, then the beneficiary is generally considered to be the "estate of the insured". This means that the death benefits will be probated and ultimately distributed according to the instructions of the last will and testament.

Christian Healthcare Ministries: Life Insurance Coverage?

You may want to see also

The policyholder can borrow from the cash value

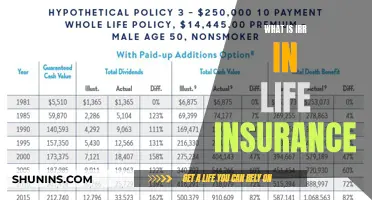

Life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or more named beneficiaries when the insured person dies. Permanent life insurance policies, which include whole life insurance and universal life insurance, build cash value over time. This means that the policyholder can borrow against the cash value to cover significant expenses, like a down payment on a home, retirement, paying down a mortgage, covering an unforeseen emergency, or a child's college tuition.

The process of borrowing from a life insurance policy is known as a life insurance policy loan. Policy loans come in the form of direct loans or indirect automatic premium loans. With a direct loan, the policyholder borrows money from themselves, with the policy's cash value serving as collateral. There is no formal credit check required, and the money can be used for anything from bills to vacation expenses. The insurance company will charge interest on the loan, known as a spread, which is usually low, ranging from 0.25% to 2%. The loan will reduce the policy's cash value and death benefit by the amount borrowed.

It is important to note that borrowing against a life insurance policy has its pros and cons. On the one hand, it offers a convenient and low-cost financing option with a low-interest rate and no formal repayment timeline. On the other hand, there is a risk of reducing the death benefit if the loan is not paid off, and the accrual of interest can lead to a policy lapse if the cash value is depleted. Additionally, if the policy terminates, the policyholder may face income tax on the borrowed amount.

Check Your SBI Life Insurance Status: Quick and Easy Steps

You may want to see also

The policyholder can withdraw from the cash value

Life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or more named beneficiaries when the insured person dies. Permanent life insurance policies, which remain active until the insured person dies, stops paying premiums, or surrenders the policy, include a cash value component. This cash value can be withdrawn by the policyholder.

Withdrawing from the Cash Value of a Life Insurance Policy

The cash value of a life insurance policy can be withdrawn by the policyholder. However, there are some important considerations to keep in mind. Firstly, withdrawals may be limited to a certain amount, usually the amount that has been put into the policy by the policyholder. Withdrawing more than this amount may result in taxable income. Additionally, withdrawals may reduce the death benefit of the policy, which could impact the funds available to beneficiaries. Withdrawing cash from a life insurance policy may also be restricted within the first two years of the policy.

Whole Life Insurance Policies

Whole life insurance policies do not always have cash values in the first two years and may not pay dividends until the third year. It is important to review the individual policy to understand the specifics of cash withdrawals. Withdrawals from whole life policies may be subject to taxes and penalties if the policy is classified as a Modified Endowment Contract (MEC). MECs are life insurance policies in which the funding exceeds federal tax law limits.

Universal Life Insurance Policies

Universal life insurance policies, another type of permanent life insurance, may lapse prematurely due to inadequate funding, an increase in insurance costs as the insured person gets older, or a low-interest crediting rate. Withdrawals from universal life policies are generally treated in the same way as those from whole life policies and may be subject to taxes and penalties if the policy is an MEC.

Understanding Life Insurance Death Benefits Payouts

You may want to see also

The policyholder can use the cash value to pay premiums

Life insurance is a legally binding contract between an insurance company and a policyholder, where the insurer guarantees to pay a sum of money to the policy's beneficiaries when the insured person dies. In exchange, the policyholder pays regular premiums to the insurer during their lifetime.

Permanent life insurance policies, such as whole life insurance, are more expensive than term life insurance but remain in force throughout the insured's lifetime. Whole life insurance has a cash value component, which is similar to a savings account. The policyholder can use the cash value for several purposes, such as taking out loans or paying policy premiums.

The cash value of permanent life insurance serves two purposes. Firstly, it is a savings account that the policyholder can use during their lifetime. Secondly, the cash accumulates on a tax-deferred basis, which can be advantageous for retirement planning. The policyholder can use the cash value to pay premiums or purchase additional insurance.

While the cash value of a permanent life insurance policy can be used to pay premiums, it is important to note that doing so will reduce the death benefit. Additionally, the policyholder must ensure that sufficient cash value has accumulated in the policy before using it to pay premiums.

Choosing the Right Term Life Insurance Duration

You may want to see also

Frequently asked questions

A spendthrift clause in the life insurance policy restricts the ability of the beneficiary to assign benefits.

A spendthrift clause is a provision in a life insurance policy that restricts the ability of the beneficiary to assign benefits. It ensures that the proceeds of the policy are protected from attachment or seizure by the beneficiary's creditors.

The key benefit of a spendthrift clause is that it protects the beneficiary's interests by safeguarding the proceeds of the life insurance policy from their creditors. It ensures that the beneficiary receives the full benefit as intended, without any deductions or seizures by third parties.