Life insurance is an important financial tool that ensures your loved ones are taken care of if you pass away. The amount of life insurance you need depends on your individual circumstances, but it's essentially about how much money your loved ones would need to stay financially secure without your income. To calculate the proper amount of life insurance, you should consider your financial obligations, such as mortgage payments or college fees, and subtract your assets, such as savings and investments. The remaining amount is the gap that life insurance needs to fill. Online life insurance calculators can help with this process, but it's recommended to consult a financial professional to determine the right coverage for your specific needs.

| Characteristics | Values |

|---|---|

| How much life insurance do you need? | This depends on your financial goals and needs. |

| How to calculate your life insurance needs | Subtract the total value of your available assets from your long-term financial obligations. |

| Financial obligations | Annual income, debts, future college costs, funeral needs, mortgage payments, etc. |

| Assets | Savings, investments, retirement savings, existing life insurance policies, etc. |

| Who do you want to protect? | Spouse or partner, children, siblings, aging parents, etc. |

| How long would they need financial support? | Consider the ages of everyone who depends on your earnings. |

| Do they have any special needs? | Remember that some people may need lifelong support. |

| How much debt do you have? | You’ll want more coverage if you have a mortgage, auto payments, credit card debt, and other outstanding loans. |

| How much savings do you have? | Factor in all of your savings and investments and how liquid they are. |

| Will you be contributing to a child's college education? | If so, you’ll want to increase your coverage level. |

| Will your spouse or partner need help funding their retirement? | If so, more coverage is needed than if they are fully funding their own retirement. |

| How to manually calculate how much life insurance you need | Multiply your annual income by 10, or use the DIME (Debt, Income, Mortgage, Education) formula. |

What You'll Learn

- Consider your annual salary and the number of years you want to replace that income

- Think about your debts and future expenses, such as college fees and funeral costs

- Evaluate your assets, including savings, investments, and existing life insurance policies

- Decide on the type of life insurance policy you want, such as term or permanent

- Consult a financial professional or use an online calculator to estimate your needs

Consider your annual salary and the number of years you want to replace that income

When calculating the proper life insurance, it's important to consider your annual salary and the number of years you want to replace that income. This is a crucial factor in determining the financial protection you want to provide for your loved ones in the event of your death. Here are some detailed instructions and considerations to help you through this process:

Assess Your Current Income

The first step is to calculate your current annual income. This includes any earnings from your job, business, or other sources that contribute to your total income. Understanding your current income level is essential for the subsequent calculations.

Determine the Number of Years for Income Replacement

Consider how many years you want your income to be replaced for your beneficiaries. This could be until your retirement age or a specific number of years to ensure your loved ones can maintain their standard of living. For example, you might want to replace your income for 10, 15, or 20 years, depending on your age and financial goals.

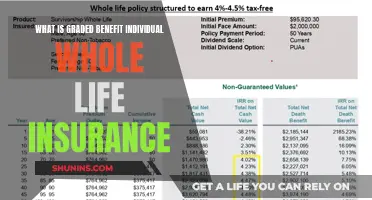

Multiply Your Annual Salary by the Number of Years

Once you have determined your annual salary and the desired number of years, multiply these two numbers together. This calculation will give you an estimate of the total income replacement needed. For instance, if your annual salary is $50,000 and you want to replace it for 15 years, the calculation would be $50,000 x 15 = $750,000.

Consider Other Financial Obligations and Goals

In addition to income replacement, there may be other financial obligations or goals you want to include in your life insurance calculation. These could include mortgage payments, future college fees for children, funeral costs, or any outstanding debts. Add these amounts to the total from the previous step to ensure all your financial obligations are covered.

Evaluate Your Current Assets and Other Sources of Income

Now, it's essential to consider your current assets and other sources of income that your loved ones can rely on. These could include savings accounts, investments, retirement funds, or existing life insurance policies. Subtract these assets from the total amount calculated in step 4. The remaining amount represents the additional coverage you may need from your life insurance policy.

Choose the Right Type of Life Insurance

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers you for a specific number of years, while permanent life insurance covers you for your entire life. Consider your long-term goals, budget, and the level of protection you want for your loved ones when choosing the type of life insurance that best suits your needs.

Remember, it's always a good idea to consult a financial professional or a licensed agent to help you navigate the different options and choose the most suitable life insurance plan for your specific circumstances.

Skydiving: Is Your Northwestern Life Insurance Valid?

You may want to see also

Think about your debts and future expenses, such as college fees and funeral costs

When calculating how much life insurance you need, it's important to consider your debts and future expenses, such as college fees and funeral costs. This is because life insurance is intended to provide financial security for your loved ones after you're gone, covering any outstanding debts and future costs they may incur.

One way to estimate your coverage needs is to use an online life insurance calculator. These tools will prompt you to input information about your debts, future expenses, income, savings, and investments, and will provide an immediate estimate of your coverage needs.

If you prefer to calculate your coverage needs manually, you can follow a few simple steps. First, add up your debts, including any credit card debt, student loans, and mortgage balance. Next, consider any future expenses you anticipate, such as college fees for your children or funeral costs. You can also include the cost of replacing services provided by a stay-at-home parent, such as childcare.

Once you have calculated your total financial obligations, you can subtract your liquid assets, such as savings, investments, and existing college funds. The remaining amount represents the gap that life insurance will need to fill, giving you a good estimate of the coverage you require.

It's worth noting that this calculation is just one aspect of determining your life insurance needs. You should also consider your income, the number of dependents, and the length of coverage you desire. Consulting a licensed agent or financial planner can help ensure that your coverage level fits your unique circumstances and goals.

Unlocking Loan Options with Life Insurance Policies

You may want to see also

Evaluate your assets, including savings, investments, and existing life insurance policies

When calculating the proper amount of life insurance, it's important to evaluate your assets, including savings, investments, and existing life insurance policies. This will help you determine the financial resources your loved ones can rely on if you pass away. Here are some key considerations:

Savings and Investments

Calculate the total value of your personal savings across various accounts, such as bank accounts, stocks, bonds, and mutual funds. Also, consider any inheritance you may have received. While real estate is an investment, keep in mind that it cannot be converted into cash instantly, so factor in its liquidity.

Retirement Savings

Evaluate your retirement savings, including money invested through an employer or other organizations, such as IRAs and 401(k) plans. Social Security benefits can also be factored in here.

Existing Life Insurance Policies

Take stock of any current life insurance policies that will be paid out to your beneficiaries in the event of your death.

After assessing these assets, you can subtract them from your financial obligations to determine the life insurance coverage amount you need. This calculation will give you a clearer idea of the financial gap your loved ones would face and help you choose a policy with an appropriate death benefit.

Remember, the right amount of life insurance depends on your unique circumstances, including your budget and priorities. It's always a good idea to consult a financial advisor or insurance agent to ensure you're making the right choices for your situation.

Understanding COBRA: Life Insurance Coverage and Benefits

You may want to see also

Decide on the type of life insurance policy you want, such as term or permanent

When deciding on the type of life insurance policy you want, you will need to consider your financial situation, your long-term goals, and your dependents' needs. There are two main types of life insurance: term and permanent.

Term life insurance is a temporary form of coverage that lasts for a specific period, typically between one and 30 years, or until a particular age. It tends to be cheaper than permanent life insurance, especially if you buy it early in life. Term life insurance is often chosen by those who want simple, inexpensive coverage to pay off debts, leave money to a partner, or cover funeral costs. It can also be a good option for those who want to lock in a premium at a relatively low rate while they are young and healthy. However, term life insurance does not offer any cash value accumulation, and once the policy term ends, the coverage ends as well.

Permanent life insurance, on the other hand, lasts your entire life, provided you continue to pay the premiums. It tends to be more expensive than term life insurance, but it offers a cash value component that grows tax-deferred over time. This cash value can be accessed to cover expenses while you are still alive, although doing so will decrease the amount of the policy's death benefit. Permanent life insurance is often chosen by those who want long-term financial protection, wish to create an inheritance for their heirs, or want a tax-advantaged way to save for future expenses.

When deciding between term and permanent life insurance, consider your needs and circumstances. If you need short-term coverage or additional protection during specific times, term life insurance may be a good option. On the other hand, if you need long-term financial protection and want to create an inheritance, permanent life insurance may be more suitable. Additionally, if you have other financial assets to leave as an inheritance, term life insurance might be sufficient.

Life Insurance and Job Loss: What's Covered?

You may want to see also

Consult a financial professional or use an online calculator to estimate your needs

If you're unsure about how much life insurance you need, it may be a good idea to consult a financial professional. They can help you assess your situation and determine the type and level of coverage that best suits your needs.

Financial professionals can also help you calculate your coverage needs by taking into account your future financial obligations and your assets, such as savings, that your loved ones can use if you pass away. They will also be able to advise on the different types of life insurance available, such as term life insurance and permanent life insurance, and which is best for you.

If you don't have access to a financial professional, you can use an online calculator to estimate your life insurance needs. These calculators will ask you to input information such as your annual income, the number of income-earning years you want to replace, your debts, future costs you want to cover (e.g. college fees), and your savings and investments. Based on this information, the calculator will provide an estimate of the death benefit amount that suits your life and priorities.

It's important to remember that these calculators provide a rough estimate, and the right amount of coverage for you will ultimately depend on your budget and priorities. Additionally, while a calculator can be a useful tool, it may still be worth consulting a licensed agent or financial planner to ensure that your coverage level fits your specific needs.

Employer Life Insurance: Cash Value or Policy Benefit?

You may want to see also

Frequently asked questions

A good calculation for life insurance needs is to add up the financial obligations you want to cover (e.g., a mortgage balance, your annual income for a certain number of years, future college costs, etc.) and then subtract assets that can be used toward those obligations (e.g., savings and existing life insurance). The answer is a good estimate of your life insurance needs.

When buying life insurance, it's a good idea to look beyond the price. Consider features that are important to your financial goals, like conversion options, renewability, and living benefits. For example, the best term life insurance policies can be converted to permanent life insurance. It's also important to prepare for the life insurance medical exam.

Life insurance needs often change with age. To determine how much coverage you need at age 60, consider how much money your life insurance beneficiary would need to cover expenses in your absence. This can include expenses covered by your income, existing debts, a mortgage payment, tuition, and end-of-life expenses. Once you determine what expenses you want to be covered, use a life insurance calculator to identify an appropriate amount of coverage.