Getting life insurance is a vital step towards securing your family's future and ensuring their financial stability in your absence. The process of buying life insurance involves several steps, from determining the need for insurance to choosing the right type of policy and finalising the purchase. Here's a comprehensive guide to help you navigate the process:

1. Assess your need for life insurance: Ask yourself if anyone depends on your income, if you have debts that your loved ones might inherit, and what your major financial obligations are. These questions will help you decide if life insurance is necessary for you.

2. Calculate the required coverage: Consider your financial resources, income, and the financial needs of your survivors or heirs. This will help you determine how much coverage you need to ensure your loved ones are taken care of.

3. Identify your financial goals: Think about why you're buying life insurance. Do you want to leave behind financial resources for your family, cover final expenses, or accumulate savings for retirement? Knowing your financial goals will guide your choice of insurance policy.

4. Choose the type of life insurance: There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers you for a specific period, usually between 10 and 30 years, and is more affordable. Permanent life insurance, including whole life and universal life options, covers you for life and often includes a cash value component.

5. Shop around for insurance providers: Compare life insurance providers based on their financial stability, customer service reviews, policy features, and premium affordability. Get quotes from multiple insurers to find the best fit for your needs and budget.

6. Decide on the mode of purchase: You can buy life insurance through an independent local insurance agent, an independent online broker, or directly from an insurance company. Each option has its advantages, so consider trying out different methods to see which one suits you best.

7. Complete the application process: Provide detailed information about your health, family medical history, lifestyle, and any risky activities you engage in. Choose your beneficiaries, who will receive the payout if you pass away. Be honest in your application, as discrepancies can affect your coverage.

8. Prepare for a medical exam: Most traditional life insurance policies require a medical exam to assess your health and determine your premium. The insurance company will arrange for a qualified medical professional to conduct the exam, which may include bloodwork and general health testing.

9. Wait for approval: The insurance company will evaluate your application and medical exam to determine your eligibility and final premium. This process can take a few weeks, and you may be approved at the same rate as quoted, a lower rate, or a higher rate.

10. Review and purchase the policy: Once approved, carefully review the policy details, including the rate and benefits. If you're satisfied, sign the policy documents, make the first premium payment, and inform your beneficiaries about the policy.

What You'll Learn

Deciding whether you need life insurance

Another key consideration is your financial situation. If you have significant debts, such as a mortgage or student loans, life insurance can help ensure that these are paid off and that your loved ones are not left with a financial burden. It can also be useful if you own a business, as the payout can help your business partners or heirs cover expenses and buy out your share of the company.

Life insurance can also be helpful if you want to leave a financial legacy, such as an inheritance or a donation to a charity. Additionally, it can provide funds to cover your final expenses, such as funeral and burial costs, which can be a significant expense for your family.

On the other hand, if you are single, have no dependents, and have enough money to cover your debts and final expenses, then you may not need life insurance. Similarly, if you have dependents but enough assets to provide for them after your death, life insurance may not be necessary.

Ultimately, the decision to get life insurance depends on your individual circumstances and financial goals. It's important to carefully consider your needs and seek professional advice if needed before making a decision.

Liquidating Life Insurance for Assisted Living Expenses

You may want to see also

Calculating how much coverage you need

When calculating how much life insurance coverage you need, it's important to consider your financial obligations, future expenses, and existing resources. Here are some steps and factors to help you determine the appropriate coverage amount:

Identify Your Financial Obligations:

- Calculate your annual salary and multiply it by the number of years you want to replace that income for your beneficiaries.

- Add up any debts, such as your mortgage balance, credit card debt, or other loans.

- Consider future expenses, such as college fees for your children or funeral costs.

- If applicable, calculate the cost of replacing services provided by a stay-at-home parent, such as childcare.

Assess Your Existing Resources:

- Subtract your liquid assets, such as savings, investments, and existing college funds, from the total financial obligations calculated in step 1.

- Include any current life insurance policies or other sources of financial support, such as employer-provided life insurance.

Use Calculators and Formulas:

- Utilize online life insurance calculators to get a more precise estimate of your coverage needs. These calculators take into account various factors, including income, debts, future expenses, and existing assets.

- Alternatively, you can use formulas like the "10 times income" guideline, which suggests multiplying your income by 10. However, this method may not consider all your family's needs, savings, or existing coverage.

- The DIME formula (Debt, Income, Mortgage, Education) provides a more detailed look at your finances. It accounts for your debts, income, mortgage, and education costs but may not include savings or the contributions of a stay-at-home parent.

Consider Your Life Stage and Goals:

- Think about your current life stage and future goals. For example, if you're expecting a baby, you may want to ensure sufficient coverage for their future needs.

- Consider any major life events, such as getting married, buying a home, or starting a family, which may impact your coverage needs.

Seek Professional Advice:

Consult a licensed agent or financial planner to help you assess your situation and determine the appropriate type and level of coverage. They can guide you in making a well-informed decision.

Remember, the amount of coverage you need depends on various factors, including your age, income, mortgage, debts, and anticipated expenses. It's essential to regularly review and adjust your coverage as your life circumstances change.

Congressman's Insurance: A Lifetime Benefit?

You may want to see also

Choosing the right type of life insurance

Term Life Insurance

Term life insurance is typically the most affordable option and is suitable for those who want coverage for a specific period. It provides a death benefit if you pass away during the term, which is usually between 10 and 30 years. Term life insurance is often chosen by individuals or families on a limited budget, as it offers high coverage amounts at a lower cost. It is also a good choice if you need coverage for a finite period, such as paying off a debt or mortgage. While term life insurance is generally simple and cost-effective, it may not be ideal if you want lifelong coverage, as the policy ends when the term is over, and you will need to renew or purchase a new policy. Additionally, over 97% of term life policies do not pay out a death benefit because the insured person outlives the policy.

Permanent Life Insurance

Permanent life insurance, on the other hand, provides coverage for your entire life, as long as you continue to pay the premiums. It is suitable for those who want lifelong protection and are willing to pay higher premiums. Permanent life insurance policies also have a savings component called cash value, which grows on a tax-deferred basis and can be borrowed against or withdrawn. This type of insurance is ideal if you want to accumulate savings and have access to funds for various purposes. The premium for permanent life insurance remains the same, regardless of your age, whereas term life insurance premiums usually increase substantially upon renewal. However, permanent life insurance is more complex and requires a long-term financial commitment, which may be unaffordable for some.

Whole Life Insurance

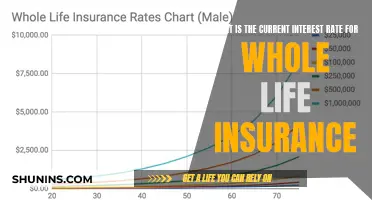

Whole life insurance is a type of permanent life insurance that provides lifetime coverage as long as premiums are paid. It offers fixed premiums and a guaranteed rate of return on the policy's cash value. Whole life insurance is considered one of the most secure forms of insurance due to its predictability and guaranteed cash value growth. However, it is generally more expensive than term life insurance.

Universal Life Insurance

Universal life insurance is another type of permanent coverage that offers flexibility. It allows you to adjust your premiums and death benefit to fit your changing needs. The cash value in a universal life policy grows based on market interest rates, and you can choose from various investment options. Universal life insurance is typically less expensive than whole life insurance and can adapt to your future requirements. However, the death benefit and cash value growth are not guaranteed.

Variable Life Insurance

Variable life insurance is a type of cash value life insurance where the policy is tied to investment accounts such as bonds and mutual funds. It offers the potential for considerable gains if your investments perform well. However, it requires hands-on management as the cash value can fluctuate daily based on market performance. Variable life insurance is suitable for those with a higher risk tolerance and a desire for greater control over their investments.

Burial or Final Expense Insurance

Burial or final expense insurance is a small whole life insurance policy designed to cover funeral, burial, and end-of-life expenses. It typically does not require a medical exam, making it accessible to seniors with pre-existing health conditions. However, the coverage amount is capped at a lower limit, and the full death benefit may not be paid out if the insured person dies within the first few years of the policy.

When choosing a life insurance policy, consider your financial situation, the length of coverage needed, and whether you want additional benefits such as savings or investment options. It is also essential to compare quotes from different insurers to find the best rates and ensure that the policy suits your specific needs and budget.

Life Insurance: AD&D Coverage and Benefits

You may want to see also

Comparing quotes from different providers

Number of Quotes

It is recommended to compare quotes from at least three or four insurers to get the best price possible. This allows you to assess the range of prices and coverage options available to you.

Coverage Amount

When comparing quotes, ensure you are selecting policies with the same level of coverage. For instance, you might choose to compare policies with a $250,000 coverage amount. This ensures that you are getting an accurate understanding of the cost of your desired coverage.

Policy Details

Not all life insurance policies are created equal. When comparing quotes, pay close attention to the specific details of each policy, including the policy type, term length, and riders (add-on coverage options). Make sure the policies you are comparing have relatively similar features to make an informed decision.

Extras and Customization

Some life insurance policies may include free riders, while others may not. If you are interested in customizing your policy with additional benefits, be sure to take this into account when comparing quotes. Consider which riders are important to you and whether they are included or come at an additional cost.

Comparison Methods

There are several ways to go about comparing quotes:

- Direct Comparison: You can go directly to each life insurer's website or speak to one of their agents to obtain a quote. This allows you to interact directly with the insurer and ask any questions you may have.

- Broker: Working with a broker can be beneficial as they can collect quotes from multiple companies on your behalf. This saves you time and provides a centralized source for comparing quotes.

- Online Comparison Tool: Utilizing an online life insurance comparison tool can generate quotes from a range of companies simultaneously. This option offers convenience and a quick way to see multiple options side by side.

Financial Strength

When assessing life insurance companies, it is essential to consider their financial strength ratings through agencies like AM Best, S&P, or Moody's. This indicates the insurer's ability to pay out claims in the future, which is especially important for long-term life insurance policies.

Customer Experience

In addition to financial strength, consider the customer experience offered by each insurer. Look at consumer reviews, complaint ratios, and ease of communication. The insurers known for their excellent customer service and strong reviews may be worth paying a slightly higher premium for added peace of mind.

Your Specific Needs

Lastly, remember that the best life insurance policy for you is one that meets your unique needs and budget. Take into account your age, health, lifestyle, and financial goals when comparing quotes. The right policy will provide the necessary coverage at a price that fits within your financial plan.

Life Insurance with Cancer: Is Term Coverage Possible?

You may want to see also

Applying for the policy

Applying for a life insurance policy involves several steps, and the process can vary depending on the insurance company and the type of policy chosen. Here is a detailed guide on applying for a life insurance policy:

Determine the need for life insurance:

Before applying, assess whether you require life insurance. Consider your personal and financial circumstances, such as having dependents, providing for elderly parents, or wanting to ease the financial burden on your family in the event of your death.

Decide on the type of policy:

There are two main types of life insurance policies: term life and permanent life insurance. Term life insurance covers you for a specific period, usually between 10 and 30 years, while permanent life insurance provides coverage for your entire life as long as premiums are paid. Permanent life insurance is generally more expensive but offers additional benefits, such as a cash value component.

Choose a reputable insurance company:

Research and compare different insurance companies to find one that suits your needs. Consider factors such as customer service, agent recommendations, consumer reviews, and the financial stability of the insurer.

Determine the coverage amount and length:

Calculate the amount of coverage you need by considering factors such as income, debts, mortgage, and the needs of your dependents. Also, decide on the length of coverage you require, especially if you choose term life insurance.

Gather information and fill out the application:

When applying for a life insurance policy, you will need to provide personal information, including your name, contact details, Social Security number, and driver's license number. Additionally, be prepared to disclose your financial and health information, such as salary, medical conditions, family medical history, lifestyle choices, and any risky hobbies. You will also need to designate a beneficiary or beneficiaries who will receive the death benefit.

Prepare for a medical exam (if required):

Some life insurance policies, especially those with higher coverage amounts, may require a medical exam. The insurance company will arrange for a paramedical examiner to visit you and conduct a basic physical examination, including taking blood and urine samples.

Review and finalise the policy:

Once your application and medical exam (if applicable) are complete, the insurance company will review your information. If approved, they will send you the policy details, including the rate. Carefully review the policy, and if you are satisfied, sign the necessary documents to finalise the purchase.

Cancer Patients: Finding Life Insurance Options

You may want to see also

Frequently asked questions

Life insurance is useful but not necessary for everyone. You should consider purchasing a policy if someone depends on you financially, if your estate won't have enough liquid assets to cover its taxes and debt, or if you wish to cover your funeral and burial expenses.

This will depend on various factors, including your personal and household income, the needs of your dependents or beneficiaries, and your financial goals. A common rule of thumb is to multiply your annual income by 10 to 15 to get an estimate.

There are two primary types of life insurance: term life and permanent life. Term life insurance covers you for a specific period, usually between 10 and 30 years, and is more affordable. Permanent life insurance covers you for your entire life and often includes a cash value investment component, making it more expensive.

You can buy life insurance through an independent local insurance agent, an independent online broker, or directly from an insurance company. You can shop around for quotes and compare factors such as customer service, consumer reviews, financial stability, and policy features and premiums.