When it comes to health insurance, the choice between a Preferred Provider Organization (PPO) and a Consumer-Directed Health Plan (CDHP) can significantly impact the cost of co-insurance. PPOs typically offer more flexibility in choosing healthcare providers, but this comes at a higher price. In contrast, CDHPs encourage individuals to take a more active role in managing their healthcare by setting aside a portion of their premium in a Health Savings Account (HSA). While CDHPs often have lower monthly premiums, they may require higher out-of-pocket expenses, including higher co-insurance rates, to encourage cost-conscious healthcare decisions. This comparison highlights the trade-offs between these two plan types and how they can affect the financial burden of co-insurance for individuals.

| Characteristics | Values |

|---|---|

| Network | PPO plans typically have a larger network of healthcare providers, which can lead to higher costs for the insurance company. |

| Provider Types | Preferred Provider Organizations (PPOs) include a wide range of healthcare providers, including out-of-network options, which can result in more complex and costly claims. |

| Utilization | PPOs often encourage higher utilization of services due to the lack of restrictions on out-of-network care, potentially increasing costs. |

| Cost-Sharing | Higher coinsurance rates in PPOs can be attributed to the flexibility in choosing providers, which may lead to more expensive treatments or visits. |

| Management | PPOs are generally more complex to manage due to the variety of providers and services, requiring more resources to negotiate rates and manage claims. |

| Negotiation Power | Insurance companies in PPOs might have less negotiation power with out-of-network providers, leading to higher costs for the plan. |

| Market Dynamics | The competitive nature of PPO markets can drive up costs as providers may charge more to be included in the network. |

| Administrative Costs | The administration of PPO plans can be more expensive due to the complexity and the need for additional resources to manage out-of-network care. |

What You'll Learn

- Design Differences: PPOs often have larger, more complex networks, requiring more co-insurance

- Risk Pooling: PPOs cover a broader range of risks, leading to higher co-insurance rates

- Benefit Structure: PPOs offer more comprehensive benefits, increasing the need for co-insurance

- Network Management: PPOs manage provider networks more extensively, impacting co-insurance rates

- Market Dynamics: Competitive PPO markets may drive co-insurance higher compared to CDHPs

Design Differences: PPOs often have larger, more complex networks, requiring more co-insurance

The design differences between Private Pay Only (PPO) and Cost-Sharing Health Plans (CDHP) significantly impact the co-insurance rates, with PPOs generally requiring higher co-insurance compared to CDHPs. One of the primary reasons for this difference lies in the network design and the associated costs. PPOs typically feature larger and more intricate networks of healthcare providers, including a wide range of specialists and advanced medical services. This extensive network is designed to offer patients more choices and flexibility in their healthcare options, which can be particularly beneficial for those with complex medical needs. However, the expanded network also means that PPOs often have higher administrative and operational costs.

In contrast, CDHPs usually have a more limited network of providers, often focusing on a specific group of healthcare professionals or a regional network. This streamlined approach aims to reduce costs and encourage patients to use in-network providers, which can lead to lower co-insurance rates. By limiting the network, CDHPs can negotiate lower rates with providers, as they have fewer options to choose from, and this cost-saving strategy is often passed on to the patients in the form of reduced co-insurance.

The complexity of PPO networks is a critical factor in determining co-insurance rates. More complex networks require sophisticated systems to manage and coordinate patient care, including advanced billing and claims processing. These systems are necessary to handle the increased number of providers and services, which can result in higher administrative costs. As a consequence, PPOs may need to charge higher co-insurance to cover these additional expenses and ensure the sustainability of the plan.

Furthermore, the design of PPOs often includes a broader range of coverage options, such as comprehensive medical, dental, and vision plans. This variety of coverage can provide patients with more comprehensive benefits but also increases the complexity of the plan and the associated costs. The additional layers of complexity in PPOs, including the extensive network and diverse coverage options, contribute to the higher co-insurance rates compared to CDHPs.

In summary, the design differences between PPOs and CDHPs, particularly the larger and more complex networks of PPOs, lead to higher co-insurance rates. These differences in network design and complexity directly impact the administrative and operational costs, which are ultimately reflected in the co-insurance amounts that patients are required to pay. Understanding these design variations is essential for individuals and employers when choosing a health insurance plan that best suits their needs and financial considerations.

Direct Auto Insurance: Legit or Scam?

You may want to see also

Risk Pooling: PPOs cover a broader range of risks, leading to higher co-insurance rates

When it comes to health insurance, the concept of risk pooling is crucial in understanding why co-insurance rates can vary between different plan types. Risk pooling refers to the practice of combining the risks of multiple individuals or groups to manage financial exposure. In the context of PPOs (Preferred Provider Organizations) and CDHPs (Consumer-Directed Health Plans), this concept plays a significant role in determining co-insurance rates.

PPOs are designed to offer a wide network of healthcare providers, allowing enrollees to seek medical services from any doctor or specialist within the network without prior authorization. This flexibility provides members with more choice and convenience but also increases the complexity of risk management for the insurance company. PPOs typically cover a broader range of medical services and treatments, which means they are exposed to a more diverse and extensive set of risks. For instance, a PPO might cover advanced medical procedures, specialist consultations, and a wide array of prescription drugs, all of which contribute to a higher overall risk pool.

In contrast, CDHPs take a different approach by empowering enrollees to make healthcare decisions and manage their own health care spending. These plans often feature higher deductibles and lower monthly premiums, encouraging individuals to take a more active role in their healthcare. While CDHPs can be cost-effective for healthy individuals, they may not cover as many comprehensive services as PPOs, resulting in a more limited risk pool. As a result, the insurance company assumes less financial risk with CDHPs, which is reflected in lower co-insurance rates compared to PPOs.

The key difference lies in the scope of coverage and the associated risks. PPOs, with their extensive networks and comprehensive benefits, attract a larger number of enrollees and cover a wider range of medical services. This broader risk pool necessitates higher co-insurance rates to ensure the insurance company can adequately manage the financial exposure. In contrast, CDHPs, with their focus on cost-sharing and individual responsibility, cater to a more specific set of enrollees and services, leading to lower co-insurance rates.

Understanding these risk pooling dynamics is essential for individuals and employers when choosing between PPOs and CDHPs. It highlights the trade-off between convenience, comprehensive coverage, and higher co-insurance rates in PPOs versus the cost-effectiveness and lower co-insurance rates in CDHPs. By grasping these concepts, individuals can make informed decisions about their healthcare coverage and manage their healthcare expenses effectively.

Safco Auto Insurance Rates: Rising Costs Explained

You may want to see also

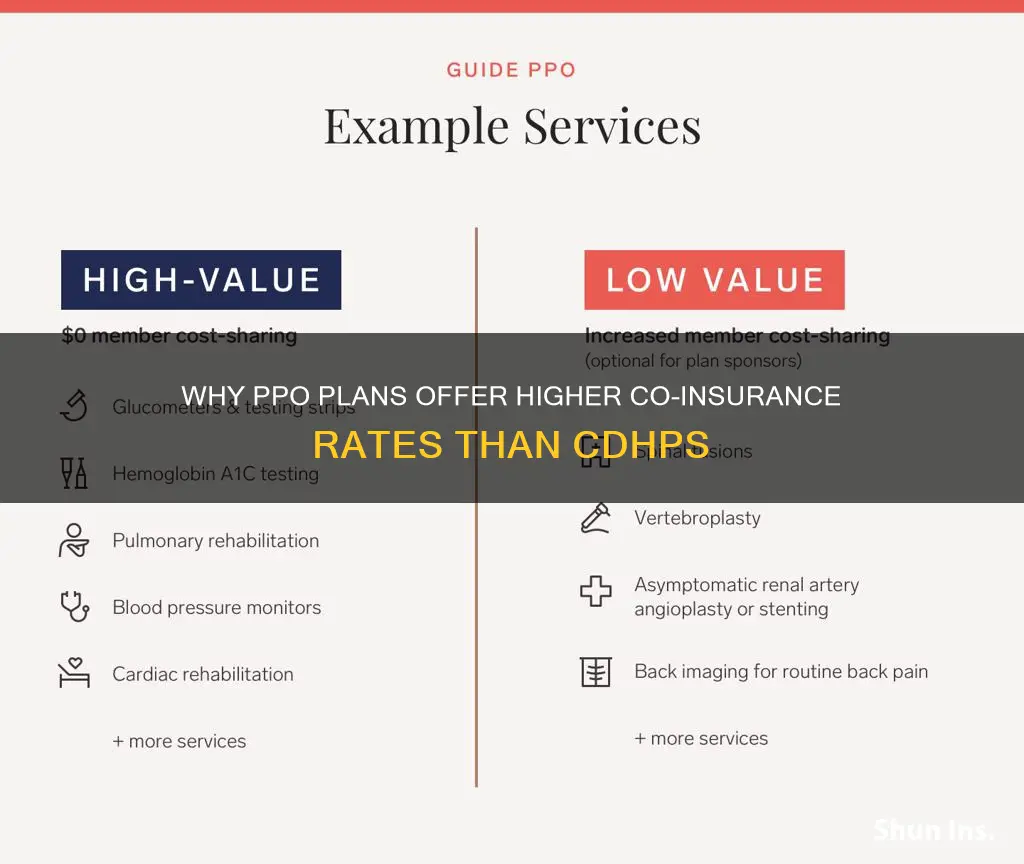

Benefit Structure: PPOs offer more comprehensive benefits, increasing the need for co-insurance

When comparing Private Fee-for-Service (PPO) and Consumer-Driven Health Plans (CDHP) or High-Deductible Health Plans (HDHP), one of the key differences that often comes into play is the structure of benefits and, consequently, the co-insurance rates. PPOs, by design, offer a more comprehensive benefits package, which can lead to higher co-insurance costs for the insured.

In a PPO, the insurance company negotiates rates with a network of healthcare providers, allowing enrollees to see any doctor or specialist without a referral. This flexibility in choice of providers often results in a broader range of covered services, including more extensive coverage for preventive care, mental health services, and prescription drugs. For instance, a PPO might cover a higher percentage of the cost for routine check-ups, mental health counseling, or specialist visits, which are often not covered as extensively in CDHPs or HDHPs.

The more comprehensive benefits in PPOs mean that when an individual uses these services, they are more likely to incur higher co-insurance payments. Co-insurance is the percentage of the total cost of a covered service that the insured person pays after the deductible has been met. Since PPOs offer a wider array of covered services, the chances of an individual needing to pay co-insurance for a significant portion of their healthcare expenses are higher compared to CDHPs, where the focus is often on lower premiums and higher deductibles.

For example, if a PPO covers 80% of the cost of a specialist visit, and the visit costs $200, the insured would pay $40 (20% of $200) as co-insurance. In contrast, a CDHP might only cover 60% of the same visit, requiring the insured to pay $80 (40% of $200) as co-insurance. This difference in co-insurance rates can be attributed to the more extensive benefits offered by PPOs, which often result in higher overall healthcare costs for the insurance company, leading to higher co-insurance rates to ensure financial stability.

Understanding these differences in benefit structures and their impact on co-insurance costs is crucial for individuals choosing between PPOs and CDHPs or HDHPs. It highlights the importance of considering not just the cost of premiums but also the potential out-of-pocket expenses, especially co-insurance, when making healthcare plan decisions.

Vehicle Insurance Declaration: What's Active?

You may want to see also

Network Management: PPOs manage provider networks more extensively, impacting co-insurance rates

The relationship between network management and co-insurance rates is a critical aspect of understanding the differences between Preferred Provider Organization (PPO) and Consumer-Driven Health Plan (CDHP) models. PPOs, in particular, have a distinct approach to managing provider networks, which directly influences the co-insurance rates for patients.

PPOs typically negotiate contracts with a wide range of healthcare providers, including doctors, specialists, and hospitals. This extensive network management allows PPOs to have more control over the cost of care. When a PPO manages its network more comprehensively, it can negotiate better rates with providers, ensuring that the overall cost of healthcare services is lower. As a result, PPOs can offer more competitive pricing for medical services, which directly impacts co-insurance rates. Co-insurance is the percentage of medical expenses that an individual pays after the deductible has been met. Lower co-insurance rates for PPO members mean that patients pay a smaller portion of their medical bills, making healthcare more affordable.

In contrast, CDHPs often take a different approach to network management. They may have a more limited network of providers, focusing on a specific group of doctors and hospitals. This strategy can lead to higher co-insurance rates for CDHP members because the plan may not have the same level of negotiating power with out-of-network providers. When patients choose out-of-network providers, they often face higher costs, and these expenses are typically not covered by the insurance, resulting in higher out-of-pocket payments.

The extensive network management of PPOs allows them to control costs more effectively, which is a significant advantage for patients. By negotiating better rates with a wide range of providers, PPOs can offer lower co-insurance rates, making healthcare more accessible and affordable for their members. This is particularly beneficial for individuals who require frequent medical services or have chronic conditions, as it can significantly reduce their financial burden.

In summary, the comprehensive network management of PPOs plays a pivotal role in determining co-insurance rates. This approach enables PPOs to negotiate favorable rates with providers, ultimately benefiting patients through more affordable healthcare and lower co-insurance payments. Understanding these network management strategies is essential for individuals to make informed decisions when choosing between PPO and CDHP plans.

Finding Affordable Auto Insurance: Tips and Tricks

You may want to see also

Market Dynamics: Competitive PPO markets may drive co-insurance higher compared to CDHPs

In the realm of health insurance, the dynamics of the market can significantly influence the cost-sharing mechanisms, particularly co-insurance, in Preferred Provider Organization (PPO) plans compared to Consumer-Driven Health Plans (CDHPs). Competitive PPO markets, characterized by a wide range of insurance providers and a diverse network of healthcare professionals, often lead to higher co-insurance rates. This phenomenon can be attributed to several market factors.

Firstly, the competitive nature of PPOs encourages insurance companies to differentiate their offerings. When there are multiple PPO options available, insurance providers may adjust their pricing strategies to attract more customers. One way to do this is by offering varying levels of co-insurance, where higher co-insurance rates can be a tool to balance costs and maintain profitability. In competitive markets, insurance companies might set higher co-insurance amounts to ensure they remain competitive while covering potential medical expenses.

Secondly, the network of healthcare providers in PPOs can impact co-insurance rates. PPOs typically have a broader network of in-network providers, allowing enrollees to access a wide range of medical services. However, this extensive network can lead to increased administrative costs for insurance companies. To manage these costs and maintain financial stability, PPOs might implement higher co-insurance requirements, shifting more financial responsibility onto the enrollees. This strategy helps in controlling overall plan costs and ensuring the sustainability of the PPO model.

Moreover, the flexibility associated with PPOs can contribute to higher co-insurance. PPOs offer enrollees the freedom to choose any healthcare provider, both in-network and out-of-network, without prior authorization. This flexibility can lead to more varied and potentially more expensive medical services. As a result, insurance companies may adjust co-insurance rates to account for the increased potential costs associated with this freedom of choice. Higher co-insurance rates can serve as a deterrent to unnecessary or non-essential medical procedures, helping to manage overall plan expenses.

In contrast, CDHPs often take a different approach to cost-sharing. These plans typically feature lower monthly premiums but higher annual out-of-pocket maximums. CDHPs encourage enrollees to take a more proactive role in managing their healthcare expenses, often resulting in lower co-insurance rates. The competitive nature of CDHPs, with a focus on cost-effective healthcare, may drive insurance providers to offer more competitive co-insurance rates to attract customers.

In summary, competitive PPO markets can drive co-insurance higher due to the need for differentiation, network-related costs, and the flexibility of PPO plans. These market dynamics influence insurance companies' pricing strategies, impacting enrollees' out-of-pocket expenses. Understanding these factors is crucial for individuals and employers making decisions about health insurance coverage, especially when considering the trade-offs between co-insurance rates and the benefits of PPO or CDHP plans.

Flexi Auto Insurance: The Flexible Coverage You Need

You may want to see also

Frequently asked questions

In a PPO, the insurance company has a broader network of healthcare providers, which allows enrollees more flexibility to choose their doctors and specialists. This flexibility comes with a trade-off in the form of higher co-insurance rates. PPOs often have more comprehensive coverage, which means the insurance company covers a larger portion of the costs, but the enrollees pay more out-of-pocket for each service. In contrast, CDHPs encourage cost-sharing and typically have lower co-insurance rates to promote member engagement in cost management.

Higher co-insurance in PPOs can lead to increased out-of-pocket expenses for individuals. When a PPO member uses a non-network provider, they may face higher co-pays and co-insurance, which can be substantial. This is because the insurance company has negotiated rates with in-network providers, offering better coverage at a lower cost. Out-of-network providers often charge higher fees, and the insurance company may not cover as much, leaving the member with a larger share of the bill. CDHPs, on the other hand, often have lower co-insurance rates, which can result in reduced out-of-pocket costs for members who choose in-network providers.

While higher co-insurance can be a concern, PPOs offer certain advantages that may offset this cost. PPOs provide members with the freedom to seek medical care from a wide range of providers without prior authorization, which can be beneficial for specialized treatments or when an individual's regular doctor is out of network. Additionally, PPOs often have more comprehensive coverage, including better prescription drug coverage and lower deductibles, which can make them more attractive to individuals who prefer the flexibility to choose their healthcare providers. However, it's essential for enrollees to carefully consider their healthcare needs and preferences before selecting a PPO plan.