Understanding the intricacies of tax forms can be challenging, especially when it comes to life insurance. Many individuals and families rely on life insurance policies for financial security, and it's important to know how these policies are treated for tax purposes. The code for life insurance on tax forms is a crucial piece of information that can impact your financial planning and reporting. This paragraph will delve into the specifics of this code, its significance, and how it affects your tax obligations.

What You'll Learn

- Life Insurance Proceeds: Tax-free up to $1,000,000 per beneficiary

- Premiums: Deductible as a medical expense, subject to income limits

- Lapse: Premiums paid for lapsed policies may be taxable as income

- Term vs. Permanent: Tax implications differ for term and permanent policies

- State Variations: Some states offer additional tax benefits for life insurance

Life Insurance Proceeds: Tax-free up to $1,000,000 per beneficiary

Life insurance proceeds can be a significant financial benefit, especially in the event of a loved one's passing. When it comes to tax implications, it's essential to understand the rules set by the Internal Revenue Service (IRS) to ensure you're handling your affairs correctly. The IRS has specific guidelines regarding life insurance payouts, and one of the key points to note is that life insurance proceeds are generally tax-free up to a certain amount per beneficiary.

The relevant code section for this matter is often referred to as the "Life Insurance Exclusion." Under the Internal Revenue Code, Section 101(a), life insurance proceeds received by an individual as a beneficiary are generally exempt from taxation, provided the total amount does not exceed $1,000,000. This means that if you are the designated beneficiary of a life insurance policy and the policyholder passes away, you may receive up to $1 million in tax-free benefits. It is important to remember that this exclusion applies to each beneficiary individually, so if there are multiple beneficiaries, the total amount received by all beneficiaries must not exceed this limit.

To ensure compliance, it is crucial to keep detailed records and documentation. When you receive life insurance proceeds, you should report them on your tax return, but only up to the $1 million threshold. Any amount exceeding this limit may be subject to taxation. It is advisable to consult with a tax professional or accountant who can provide guidance tailored to your specific situation, ensuring you understand the tax implications and any potential reporting requirements.

Additionally, it's worth noting that there are some exceptions and special cases to consider. For instance, if the life insurance policy was owned by a trust or an entity other than the insured individual, the rules might differ. In such cases, the proceeds may be subject to different tax treatments. It is always best to seek professional advice to navigate these complexities and ensure your financial affairs are in order.

Understanding the tax implications of life insurance proceeds is essential for effective financial planning. By being aware of the $1 million exclusion, you can make informed decisions and take appropriate actions when dealing with life insurance benefits. Remember, proper tax handling ensures that you maximize the financial support provided by life insurance while adhering to legal requirements.

Life Insurance: Strategies for Better Coverage and Peace of Mind

You may want to see also

Premiums: Deductible as a medical expense, subject to income limits

When it comes to tax deductions for life insurance premiums, there are specific rules and limitations that taxpayers should be aware of. Firstly, life insurance premiums can be deductible as a medical expense, which is a valuable benefit for those who itemize their deductions. However, this deduction is subject to certain income limits, which means not everyone will qualify for this tax break.

To claim the deduction, individuals must meet specific criteria. The premiums must be for a qualified long-term care insurance contract or a life insurance policy that meets the requirements set by the Internal Revenue Service (IRS). These policies typically provide coverage for extended care services, such as nursing home care, or they can be term life insurance policies that meet certain conditions. It's important to note that the deduction is limited to the amount of premium payments that exceed a certain percentage of the taxpayer's adjusted gross income (AGI).

For tax year 2023, the income limits for this deduction are as follows: For single filers and married couples filing separately, the income limit is $100,000, and for married couples filing jointly and surviving spouses, the limit is $150,000. If the taxpayer's income exceeds these limits, they may not be able to claim the full deduction, or they may have to adjust the amount claimed.

To calculate the deduction, taxpayers should start by determining their AGI for the tax year in question. Then, they need to calculate the amount of life insurance premiums paid during the year. The excess of these premiums over the applicable percentage of AGI can be deducted. For example, if a single filer's AGI is $120,000 and their life insurance premiums are $5,000, the excess over the 10% limit is $4,000, which can be deducted.

It's crucial to keep detailed records of life insurance premium payments and related documentation to support any deductions claimed. Taxpayers should also be aware that the rules regarding life insurance deductions can be complex, and seeking advice from a tax professional or accountant is recommended to ensure compliance with the IRS guidelines. Understanding these rules can help individuals maximize their tax benefits while ensuring they adhere to the legal requirements.

Gap Insurance: Understanding Loan Protection

You may want to see also

Lapse: Premiums paid for lapsed policies may be taxable as income

When it comes to life insurance, understanding the tax implications of policy lapses is crucial for policyholders. If you have a life insurance policy that has lapsed, meaning the premiums were not paid on time, there are specific tax considerations to keep in mind. The Internal Revenue Service (IRS) treats the return of premiums on lapsed policies as taxable income, which can be a surprise for many policyholders.

When a life insurance policy lapses, the insurance company typically returns the premiums paid for the period after the lapse. This return of premiums can be significant, especially if the policy was in force for an extended period. The key point to understand is that this returned amount is considered taxable income by the IRS. It is important to report this income accurately on your tax return, as it can impact your overall tax liability.

To handle this situation, policyholders should carefully review their tax forms and ensure they report the returned premiums correctly. The code section that pertains to this scenario is likely to be related to unearned income or other income. The specific code or regulation will depend on the tax year and the insurance company's practices. It is advisable to consult the IRS guidelines or seek professional tax advice to ensure compliance with the tax laws.

In some cases, the returned premiums may be subject to penalties and interest if not reported correctly. Therefore, it is essential to stay informed and take prompt action if a policy lapse occurs. Policyholders should also keep detailed records of the premiums paid, the lapse dates, and any communications with the insurance company regarding the return of premiums. This documentation will be crucial when filing tax returns and can help in accurately reporting the taxable income.

In summary, when a life insurance policy lapses, and premiums are returned, it is important to recognize that this amount may be taxable. Policyholders should be aware of the tax implications and take the necessary steps to report this income accurately on their tax forms. Seeking professional guidance can ensure that you navigate this process smoothly and avoid any potential tax-related issues.

Life Insurance: Demographics' Vital Role Explored

You may want to see also

Term vs. Permanent: Tax implications differ for term and permanent policies

When it comes to life insurance, understanding the tax implications of your policy is crucial for making informed financial decisions. The tax treatment of life insurance can vary depending on the type of policy you have, whether it's a term policy or a permanent (whole life) policy. Here's a breakdown of the tax considerations for each:

Term Life Insurance:

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. During this term, the policy is in force, and there are certain tax implications to consider. Firstly, the premiums paid for term life insurance are generally tax-deductible. This means you can claim a deduction for the amount you pay in premiums as a business expense or a personal deduction, depending on your overall income and deductions. This tax benefit can be advantageous, especially for high-income earners who may benefit from reducing their taxable income. Additionally, if you own a term policy and decide to surrender it before the end of the term, you may be subject to a surrender charge, which is typically a percentage of the premiums paid. This charge is often taxable as ordinary income.

Permanent (Whole Life) Insurance:

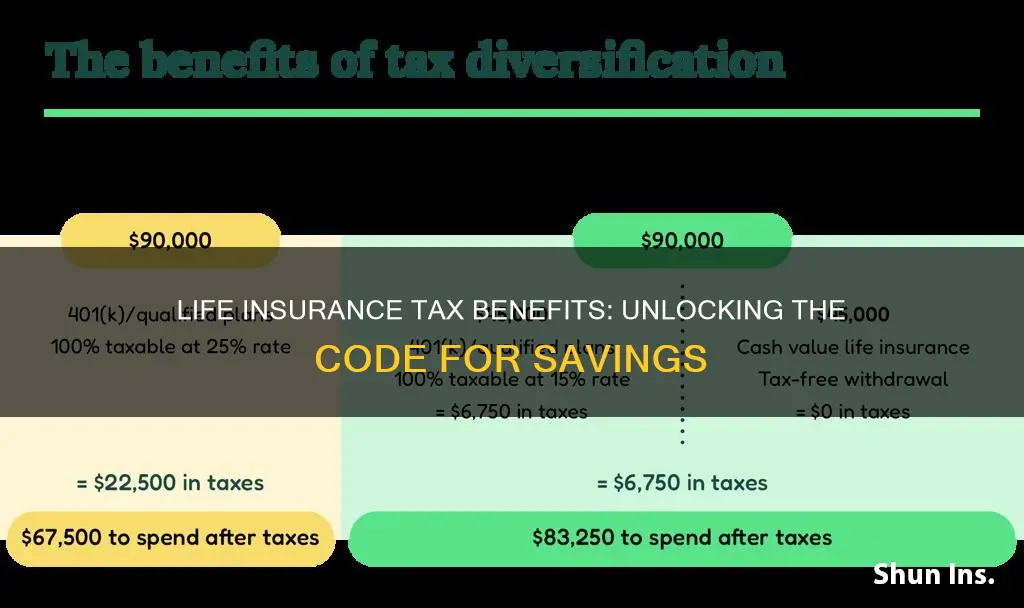

Permanent life insurance, also known as whole life insurance, provides lifelong coverage and offers a combination of death benefit and savings components. The tax implications of permanent insurance are different and more complex. Firstly, the cash value of a permanent policy grows tax-deferred, meaning it accumulates over time without being taxed annually. This can be a significant advantage, as the cash value can be borrowed against or withdrawn without incurring immediate tax consequences. Additionally, the death benefit paid out upon the insured's passing is generally tax-free to the beneficiary. However, if you surrender a permanent policy for its cash value, you may be subject to income tax on the amount surrendered, depending on the policy's age and the surrender charge rules.

Understanding these tax differences is essential for maximizing the benefits of your life insurance policy. Term life insurance can provide tax deductions and potential savings on premiums, while permanent insurance offers tax-deferred growth and tax-free death benefits. It's advisable to consult with a tax professional or financial advisor to determine the best approach based on your specific circumstances and financial goals. They can guide you in choosing the right policy and help you navigate the tax implications to make the most of your life insurance investment.

Understanding Franchise Life Insurance: A Comprehensive Guide

You may want to see also

State Variations: Some states offer additional tax benefits for life insurance

When it comes to tax benefits for life insurance, it's important to understand that the rules can vary significantly from state to state. Some states offer additional advantages to policyholders, providing further incentives for purchasing life insurance. These variations can be particularly beneficial for individuals and families who want to maximize their tax savings while also ensuring financial security.

For instance, certain states allow policyholders to deduct the cost of life insurance premiums from their taxable income. This deduction can be a substantial benefit, especially for those with higher incomes, as it directly reduces the amount of taxable income, resulting in lower tax liabilities. Additionally, some states provide tax credits for life insurance premiums, which further enhances the financial advantage of purchasing life insurance. These credits can be especially valuable for individuals who may not be able to claim the full deduction but still benefit from the reduced tax burden.

In addition to premium deductions and credits, some states offer tax advantages for the cash value of permanent life insurance policies. The cash value is the portion of the policy that accumulates over time and can be borrowed against or withdrawn. By allowing tax-deferred growth on the cash value, these states enable policyholders to build a substantial savings component within their life insurance policy. This feature can be particularly attractive for long-term financial planning and can provide a safety net for policyholders and their beneficiaries.

It's worth noting that the availability of these state-specific tax benefits can vary, and some states may offer more generous incentives than others. Therefore, individuals should carefully research and understand the tax laws in their respective states to ensure they are taking full advantage of any applicable deductions, credits, or tax-advantaged features of life insurance policies. Consulting with a tax professional or insurance advisor can also provide valuable guidance in navigating these state variations and optimizing one's tax strategy.

Life Insurance Basics: Unum's Essential Coverage Explained

You may want to see also

Frequently asked questions

The code for life insurance premiums on tax forms is typically "109" or "109(a)" in the United States. This code is used to report the amount paid for life insurance policies as a deduction on your tax return.

When filing your taxes, you can claim a deduction for life insurance premiums paid during the tax year. You'll need to fill out the appropriate sections on your tax form, usually Schedule A (Form 1040), and provide the necessary documentation, such as proof of payment.

Yes, there are certain rules and limitations. Generally, the deduction is limited to the amount paid for term life insurance. Additionally, the total deductions for itemized deductions, including life insurance, cannot exceed the standard deduction or 100% of your adjusted gross income (AGI), whichever is less.

If you choose not to itemize, you may still be able to claim the standard deduction, which includes a limited deduction for life insurance premiums. However, the standard deduction amount may not fully cover your eligible expenses.

You can deduct the premiums for each qualifying life insurance policy. Ensure you keep records and documentation for each policy to accurately report the deductions on your tax return.