AAA offers a variety of life insurance policies, including term life, whole life, and universal life insurance. AAA's whole life insurance and universal life insurance policies build cash value over time, which can be borrowed against or withdrawn. Whole life insurance provides permanent coverage with guaranteed premiums, while universal life insurance offers flexible premiums and death benefits. AAA's term life insurance policies do not appear to build cash value. AAA also provides discounts for members, such as a 10% discount on annual term life insurance premiums.

| Characteristics | Values |

|---|---|

| Type of insurance | Whole life insurance, universal life insurance, term life insurance |

| Coverage amount | Up to $500,000 (term life insurance), up to $5 million (traditional term life insurance), up to $25,000 (whole life insurance), up to $5,000 to $75,000 (whole life insurance), up to $100,000 (lifetime universal life insurance), starts at $100,000 (accumulator universal life insurance) |

| Medical exam required | No (whole life insurance, guaranteed issue whole life insurance, express term life insurance), yes (traditional term life insurance, whole life insurance, lifetime universal life insurance) |

| Application | Quick and entirely online (term life insurance), must be purchased through an agent (whole life insurance, traditional term life insurance, lifetime universal life insurance) |

| Discounts | 10% discount for AAA members (term life insurance, whole life insurance, traditional term life insurance, guaranteed issue whole life insurance), $60 annual fee waived for AAA members (guaranteed issue whole life insurance) |

| Riders | Accelerated death benefit rider, accidental death rider, child term rider, disability waiver of premium rider, return of premium rider, travel accident rider, waiver of monthly deductions rider, terminal illness rider, guaranteed purchase option rider |

What You'll Learn

- AAA's Whole Life Insurance policy offers permanent coverage with premiums that never increase

- AAA's Universal Life Insurance policy offers lifelong protection with potential cash value growth

- AAA's Accumulator Universal Life policy is designed to accumulate cash value

- AAA's Lifetime Universal Life policy offers permanent coverage with some cash value build

- AAA's Whole Life Insurance policy can be purchased without a medical exam

AAA's Whole Life Insurance policy offers permanent coverage with premiums that never increase

AAA's Whole Life Insurance policy is a permanent policy that provides coverage for the entirety of the policyholder's life. It also builds cash value over time, which can be borrowed or withdrawn while the policyholder is still alive. AAA's Whole Life Insurance policy offers permanent coverage with premiums that never increase.

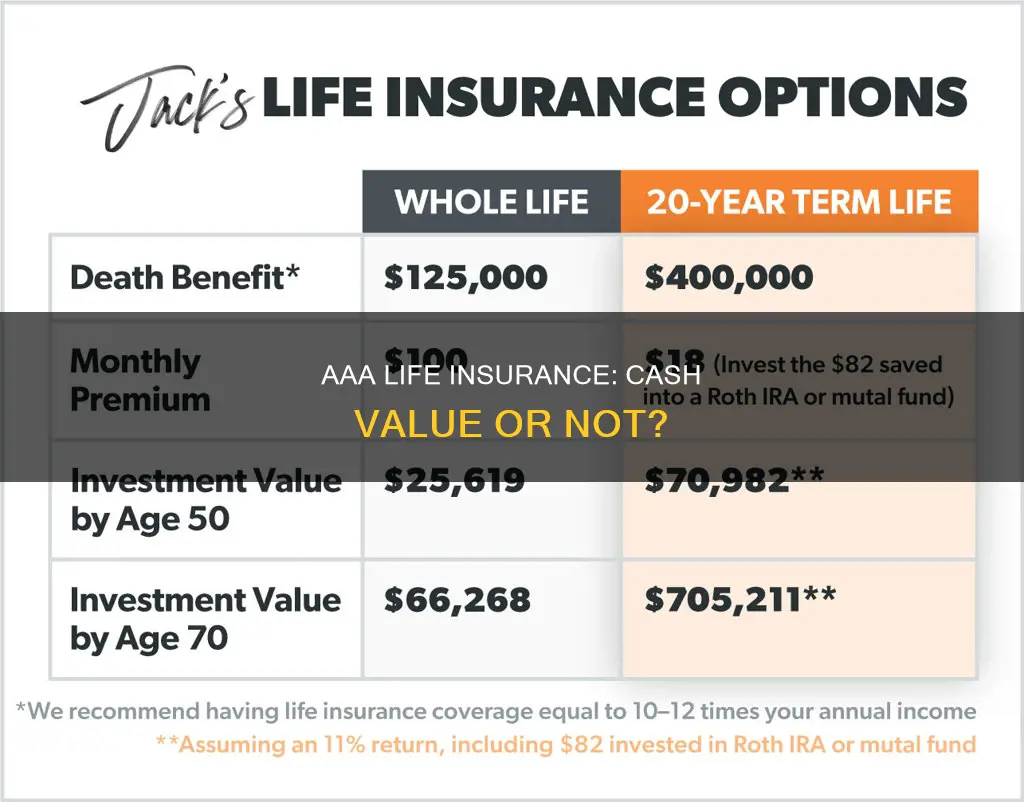

Whole life insurance is a type of permanent life insurance that covers the insured's entire life, with fixed premiums and a guaranteed death benefit. It is designed to provide lifelong protection and is more expensive than term life insurance. However, it builds cash value over time, which can be borrowed against or withdrawn. This makes it a good option for those seeking long-term financial security.

AAA's Whole Life Insurance policy offers coverage ranging from $5,000 to $75,000. The price never changes once it is locked in, and there is no need for a medical exam to qualify for coverage. This policy is ideal for those seeking permanent coverage without the hassle and expense of medical exams.

The Whole Life Insurance policy from AAA provides reliable coverage that lasts a lifetime. It helps individuals lay the foundation for added long-term financial security. The policy builds cash value over time, and once the premiums are locked in, they never increase. This makes it a smart, simple, and reliable option for individuals and their families.

With AAA's Whole Life Insurance policy, individuals can rest assured that their loved ones will be cared for after they're gone. The coverage is simple to request, and individuals can speak to an agent or apply online. It is important to understand the whole life insurance policy and its benefits, and AAA encourages individuals to read their education articles and frequently asked questions.

IRS Lien on Life Insurance Benefits: Is It Possible?

You may want to see also

AAA's Universal Life Insurance policy offers lifelong protection with potential cash value growth

AAA Life Insurance offers a range of life insurance products, including term, whole, and universal life insurance policies. While term life insurance provides coverage for a specific number of years, whole and universal life insurance policies offer permanent coverage and can build cash value over time.

The Universal Life Insurance policy offered by AAA is a type of permanent life insurance that combines lifelong coverage with the potential for cash value accumulation. This means that, in addition to providing a death benefit, the policy can also build cash value, which can be accessed by the policyholder during their lifetime.

AAA's Lifetime Universal Life insurance is designed for those who prioritize the death benefit over accumulating a large cash value. This policy offers steady, guaranteed premiums that remain the same over the life of the policy and builds some cash value. On the other hand, AAA's Accumulator Universal Life insurance is designed to accumulate more cash value, offering flexible premiums that can be adjusted if there is enough cash value.

The Universal Life Insurance policy from AAA provides permanent coverage and financial flexibility, allowing policyholders to make adjustments as their needs change. The cash value component of the policy can be used to adjust premiums and death benefits, providing a source of funds that can be utilized for various purposes.

By choosing AAA's Universal Life Insurance policy, individuals can benefit from lifelong protection while also having the potential for their policy to grow in cash value. This dual benefit of coverage and cash value growth makes it a versatile option for individuals seeking both insurance and investment components in their financial planning.

Term Life Insurance: What Documents Will I Receive?

You may want to see also

AAA's Accumulator Universal Life policy is designed to accumulate cash value

AAA's Accumulator Universal Life insurance policy is designed to accumulate cash value. This policy is available to people of almost any age, from 15 days old to 80 years old. It is a form of permanent life insurance that offers lifelong coverage and builds cash value over time. The Accumulator Universal Life policy is ideal for those seeking an investment component alongside their life insurance. It offers flexible premiums that can be adjusted if there is enough cash value. This flexibility allows policyholders to increase or decrease their premiums as their financial circumstances change.

AAA's Accumulator Universal Life insurance policy is one of two universal life insurance options offered by AAA Life Insurance Company. The other option is the Lifetime Universal Life insurance policy, which is geared towards those who prioritise the death benefit over building cash value. In contrast to the Accumulator policy, the Lifetime policy offers steady, guaranteed premiums that remain the same over the life of the policy and builds less cash value.

AAA's Accumulator Universal Life insurance policy is a good choice for individuals who want to accumulate cash value through their life insurance policy. This policy provides the flexibility to adjust premiums and the potential for higher cash value accumulation compared to the Lifetime policy. It is important to note that while the Accumulator policy allows for premium adjustments, any changes made will impact the policy's death benefit.

The ability to accumulate cash value within a life insurance policy can be advantageous for individuals seeking to supplement their income during their lifetime. The cash value can be borrowed against to help fund purchases or cover expenses, such as a child's college tuition, home improvements, or retirement income. However, it is essential to repay any loans taken against the policy to ensure that the death benefit remains intact.

When considering life insurance, it is crucial to choose a policy that aligns with your specific needs and financial situation. AAA Life Insurance offers a range of options, including term life, whole life, and universal life insurance, each with unique features and benefits. Be sure to review the details of each policy and consult with a professional to determine which option is best suited to your circumstances.

Tramadol Use: Denying Life Insurance, Affecting Lives

You may want to see also

AAA's Lifetime Universal Life policy offers permanent coverage with some cash value build

AAA Life Insurance offers a variety of policies, including term life, whole life, and universal life insurance. While term life insurance provides coverage for a specific number of years, whole life insurance is a type of permanent policy that provides lifetime protection. Universal life insurance is also a form of permanent life insurance that combines lifelong coverage with flexible premiums and death benefits.

One of the universal life insurance policies offered by AAA is the Lifetime Universal Life policy. This policy is designed for individuals aged 18 to 85 who prioritize the death benefit over building a substantial cash value. The Lifetime Universal Life policy guarantees level premiums that remain the same throughout the life of the policy. While it does build some cash value, the main focus of this policy is the death benefit.

The Lifetime Universal Life policy can only be purchased through an AAA agent, and a medical exam is typically required as part of the application process. The coverage amount for this policy starts at $100,000 and can go up to $5 million or higher. By choosing this policy, individuals can ensure they have permanent life insurance protection while also having the financial flexibility to make adjustments as their needs change.

The Lifetime Universal Life policy from AAA is a good option for those who want the peace of mind of lifelong coverage while also having the ability to adjust their policy as their circumstances evolve. With guaranteed premiums and the potential for some cash value growth, this policy offers a combination of stability and flexibility to meet the diverse needs of individuals and their families.

Life Insurance Options for People with Fatty Liver Disease

You may want to see also

AAA's Whole Life Insurance policy can be purchased without a medical exam

AAAs Whole Life Insurance policy can be purchased without a medical exam, which is ideal for those seeking fast coverage without the hassle of medical exams. This permanent insurance provides death benefit coverage for the policy owner throughout their life and is available to those aged 45-85. Whole Life Insurance policies from AAA also build cash value over time, and the insured can borrow money from this cash value. Once locked in, your premiums never increase.

The process of obtaining a Whole Life Insurance policy without a medical exam is simple. You can obtain it online, by mail, or over the phone. You will need to answer a few simple questions, and you could be covered the same day.

It is important to note that no-exam life insurance policies may have lower coverage amounts and higher premiums than policies that require a medical exam. Additionally, you will likely still need to answer health questions, and your provider may use past medical records to make an assessment.

If you are healthy, you may want to consider a policy with full medical underwriting to get the most options and the best rates. A life insurance medical exam is a relatively painless process that involves tests you are likely familiar with from yearly checkups, like a physical and a blood draw. It is normally free and takes about 30 minutes.

Speak to an agent to find out more about prices, benefits, and the application process so that you can choose the solution that meets your unique needs.

Life Insurance: Impact on Net Worth Calculations

You may want to see also

Frequently asked questions

Yes, AAA's permanent life insurance policies, including whole life insurance and universal life insurance, build cash value.

AAA's permanent life insurance policies build cash value over time. Once your cash value reaches a certain balance, you can withdraw the money or borrow it while you're still alive.

The cash value of life insurance can be used to help pay for a child's college tuition, take out a loan for home improvements, or supplement retirement income.

AAA's whole life insurance and universal life insurance policies have cash value. You can check your policy documents or contact AAA customer service to confirm if your policy has cash value.

Yes, you can borrow against the cash value of your AAA life insurance policy. However, it's important to repay any loans against your policy to ensure that the death benefit is not reduced.