When it comes to life insurance, understanding the average deductible is crucial for making informed decisions. The deductible is a specific amount that you, as the policyholder, agree to pay out of pocket before the insurance company kicks in. This figure can vary widely depending on the type of policy and the insurance provider. For instance, term life insurance policies often have lower deductibles compared to whole life insurance, which may have a higher deductible but offers more comprehensive coverage. Knowing the average deductible for life insurance can help you assess the financial commitment required and ensure that your policy aligns with your budget and coverage needs.

What You'll Learn

- Insurance Types: Term, whole life, and universal life insurance offer different deductible structures

- Policy Structure: Deductibles vary based on policy type and rider add-ons

- Company Policies: Insurance companies set specific deductible guidelines for their policies

- State Regulations: State laws influence the minimum and maximum deductible limits

- Customer Preferences: Policyholders may choose higher deductibles for lower premiums

Insurance Types: Term, whole life, and universal life insurance offer different deductible structures

When it comes to life insurance, understanding the various types and their associated deductible structures is crucial for making informed decisions. Three primary types of life insurance are Term, Whole Life, and Universal Life, each with its own unique features and deductible considerations.

Term Life Insurance: This type of insurance provides coverage for a specified period, typically 10, 20, or 30 years. During this term, the policyholder pays a fixed premium, and the insurance company guarantees a death benefit if the insured individual passes away within the term. Term life insurance does not have a traditional deductible in the way other insurance types do. Instead, the policyholder pays a set premium, and the coverage begins immediately upon enrollment. The key advantage is its affordability, making it an excellent choice for those seeking temporary coverage or a budget-friendly option.

Whole Life Insurance: In contrast, whole life insurance offers lifelong coverage, providing a death benefit to the policyholder's beneficiaries regardless of when the insured individual passes away. Premiums for this type of insurance are typically higher than term life insurance. While there is no specific deductible, the policyholder pays a fixed premium, and the coverage remains in force for the entire policy term. The premiums are calculated based on the insured individual's age, health, and the desired death benefit. This type of insurance is ideal for those seeking long-term financial security and a consistent premium payment structure.

Universal Life Insurance: This insurance type offers flexibility in premium payments and death benefit amounts. Policyholders can adjust their premiums and death benefits over time, providing a level of customization not available in term or whole life insurance. While there is no traditional deductible, the policyholder can choose to pay a lower initial premium and increase it later, or vice versa. Universal life insurance provides a death benefit and an investment component, allowing the policyholder to build cash value over time. This flexibility makes it suitable for those who want to adapt their insurance coverage as their financial situation changes.

In summary, the average deductible for life insurance varies significantly depending on the type of policy. Term life insurance offers immediate coverage with fixed premiums, while whole life insurance provides lifelong coverage with consistent premium payments. Universal life insurance, on the other hand, offers flexibility in premium payments and death benefit adjustments, catering to those who want to customize their insurance plan. Understanding these differences is essential for individuals to choose the right insurance type that aligns with their financial goals and risk tolerance.

Who Qualifies as a Proposed Insured in Life Insurance?

You may want to see also

Policy Structure: Deductibles vary based on policy type and rider add-ons

When it comes to life insurance policies, the concept of deductibles can be a bit complex, especially when considering the various policy types and add-ons available. Deductibles are essentially the amount of money an individual pays out of pocket before their insurance coverage kicks in. In the context of life insurance, understanding how deductibles work is crucial for making informed decisions about your coverage.

The structure of a life insurance policy can significantly impact the deductibility of premiums. There are primarily two types of life insurance policies: term life and permanent life. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years, and is generally more affordable. On the other hand, permanent life insurance, including whole life and universal life, offers lifelong coverage and often includes an investment component. The deductibility of premiums can vary between these policy types. For term life, the deductibility is typically straightforward, with a set amount deducted from the premium each year until the policy term ends. In contrast, permanent life insurance may have more complex deductibility structures, especially when considering rider add-ons.

Riders are additional benefits or features that can be added to a life insurance policy to enhance its coverage. These add-ons can include options like accelerated death benefits, which allow policyholders to receive a portion of their death benefit if they are diagnosed with a critical illness or condition. Other riders might provide additional coverage for accidental death or offer waiver of premium benefits, ensuring that policy payments are waived if the insured becomes disabled. The presence of these riders can significantly impact the deductibility of premiums. For instance, adding an accelerated death benefit rider might result in a higher annual deductible, as the insurance company needs to account for the potential early payout. Similarly, riders that provide additional coverage may increase the overall cost of the policy, affecting the deductibility of premiums.

It's important to note that the deductibility of premiums is not a one-size-fits-all concept. Insurance companies often offer flexibility in structuring policies to cater to individual needs. This means that the deductibility can vary based on factors such as the insured's age, health, and the specific riders chosen. Younger individuals may have lower deductibility rates, while those with pre-existing health conditions might face higher deductibles. Additionally, the choice of riders can further customize the policy, allowing individuals to tailor their coverage to their unique circumstances.

In summary, understanding the policy structure and how deductibles vary based on the type of life insurance and rider add-ons is essential for making informed decisions. The deductibility of premiums can significantly impact the overall cost of the policy, and insurance companies offer flexibility to cater to diverse needs. By carefully considering the policy options and riders, individuals can choose a life insurance plan that provides adequate coverage while aligning with their financial goals and preferences.

Transamerica Life Insurance: Is the Company Still Operational?

You may want to see also

Company Policies: Insurance companies set specific deductible guidelines for their policies

Insurance companies often have specific policies and guidelines when it comes to deductibles, which can vary depending on the type of insurance and the company's practices. When it comes to life insurance, the concept of a deductible is not as commonly used as in other forms of insurance, such as health or auto insurance. However, some life insurance policies, particularly those with an integrated rider or add-on feature, may include a deductible component.

In the context of life insurance, a deductible typically refers to the amount of the death benefit that the insured individual or their beneficiaries must pay out of pocket before the insurance company starts covering the remaining amount. This is similar to how deductibles work in health insurance, where policyholders pay a certain amount before the insurance coverage kicks in. For example, if a life insurance policy has a $5,000 deductible, the insured person or their beneficiaries would need to pay the first $5,000 of the death benefit before the insurance company starts paying out the remaining amount.

Insurance companies set these deductible guidelines based on various factors, including the type of life insurance policy, the insured individual's health and age, and the overall risk assessment of the policyholder. For instance, term life insurance policies, which provide coverage for a specific period, might have different deductible structures compared to permanent life insurance policies, which offer lifelong coverage. Additionally, the age and health of the insured individual play a crucial role in determining the deductible, as younger and healthier individuals may be offered lower deductibles, while older or healthier individuals might face higher ones.

It's important to note that not all life insurance companies use deductibles in the same way. Some companies may offer policies with a flat deductible amount, while others might have a percentage-based deductible, where a certain percentage of the death benefit is paid by the insured or their beneficiaries. The specific terms and conditions of the policy should be clearly outlined in the insurance contract, ensuring that policyholders understand their obligations and the coverage provided.

When considering life insurance, it is essential to review the policy documents and consult with insurance professionals to understand the specific deductible guidelines and how they impact the overall coverage. This ensures that individuals can make informed decisions about their insurance needs and choose policies that align with their financial goals and risk tolerance.

Keep Life Insurance Statements: How Long is Too Long?

You may want to see also

State Regulations: State laws influence the minimum and maximum deductible limits

State regulations play a crucial role in determining the deductible limits for life insurance policies, and these laws can vary significantly from one state to another. When it comes to insurance, deductibles are a common feature, especially in health insurance, where policyholders often pay a certain amount before the insurance coverage kicks in. However, in the context of life insurance, the term "deductible" is less frequently used, and the concept is more closely tied to the policy's cash value or surrender value.

In many states, insurance companies are required to adhere to specific guidelines set by the state insurance department regarding the maximum and minimum limits on deductibles or policy values. These regulations ensure that insurance policies are fair and transparent, protecting consumers from excessive or unreasonable charges. For instance, some states may set a minimum deductible or policy value threshold, ensuring that the insurance company provides a certain level of coverage or benefits. This can be particularly important for life insurance, where policyholders rely on the financial security provided by the policy.

The influence of state laws becomes evident when considering the range of deductible limits across different states. For example, State A might have a strict regulation that limits the maximum deductible to a specific percentage of the policy's total value, ensuring that the policyholder's financial burden is manageable. Conversely, State B may have more lenient regulations, allowing insurance companies to set higher deductibles, which could result in lower premiums for policyholders. These variations in state laws can significantly impact the overall cost and accessibility of life insurance policies.

Furthermore, state regulations often require insurance companies to provide clear and transparent information to policyholders about the deductible limits and any associated fees. This ensures that consumers are well-informed about their policy's terms and conditions. For instance, a state law might mandate that insurance providers disclose the specific amount of the deductible and how it affects the policy's overall cost, allowing customers to make more informed decisions.

Understanding state-specific regulations is essential for both insurance companies and policyholders. Insurance providers must navigate these laws to offer competitive and compliant policies, while consumers need to be aware of their rights and the potential variations in deductible limits when purchasing life insurance. This knowledge empowers individuals to make choices that align with their financial goals and risk tolerance.

Cracking the NC Life Insurance Exam: Is It Tough?

You may want to see also

Customer Preferences: Policyholders may choose higher deductibles for lower premiums

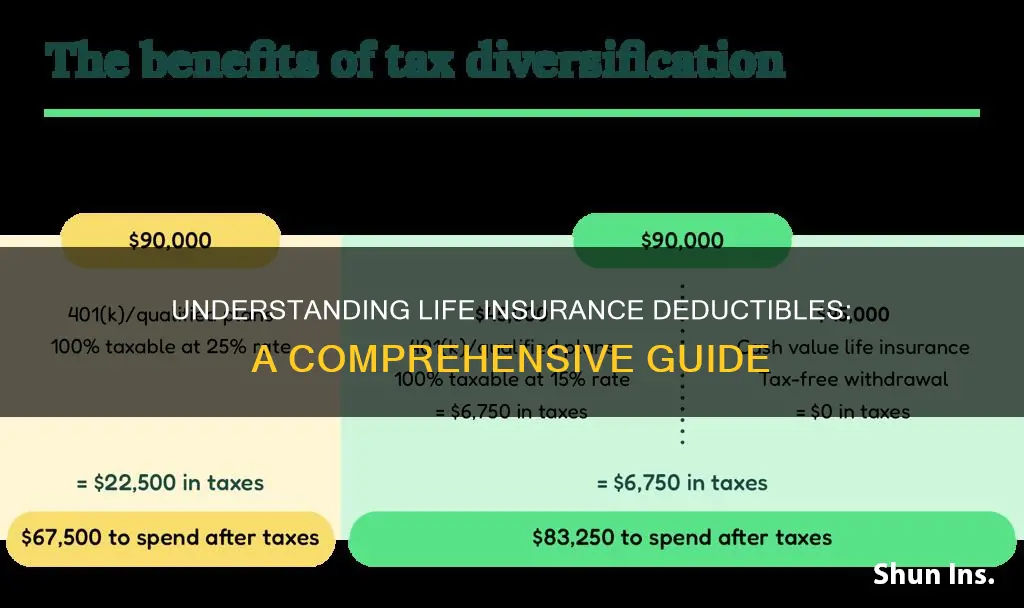

When it comes to life insurance, one of the key decisions policyholders make is choosing the level of coverage that suits their needs and financial situation. One of the factors that significantly influence this decision is the deductible, which is the amount of money a policyholder must pay out of pocket before the insurance coverage kicks in. Interestingly, many customers opt for higher deductibles, even though it means paying more upfront, in exchange for lower monthly premiums. This preference highlights a strategic approach to managing insurance costs and understanding the trade-offs involved.

The decision to opt for a higher deductible is often driven by the desire to save money in the long run. By choosing a higher deductible, policyholders can reduce their monthly premium payments. Insurance companies typically offer lower rates for higher deductibles because they assume a lower risk of frequent claims. This strategy allows individuals to allocate the savings from reduced premiums to other financial goals or build a personal emergency fund. For instance, someone might choose a higher deductible and allocate the difference between the old and new premium amounts to a savings account, ensuring they have a financial cushion for unexpected events.

However, it's essential to understand the implications of this choice. With a higher deductible, policyholders must pay more out of pocket when filing a claim. This means that if a covered event occurs, the individual will need to cover the deductible amount before the insurance benefits kick in. For example, if a life insurance policy has a $5,000 deductible and a covered event results in a payout of $10,000, the policyholder will receive $5,000, and the insurance company will pay the remaining $5,000. This can be a significant amount, especially for those on a tight budget.

Despite the potential financial burden, many customers find that the benefits of lower premiums outweigh the risks. This preference for higher deductibles is particularly common among individuals who are risk-averse and prefer to have more control over their insurance expenses. By carefully considering their financial situation and risk tolerance, policyholders can make an informed decision that aligns with their long-term financial goals.

In summary, the choice of a higher deductible for life insurance is a strategic decision that allows policyholders to manage their insurance costs effectively. While it may require a more substantial out-of-pocket payment in the event of a claim, the lower premiums can provide significant savings over time. Understanding the trade-offs and carefully evaluating one's financial circumstances can help individuals make the best choice for their insurance needs.

Understanding Block Mortgage Life Insurance Coverage

You may want to see also

Frequently asked questions

In life insurance, the term "deductible" is not commonly used. Instead, the concept is often referred to as a "premium" or "policy cost." However, if you're asking about a deductible in a broader sense, it typically refers to the amount you pay out of pocket before your insurance coverage kicks in. In life insurance, this could be a monthly or annual payment you make to keep the policy active.

The average deductible for life insurance policies can vary widely depending on several factors, including the type of policy, the insurer, your age, health, and the coverage amount. Generally, term life insurance policies have lower deductibles compared to whole life or universal life policies. The average deductible is often calculated based on industry trends and risk assessments, taking into account the expected claims and administrative costs.

There isn't a universal standard deductible amount for life insurance. The deductible can range from a small fixed amount to a percentage of the policy's death benefit. For example, some term life insurance policies might have a deductible of $100 per year, while others could be a percentage of the coverage, such as 1% or 2% of the death benefit.

Yes, in many cases, you can customize the deductible for your life insurance policy. This flexibility allows you to choose a deductible amount that aligns with your financial situation and risk tolerance. Higher deductibles often result in lower monthly/annual premiums, while lower deductibles may mean higher premiums. It's essential to review the policy details and understand the trade-offs before making any changes.