A proposer in the context of life insurance is the person who appeals to the insurance company to initiate a policy and submits the request. The proposer is also called a policyholder and is liable to pay premiums. The proposer is an essential person under a life insurance policy who plays several roles, including initiating the policy purchase by filling out the proposal form, deciding the coverage, premium, and sum assured, and paying the premium for the life cover. The proposer can be the same as or different from the insured, who is the person whose life is covered by the policy. The proposer must have an insurable interest in the insured's life, which means that the proposer either gains from the survival or suffers a financial loss due to the death of the insured person.

| Characteristics | Values |

|---|---|

| Definition | Proposed life insurance is life insurance that is intended to replace existing life insurance. |

| Formal Definition | A proposer in insurance is the one who appeals to the insurance company to initiate a policy and submits the request. |

| Who is the proposer? | The proposer is the person who purchases the policy either for self or for someone else. |

| Role and Responsibility | The proposer initiates the insurance request, shares and updates information, pays the premium, and can cancel the policy. |

| Importance | The proposer is important because they fill in the proposal form, which helps the insurer gauge the risk of insuring the individual. |

| Proposal Form | The proposer fills out a proposal form, which includes personal details, medical history, income, and occupation of the insured person. |

| Change of Proposer Name | The proposer's name can be changed when the proposer dies or the insured minor becomes an adult. |

What You'll Learn

- The proposer is the one who appeals to the insurance company to initiate a policy and submits the request

- The proposer is also called a policyholder and is liable to pay premiums

- The proposer is the applicant, owner and payer of premiums under a policy

- The proposer is responsible for updating the insurer about any change in the information shared during purchase

- The proposer can request the cancellation of the insurance policy

The proposer is the one who appeals to the insurance company to initiate a policy and submits the request

The proposer is the person who appeals to the insurance company to initiate a policy and submits the request. They are the applicant, owner and payer of premiums under a policy. The proposer fills out a proposal form, which is one of the most important documents in life insurance. This form helps the insurer to seek information about the life assured. It includes details such as age, name, gender, address, medical history, income, and occupation of the insured person. The proposer decides the coverage, premium, sum assured, etc., for the life insurance policy and is liable to pay the premiums for the life cover. They can also change the name of the beneficiary or other aspects of the life insurance and can cancel the policy.

The proposer and the insured in a life insurance policy can be the same or different individuals. For example, if you buy a policy in your name, you are the proposer and the insured. But if you buy a policy for your spouse or child, you are the proposer, while the spouse/child will be the insured. In both cases, it is the proposer who bears the cost of the policy and is responsible for updating the insurer about any changes in the information shared during the purchase, such as the health condition of the insured.

The proposer plays a crucial role in the insurance process as it is their shared information and activities that lead to the approval, smooth operation and availability of benefits of the policy. The insurer uses the information shared by the proposer in the application to decide whether to accept the proposal and approve the request.

Ghetto Residents' Guide to Getting Life Insurance

You may want to see also

The proposer is also called a policyholder and is liable to pay premiums

The proposer is a key figure in a life insurance policy. They are the person who submits the request to initiate a life insurance policy with the insurance provider. The proposer can buy the policy for themselves or someone else. The proposer is also called the policyholder and is liable to pay the premiums.

The proposer is responsible for filling out the proposal form, which is one of the most important documents in life insurance. It is based on the information shared by the proposer that the insurer decides whether to accept the proposal and approve the request. The proposer decides the coverage, premium, sum assured, etc., for the life insurance policy. They also decide the names of the beneficiaries under the policy.

The proposer is responsible for sharing accurate and complete information with the insurance provider. Based on the information shared, the premium amount and the terms and conditions are decided for the policy. The proposer is also responsible for updating the insurer about any changes to the information shared during the purchase, such as the health condition of the insured.

The proposer is also the person who can request the cancellation of the insurance policy and make changes to the beneficiary or nominee of the policy. They are also the ones who need to fill in the proposal form and submit it to the insurance provider. The proposer can be the insured or a different person. However, to buy a policy for someone else, the proposer must have an insurable interest in the insured's life.

The proposer plays a crucial role in the life insurance policy as they are the source of primary information for the insurer. It is because of the proposer that the policy application gets approved and issued. The proposer is also responsible for continuing with the premium payments to ensure active coverage of the policy.

Life Insurance Tax: Voluntary Benefits and Implications

You may want to see also

The proposer is the applicant, owner and payer of premiums under a policy

The proposer is the applicant, owner, and payer of premiums under a life insurance policy. They are the person who submits a request to initiate the policy, purchases it, and maintains the premium payment schedule to keep the policy active. The proposer is also called a policyholder and is liable to pay premiums. The proposer may or may not be the person insured by the policy. For example, if you buy a life insurance policy for yourself, you are the proposer as well as the insured. But if you buy a policy for your spouse, child, or dependent parent, the corresponding person is the insured while you are the proposer. In both cases, the proposer bears the cost of the policy.

The proposer plays several important roles in a life insurance policy. They initiate the policy purchase by filling out the proposal form, deciding on the coverage, premium, sum assured, etc. They also decide on the names of the beneficiaries under the policy. The proposer pays the premium for the life cover and can change the name of the beneficiary or other aspects of the life insurance. They can also cancel the policy.

The proposer is responsible for sharing accurate and complete information with the insurance provider. Based on the information shared, the premium amount and the terms and conditions are decided for the policy. In turn, the acceptance of the proposal form, the approval, and the issuance of the policy take place. Subsequently, the proposer is responsible for updating the insurer about any changes to the information shared during the purchase, such as the health condition of the insured.

The proposer is an integral and important person in life insurance as they are the source of primary information for the insurer. It is because of the proposer that the policy application gets approved and issued.

Health and Life Insurance Exam: Challenging or Easy?

You may want to see also

The proposer is responsible for updating the insurer about any change in the information shared during purchase

The proposer is the person who initiates a life insurance policy with an insurance provider. They are also known as the policyholder and are liable to pay the premiums. The proposer can be the same person as the insured, or they can be different. For example, if you buy a policy in your name, you are the proposer and the insured. But if you buy a policy for your spouse or child, you are the proposer, and they are the insured.

The proposer plays a crucial role in a life insurance policy. They fill out the proposal form, which is one of the essential documents in life insurance. The form seeks information about the insured, including their age, name, gender, address, medical history, income, and occupation. The details provided are used by the insurance company to assess the risks and eligibility for life insurance cover.

The proposer is responsible for sharing accurate and complete information with the insurance provider. Based on the information shared, the premium amount and the terms and conditions are decided for the policy. The proposer is also responsible for updating the insurer about any change in the information shared during the purchase, such as the health condition of the insured.

The proposer decides on the coverage, premium, sum assured, and other aspects of the life insurance policy. They can also change the name of the beneficiary or cancel the policy if needed.

In the event of the proposer's death, the policy's ownership is usually transferred to the insured or the person named in the proposer's will. A "change in ownership" form must be filled out to inform the insurance company about the new owner of the policy.

The proposer is an integral part of the life insurance process, as they are the source of primary information for the insurer. It is because of the proposer that the policy application gets approved and issued.

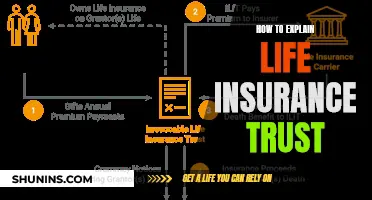

Designating Trust as Life Insurance Beneficiary: A Simple Guide

You may want to see also

The proposer can request the cancellation of the insurance policy

The proposer, also known as the policyholder, is the person who applies for a life insurance policy. They are liable to pay the premiums and can decide on the coverage, premium, sum assured, and beneficiaries under the policy. The proposer can also change the name of the beneficiary or other aspects of the life insurance and cancel the policy.

If the proposer decides to cancel their life insurance policy, they can do so by contacting their insurance company by phone or in writing. They may also need to fill out a form to finalize the cancellation. It is important to note that the proposer should carefully consider their decision to cancel as it could have financial implications.

In the case where the proposer and the insured are the same person, and the proposer dies, the beneficiary will receive the policy benefit. However, if the proposer and the insured are different people, the person named in the proposer's will becomes the new policyholder.

The proposer plays a crucial role in initiating and maintaining a life insurance policy, ensuring that it meets their needs and protects their loved ones.

Understanding Group Term Life Insurance Tax Calculation

You may want to see also

Frequently asked questions

A proposer in life insurance is the person who appeals to the insurance company to initiate a policy and submits the request. The proposer is also called a policyholder and is liable to pay premiums.

The proposer and the insured in a life insurance policy are either the same or different individuals. The proposer is the applicant, owner, and payer of premiums under a policy. The insured or life assured is the person whose life is covered. Thus, the proposer doesn't need to be insured under the policy purchased.

The proposer is the essential person under a life insurance policy who plays the following roles: initiates the policy purchase by filling out the proposal form; decides the coverage, premium, sum assured, etc., for the life insurance policy; decides the names of the beneficiaries under the policy; pays the premium for the life cover; can change the name of the beneficiary or other aspects of the life insurance; and can cancel the policy.

Yes, if an individual buys a life insurance policy for themselves, they are both the proposer and the insured.

If the proposer is the insured person under a policy, the beneficiary receives the policy benefit after the proposer's death. But when the proposer and insured are different, the person in the proposer's will becomes the policyholder.