A life insurance trust is a legal arrangement that allows a third party, or trustee, to manage the death benefit from a life insurance policy. This ensures that the policy's death benefit is distributed to beneficiaries according to the grantor's wishes and may also exempt the funds from probate and reduce any estate tax owed. Life insurance trusts are commonly used by individuals with a high net worth, as well as parents who want to structure benefit payments to their children.

What You'll Learn

How life insurance trusts work

A life insurance trust is a legal vehicle that allows a third party (the trustee) to hold and manage assets for the benefit of one or more beneficiaries. The two most common types of trusts are revocable and irrevocable life insurance trusts.

Revocable Life Insurance Trusts (RLITs)

RLITs, also known as living trusts, can be changed or cancelled by the grantor (the person who sets up the trust). Assets in this type of trust are considered part of the grantor's estate, so they may be subject to federal and state estate taxes. RLITs become irrevocable upon the grantor's death or incapacitation, locking in the grantor's wishes.

Irrevocable Life Insurance Trusts (ILITs)

ILITs cannot be changed or terminated once they are established. Since the assets are no longer controlled by the grantor, they are protected from creditors and estate taxes. This type of trust is often used by individuals with substantial wealth to reduce tax liabilities and preserve family wealth.

How to Set Up a Life Insurance Trust

To set up a life insurance trust, you will need to work with an experienced estate planning attorney. You will need to decide on a trustee and determine the circumstances under which the beneficiaries will have access to the insurance proceeds. Once the trust document is drafted and signed, you will need to transfer ownership of the life insurance policy to the trust. This can be done by completing a change of ownership form and submitting it to the insurance company.

Funding a Life Insurance Trust

Life insurance trusts can be funded through permanent life insurance policies, such as whole life or universal life, which provide a guaranteed death benefit. Term life insurance policies may not be suitable as they expire after a certain period, potentially leaving the trust unfunded.

Tax Implications of Life Insurance Trusts

Life insurance trusts have significant tax implications during the grantor's lifetime and after their death. During the grantor's lifetime, the trust may be subject to income tax on the earnings of the life insurance policy, and transfers of assets to the trust may be subject to gift tax. After the grantor's death, the death benefit of the life insurance policy may be subject to estate tax, but proper structuring of the trust can help mitigate these liabilities.

Excess Interest Life Insurance: Taxable or Not?

You may want to see also

Irrevocable life insurance trusts

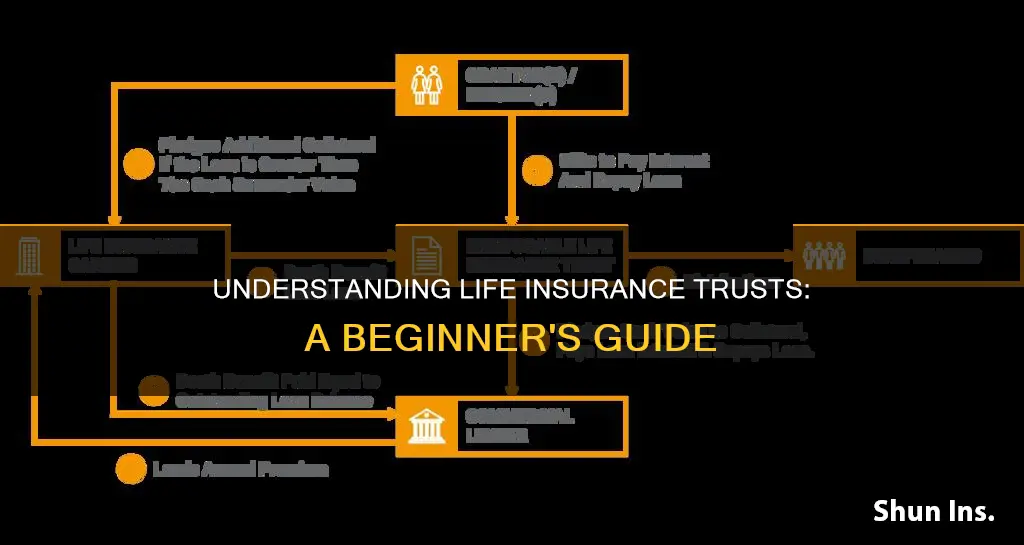

ILITs are set up between three legal parties: the grantor (who creates and funds the trust), the trustee (who manages the trust), and the beneficiary/beneficiaries (who will receive the trust assets upon the grantor's death). The grantor transfers ownership of their life insurance policy to the trust, and the trustee manages the benefits. When the insured person dies, the death benefit is paid to the trust, and the trustee distributes the funds according to the terms of the trust document.

One of the main advantages of ILITs is that they can help reduce estate taxes. By transferring assets from the grantor to the trust, the trust owns the insurance policy, and the proceeds are not included in the grantor's taxable estate. This can result in significant tax savings for the beneficiaries. Additionally, ILITs can provide protection from creditors and legal action, as well as help preserve eligibility for government benefits such as Social Security Disability Income or Medicaid.

Another benefit of ILITs is the ability to control distributions. The grantor can instruct the trustee on how and when the funds should be distributed to the beneficiaries, ensuring that the assets are used according to their wishes. This can be especially useful for beneficiaries who may not be able to manage large sums of money responsibly, such as minor children or adults with special needs.

It is important to note that ILITs are irrevocable, meaning they cannot be modified or terminated once they are established. This can be a downside for some, as it limits control over the assets. The cost of setting up and maintaining an ILIT may also be a consideration, as it may require professional fees and gift tax returns.

Understanding Tax Implications for Life Insurance Beneficiaries

You may want to see also

Revocable life insurance trusts

RLITs offer flexibility, which is beneficial for families who want to be able to adapt to changing circumstances in the future. They are typically used to control the flow of assets to minor children, young adults, or children with special needs. For example, a parent who has reservations about leaving a large sum of money to an 18-year-old child can set up an RLIT to pay out the inheritance in instalments over an extended period. This helps to ensure that the child doesn't spend their entire inheritance all at once.

While life insurance is not essential for forming an RLIT, it can be useful for funding these trusts because the benefits are paid almost immediately. This prevents delays and uncertainty in estate administration, as trusts do not have to go through probate. It also allows for the liquidation of other estate assets, such as a house or stocks, to occur at a more favourable time.

A revocable life insurance trust can be particularly beneficial for those seeking more control over their life insurance policies. It allows the grantor to change the trust at any time, providing more control over the life insurance policies within their estate planning strategy.

Life Insurance Options: Understanding the Different Types

You may want to see also

Tax implications

Life insurance trusts can have significant tax implications, both during the grantor’s lifetime and after their death. During the grantor’s lifetime, the trust may be subject to income tax on the earnings of the life insurance policy. Additionally, if the grantor transfers assets to the trust, those transfers may be subject to gift tax.

After the grantor’s death, the death benefit of the life insurance policy may be subject to estate tax. However, if the trust is properly structured, the death benefit can be excluded from the grantor’s estate for estate tax purposes. This exclusion can help mitigate estate tax liabilities, ensuring that the trust assets pass to the beneficiaries with reduced tax burdens.

If you own a life insurance policy, you probably know that the beneficiaries you’ve named to receive the insurance proceeds when you pass away get that money income tax-free. However, payout on a life insurance policy may not be exempt from estate tax, which is why planners often recommend that a trust own your life insurance policy instead of you owning it.

If you’re married and you name your spouse as the beneficiary of a life insurance policy that you own, there’s no estate tax on the insurance proceeds when you pass away because the payment to your spouse qualifies for the unlimited marital deduction from estate tax. When your spouse eventually passes away, however, any of the proceeds that are still in your spouse’s name are subject to estate tax.

An Irrevocable Life Insurance Trust (ILIT) owns a life insurance policy and will eventually hold the proceeds when you, the Grantor, die. Since the irrevocable trust owns these assets and there is an independent Trustee, the ILIT is considered a separate legal entity and the assets are not included in your estate when you die. The ILIT has its own federal tax identification number and must file annual state and federal income tax returns, although it usually has no taxable income while you are alive. When you die, the entity that owns the policy and collects the death benefit remains, so the death benefits are not taxed.

Given the complexity of tax laws and regulations surrounding life insurance trusts, it’s essential to work with an estate planning attorney. They can help you understand the tax implications and ensure that the trust is structured in a way that helps mitigate tax liabilities. An experienced attorney can navigate the intricate tax landscape, ensuring compliance with all applicable laws and helping you achieve your estate planning goals.

Understanding Life Insurance Underwriting: The Basics Explained

You may want to see also

Who life insurance trusts are for

Life insurance trusts are for people who want to protect their assets and the financial future of their loved ones. They are commonly used by individuals with a high net worth, as well as parents who want to structure benefit payments to their children.

Life insurance trusts are also for those who want to reduce estate taxes for their family. This is because the proceeds from a life insurance policy owned by a trust are not subject to federal estate tax. Trusts can also help preserve eligibility for any beneficiaries that may receive asset-dependent benefits from the state or federal government.

Life insurance trusts can be particularly useful for people with young children or children with special needs. In the case of young children, a trust can control when and how funds are disbursed, providing long-term support until they reach adulthood. For parents with a child with special needs, a revocable special needs trust can hold funds for their child and define when and how that money should be spent. Because the trust owns the assets, it can also help preserve eligibility for essential government benefits, such as Medicaid.

Life insurance trusts can also be beneficial for those who are unmarried or who have a policy that only pays out on the death of the second spouse. In these cases, having a trust as the policy owner can protect the insurance proceeds from estate tax on the death of the survivor.

Life Insurance: Customizable Coverage or Fixed Amounts?

You may want to see also

Frequently asked questions

A life insurance trust is a legal agreement that allows a third party, known as a trustee, to manage the death benefit from a life insurance policy. It ensures that the benefit is distributed according to the policyholder's wishes and may reduce any estate tax owed.

Life insurance trusts offer several advantages. They can help shield beneficiaries from estate taxes on life insurance proceeds, preserving wealth for future generations. They also ensure that loved ones receive support as intended and can provide control over how and when funds are distributed. Trusts bypass the probate process, saving time and expense for beneficiaries.

Setting up and maintaining a life insurance trust can be complex and costly. There may be significant legal fees involved, and irrevocable trusts cannot be changed or cancelled once established. This can result in a loss of control and flexibility over the policy and its assets.

Life insurance trusts are commonly used by individuals with a high net worth to protect their assets and reduce tax liabilities. They can also be beneficial for parents who want to structure benefit payments to their children, especially in cases of underage or special-needs dependents.

Setting up a life insurance trust typically involves choosing a trustee, creating the trust document with the help of an attorney, transferring the life insurance policy to the trust, and funding the trust with assets or premium payments. It is a complex process, and it is recommended to seek professional advice to ensure compliance with legal and tax requirements.