Verifying a driver's insurance coverage is an essential step in ensuring road safety and legal compliance. When you need to confirm that a driver has the necessary insurance, you can start by requesting a copy of their insurance card or policy documents. These documents typically include the driver's name, the insurance company's details, and the policy number. You can also contact the insurance company directly to verify the policy's validity and coverage. Additionally, some states allow you to check a driver's insurance status through online databases or by calling the state's department of motor vehicles (DMV). It's crucial to follow the legal procedures and guidelines in your jurisdiction to ensure a smooth and accurate verification process.

What You'll Learn

- Policy Verification: Check the driver's insurance policy documents for coverage details

- ID Card: Verify the insurance ID card matches the driver's information

- Contact Insurance Company: Directly contact the insurance provider to confirm coverage

- Digital Verification: Use online tools to verify insurance details instantly

- License Plate Check: Use a service to check if the vehicle is insured

Policy Verification: Check the driver's insurance policy documents for coverage details

Verifying a driver's insurance coverage is an essential step in ensuring road safety and legal compliance. When you are involved in an accident, the driver's insurance policy can provide financial protection and cover for damages. Here's a guide on how to verify a driver's insurance policy and understand its coverage details:

Obtain the Insurance Information: After an accident or when you suspect a driver might not have insurance, request the necessary details. The driver should provide you with their insurance company's name, policy number, and contact information. This information is crucial for the verification process.

Contact the Insurance Company: Reach out to the insurance company directly to confirm the validity of the policy. You can call their customer service number and provide the policy number or driver's details. The insurance representative will be able to verify if the policy is active and if it covers the driver and the vehicle in question. Ask for a confirmation of the policy's validity and the specific coverage details, including the types of coverage (e.g., liability, collision, comprehensive) and any relevant limits.

Review Policy Documents: Once you have access to the insurance policy documents, thoroughly review them. These documents will outline the coverage terms and conditions. Look for sections that describe liability coverage, which typically includes bodily injury liability and property damage liability. Ensure that the policy covers the driver and the vehicle involved in the accident. Check the policy limits and deductibles to understand the extent of coverage.

Cross-Reference with State Requirements: Insurance policies may vary, but it's essential to know the minimum insurance requirements in your state or country. These requirements often specify the minimum liability coverage a driver must have. Compare the policy's coverage with the legal minimum to ensure the driver is adequately insured. If the policy falls short, the driver may need to obtain additional coverage to meet the legal standards.

By following these steps, you can verify a driver's insurance policy and gain a comprehensive understanding of their coverage. This process is vital for accident claims, legal proceedings, and ensuring that all parties involved are protected financially. It empowers individuals to make informed decisions and take appropriate actions when dealing with insurance-related matters.

Auto Owners Insurance: Test-Driving a Motorcycle, What's Covered?

You may want to see also

ID Card: Verify the insurance ID card matches the driver's information

Verifying a driver's insurance coverage is a crucial step in ensuring road safety and legal compliance. One common method is by examining the insurance identification card, which is a physical document that provides essential information about the driver's insurance policy. This card is typically issued by the insurance company and serves as proof of insurance. Here's a detailed guide on how to verify the insurance ID card and ensure it matches the driver's information:

Obtain the Insurance ID Card: Start by requesting a copy of the insurance identification card from the driver. This card should be readily available to the driver, as it is a standard document provided by the insurance company. The driver can usually obtain a copy from their insurance provider or through their online account.

Check for Validity and Currency: Verify that the insurance ID card is valid and up-to-date. Insurance policies have specific terms and coverage periods, so ensure that the card reflects the current policy details. Look for any expiration dates or renewal notices on the card. If the card is outdated, the driver may need to obtain a new one or update their policy.

Compare Driver's Information: Carefully examine the information on the insurance ID card to ensure it matches the driver's details. The card should include the driver's full name, date of birth, address, and contact information. Cross-reference this information with the driver's license or other official documents to ensure accuracy. Pay attention to any discrepancies, as these could indicate potential issues with the insurance coverage or the driver's identity.

Verify Policy Details: The insurance ID card should also display the policy number, insurance company information, and a summary of the coverage provided. Check that the policy number matches the one mentioned in the driver's insurance documents. Ensure that the insurance company's contact information is correct, as this will be crucial for any claims or inquiries.

Online Verification (if available): Some insurance companies offer online verification systems, allowing you to check the validity of an insurance ID card digitally. If this option is available, you can input the card details and verify the policy's authenticity. This method provides real-time confirmation and can be especially useful for quick verifications.

By following these steps, you can effectively verify a driver's insurance coverage through their insurance ID card. It is essential to maintain accurate records and ensure that all drivers have valid insurance to promote road safety and legal compliance.

Auto Insurance for New Ohio Drivers: When Does It Start?

You may want to see also

Contact Insurance Company: Directly contact the insurance provider to confirm coverage

Verifying that a driver has valid insurance coverage is an essential step in ensuring road safety and managing risks. One of the most direct and reliable methods to confirm a driver's insurance status is by contacting the insurance company directly. This approach provides a clear and transparent way to obtain the necessary information.

When you suspect a driver might not have adequate insurance, reaching out to their insurance provider is a proactive step. Insurance companies have the resources to verify the validity of a policy and its coverage details. You can initiate this process by obtaining the driver's insurance policy number or the name of their insurance provider. With this information, you can make a direct inquiry to the insurance company's customer service department.

During the conversation, clearly state your purpose and request for verification. Ask the representative to confirm if the driver's policy is active and if it covers the specific vehicle in question. Inquire about the policy's liability limits, coverage types, and any exclusions or special conditions. This detailed information will help you understand the extent of the driver's insurance coverage.

The insurance company's representative should be able to provide you with a comprehensive overview of the policy, including any relevant documents or certificates. They might also offer guidance on how to proceed if the policy is found to be insufficient or invalid. This direct communication ensures that you have the most accurate and up-to-date information regarding the driver's insurance status.

By taking the initiative to contact the insurance provider, you can efficiently verify the driver's insurance coverage, which is crucial for maintaining a safe and legal driving environment. This method empowers you with the knowledge to make informed decisions and take appropriate actions based on the driver's insurance status.

Switching States: Transferring Auto Insurance from NY

You may want to see also

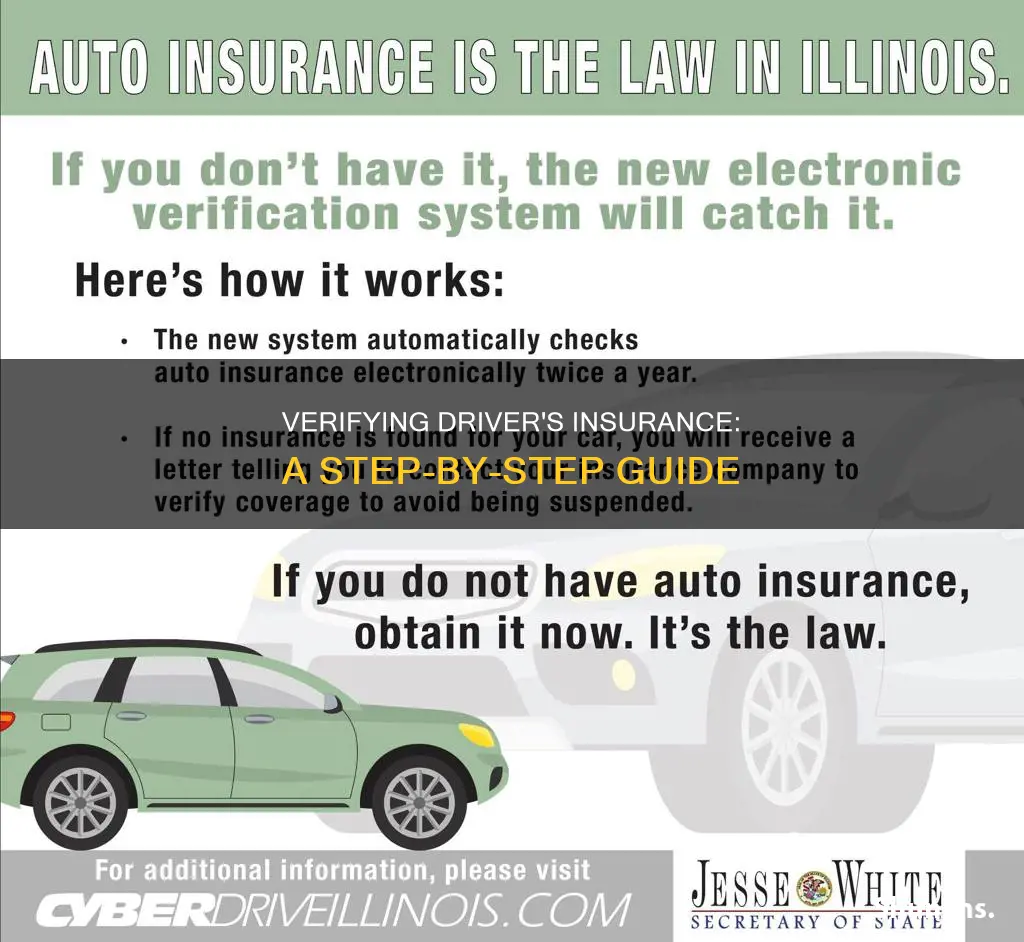

Digital Verification: Use online tools to verify insurance details instantly

In today's digital age, verifying a driver's insurance coverage has become more accessible and efficient through various online tools and platforms. This method of verification is particularly useful for car rental companies, ride-sharing services, and anyone who needs to ensure that a driver is adequately insured before granting access to their vehicles or services. Here's a guide on how to utilize digital verification for this purpose:

Online Insurance Verification Platforms: Numerous websites and mobile applications specialize in providing insurance verification services. These platforms often allow users to input a driver's insurance policy details, such as the policy number, driver's name, and vehicle information. By entering this data, you can instantly access the driver's insurance information, including coverage types, policy limits, and insurance provider details. Some popular options include InsureVerify, PolicyCheck, and VerifyInsure, each offering user-friendly interfaces and secure data handling.

Benefits of Digital Verification: The digital approach to insurance verification offers several advantages. Firstly, it saves time and eliminates the need for manual paperwork. With just a few clicks, you can obtain accurate and up-to-date insurance information, ensuring that the driver is covered for any potential incidents. Secondly, online tools provide a convenient way to verify multiple drivers' insurance simultaneously, making it ideal for businesses managing fleets of vehicles. Lastly, digital verification systems often offer real-time updates, allowing you to quickly identify any changes in the driver's insurance status.

Step-by-Step Process: To verify a driver's insurance using online tools, follow these steps: 1. Choose a reputable insurance verification platform that suits your needs. 2. Enter the required details, ensuring accuracy. 3. Review the provided insurance information for completeness and validity. 4. If the insurance coverage appears satisfactory, proceed with granting access or providing the service. 5. Regularly update the verification process, especially if the driver's insurance policy is due for renewal.

Security and Privacy Considerations: When utilizing online insurance verification services, it is crucial to prioritize security and privacy. Ensure that the chosen platform employs encryption and secure data storage to protect sensitive information. Look for platforms that comply with data protection regulations and offer two-factor authentication for added security. Additionally, regularly review and update the verification process to maintain accuracy and address any potential risks associated with outdated or fraudulent insurance information.

By embracing digital verification methods, you can streamline the process of ensuring driver insurance coverage, providing a more efficient and secure approach to managing vehicle access and services. This method is particularly valuable in the context of ride-sharing and car rental industries, where verifying driver insurance is essential for liability and safety reasons.

Understanding Auto Insurance: The 30-60-10 Rule Explained

You may want to see also

License Plate Check: Use a service to check if the vehicle is insured

Verifying a driver's insurance coverage is an essential step in ensuring road safety and legal compliance. One effective method to achieve this is by utilizing a license plate check service, which can provide valuable information about a vehicle's insurance status. This process is straightforward and can be completed in a few simple steps.

When you need to verify insurance, a license plate check is a reliable approach. It involves using specialized software or online platforms that can access vehicle registration databases. These services are designed to provide real-time information about a vehicle's insurance status, including the presence of valid coverage. By entering the license plate number, you can quickly obtain the necessary details.

The process typically begins with a user-friendly interface where you input the license plate information. The system then connects to relevant databases, such as those maintained by the Department of Motor Vehicles (DMV) or insurance regulatory bodies. These databases contain up-to-date records of vehicle registrations and insurance policies. Within seconds, the service will display the vehicle's insurance status, indicating whether it is currently insured and with which insurance provider.

License plate check services often provide additional details, such as the type of insurance coverage, policy expiration dates, and any outstanding payments or violations. This comprehensive information ensures that you have a complete picture of the vehicle's insurance history. It is particularly useful for fleet managers, car rental companies, or individuals who frequently interact with different vehicles and need to ensure compliance with insurance regulations.

In summary, using a license plate check service is a convenient and efficient way to verify a driver's insurance coverage. It offers a quick solution to ensure that vehicles on the road are legally insured, promoting a safer driving environment. With this method, you can easily access critical information, making it an invaluable tool for anyone involved in the transportation industry or seeking to confirm insurance status.

Car-Free Auto Insurance: Is It Possible?

You may want to see also

Frequently asked questions

You can request a proof of insurance from the driver, which typically includes an insurance card or a document showing their policy details. This can be done by asking the driver to provide it directly or by contacting their insurance company.

If the driver is unwilling to provide proof, you can suggest alternative methods like checking their vehicle registration, which often includes insurance information. You can also report the incident to the relevant authorities, who may have the power to investigate and enforce compliance.

Yes, many insurance companies provide online tools and databases that allow you to verify a driver's insurance coverage. These resources often require the driver's policy number or vehicle information to access their insurance details.

If you have reasons to believe a driver is operating a vehicle without insurance, it is advisable to report this to the appropriate authorities, such as the police or a local insurance regulatory body. They can guide you on the necessary steps to take and may have procedures in place to address such situations.