Navigating the world of insurance can be complex, especially for Uber drivers who rely on the app for their livelihood. Understanding how to view and manage insurance documents on the Uber Driver app is crucial for staying compliant with regulations and ensuring coverage. This guide will provide a step-by-step breakdown of the process, empowering drivers to access their insurance information effortlessly and make informed decisions about their protection.

What You'll Learn

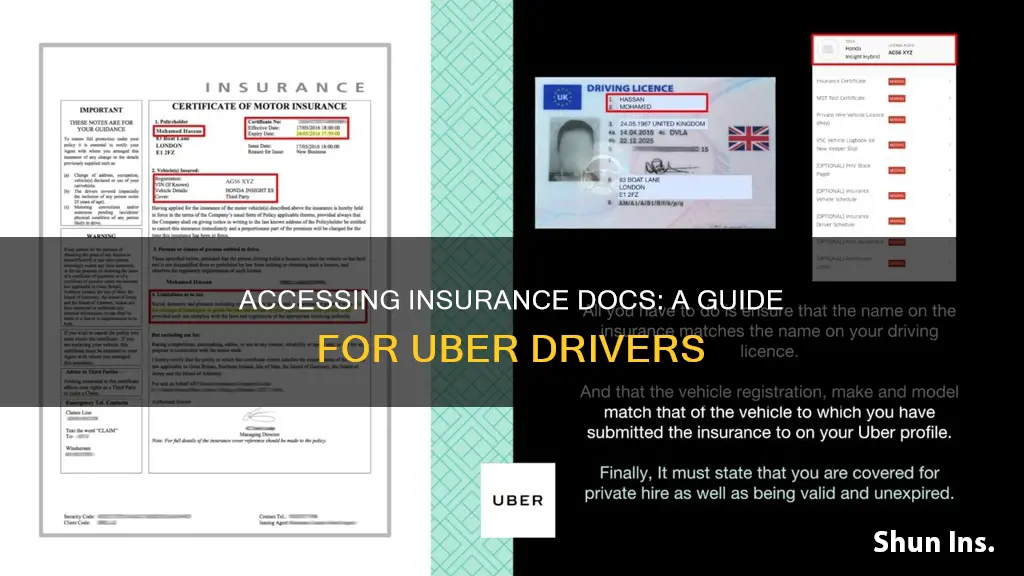

- Document Accessibility: Uber provides insurance documents directly within the app for easy access

- Policy Details: Drivers can view their insurance coverage and terms on the Uber platform

- Claims Process: Understanding the claims process is crucial for Uber drivers

- Coverage Limits: Uber drivers need to know their insurance coverage limits and what is covered

- Updates and Changes: Regularly checking for updates to insurance policies is essential for Uber drivers

Document Accessibility: Uber provides insurance documents directly within the app for easy access

Uber has revolutionized the way drivers access their essential documents, making the process of viewing insurance documents seamless and efficient. One of the key advantages of using the Uber driver app is the direct integration of important resources, including insurance documents, within the platform. This feature ensures that drivers can quickly and easily access their necessary paperwork without any unnecessary complications.

When you log into the Uber driver app, you will find a dedicated section specifically designed for document management. This section typically includes various categories of documents, with insurance documents being a prominent feature. Uber's user-friendly interface allows drivers to navigate through the app effortlessly, ensuring that finding the insurance documents is a straightforward process. Upon opening the insurance section, you will likely see options to view different types of insurance coverage, such as liability, passenger, and vehicle insurance. Each document will be clearly labeled, making it simple to identify the specific policy you require.

The app might provide a secure and encrypted system to display these documents, ensuring the privacy and security of the driver's information. This could involve a login process or a verification step to confirm the driver's identity before granting access. Once authenticated, drivers can view their insurance documents in a clear and readable format, often with the option to download or print them for future reference. This accessibility feature is particularly beneficial for drivers who need quick access to their insurance information, especially during unexpected situations or when interacting with law enforcement or insurance companies.

Moreover, Uber's approach to document accessibility demonstrates a commitment to providing a comprehensive and supportive environment for its drivers. By centralizing important documents within the app, Uber streamlines the process of managing and accessing these resources, ultimately enhancing the overall driving experience. This level of organization and efficiency can save drivers valuable time and effort, allowing them to focus on their primary tasks without unnecessary delays.

In summary, Uber's integration of insurance documents within the driver app is a practical and innovative solution for drivers' document management needs. This feature not only simplifies the process of accessing important paperwork but also contributes to a more efficient and user-friendly driving experience. Drivers can now quickly locate and view their insurance documents, ensuring they have the necessary information readily available when needed.

Auto Insurance Trackers: Worth the Cost?

You may want to see also

Policy Details: Drivers can view their insurance coverage and terms on the Uber platform

Uber provides a comprehensive insurance overview for its drivers, ensuring they are well-informed about their coverage. Drivers can access this information through the Uber Driver app, which offers a dedicated section for insurance-related details. This feature is an essential part of Uber's commitment to transparency and driver support.

When drivers log into the app, they can navigate to the 'Insurance' or 'Coverage' section, depending on the app's layout. Here, they will find a summary of their insurance policy, including key details such as coverage limits, policy types, and any applicable discounts or add-ons. The app might also display the insurance provider's name and contact information for further inquiries. This accessible information empowers drivers to understand their insurance benefits and make informed decisions regarding their driving activities.

The policy details section typically includes a breakdown of the insurance coverage, such as liability coverage, which protects drivers against claims for bodily injury or property damage to third parties. It may also outline personal injury protection (PIP) coverage, which provides medical benefits for drivers and passengers in the event of an accident. Additionally, drivers can review any additional coverage options they have chosen, such as collision damage waiver or non-owned vehicle liability.

Uber's insurance platform ensures that drivers can quickly review their policy documents, making it convenient to stay updated on their coverage. This accessibility is particularly useful for drivers who may need to quickly verify their insurance details before accepting a ride or when making changes to their policy. The app's user-friendly interface allows drivers to easily scroll through the policy summary, ensuring they have a clear understanding of their insurance benefits.

Furthermore, the app might provide educational resources or FAQs to help drivers comprehend complex insurance terms and conditions. This additional support can be valuable for drivers who are new to the platform or want to ensure they fully grasp their insurance obligations and rights. By offering this level of transparency, Uber aims to create a secure and informed driving environment for its drivers.

Lease Deals and Insurance: What's Covered?

You may want to see also

Claims Process: Understanding the claims process is crucial for Uber drivers

Understanding the claims process is essential for Uber drivers to ensure they are adequately prepared and informed in the event of an accident or incident. The Uber app provides a platform for drivers to report incidents and file claims, but it's crucial to know the steps involved to navigate the process smoothly. Here's a detailed breakdown of the claims process:

When an accident occurs, Uber drivers should remain calm and assess the situation. It is important to ensure everyone's safety and then report the incident to Uber immediately. The app typically has a dedicated section for incident reporting, where drivers can provide details such as the date, time, location, and a description of the event. Uber's system is designed to guide drivers through the reporting process, ensuring all necessary information is captured. After reporting, drivers should also contact their insurance provider to initiate the claims process.

The insurance provider will have a specific team or department dedicated to handling Uber-related claims. Drivers should provide them with all the relevant details, including the incident report number from Uber. This information is crucial for the insurance company to access the driver's policy and initiate the claims process. During this stage, it is advisable to document the incident by taking photos of the accident scene, vehicle damage, and any relevant evidence. This documentation will be essential when submitting the claim.

Once the insurance provider receives the claim, they will assess the situation and determine the next steps. This may involve an investigation, which could include inspecting the vehicle, reviewing witness statements, or obtaining police reports. Uber drivers should cooperate fully with the insurance company's inquiries and provide any additional information requested. The insurance provider will then decide whether to settle the claim or require further documentation.

In some cases, Uber may also provide support and guidance during the claims process. They might offer resources or assistance to help drivers navigate the insurance procedures. It is beneficial to stay in communication with both the insurance company and Uber to ensure a smooth and efficient resolution. Understanding the claims process and being proactive in gathering the necessary information can significantly impact the outcome of a claim.

By familiarizing themselves with the Uber app's incident reporting system and the insurance claims procedure, drivers can ensure they are well-prepared for any unforeseen events. This knowledge empowers drivers to take the necessary actions promptly, potentially reducing the impact of the incident on their earnings and overall driving experience.

Florida Auto Insurance: Why So Expensive?

You may want to see also

Coverage Limits: Uber drivers need to know their insurance coverage limits and what is covered

Understanding your insurance coverage is crucial for any Uber driver to ensure you are protected while on the job. The insurance coverage limits and what is included in your policy can vary, and it's essential to be aware of these details to avoid any surprises when making a claim. Here's a guide to help you navigate this aspect of your Uber driving responsibilities:

When you sign up with Uber, you'll typically be offered different insurance options. These may include personal auto insurance, which you can use while driving for Uber, or a separate Uber-provided policy. It is imperative to carefully review the coverage limits and terms of your chosen insurance plan. Coverage limits refer to the maximum amount your insurance will pay for a specific claim or incident. For instance, if you have a liability coverage limit of $100,000, this means your insurance will cover up to $100,000 for any third-party claims related to bodily injury or property damage that you are found liable for while driving for Uber. Understanding these limits is vital as it determines the financial protection you have in case of an accident.

Different types of insurance coverage are associated with Uber driving, and each has its own set of coverage limits. For example, liability coverage protects you against claims from third parties for injuries or damage they sustain due to your actions while driving. This coverage typically includes bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and legal fees if you cause injury to another person, while property damage liability covers damage to someone else's property. It's important to note that Uber's base policy provides a limited amount of liability coverage, and additional coverage may be required for more comprehensive protection.

In addition to liability, you might also want to consider collision and comprehensive coverage, which are typically offered as add-ons to your policy. Collision coverage pays for repairs to your vehicle if you're involved in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers non-collision-related incidents like theft, vandalism, or natural disasters. These add-ons often have their own coverage limits, and understanding these limits will help you decide if you need to upgrade your policy for added peace of mind.

To view your insurance documents on the Uber driver app, look for the 'Settings' or 'Account' section, where you can usually find your insurance information. Here, you should be able to access a summary of your coverage, including the coverage limits and types of insurance you have. It is recommended to regularly review these documents to ensure you are aware of any changes or updates to your policy. Staying informed about your insurance coverage will enable you to make the most of your protection and ensure you are prepared for any eventualities while driving for Uber.

Insurance Costs: SD vs CO

You may want to see also

Updates and Changes: Regularly checking for updates to insurance policies is essential for Uber drivers

Staying on top of insurance policy updates is a critical aspect of being an Uber driver, ensuring you are fully protected and aware of any changes that may impact your coverage. Insurance policies can be complex documents, and it's easy to overlook important details or miss changes that could affect your driving and liability. Regularly reviewing your insurance policy is a proactive approach to managing your Uber driving business.

The Uber Driver app provides a platform for drivers to access their insurance documents, but it's not just about viewing the documents; it's about understanding the content and staying informed. Uber drivers should make it a habit to log into the app and review their insurance coverage periodically. This practice ensures that you are aware of any adjustments to your policy, including changes in coverage limits, exclusions, or additional benefits. For instance, if your insurance provider has introduced a new policy that covers medical expenses for passengers in the event of an accident, you'll be the first to know through this regular review process.

Over time, insurance policies can evolve, and these changes might not always be communicated directly to you. By regularly checking the app, you can take control of your insurance management. This proactive approach allows you to identify any discrepancies or missing information promptly. For example, if your policy has been updated to include a specific clause about ride-sharing activities, you'll be able to review this and ensure that your driving practices align with the new terms.

Furthermore, staying informed about insurance updates can help you make better decisions regarding your Uber driving. It enables you to understand the scope of your coverage and identify any potential gaps in protection. This knowledge is crucial for managing risks and ensuring that you are adequately prepared for various driving scenarios. For instance, if you notice a change in the policy that affects your liability coverage, you can decide whether additional insurance is necessary to cover specific risks associated with your Uber driving.

In summary, regularly checking for updates to your insurance policies through the Uber Driver app is a vital practice for Uber drivers. It empowers you to stay informed, manage risks effectively, and ensure that your insurance coverage remains relevant and comprehensive. By making this a routine, you can drive with confidence, knowing that you have the necessary protections in place.

Auto Insurance Total Loss: What Does It Cover?

You may want to see also

Frequently asked questions

You can view your insurance documents by logging into your Uber Driver app and navigating to the 'Settings' or 'Profile' section. Look for a tab or option labeled 'Documents', 'Insurance', or 'Legal'. Here, you should find a list of your insurance certificates or documents, which you can view, download, or share as needed.

Yes, the Uber Driver app provides a dedicated area for drivers to manage their insurance and legal documents. Go to the 'Profile' or 'Settings' menu, then select 'Insurance' or 'Legal'. This section will display your insurance coverage details, including policy numbers, expiration dates, and any relevant documents.

While the app allows you to view and download insurance documents, updating insurance information typically requires you to contact your insurance provider directly. You can inform them about your Uber driving activities and request any necessary adjustments to your policy. Uber may also provide a link or option to update insurance details within the app, but this is usually a notification or a separate process.

If you're unable to locate the insurance documents section, ensure that you are using the latest version of the Uber Driver app. Sometimes, updates introduce new features or changes to the app's layout. If the issue persists, you can reach out to Uber's customer support team for assistance. They can guide you through the process or provide the necessary information via email or phone.