Life insurance is a contract between an insurance company and a policyholder. In exchange for a premium, the insurance company agrees to pay a sum of money to one or more named beneficiaries upon the death of the policyholder. The purpose of life insurance is to provide financial security to your loved ones after your death.

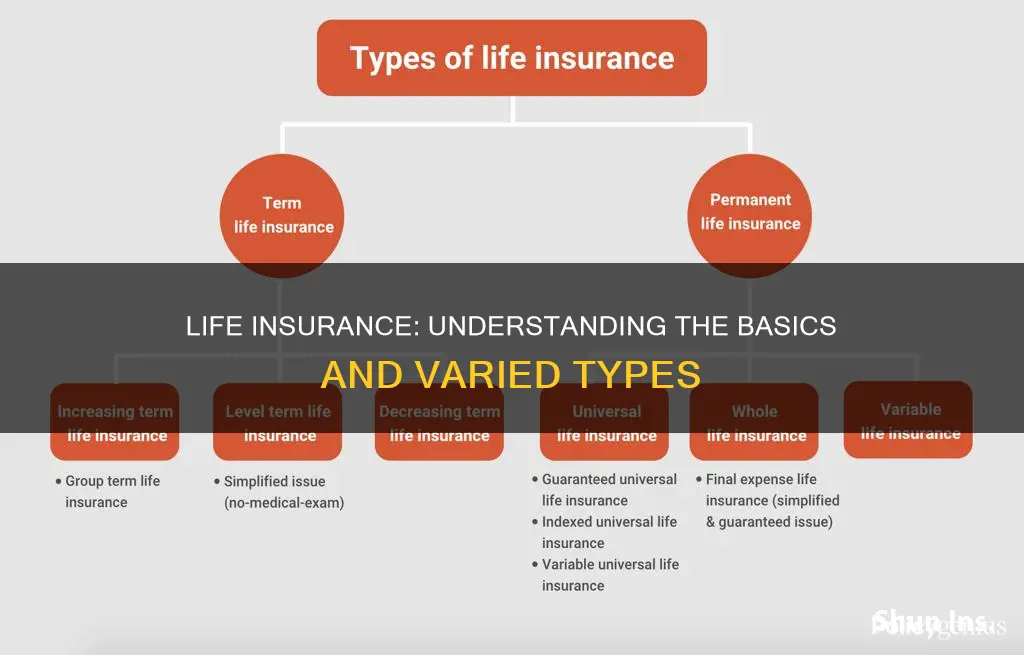

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers the policyholder for a set number of years, while permanent life insurance covers the policyholder for their entire life. Within these two main types, there are several subtypes of life insurance policies, including whole life insurance, universal life insurance, variable life insurance, and final expense life insurance. Each type of life insurance is designed to meet specific needs, such as providing coverage for a certain number of years or offering lifelong protection.

When choosing a life insurance policy, it is important to consider your needs, budget, and financial goals. Term life insurance is typically more affordable but does not build cash value, while permanent life insurance offers lifelong coverage and may include a savings component. Additionally, life insurance riders can be added to a policy to customise the coverage according to an individual's specific requirements.

| Characteristics | Values |

|---|---|

| Number of types | 5 main types: Term, Whole, Universal, Variable, Final Expense |

| Coverage length | Temporary or permanent |

| Complexity | Simple or complex |

| Coverage amount | $50,000+ |

| Cash value | Yes or no |

| Medical exam required | Yes or no |

| Best for ages | 18-85 |

| Premium flexibility | Fixed or flexible |

| Death benefit | $2,500 - $100,000+ |

What You'll Learn

Term life insurance

One of the biggest advantages of term life insurance is its cost-effectiveness. It is often the cheapest option available, making it a good choice for those on a budget. Additionally, term life insurance offers flexibility in terms of coverage length, allowing you to choose the term that best suits your needs. You can also scale your death benefit up or down with increasing and decreasing term policies.

Another benefit of term life insurance is the peace of mind it provides. If the policyholder passes away during the term, their beneficiary will receive a tax-free death benefit. This can be used to cover funeral expenses, pay off debts, or provide financial support for loved ones.

However, one downside to consider is that if the policyholder outlives the term, the insurance company will keep the premium payments, and there will be no payout. Additionally, term life insurance may not offer the same long-term security as whole life insurance, which provides coverage for your entire life. Nevertheless, many term life insurance policies can be converted into whole life insurance policies, providing an option for continued coverage.

Overall, term life insurance is a cost-effective and flexible option for those seeking temporary coverage. It allows individuals to plan for specific timelines and provides financial protection for their loved ones during the selected term.

Umbrella Insurance: Key Man Life Insurance Coverage Explained

You may want to see also

Whole life insurance

There are several types of whole life insurance policies, categorised based on how premiums are paid. Level payment policies, where premiums remain unchanged, are the most common. Single premium policies are paid for with a one-time large premium, while limited payment policies involve a limited number of higher premium payments. Modified whole life insurance policies have lower premiums in the first few years, followed by higher-than-standard premiums in later years.

Life Worth Living Cincinnati: Exploring Insurance Options

You may want to see also

Universal life insurance

One of the key features of universal life insurance is the ability to adjust your death benefit and monthly premium payments within certain limits. This flexibility allows you to increase or decrease your death benefit and even skip monthly premium payments if you have sufficient cash value in your policy.

Another difference between universal life and whole life insurance is that the death benefit and cash value growth are not guaranteed with universal life insurance. If your investments underperform or you underpay for an extended period, it could negatively impact your death benefit or cause your policy to lapse.

Overall, universal life insurance offers flexibility in terms of premium payments, death benefits, and the ability to borrow against the cash value. However, it is important to carefully manage the policy to avoid potential risks and ensure the coverage continues.

Understanding Your Fegli Life Insurance Coverage

You may want to see also

Variable life insurance

Variable universal life insurance (VUL) is a type of variable life insurance that offers flexibility. In addition to death benefit protection, VUL allows you to allocate among purely market-driven and fixed options with guaranteed minimum interest crediting. With a wide range of investment options, you can adjust your policy's allocations to meet potential lifetime growth objectives and risk tolerances—all in one flexible policy.

Universal Life Insurance: Does It Expire or Endure?

You may want to see also

Final expense life insurance

Final expense insurance policies generally do not require a medical exam for approval, making them more accessible to seniors or individuals with pre-existing health conditions. The application process is relatively simple, with coverage often issued within days of applying, and sometimes on the same day. Policy rates start at around $63 per month, with coverage amounts ranging from $5,000 to $40,000. The death benefit can be used for anything, but it is typically intended to cover funeral costs, medical bills, and other end-of-life expenses.

Final expense policies can build cash value over time, allowing policyholders to withdraw cash, borrow money, or pay premiums. The coverage remains in place as long as the premiums are paid, and there are no expiration dates on the policies. This type of insurance is popular among seniors due to its affordable price, smaller benefit amounts, and focus on covering funeral costs.

When considering final expense life insurance, it is important to review the specific features and benefits offered by different insurance companies, as they may vary. Some policies may include additional features such as child riders, accidental death and dismemberment coverage, or support benefits for surviving loved ones. It is also essential to be honest when answering health-related questions during the application process, as withholding information could result in the denial of a claim.

HSBC Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Life insurance is a contract between an insurance company and a policyholder. In exchange for a premium, the insurance company agrees to pay a sum of money to one or more named beneficiaries upon the death of the policyholder.

Life insurance policies fall into two categories: term and permanent. Term life insurance provides coverage for a set number of years, while permanent life insurance does not expire and will cover you for your whole life.

The three most common types of permanent life insurance policies are whole, universal, and variable.

Whole life insurance is a type of permanent life insurance where the premium and death benefit remain the same each year. It also includes a cash value component, similar to a savings account, which policyholders can use to take out loans or pay policy premiums.

Term life insurance is designed to last for a certain number of years, after which it ends. Common terms are 10, 20, or 30 years. Level term, the most common type, pays the same amount of death benefit throughout the policy's term.