Life insurance is a legally binding contract between an individual and an insurance company. The insurance company agrees to pay a sum of money to the policyholder's beneficiaries upon their death. In exchange, the policyholder pays a premium to the insurance company. The purpose of life insurance is to provide financial security to loved ones after the policyholder's death. There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers the policyholder for a specific period, while permanent life insurance covers the policyholder for their entire life.

| Characteristics | Values |

|---|---|

| Type of Insurance | Life insurance and accidental death and dismemberment (AD&D) insurance are two different types of insurance. |

| Payout Conditions | Life insurance pays out upon the death of the insured, regardless of the cause (except for specific exclusions). AD&D insurance only pays out for accidental causes of death and injury defined in the policy. |

| Purpose | Life insurance is meant to provide financial security for dependents and loved ones after the insured's death. AD&D insurance provides financial protection in the event of accidental death or serious injury, such as paralysis, loss of limb, eyesight, hearing, or speech. |

| Policy Structure | Life insurance is typically an independent, standalone policy. AD&D insurance can be offered as a standalone policy or as a rider (additional benefit) to a life insurance policy. |

| Cost | AD&D insurance is generally more affordable than standard life insurance. |

| Eligibility | AD&D insurance may not be available to those in high-risk jobs, such as firefighting, law enforcement, or the military. |

What You'll Learn

Term life insurance vs. permanent life insurance

Life insurance is an important financial tool that provides financial security to your loved ones in the event of your death. There are two main types of life insurance: term life insurance and permanent life insurance. Both types have their own unique features, benefits, and costs, so choosing the right one depends on your specific needs and circumstances. Here is a detailed comparison between the two:

Term Life Insurance

Term life insurance is a temporary form of life insurance that covers you for a specific period, typically between 10 and 30 years, or until a particular age. It is generally more affordable than permanent life insurance, making it a good option for those on a budget or those seeking short-term coverage. Term life insurance does not require a medical exam for approval, and the premiums usually remain level throughout the policy term. However, once the policy term ends, the coverage ends as well, and the paid premiums are not refunded. Term life insurance does not carry a cash value component, meaning there are no savings that can be accessed by the policyholder. It is important to consider the length of the term carefully, as renewing the policy after it expires will result in higher premiums.

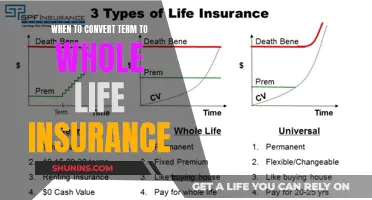

Permanent Life Insurance

Permanent life insurance, on the other hand, provides coverage for your entire life, as long as you continue to pay the premiums. It is more expensive than term life insurance but offers additional benefits. One of its key features is the cash value component, which grows over time and can be accessed by the policyholder during their lifetime. This makes permanent life insurance a useful financial tool for paying unexpected expenses, such as college tuition or supplemental retirement income. The death benefits are guaranteed, and the premiums remain stable throughout, though there are some exceptions. Permanent life insurance comes in various types, including whole life, universal life, and variable life, each with its own specific features and flexibility.

Key Differences

The main differences between term and permanent life insurance lie in the length of coverage, the presence or absence of a cash value component, and the cost of premiums. Term life insurance is temporary and less expensive, while permanent life insurance offers lifelong coverage and is more expensive. Permanent life insurance also provides the opportunity to build cash value, which can be a valuable financial asset. When deciding between the two, it is essential to consider your long-term financial goals, budget, and the specific needs of your loved ones.

Globe Insurance: Term Life Insurance Options and Availability

You may want to see also

Whole life insurance

There are several types of whole life insurance policies, categorised by how premiums are paid:

- Level Payment: Premiums remain unchanged throughout the duration of the policy.

- Single Premium: The insured pays a one-time large premium, which funds the policy for life.

- Limited Payment: The insured pays a limited number of premiums, which are higher than level-payment policies.

- Modified Whole Life Insurance: Features lower premiums than standard policies in the first few years, and higher-than-standard premiums in later years.

Life Insurance Proceeds: Canadian Tax Implications

You may want to see also

Universal life insurance

One of the key features of universal life insurance is its ability to accumulate cash value. The policy can earn interest, with the rate set by the insurer, and this interest accumulates over time. Policyholders can then borrow against this cash value or use it as collateral for a loan, providing financial flexibility during their lifetime. However, it is important to monitor the cash value, as underperformance or underpayment may affect the death benefit or cause the policy to lapse.

When choosing between universal life insurance and other options, it is essential to consider your specific needs and goals. Universal life insurance can be an attractive choice for those seeking flexible coverage, lifetime protection, and the ability to build a cash savings component. However, careful management is required to ensure the policy remains adequately funded and to avoid potential tax consequences.

Life Insurance and DSHS: Counting Assets and Impact

You may want to see also

Variable universal life insurance

Variable universal life (VUL) insurance is a type of permanent life insurance policy that offers flexible premiums and a savings component. This savings component, or cash value, can be invested to produce greater returns. VUL insurance policies are similar to traditional universal life insurance policies but allow you to invest the cash value in the market through subaccounts.

VUL insurance provides lifelong insurance protection and combines a death benefit with a savings component. As long as you continue to pay the insurance costs, this coverage can last your entire life. Like traditional universal life insurance, VUL lets you adjust your annual payments to fit your budget. However, you must pay enough each year to cover the insurance costs of your policy. The remainder of your premiums will be allocated to the policy's cash value.

VUL insurance offers you control over how to invest your cash value. You can choose from a variety of subaccounts that align with your risk tolerance and investment goals. The performance of your investments will determine the interest and future growth of your cash value. The growth of the cash value in a VUL insurance policy is tax-deferred, and you can access it by withdrawing or borrowing funds.

While VUL insurance offers increased flexibility and growth potential, it also comes with certain risks. The return on the cash component is not guaranteed, and you can even lose money. If your investments perform poorly, you may need to make larger premium payments to maintain your life insurance coverage and rebuild your cash value.

VUL insurance can be a good option for those seeking permanent life insurance protection, comfortable with higher investment risk, and interested in managing their investments. It is important to carefully assess the risks and compare VUL with other life insurance and investment options before purchasing.

New York Life Insurance: Offering Humana Insurance Plans?

You may want to see also

Final expense insurance

Unlike traditional life insurance policies, final expense insurance is specifically designed to cover funeral costs and other end-of-life expenses. It is a popular choice among seniors due to its affordable price, smaller benefit amounts, and emphasis on covering these specific costs. While traditional life insurance policies are intended to replace lost income, final expense insurance provides a way to pay for any expenses left behind when you pass away.

In addition to funeral and burial costs, final expense insurance can help cover outstanding medical, legal, or credit card bills. It can also be used to pay for probate costs, which can be a shock to family and loved ones. The legal proceedings and related accounting fees can take months or even years to resolve.

When choosing a final expense insurance plan, it is important to consider your monthly expenses and potential funeral costs to determine the appropriate coverage amount. Final expense insurance typically only requires a brief health questionnaire rather than a formal medical exam. By planning ahead and choosing the right coverage, you can rest assured that your beneficiary will receive the necessary financial support during a difficult time.

Crohn's Impact: Life Insurance Underwriting

You may want to see also

Frequently asked questions

Life insurance is a legally binding contract between an insurance company and a policyholder. In exchange for a premium, the insurance company agrees to pay a sum of money to one or more named beneficiaries upon the death of the policyholder.

Term life insurance provides coverage for a specific period, typically between 10 and 30 years. Permanent life insurance provides coverage for the entire life of the policyholder. Term life insurance does not have a cash value component, while permanent life insurance does.

Life insurance is often purchased by people who want to provide financial security for their loved ones upon their death. It can also be used to cover future college expenses, support a partner who relies on your income, or leave an inheritance.

The cost of life insurance depends on various factors such as age, gender, health, and lifestyle. Term life insurance is generally more affordable than permanent life insurance, and female customers tend to get lower rates than male customers. Getting life insurance at a younger age can also result in lower premiums.