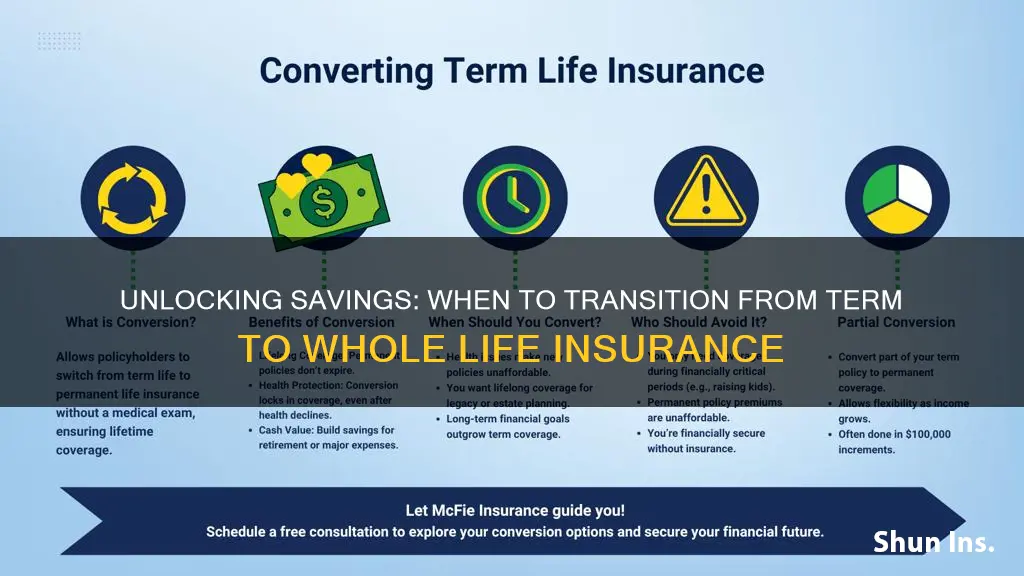

When considering life insurance, understanding the timing of converting from term life to whole life is crucial. Term life insurance provides coverage for a specific period, offering a cost-effective solution for temporary needs. However, as individuals progress through life, their insurance requirements may evolve. Converting to whole life insurance at the right time can offer long-term financial security, providing coverage for life and potential investment opportunities. This transition is particularly beneficial when individuals want to ensure their loved ones are protected for the long term or when they seek a policy that builds cash value over time. Knowing when to make this switch can help individuals make informed decisions about their insurance needs and financial planning.

What You'll Learn

- Cost Comparison: Term is cheaper, but Whole Life offers long-term savings and investment

- Financial Goals: Consider converting when you need coverage for a longer period

- Mortgage Protection: Whole Life ensures mortgage coverage even if you outlive the term

- Long-Term Savings: Convert when you want guaranteed cash value accumulation over time

- Flexibility: Term allows easy adjustments, while Whole Life provides consistent benefits

Cost Comparison: Term is cheaper, but Whole Life offers long-term savings and investment

When considering the transition from term insurance to whole life insurance, understanding the cost implications is crucial. Term insurance, a temporary coverage option, is generally more affordable than whole life insurance, which provides permanent coverage and additional features. The initial lower cost of term insurance is a significant advantage, especially for those on a tight budget or with limited financial resources. This affordability is a primary reason why many individuals opt for term policies, especially when they are young and healthy, as they often qualify for lower premiums.

However, the decision to convert to whole life insurance should not be based solely on the initial cost savings. Whole life insurance offers a unique combination of long-term financial benefits. It provides a guaranteed death benefit, ensuring that your beneficiaries receive a specified amount upon your passing. Additionally, whole life policies accumulate cash value over time, which can be borrowed against or withdrawn, offering a potential source of funds for various financial needs. This feature is particularly valuable for those who want to build a substantial financial asset while also having insurance coverage.

The cost of whole life insurance is structured to account for these long-term benefits. While the premiums may be higher, they are calculated to cover the death benefit and the ongoing administration of the policy, including the accumulation of cash value. Over time, the cash value in a whole life policy can grow, providing a financial cushion that can be used for various purposes, such as funding education, starting a business, or supplementing retirement income. This aspect of whole life insurance is often overlooked in favor of the immediate cost savings of term insurance.

In contrast, term insurance is designed for a specific period, typically 10, 20, or 30 years. During this time, it provides a fixed level of coverage at a lower cost. However, once the term expires, the policy ends, and any built-up cash value or investment components may be lost. This makes term insurance a more limited option for long-term financial planning. While it is an excellent choice for temporary coverage, it may not provide the same level of financial security and flexibility as whole life insurance.

In summary, while term insurance is cheaper upfront, whole life insurance offers a more comprehensive solution for long-term financial planning. The decision to convert should consider both the immediate cost savings and the potential for long-term financial growth and security. By understanding the cost structure and benefits of both options, individuals can make an informed choice that aligns with their financial goals and needs. This approach ensures that insurance coverage is not just a short-term solution but a long-lasting financial tool.

Canceling AMP Life Insurance: A Step-by-Step Guide

You may want to see also

Financial Goals: Consider converting when you need coverage for a longer period

When it comes to financial planning, ensuring you have adequate insurance coverage is crucial, especially when you need long-term protection. One common decision point for many individuals is whether to convert their term life insurance into a whole life insurance policy. This conversion can be a strategic move to align your insurance needs with your financial goals.

Term life insurance provides coverage for a specific period, often 10, 20, or 30 years. It is a cost-effective way to secure financial protection during a particular phase of life, such as when you have a mortgage, dependants, or other financial commitments. However, as your life circumstances change, you may find that you no longer require the same level of coverage. This is where the conversion to whole life insurance becomes relevant.

Whole life insurance, on the other hand, offers lifelong coverage and provides a range of benefits. It typically involves a single premium payment, ensuring that the policy remains in force for the entire duration of your life. This type of insurance is particularly valuable when you need coverage for an extended period, as it provides a sense of security and financial stability. By converting to whole life, you can ensure that your loved ones are protected even in the long term, which is essential for your financial goals.

The decision to convert is often driven by the need for long-term financial security. As you progress through life, your financial goals may evolve, and you might require insurance that adapts to your changing needs. For instance, when you have a growing family and increasing financial responsibilities, a term policy might not provide the necessary coverage. Converting to whole life insurance can offer a more comprehensive solution, ensuring that your insurance keeps pace with your life's milestones.

Additionally, whole life insurance can be a valuable asset for wealth accumulation. It includes an investment component, allowing your premiums to grow over time. This feature can be advantageous if you are looking to build a financial nest egg alongside your insurance coverage. By regularly reviewing and adjusting your insurance needs, you can make informed decisions to support your financial goals and ensure that your insurance strategy remains effective and relevant throughout your life.

Life Insurance: Pre-tax Benefits and Their Implications

You may want to see also

Mortgage Protection: Whole Life ensures mortgage coverage even if you outlive the term

When considering mortgage protection, whole life insurance is a valuable tool that provides long-term financial security. This type of insurance ensures that your mortgage is fully covered, even if you outlive the initial term of the policy. Here's why this is an essential aspect of financial planning:

Mortgage protection is a critical component of financial security, especially for those with significant debts like a home loan. Term life insurance, while affordable, only covers you for a specified period, typically 10, 15, or 20 years. Once the term ends, the coverage expires, leaving you vulnerable if you haven't paid off your mortgage. This is where whole life insurance steps in as a reliable solution. It offers permanent coverage, ensuring that your mortgage remains protected throughout your entire life, not just a limited period.

The beauty of whole life insurance for mortgage protection is its longevity. It provides a safety net that adapts to your changing needs. As you age, your mortgage balance may decrease, but the insurance policy continues to offer coverage. This is particularly important if you plan to stay in your home for an extended period or if you want to ensure your family's financial stability in the long run. With whole life insurance, you can rest assured that your mortgage is secure, even if you outlive the initial term.

Converting from a term life policy to whole life insurance for mortgage protection is a strategic financial move. It allows you to lock in a fixed rate and ensure that your mortgage is always covered. This is especially beneficial if you've taken out a substantial loan and want to provide peace of mind for your loved ones. By making this conversion, you're not only protecting your mortgage but also building a long-term financial asset.

In summary, when it comes to mortgage protection, whole life insurance is a powerful tool. It guarantees that your mortgage will be covered, even if you surpass the initial term of your policy. This type of insurance provides permanent coverage, adapting to your changing circumstances and ensuring financial security for your mortgage and, by extension, your home.

Employee Life Insurance: Voluntary Benefits Worth the Cost?

You may want to see also

Long-Term Savings: Convert when you want guaranteed cash value accumulation over time

When considering the transition from term life insurance to a more permanent policy, such as whole life insurance, it's essential to understand the long-term savings and financial benefits that whole life offers. This conversion is particularly advantageous when you aim for consistent and guaranteed cash value accumulation over an extended period. Here's a detailed guide on why and how to make this decision:

Understanding Cash Value Accumulation: Whole life insurance provides a unique feature known as cash value, which is a portion of the premium that is invested and grows over time. Unlike term life, where the focus is solely on providing coverage for a specific period, whole life insurance ensures that a portion of your premium contributes to building a cash value. This cash value grows at a guaranteed rate, providing a secure investment with a predictable return. Over the long term, this can result in substantial savings, which can be borrowed against or withdrawn when needed.

Long-Term Financial Planning: Converting to whole life insurance is an excellent strategy for long-term financial planning. When you opt for this conversion, you're essentially locking in a consistent savings rate. The guaranteed cash value accumulation means that your money is working for you, and the growth is predictable. This is particularly beneficial if you have long-term financial goals, such as saving for your child's education, a retirement fund, or even a down payment on a house. By converting, you ensure that your savings are not only secure but also grow at a steady pace.

Guaranteed Returns: One of the most appealing aspects of converting to whole life is the guaranteed return on your investment. Unlike some other investment vehicles, whole life insurance offers a fixed rate of return, ensuring that your cash value will grow as expected. This predictability is crucial for long-term savings, as it allows you to plan and make informed financial decisions. With term life, the coverage ends after a set period, but with whole life, your savings continue to grow, providing a safety net for the future.

Building Wealth Over Time: The power of converting to whole life insurance lies in its ability to build wealth over time. As your cash value accumulates, it can be used to pay future premiums, ensuring that your policy remains in force indefinitely. This strategy allows you to build a substantial financial asset while also having a safety net in the form of life insurance coverage. Over the years, the cash value can grow significantly, providing a valuable resource that can be utilized for various financial goals or even passed on as an inheritance.

In summary, converting from term to whole life insurance is a strategic move for those seeking long-term savings and guaranteed cash value accumulation. It provides a secure and predictable way to build wealth, ensuring that your financial goals are met and your family is protected. By understanding the benefits of cash value and the long-term financial advantages, you can make an informed decision that will serve your financial well-being for years to come.

Life Insurance License: Avoid Losing It

You may want to see also

Flexibility: Term allows easy adjustments, while Whole Life provides consistent benefits

When it comes to insurance, especially life insurance, understanding the flexibility and long-term benefits of different policies is crucial. Term life insurance and whole life insurance are two popular options, each with its own advantages. Here's an exploration of the flexibility aspect and how it relates to the decision to convert from term to whole life insurance.

Term life insurance is known for its simplicity and flexibility. This type of policy provides coverage for a specific period, often 10, 20, or 30 years. During this term, the policyholder pays a fixed premium, and in return, the insurance company promises to pay a death benefit to the policy's beneficiaries if the insured person passes away within that term. The beauty of term insurance lies in its adjustability. Policyholders can easily modify their coverage as their needs change. For instance, if you start a family or experience a significant life event, you can opt for a longer term policy or increase the coverage amount without undergoing a lengthy medical examination, which is often required for whole life insurance. This flexibility is particularly valuable for those who want insurance coverage during specific life stages, such as when starting a family or during the early years of a career.

On the other hand, whole life insurance offers a different kind of flexibility and security. This permanent insurance policy provides coverage for the entire lifetime of the insured individual, hence the name. One of the key advantages of whole life insurance is the consistency it offers. Once the policy is in force, the death benefit remains the same, and the premiums are typically guaranteed for as long as the policyholder lives. This predictability is attractive to those seeking long-term financial security. With whole life, policyholders can rest assured that their loved ones will receive a predetermined amount upon their passing, providing a sense of stability and peace of mind.

The decision to convert from term to whole life insurance often stems from a desire for long-term financial planning and the need for consistent coverage. As individuals progress through life, their insurance needs may evolve. For example, a young professional might start with a 10-year term policy to cover their initial responsibilities. As they advance in their career and start a family, they may consider converting to whole life insurance to ensure that their loved ones are protected for the long term. This conversion allows for a more comprehensive financial strategy, especially when combined with other insurance and investment products.

In summary, the flexibility of term life insurance enables easy adjustments to meet changing needs, while whole life insurance provides the consistency of long-term benefits and financial security. Understanding these differences is essential for individuals to make informed decisions about their insurance coverage, ensuring they have the right protection at every stage of life.

Universal Life Insurance: Agent Commission and Your Policy

You may want to see also

Frequently asked questions

The decision to convert from term life insurance to whole life insurance depends on your personal financial goals and circumstances. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and it's often more affordable. When you reach the end of the term, you have the option to renew or convert to a permanent policy like whole life. If you've outlived your term and still need long-term coverage, converting to whole life can offer lifelong protection and potential cash value accumulation.

Whole life insurance provides permanent coverage, ensuring your beneficiaries receive a death benefit regardless of when you pass away. It also offers a guaranteed death benefit and an accumulation of cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. Additionally, whole life insurance is a long-term investment, and the premiums remain level for the entire policy term, providing stability and predictability in your insurance costs.

Converting to whole life insurance early can be a significant financial commitment. Whole life policies typically have higher premiums compared to term life, especially for younger and healthier individuals. If you're in the early stages of your life and have other financial priorities, it might be more beneficial to keep the term policy and reassess your needs later. Additionally, the cash value in whole life insurance grows at a guaranteed rate, but it may take time to accumulate a substantial amount, and the policy's value is tied to the performance of the insurance company's investment portfolio.