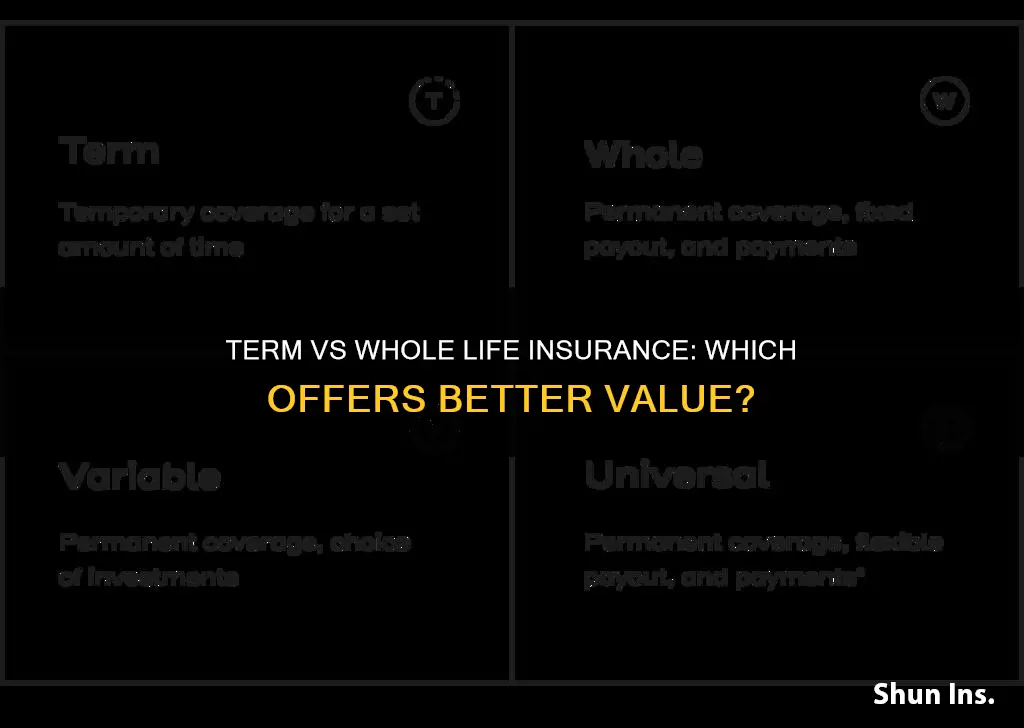

Life insurance is a crucial financial product that can protect your loved ones in the event of your death. When considering life insurance, you may wonder whether term or whole life insurance is the better option. Here's an introduction to the topic to help you understand the key differences and make an informed decision.

Term life insurance provides coverage for a specific period, usually between 10 and 30 years. It is more affordable than whole life insurance, as it does not offer lifelong coverage. If the policyholder passes away during the specified term, the beneficiaries will receive a payout. Term life insurance is ideal for those who want coverage for a particular period, such as the duration of their mortgage or until their children become financially independent.

On the other hand, whole life insurance, as the name suggests, provides coverage for the policyholder's entire life. It tends to be significantly more expensive than term life insurance due to its lifelong coverage and additional features. Whole life insurance includes a cash value component, allowing the policy to function as an investment that grows tax-free over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. However, if the policyholder passes away with an outstanding loan against the cash value, the death benefit will be reduced accordingly.

In summary, term life insurance is best suited for those seeking affordable coverage for a specific period, while whole life insurance offers lifelong protection and additional benefits such as the ability to build cash value. The choice between term and whole life insurance depends on individual needs, budget, and financial goals.

| Characteristics | Values |

|---|---|

| Cost | Term life insurance is cheaper than whole life insurance |

| Coverage length | Term life insurance covers a set period, e.g. 10, 20 or 30 years |

| Whole life insurance covers the policyholder's entire life | |

| Cash value | Term life insurance has no cash value |

| Whole life insurance accumulates cash value over time | |

| Complexity | Term life insurance is simpler and easier to understand |

| Whole life insurance is more complex | |

| Flexibility | Term life insurance is more flexible as the policyholder chooses the coverage length |

What You'll Learn

Term life insurance is cheaper but only covers a set period

Term life insurance is a more affordable option than whole life insurance, but it only covers you for a set number of years, typically between 10 and 30. This type of insurance is ideal for those who want coverage for a specific period, such as the duration of their mortgage or until their children become financially independent. It is also a good choice for those who want to keep premiums low. However, if you outlive the term, your coverage will end, and you will not receive any benefits.

Term life insurance is straightforward and easy to understand. It offers a guaranteed death benefit if the insured person dies during the specified term. The premiums for term life insurance are generally fixed and remain level throughout the policy term. This means that you will pay the same amount each month, making it easier to budget. Additionally, term life insurance does not accumulate cash value, so there is no investment or savings component. This means that you cannot borrow or withdraw money from the policy.

When deciding between term and whole life insurance, it is important to consider your financial goals, budget, and coverage needs. Term life insurance may be a good choice if you only need coverage for a specific period or if you want to keep costs low. However, if you are looking for lifelong coverage and the ability to build cash value, whole life insurance may be a better option. Ultimately, the decision between term and whole life insurance depends on your individual needs and circumstances.

Life Insurance at 61: A Wise Investment?

You may want to see also

Whole life insurance is more expensive but lasts your whole life

Whole life insurance is a form of permanent life insurance that covers you for your entire life. It is more expensive than term life insurance but offers fixed premiums and a fixed rate of cash value growth. Whole life insurance can be a good option if you want lifelong coverage, to build cash value that you can access while still living, or to ensure your final expenses are covered regardless of when you die.

Whole life insurance policies have fixed premiums, which means your premium payments won't change. The premiums are typically much higher than those of term life insurance because whole life insurance offers lifetime coverage and includes a cash value component. The cash value of a whole life insurance policy grows at a guaranteed rate and can be accessed through a withdrawal or loan. This makes whole life insurance a flexible financial tool, but it is important to note that any outstanding loans or withdrawals will reduce the death benefit paid out to your beneficiaries.

Whole life insurance is a good option for those who want lifelong coverage and the ability to build cash value. It is also a good choice for those who want to ensure their final expenses, such as funeral costs, are covered. However, it is important to consider the higher cost of whole life insurance compared to term life insurance. Term life insurance offers temporary coverage at a lower cost, making it a more affordable option for those who only need coverage for a specific period or debt.

Understanding Life Insurance and Annuity with a 1035 Exchange

You may want to see also

Whole life insurance has a cash value component

The cash value of whole life insurance policies grows tax-free, providing a savings component that is not available with term life insurance. This makes whole life insurance a useful tool for retirement planning and can provide a source of funds for future needs. The ability to borrow against or withdraw from the cash value of a whole life insurance policy makes it a flexible financial tool.

However, it is important to note that if the policyholder borrows against the cash value and does not repay the loan before their death, the death benefit paid out to the beneficiaries will be reduced by the outstanding loan amount. Additionally, whole life insurance policies are significantly more expensive than term life insurance policies due to the added investment component. The high cost of whole life insurance can make it challenging for some individuals to keep up with payments.

In summary, while whole life insurance offers the advantage of a cash value component that can be accessed during the policyholder's lifetime, it also comes with higher costs and complexity when compared to term life insurance.

AARP Life Insurance: Can It Be Cancelled?

You may want to see also

Term life insurance is simple and straightforward

Term life insurance is often the best choice for parents with young children and a mortgage, as their family may be dependent on their income to meet basic expenses. It is also a good option for those who want flexible coverage. You can choose the length of your term based on your unique situation, possibly reducing costs in the long run. For example, you can choose a term that will see you through until your kids are heading off to college and living on their own.

Term life insurance is also simple because it is typically much cheaper than whole life insurance. This is because term life insurance is temporary and does not build cash value. Whole life insurance, on the other hand, is permanent and includes a cash value component that grows over time. This makes whole life insurance more complex and expensive. With whole life insurance, you are paying for lifetime coverage and the opportunity to build cash value.

Term life insurance is also straightforward when it comes to premiums. The premiums for term life insurance are usually level throughout the term and much lower than those for whole life insurance. The premiums for whole life insurance, on the other hand, are typically locked in for life and can be very high.

In summary, term life insurance is simple and straightforward because it serves one purpose (providing a death benefit during the term of the policy), is typically cheaper than whole life insurance, and has level premiums that are much lower than those for whole life insurance.

When Can Life Insurance Policies Be Restricted?

You may want to see also

Whole life insurance is overly complicated

Whole life insurance is a type of permanent life insurance that lasts as long as you live and is generally active through age 95 or 102. It is often expensive, but offers fixed premiums and a fixed rate of cash value growth. The policyholder can take money from the available cash value through a withdrawal or loan, or they could surrender the policy and walk away with the cash value (minus any surrender charge). Whole life insurance is a hybrid of insurance and investment, and the cash value grows in a tax-protected manner.

Whole life insurance is complicated because it has a cash value component, which is where things can get complex. The policies earn interest in a tax-advantaged account and offer guaranteed returns, but they’re expensive and not suitable for most people.

Whole life insurance is also complicated because it has many different ways it can be set up. For example, you can pay a monthly or annual premium for either a defined period of time, or until you die. The longer the period of time over which you pay the premiums, the lower the premiums.

Whole life insurance is also complicated because of the many myths surrounding it. For example, some people believe that whole life insurance is a great investment return, but this is not true. When you pay your whole life premiums, part of the money goes toward buying insurance, part of it goes toward overhead and profit for the insurance company, and part of it goes toward the commission for the salesman. The rest then goes into the cash value portion of the policy.

Becoming an Independent Life Insurance Agent: Is It Possible?

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a set term or specific amount of time, usually between 10 and 30 years. Whole life insurance, on the other hand, provides coverage for your entire life.

Term life insurance is generally the cheaper option as it only covers you for a set number of years and does not build cash value.

Yes, but only if you have whole life insurance. Whole life insurance has a cash value component that you can borrow against or withdraw from.

If you outlive your term life insurance policy, the coverage will end and you will not receive any benefits. You may be able to renew the policy, but the rates will be much higher.

When choosing between term and whole life insurance, you should consider your budget, whether you want permanent or temporary coverage, and whether you want a savings component included in your policy. You should also consider your coverage needs and whether you want to build cash value.