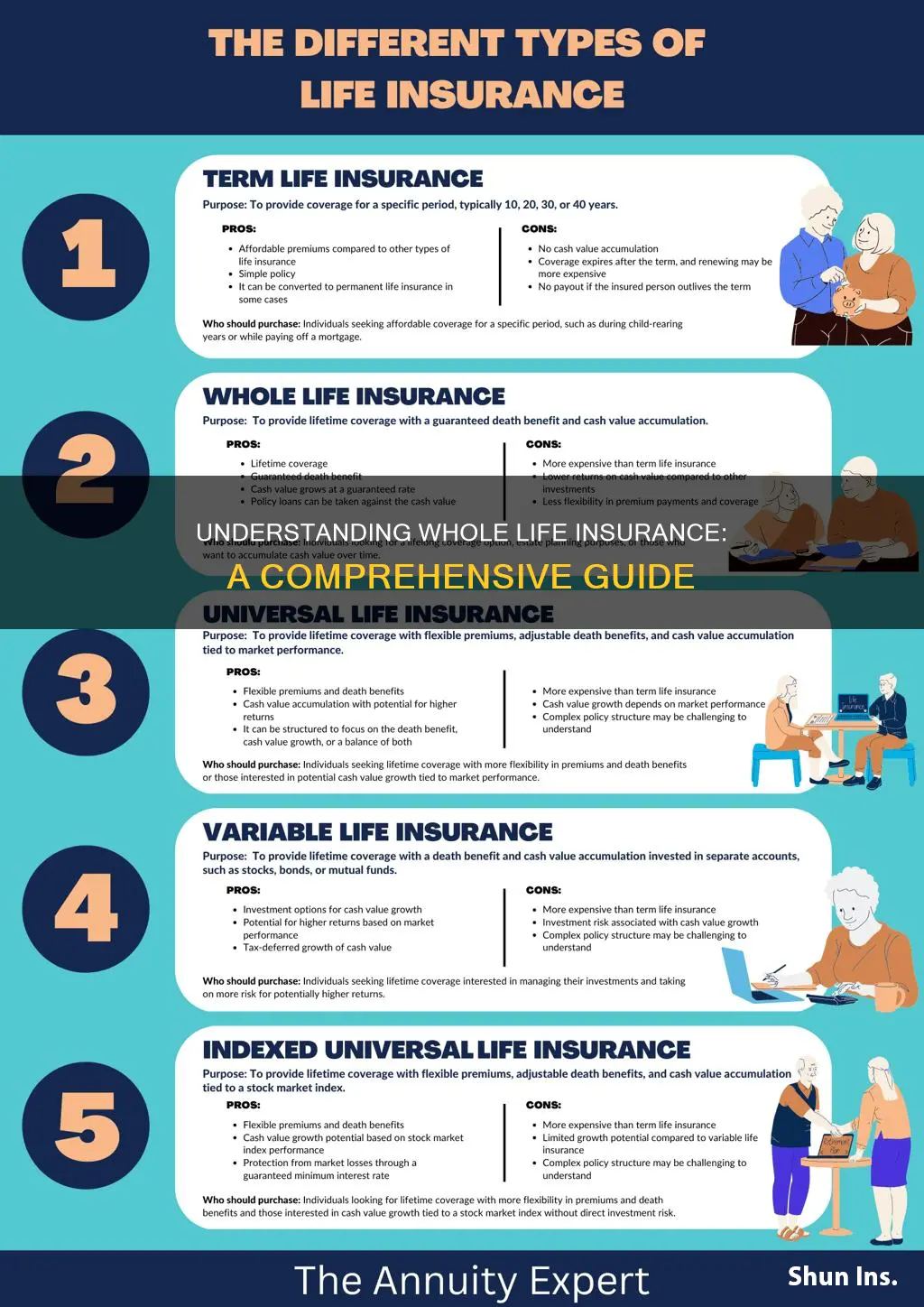

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specified period, whole life insurance offers lifelong protection. It combines a death benefit with a savings component, allowing policyholders to build cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. Whole life insurance is an attractive option for those seeking long-term financial security and a guaranteed death benefit, making it a popular choice for individuals looking to protect their loved ones and build a financial asset.

What You'll Learn

- Definition: Whole life insurance is a permanent policy with a guaranteed death benefit and an investment component

- Premiums: Premiums are fixed and remain the same throughout the policyholder's lifetime

- Cash Value: The policy builds cash value, which can be borrowed against or withdrawn

- Death Benefit: Provides a tax-free death benefit to beneficiaries upon the insured's passing

- Longevity: Whole life ensures financial security for the entire life of the insured

Definition: Whole life insurance is a permanent policy with a guaranteed death benefit and an investment component

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It is a long-term financial commitment that offers a range of benefits and features. One of the key aspects of whole life insurance is its guaranteed death benefit, which means that the insurance company promises to pay out a specific amount to the policyholder's beneficiaries upon the insured's death. This guarantee provides financial security and peace of mind, knowing that there will be a financial safety net for loved ones in the event of the insured's passing.

In addition to the death benefit, whole life insurance also includes an investment component. This means that a portion of the premium paid by the policyholder is allocated to an investment account. The investment aspect allows the policy to accumulate cash value over time, which can be used for various purposes. Policyholders can access this cash value through policy loans or withdrawals, providing flexibility and potential financial benefits. The investment component is designed to grow the policy's value, and it can be a valuable tool for long-term financial planning.

The investment part of whole life insurance is typically managed by the insurance company, who invests the funds in a diversified portfolio of assets. This investment strategy aims to generate returns that can outpace the policy's expenses and provide a growing cash value. As the policyholder, you have the option to increase or decrease the amount contributed to the investment component, allowing for customization based on your financial goals and risk tolerance.

Whole life insurance is considered a permanent policy, meaning it remains in force for the insured's entire life, provided premiums are paid. Unlike term life insurance, which has a specific period of coverage, whole life insurance offers lifelong protection. This permanence ensures that the death benefit is always available, providing a consistent level of financial security. Additionally, the cash value accumulation can be a valuable asset that can be borrowed against or withdrawn, offering financial flexibility during the policyholder's lifetime.

In summary, whole life insurance is a comprehensive financial product that combines insurance coverage with an investment opportunity. Its guaranteed death benefit ensures financial protection for beneficiaries, while the investment component allows for potential growth and flexibility. Understanding the features and benefits of whole life insurance is essential for individuals seeking long-term financial security and a permanent solution to their insurance needs.

Chronic Alcoholics: Life Insurance Eligibility and Options

You may want to see also

Premiums: Premiums are fixed and remain the same throughout the policyholder's lifetime

Whole life insurance, often referred to as permanent life insurance, is a type of long-term insurance policy that provides coverage for the entire lifetime of the insured individual. One of the key features that sets whole life insurance apart from other types of life insurance is its guaranteed premium structure.

When you purchase a whole life insurance policy, you agree to pay a fixed premium amount at regular intervals, typically monthly, annually, or as part of a lump sum payment. This premium rate is determined based on various factors, including your age, health, lifestyle, and the amount of coverage you choose. Importantly, once the initial premium is set, it remains constant throughout the entire duration of the policy. This means that regardless of changes in your age, health, or other circumstances, the premium you pay will not increase.

The fixed nature of the premiums in whole life insurance is a significant advantage for policyholders. It provides financial planning stability, as individuals can budget and plan their expenses knowing that their insurance costs will not fluctuate. This predictability is particularly beneficial for long-term financial planning, as it allows individuals to allocate funds more effectively and make informed decisions about their insurance needs.

Furthermore, the fixed premiums in whole life insurance ensure that the policyholder's loved ones will receive the promised death benefit at the agreed-upon amount, regardless of future changes in the insurance market or the insured's health. This guarantee provides a sense of security and peace of mind, knowing that the insurance coverage will remain intact for the policy's entire term.

In summary, the fixed and unchanging nature of premiums in whole life insurance offers policyholders financial stability and predictability. This feature, combined with the lifelong coverage, makes whole life insurance an attractive option for those seeking long-term financial security and a reliable insurance solution.

Term Life Insurance: Understanding the Contractual Basics

You may want to see also

Cash Value: The policy builds cash value, which can be borrowed against or withdrawn

Whole life insurance is a type of permanent life insurance that offers a range of unique features, one of which is the accumulation of cash value. This is a significant benefit that sets whole life insurance apart from other life insurance policies.

When you purchase a whole life insurance policy, a portion of your premium payments goes towards building a cash reserve. This reserve grows over time, earning interest, and can be considered an investment within the insurance policy. The cash value is essentially the policy's investment account, where a portion of your premiums is invested to create a financial asset. This feature allows the policy to grow in value, providing a financial safety net for the policyholder.

One of the key advantages of this cash value accumulation is the ability to borrow against it. Policyholders can take out loans against the cash value, allowing them to access funds without selling the policy or disrupting their coverage. These loans are typically interest-free, making them an attractive option for those who need immediate financial resources. For example, if a policyholder needs to cover unexpected expenses or invest in a business opportunity, they can borrow against the cash value, providing a flexible financial tool.

Additionally, the cash value can be withdrawn as needed. Policyholders have the option to take out the accumulated cash value in a lump sum, providing a significant financial benefit. This feature is particularly useful for those who may need to access funds for various purposes, such as retirement planning, education expenses, or other financial goals. Withdrawals can be made without affecting the death benefit or the overall policy structure.

The ability to borrow against and withdraw cash value provides policyholders with financial flexibility and control. It allows individuals to utilize the policy's investment component for their financial needs while still maintaining the death benefit, which is a crucial aspect of life insurance. This feature is especially valuable for long-term financial planning and can contribute to a more secure financial future.

Understanding Voluntary Employee Life and AD&D Insurance Benefits

You may want to see also

Death Benefit: Provides a tax-free death benefit to beneficiaries upon the insured's passing

Whole life insurance is a type of permanent life insurance that offers a guaranteed death benefit to the policyholder's beneficiaries when the insured individual passes away. This death benefit is a fixed amount that is paid out tax-free to the designated recipients, providing financial security and peace of mind for the family or beneficiaries. The primary purpose of whole life insurance is to ensure that loved ones are financially protected in the event of the insured's death, covering expenses such as funeral costs, mortgage payments, or any other financial obligations that may arise.

Upon purchasing a whole life insurance policy, the insurance company agrees to pay out the death benefit to the beneficiaries when the insured individual dies. This benefit is typically tax-free, meaning the recipients receive the full amount without any deductions or taxes imposed by the government. The tax-free nature of the death benefit is a significant advantage, ensuring that the entire amount goes directly to the intended recipients.

One of the key advantages of whole life insurance is the guaranteed death benefit. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers coverage for the entire lifetime of the insured individual. This means that as long as the premiums are paid, the death benefit will be paid out when the insured passes away, providing long-term financial security. The insured can choose the amount of the death benefit, ensuring that it aligns with their specific financial needs and goals.

The death benefit in whole life insurance is often used to cover various expenses and financial responsibilities. For example, it can help pay for college tuition for children, provide a financial cushion for a spouse or partner, or ensure that mortgage payments are covered if the primary income earner passes away. By having a guaranteed death benefit, individuals can have confidence that their loved ones will be taken care of, even in the face of unexpected circumstances.

In summary, the death benefit in whole life insurance is a critical component that ensures financial protection for beneficiaries. It provides a tax-free payout upon the insured's passing, offering peace of mind and financial security to the family. With the guaranteed death benefit, individuals can leave a lasting legacy and ensure that their loved ones are provided for, even when they are no longer present. This aspect of whole life insurance makes it an attractive and valuable financial tool for long-term planning.

Life Insurance Value: Does Term Insurance Decrease Over Time?

You may want to see also

Longevity: Whole life ensures financial security for the entire life of the insured

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It is a long-term financial commitment that offers a range of benefits, particularly in terms of longevity and financial security. This type of insurance is designed to provide a sense of reassurance and peace of mind, knowing that your loved ones will be financially protected, no matter how long they live.

One of the key advantages of whole life insurance is its guaranteed death benefit. When you purchase a whole life policy, you are essentially locking in a death benefit that will be paid out to your designated beneficiaries upon your passing. This benefit is guaranteed and will not be affected by changes in your health or age, providing a stable and secure financial foundation for your family. The death benefit can be used to cover various expenses, such as mortgage payments, children's education, or any other financial obligations that your loved ones may have.

In addition to the death benefit, whole life insurance also accumulates cash value over time. This cash value grows tax-deferred and can be borrowed against or withdrawn, providing a source of funds that can be used for various purposes. For example, you can take out a loan against the policy to access the cash value, which can be useful for major purchases or investments. The cash value also ensures that your policy will continue to provide coverage even if you decide to reduce the death benefit or make other changes to the policy.

The longevity aspect of whole life insurance is a significant benefit. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers coverage for life. This means that as long as the premiums are paid, the policy will remain in force, providing financial security for your beneficiaries indefinitely. This is particularly important for those who want to ensure that their loved ones are protected throughout their entire lives, especially if they have long-term financial obligations or dependants who rely on their income.

Furthermore, whole life insurance can be a valuable investment tool. The cash value accumulation can be used to build wealth over time, providing a potential source of funds for retirement or other financial goals. With proper investment management, the policyholder can benefit from the power of compounding, allowing their money to grow exponentially. This aspect of whole life insurance makes it an attractive option for those seeking both financial security and long-term wealth accumulation.

In summary, whole life insurance is a comprehensive financial tool that ensures longevity and financial security for the insured. Its guaranteed death benefit, cash value accumulation, and long-term coverage make it an excellent choice for individuals who want to provide for their loved ones and build wealth simultaneously. By understanding the benefits of whole life insurance, you can make an informed decision about your long-term financial planning and ensure a secure future for your family.

Life Insurance for Canadians in Ireland: Is It Possible?

You may want to see also

Frequently asked questions

Whole life insurance, also known as permanent life insurance, is a type of long-term insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a combination of insurance protection and an investment component, ensuring a guaranteed death benefit and a fixed premium.

When you purchase a whole life insurance policy, you agree to pay a fixed premium to the insurance company for the rest of your life. In return, the insurer promises to pay out a death benefit to your designated beneficiaries when you pass away. The policy also includes an accumulation of cash value, which grows tax-deferred and can be borrowed against or withdrawn.

This type of insurance offers several advantages. Firstly, it provides lifelong coverage, ensuring that your loved ones are financially protected even if you're no longer around. Secondly, the cash value component allows you to build a substantial savings over time, which can be used for various purposes, such as funding education, starting a business, or supplementing retirement income. Additionally, whole life insurance offers a fixed premium, providing long-term financial stability.

Whole life insurance is suitable for individuals seeking long-term financial security and a combination of insurance and investment benefits. It is often preferred by those who want a guaranteed death benefit and a consistent savings plan. Young and healthy individuals may find it more affordable and beneficial as they can build substantial cash value over their working years. However, it can be valuable for anyone looking for permanent coverage and a reliable savings strategy.