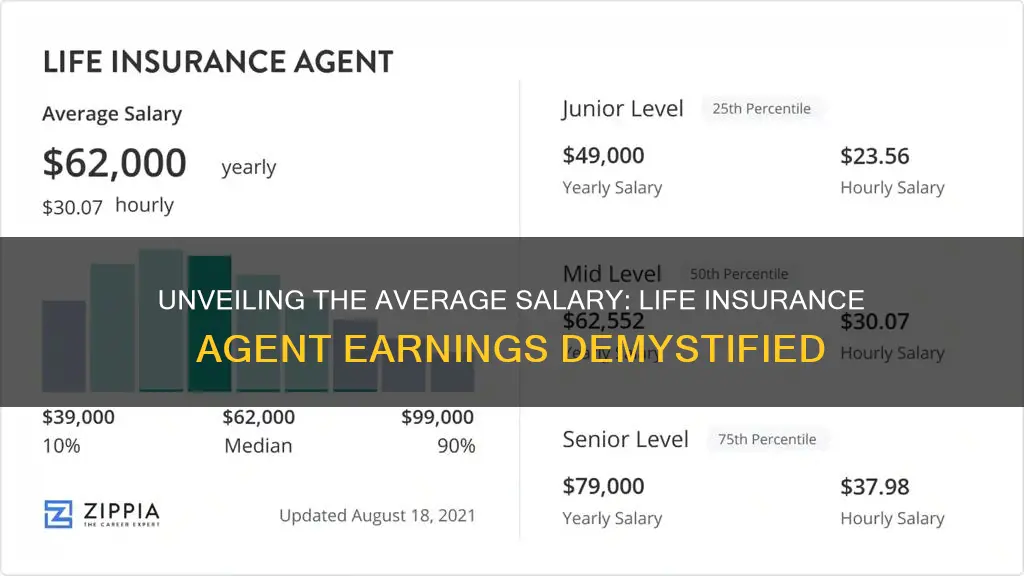

The average salary of a life insurance agent can vary significantly depending on several factors, including experience, location, and the specific company they work for. On average, life insurance agents earn a base salary plus commissions, with the potential for earnings to range from $40,000 to over $100,000 annually. Factors such as the number of policies sold, the types of products offered, and the agent's ability to build and maintain a strong client base can all influence their income. Additionally, some agents may also receive bonuses and incentives based on their performance and the success of their team. Understanding these variables is crucial for anyone considering a career in life insurance sales.

What You'll Learn

- Compensation Structure: Average salary varies based on commission, bonuses, and sales targets

- Experience and Region: Income is influenced by experience, location, and market demand

- Performance Metrics: Sales performance, customer satisfaction, and policy renewals impact earnings

- Company Policies: Benefits, incentives, and training programs affect agent compensation

- Industry Trends: Salary trends, market competition, and technological advancements shape agent earnings

Compensation Structure: Average salary varies based on commission, bonuses, and sales targets

The compensation structure for life insurance agents is primarily based on a commission-driven model, which means their earnings are directly tied to their sales performance. This structure is common in the insurance industry and can vary significantly depending on the company, region, and individual agent's performance. Here's a detailed breakdown of how this compensation system works and how it influences the average salary of a life insurance agent.

Commission Structure: Life insurance agents typically earn a commission on each policy they sell. The commission rate can vary widely, ranging from 1% to 5% or more of the policy's annual premium. For instance, if an agent sells a $10,000 life insurance policy with a 3% commission rate, their earnings from that sale would be $300 per year. This commission is usually paid monthly or quarterly, and it can vary based on the type of policy sold (term life, whole life, universal life, etc.).

Bonuses and Incentives: In addition to commissions, life insurance companies often provide bonuses and incentives to motivate agents. These bonuses can be based on various factors, such as the number of policies sold, the total premium volume, meeting sales targets, or achieving specific performance milestones. For example, an agent might receive a bonus of $500 for each new policyholder they bring in during a quarter, or a percentage bonus on their total sales for the year. These incentives can significantly boost an agent's income and are a crucial part of the compensation structure.

Sales Targets and Performance: The average salary of a life insurance agent is heavily influenced by their ability to meet sales targets and perform consistently. High-performing agents who consistently exceed their sales targets can earn significantly more than those who struggle to meet their goals. Sales targets are often set by the insurance company and can vary based on the agent's experience, the region they operate in, and the company's overall sales goals. Agents who consistently meet or exceed these targets may also be eligible for additional benefits, such as performance-based bonuses, commissions on their team's sales, or even profit-sharing in some cases.

Experience and Specialization: Experience plays a vital role in determining the average salary of a life insurance agent. More experienced agents often have a higher earning potential due to their established client base and industry knowledge. Additionally, specialization in certain areas, such as senior life insurance, disability insurance, or mortgage protection, can also impact earnings. Specialized agents may command higher commission rates and bonuses due to their expertise in specific product areas.

In summary, the average salary of a life insurance agent is not a fixed number but rather a dynamic figure that fluctuates based on various factors. These factors include commission rates, bonuses, sales targets, performance, experience, and specialization. Understanding this compensation structure is essential for both agents and prospective clients, as it provides insight into the potential earnings and the performance expectations associated with this profession.

Unlocking Globe Life Insurance: Age Limits Revealed

You may want to see also

Experience and Region: Income is influenced by experience, location, and market demand

The income of a life insurance agent can vary significantly based on several factors, primarily their level of experience, the region in which they operate, and the overall market demand for insurance products. These elements collectively shape the earning potential of these professionals.

Experience: Life insurance agents with extensive experience often command higher salaries. This is because their expertise allows them to navigate complex sales, provide valuable advice to clients, and build a strong reputation. Senior agents who have been in the industry for a decade or more typically earn more due to their proven track record and ability to attract and retain a loyal customer base. Newer agents, while passionate and eager, might start with lower base salaries as they focus on building their client portfolio and industry knowledge.

Region: The geographical location plays a pivotal role in determining the average salary of a life insurance agent. Agents in metropolitan areas, especially those in high-cost-of-living cities, often earn more due to the higher cost of living and the increased demand for insurance services. In contrast, agents in rural or less populated regions might have a smaller client base and lower competition, which can result in lower earnings. Additionally, regional economic factors, such as employment rates and income levels, can influence the demand for insurance products, thereby affecting the income of agents.

Market Demand: The overall market demand for life insurance products directly impacts the income of agents. During periods of economic uncertainty or when there is a heightened awareness of life's fragility, the demand for insurance products tends to increase. This surge in demand can lead to higher commissions and bonuses for agents, as they capitalize on the heightened interest from potential clients. Conversely, in a booming economy, when people may feel more secure, the demand for insurance might decrease, potentially affecting the income of agents.

In summary, the income of a life insurance agent is a multifaceted issue, influenced by their experience, the region they operate in, and the prevailing market conditions. Understanding these factors can provide valuable insights into the earning potential of life insurance agents and help them make informed decisions about their career paths and business strategies.

Canceling Pru Life Insurance: A Step-by-Step Guide

You may want to see also

Performance Metrics: Sales performance, customer satisfaction, and policy renewals impact earnings

The average salary of a life insurance agent can vary significantly depending on several factors, including experience, location, and the company they work for. However, according to various sources, the average annual income for a life insurance agent in the United States is around $45,000 to $60,000. This figure includes both base pay and commissions earned from sales.

Performance metrics are crucial in the life insurance industry as they directly impact an agent's earnings. Here's a breakdown of how these metrics influence income:

Sales Performance: Life insurance agents primarily earn through commissions, which are a percentage of the premiums collected from policyholders. High sales performance is a key indicator of an agent's success. Top-performing agents often have a strong understanding of their target market and can effectively promote various insurance products. They may offer a range of life insurance policies, including term life, whole life, and universal life insurance. The more policies an agent sells, the higher their earnings potential. For instance, achieving monthly sales targets or exceeding them can lead to performance bonuses, which significantly boost income.

Customer Satisfaction: Building and maintaining positive relationships with clients is essential for life insurance agents. High customer satisfaction scores can lead to increased policy renewals and referrals, both of which contribute to higher earnings. Satisfied customers are more likely to continue their insurance coverage, ensuring a steady income stream for the agent. Additionally, positive reviews and testimonials can enhance an agent's reputation, attracting more clients and potentially increasing sales.

Policy Renewals: The renewal rate of insurance policies is a critical performance metric. When a policy is due for renewal, the agent has the opportunity to upsell or cross-sell additional products. Renewals are often more profitable than new sales because they typically involve higher commission rates. For example, if an agent can secure a high renewal rate for term life insurance policies, it will positively impact their earnings. Moreover, successful policy renewals can lead to long-term client relationships, providing a stable income over time.

In summary, the average salary of a life insurance agent is influenced by various performance metrics. Sales performance, customer satisfaction, and policy renewals are key factors that determine an agent's earning potential. By focusing on these areas, agents can increase their income and build a successful career in the life insurance industry. It is essential for agents to continuously improve their skills and strategies to meet the evolving needs of their clients and stay competitive in the market.

Veterans' Life Insurance: Cashing in on Policies

You may want to see also

Company Policies: Benefits, incentives, and training programs affect agent compensation

When considering a career in life insurance, it's important to understand the various factors that influence an agent's compensation, which can significantly impact their earnings. Company policies play a crucial role in determining the financial rewards and support provided to agents. Here's an overview of how benefits, incentives, and training programs can affect an agent's salary and overall success in this profession.

Benefits and Compensation Packages: Life insurance companies often offer comprehensive benefits packages to attract and retain top talent. These packages typically include health insurance, retirement plans, and paid time off. While these benefits are essential for an agent's well-being, they also contribute to the overall cost of employment. Agents should carefully review the company's benefits structure to ensure it aligns with their needs and expectations. Additionally, the base salary offered by the company can vary widely, with some companies providing a fixed salary, while others operate on a commission-based model. Understanding the compensation structure is key to assessing the potential earning capacity.

Incentives and Performance Bonuses: Many life insurance companies implement incentive programs to motivate agents and drive sales. These incentives can take various forms, such as performance-based bonuses, production-based rewards, or even non-monetary incentives like gift cards or company merchandise. For instance, an agent might receive a bonus for achieving a certain number of new policy sales within a defined period. These incentives can significantly boost an agent's income, especially for high-performing individuals. However, it's important to note that the structure and availability of incentives may vary between companies, and some may offer more lucrative incentives than others.

Training and Professional Development: Comprehensive training programs are vital for life insurance agents to succeed in their roles. Companies often provide initial training to educate agents about products, sales techniques, and regulatory compliance. This training can be a significant investment for the company, and they may offer ongoing support and professional development opportunities. Agents who actively participate in training programs and continuously enhance their skills can improve their performance and, consequently, their earnings potential. Moreover, companies that invest in their agents' growth are more likely to foster a loyal and dedicated workforce.

The average salary of a life insurance agent can vary depending on the company, location, and individual performance. While some agents may earn a modest income, others can achieve substantial success through high sales volumes and effective utilization of company incentives. Company policies, including benefits, incentives, and training programs, significantly influence an agent's earning potential and overall job satisfaction. Prospective agents should research and compare different companies to find the best fit, considering both the financial rewards and the support provided by the employer.

Life Insurance Proceeds: Tax-Free to Living Trust?

You may want to see also

Industry Trends: Salary trends, market competition, and technological advancements shape agent earnings

The life insurance industry is experiencing a dynamic shift, and understanding the trends that influence the earnings of life insurance agents is crucial for those looking to enter or advance in this field. Here's an overview of how salary trends, market competition, and technological advancements are impacting the profession:

Salary Trends: The average salary of a life insurance agent can vary significantly based on several factors. Traditionally, commissions have been the primary source of income for these agents, with earnings depending on the number of policies sold. However, recent trends indicate a shift towards a more structured compensation model. Many companies are now offering base salaries, performance bonuses, and incentives, which provide a more stable income stream for agents. This change is particularly beneficial for new agents who are still building their client base, as it ensures a minimum income during the initial stages of their career. On average, life insurance agents can expect to earn between $40,000 and $80,000 annually, but this figure can go up for those in higher-tier roles or with a large client portfolio.

Market Competition: The life insurance market is highly competitive, with numerous companies vying for customers' attention. This competition has led to a more customer-centric approach, where agents are encouraged to provide personalized solutions and build long-term relationships. As a result, agents with a strong focus on customer satisfaction and loyalty tend to thrive in this environment. Market competition also drives agents to continuously enhance their skills and knowledge, ensuring they stay ahead of the curve. In highly competitive regions, agents might need to adapt their strategies and offer unique value propositions to stand out and attract clients.

Technological Advancements: Technology has had a profound impact on the life insurance industry, and it continues to shape the way agents earn their income. Online platforms and digital tools have made it easier for agents to reach a wider audience and manage their client relationships efficiently. For instance, video conferencing and online appointment scheduling systems allow agents to conduct client meetings remotely, expanding their potential client base. Additionally, advanced analytics and data-driven insights enable agents to offer tailored products and services, increasing their chances of success. Technological advancements also streamline administrative tasks, reducing the time spent on paperwork and allowing agents to focus more on client engagement and development.

The life insurance industry is evolving, and agents who stay abreast of these trends will be better positioned for success. Salary structures are becoming more diverse, providing agents with opportunities to earn beyond traditional commission-based models. Market competition encourages a customer-first approach, and technological advancements empower agents with efficient tools to enhance their productivity and reach. As the industry continues to transform, agents who adapt to these changes will likely see a positive impact on their earnings and overall career trajectory.

How Life Insurance Sales Can Make You Rich

You may want to see also

Frequently asked questions

The average salary for a life insurance agent in the United States can vary depending on several factors, including experience, location, and the company they work for. On average, a life insurance agent can earn an annual salary ranging from $40,000 to $100,000 or more. Entry-level agents typically start with a base salary and earn a commission on the policies they sell. With experience and a strong client base, agents can increase their earnings significantly.

Life insurance agents' salaries can vary widely compared to other sales roles. While the average base salary might be lower than some high-commission sales jobs, life insurance agents often have the potential to earn more in commissions and bonuses. The earning potential is closely tied to the number of policies sold and the quality of the client relationships built over time.

Yes, apart from the base salary, life insurance agents often receive various benefits and incentives. These may include commissions on the premiums collected from the policies they sell, bonuses for achieving sales targets, and performance-based rewards. Additionally, many companies provide training and support to help agents develop their skills and expand their client base.

Increasing earning potential in this field often involves building a strong network of clients, developing comprehensive knowledge of insurance products, and providing exceptional customer service. Agents can also enhance their skills through continuous education and training. Expanding one's market reach by networking and utilizing digital tools can also lead to more opportunities and higher earnings.