Navigating life insurance options can be particularly challenging for individuals living with diabetes, as insurers often consider it a pre-existing condition. However, several companies offer specialized policies tailored to those with diabetes, ensuring comprehensive coverage despite health challenges. This guide will explore the best places to find life insurance for diabetics, including independent brokers, diabetes-focused insurance companies, and online platforms, providing valuable insights to help you secure the right policy for your needs.

What You'll Learn

- Online Platforms: Compare rates and policies from multiple insurers online

- Specialized Insurers: Find companies that offer diabetes-friendly coverage and rates

- Medical History: Be transparent about diabetes history for accurate quotes

- Type of Policy: Choose between term, whole life, or universal life

- Support Groups: Join diabetes communities for advice on finding suitable insurance

Online Platforms: Compare rates and policies from multiple insurers online

When considering life insurance with diabetes, it's crucial to explore online platforms that allow you to compare rates and policies from various insurers. These platforms provide a convenient way to gather information and make informed decisions about your coverage options. Here's a guide on how to navigate this process effectively:

Research and Compare Online: Start by utilizing online search engines to find reputable insurance comparison websites. These platforms often have partnerships with multiple insurance companies, allowing you to access a wide range of quotes and policies. Enter your specific requirements, including your age, health status (including diabetes management), and desired coverage amount. The website will then display a list of insurers who can provide suitable options. This initial comparison helps you understand the market and identify potential providers.

Evaluate In-Depth Policy Details: Once you've identified a few insurers, delve into the specifics of their policies. Online platforms typically offer detailed information about each insurer's offerings. Pay close attention to the terms and conditions, coverage benefits, and any exclusions related to diabetes. Look for policies that offer comprehensive coverage despite your medical condition. Compare the premiums, death benefits, and any additional perks or discounts provided by each insurer. This thorough comparison ensures you make an informed choice.

Request Quotes and Quotes Comparison: Many online platforms enable you to request quotes directly from insurers. Provide your personal and medical details accurately to receive customized quotes. Compare these quotes side by side, considering factors like monthly premiums, coverage duration, and any additional fees. Some platforms may also provide tools to calculate the total cost of insurance over time, helping you understand the long-term financial implications.

Read Customer Reviews: Online reviews can offer valuable insights into the experiences of other individuals with similar health conditions. Look for platforms that include customer testimonials or ratings. Reading about others' experiences can help you gauge the reliability and customer service of different insurers. Positive reviews indicating prompt claims processing and supportive policies can be indicative of a reliable insurer.

Contact Insurers Directly: If you have specific questions or concerns, don't hesitate to contact the insurers directly through their online contact forms or customer support. Ask about any additional requirements or medical assessments they may need. Inquire about the process of obtaining a policy with diabetes and any potential discounts or incentives. This direct communication can provide clarity and ensure you receive personalized assistance.

Primerica Life Insurance: Canceling Your Policy, Simplified

You may want to see also

Specialized Insurers: Find companies that offer diabetes-friendly coverage and rates

When searching for life insurance with diabetes, it's crucial to explore options provided by specialized insurers who understand the unique challenges and risks associated with this condition. These insurers offer tailored coverage and rates that can provide peace of mind and financial security for individuals living with diabetes. Here's a guide to help you navigate this process:

Research and Compare Specialized Insurers: Start by researching insurance companies that specialize in diabetes-related coverage. These insurers often have a deeper understanding of the condition and can offer more competitive rates. Look for companies that have experience in underwriting diabetes-related policies and have a track record of providing coverage to individuals with diabetes. Online searches, financial advisory websites, and health insurance comparison platforms can be excellent resources to find these specialized insurers.

Understand Diabetes-Friendly Coverage: Specialized insurers typically offer two main types of coverage for individuals with diabetes: standard life insurance and diabetes-specific policies. Standard life insurance rates may be higher for those with diabetes, but it provides basic coverage. Diabetes-specific policies, on the other hand, are designed to cater to the unique needs of individuals with diabetes. These policies often consider factors like blood sugar control, type of diabetes, and treatment history to determine rates and coverage terms. Understanding the differences between these options will help you make an informed decision.

Provide Accurate and Detailed Information: When applying for life insurance with a diabetes diagnosis, be transparent and provide accurate medical information. Insurers will review your medical history, including diabetes-related complications and treatments. Disclose all relevant details, such as blood sugar levels, diabetes management strategies, and any related health issues. This transparency ensures that the insurer can accurately assess your risk and provide appropriate coverage.

Consider Online Resources and Brokers: Online platforms and brokers specializing in diabetes-related insurance can be valuable resources. These platforms often have partnerships with various insurers and can provide quotes and comparisons tailored to individuals with diabetes. They may also offer guidance and support throughout the application process. Additionally, consider reaching out to diabetes support groups or online communities, as they can provide insights and recommendations based on personal experiences.

Review and Compare Quotes: Once you've gathered quotes from multiple specialized insurers, carefully review and compare them. Pay attention to coverage limits, premiums, and any exclusions or limitations. Consider your financial situation and long-term goals when making a decision. It's essential to find a balance between affordable rates and comprehensive coverage that meets your needs.

By exploring specialized insurers and their offerings, individuals with diabetes can find life insurance options that provide the necessary protection and peace of mind. Remember, early research and transparency in medical information are key to securing suitable coverage.

IRS Rule Change: Life Insurance Implications Explained

You may want to see also

Medical History: Be transparent about diabetes history for accurate quotes

When considering life insurance with diabetes, transparency about your medical history is crucial for obtaining accurate quotes and ensuring you receive the best coverage. Insurance companies need to understand the specific details of your diabetes management to assess your risk accurately and provide appropriate coverage options. Here's a guide on how to approach this process:

Provide Comprehensive Information: When researching and comparing life insurance providers, be thorough in sharing your medical history. Start by reviewing the application forms and questionnaires provided by different insurance companies. These documents often include sections specifically for diabetes-related details. Disclose the type of diabetes you have, the duration of your diagnosis, and any relevant medical history, such as previous complications or treatments. For instance, if you have had diabetes-related kidney issues or eye problems, mention these to ensure a comprehensive evaluation.

Understand Your Diabetes Management: Insurance companies will assess your diabetes management strategies. Be prepared to provide details about your daily routines, including medication or insulin usage, blood sugar monitoring frequency, and any dietary or exercise plans you follow. The more accurate and up-to-date this information is, the better the insurance provider can assess your risk profile. If you have a consistent and well-managed diabetes regimen, it may reflect positively on your insurance quote.

Seek Professional Advice: Consult your healthcare provider or endocrinologist to obtain a detailed medical report. They can provide insights into your diabetes management and any potential risks or complications. A professional medical opinion can support your application and ensure that the insurance company has a comprehensive understanding of your health. This step is especially important if you have recently been diagnosed or if your diabetes management has changed significantly.

Compare Quotes and Policies: Once you have gathered the necessary information, start comparing quotes from various insurance companies. Transparency about your diabetes history will allow for more accurate pricing. Some companies may offer specialized policies for individuals with diabetes, so be sure to explore these options. Review the terms and conditions of each policy to understand the coverage, exclusions, and any additional benefits provided.

Remember, being honest and transparent about your medical history, especially diabetes-related details, is essential for obtaining the right life insurance coverage. It ensures that you receive quotes that accurately reflect your risk profile and allows you to make informed decisions about your insurance options.

Term Life Insurance: A Comprehensive Guide for Singapore Residents

You may want to see also

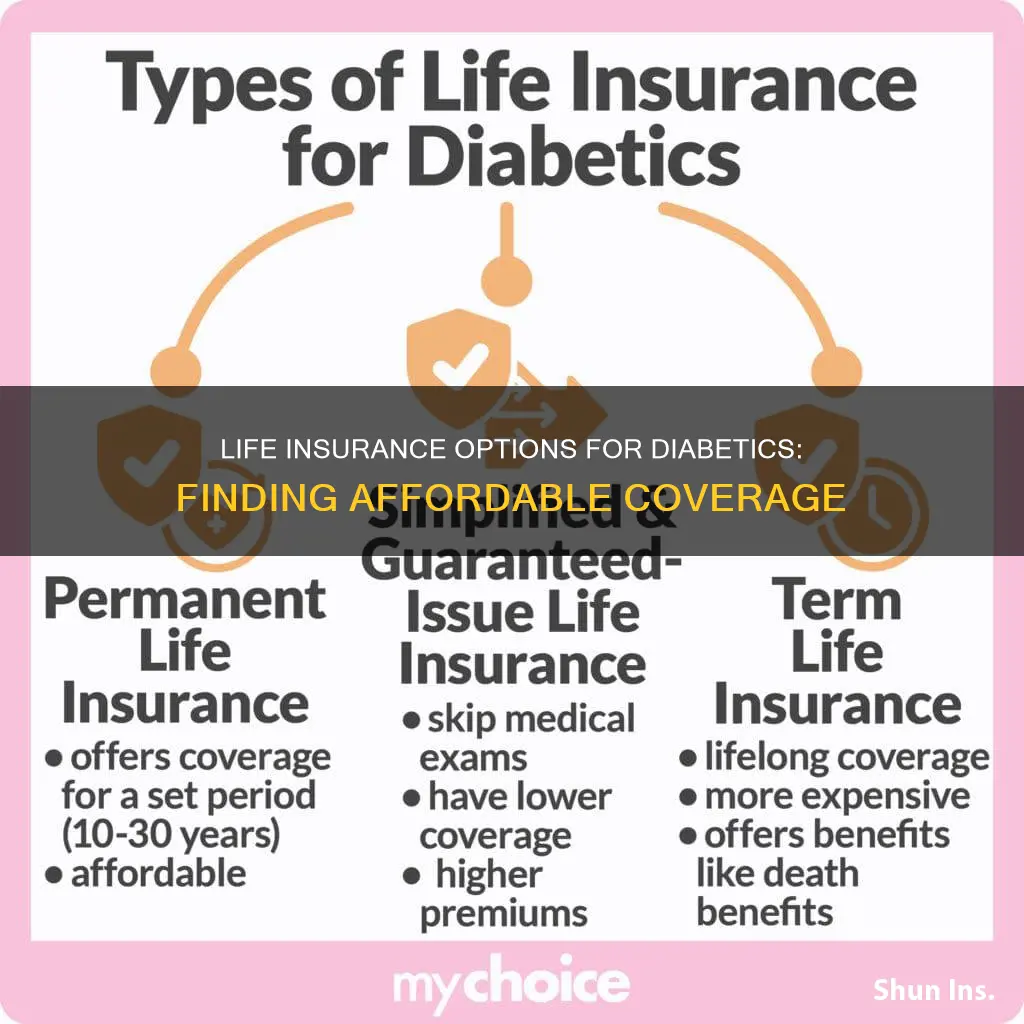

Type of Policy: Choose between term, whole life, or universal life

When considering life insurance with diabetes, it's important to understand the different types of policies available and how they can impact your coverage. Here's a breakdown of the options:

Term Life Insurance: This is a straightforward and cost-effective choice for individuals with diabetes. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. It offers a fixed death benefit if the insured person passes away during the term. For those with diabetes, term life insurance can be an excellent way to secure financial protection for your loved ones without the long-term commitment and higher costs associated with permanent policies. The key advantage is the simplicity and predictability of the premium payments, making it easier to budget for the future.

Whole Life Insurance: This type of policy offers lifelong coverage, providing a sense of security that term life insurance cannot. With whole life insurance, you pay a fixed premium throughout your life, and the death benefit is guaranteed. For individuals with diabetes, this can be a valuable option as it ensures that your beneficiaries will receive the intended financial support regardless of when you pass away. The premiums for whole life insurance are typically higher than term life, but they remain constant, and the policy builds cash value over time, which can be borrowed against or withdrawn. This type of policy is ideal for those seeking long-term financial protection and a sense of stability.

Universal Life Insurance: Universal life insurance offers flexibility and adaptability, making it a versatile choice for people with diabetes. It provides permanent coverage, similar to whole life, but with adjustable premiums and a death benefit that can increase or decrease based on market performance. One of the unique features is the ability to borrow against the cash value of the policy, providing financial flexibility. For individuals with diabetes, this policy can be tailored to their specific needs, allowing them to adjust the coverage and premiums as their health and financial situation evolve. Universal life insurance is a good option for those who want the security of permanent coverage but prefer the adaptability of variable premiums.

When deciding on a policy type, consider your financial goals, the level of coverage needed, and your long-term plans. Term life insurance is ideal for short-term needs, while whole life provides lifelong security. Universal life insurance offers flexibility and can be customized to fit various circumstances. It's recommended to consult with insurance advisors who specialize in diabetes-related coverage to find the best fit for your unique situation.

Building a Life Insurance Agency: Strategies for Success

You may want to see also

Support Groups: Join diabetes communities for advice on finding suitable insurance

When navigating the complex world of life insurance with diabetes, support groups and online communities can be invaluable resources. These platforms provide a space for individuals with diabetes to connect, share experiences, and offer advice on finding suitable insurance coverage. Here's how joining these communities can help:

Understanding Insurance Options: Diabetes communities often have members who have successfully navigated the insurance process. They can provide insights into different insurance providers and policies tailored to those with diabetes. These members can share their research, recommendations, and personal experiences, helping you understand the various options available. For instance, they might discuss the benefits of term life insurance for long-term coverage or permanent life insurance for lifelong protection, considering your diabetes management and health status.

Gaining Confidence in Negotiations: Support groups can empower you to negotiate with insurance companies. Members can share tips on how to present your health information effectively, negotiate premiums, and advocate for your needs. This collective knowledge can boost your confidence when communicating with insurance providers, ensuring you get a fair deal.

Accessing Personalized Advice: Online diabetes communities often cater to specific types of diabetes, such as type 1 or type 2. These specialized groups can offer tailored advice based on your condition. For example, members with type 1 diabetes can provide insights into managing insurance challenges unique to their condition, while those with type 2 diabetes can share their experiences with finding affordable coverage. This personalized guidance can be instrumental in making informed decisions.

Staying Informed and Updated: Support groups are dynamic spaces where members regularly share the latest news, updates, and changes in insurance policies. They can alert you to new offers, discounts, or policy changes that might benefit individuals with diabetes. By staying connected, you can ensure that your insurance coverage remains relevant and suitable as your health and circumstances evolve.

Emotional Support and Motivation: Beyond practical advice, support groups provide emotional support and motivation. Members can offer encouragement and empathy, helping you stay motivated during the insurance application process. This sense of community can make the journey less daunting and more rewarding.

Engaging with diabetes communities can significantly impact your ability to find the right life insurance coverage. These groups offer a wealth of knowledge, support, and shared experiences that can guide you through the process, ensuring you make informed decisions about your future.

Child Term Life Insurance: What Parents Need to Know

You may want to see also

Frequently asked questions

Yes, having diabetes does not automatically disqualify you from getting life insurance. Many insurance companies offer policies specifically designed for individuals with pre-existing conditions, including diabetes. The key factor is managing your diabetes effectively and maintaining stable health metrics.

Diabetes can impact your insurance rates, but the extent depends on various factors. Insurance companies consider the type of diabetes, your blood sugar control, overall health, and any complications. Well-managed diabetes with stable blood sugar levels may result in more favorable rates. It's best to get quotes from multiple insurers to understand the potential cost.

When applying for life insurance with diabetes, you may need to provide additional medical information and documentation. This can include recent blood sugar test results, medical records, and a detailed medical history. Some insurers might require a medical exam, including blood tests and a physical examination, to assess your health status accurately.

Yes, type 1 diabetes may require more careful evaluation and consideration. Insurance companies often look for consistent insulin usage, stable blood sugar control, and a history of effective diabetes management. It's essential to disclose all relevant medical information accurately to ensure proper assessment and pricing.