Term life insurance in Singapore is a type of life insurance that provides coverage for a specific period, or term, typically ranging from 10 to 30 years. It offers a straightforward and cost-effective way to protect your loved ones financially during a defined period. This insurance policy guarantees a death benefit if the insured individual passes away during the term, ensuring financial security for beneficiaries. Unlike permanent life insurance, term life insurance is designed to be a temporary solution, offering peace of mind and financial protection without the long-term commitment and higher costs associated with permanent policies.

What You'll Learn

- Definition: Term life insurance in Singapore is a temporary policy with a set duration

- Cost: Premiums are typically lower than permanent life insurance

- Coverage: It provides a death benefit if the insured dies during the term

- Flexibility: Policies can be tailored to specific needs and often offer convertible options

- Renewal: At the end of the term, the policy may be renewed or terminated

Definition: Term life insurance in Singapore is a temporary policy with a set duration

Term life insurance in Singapore is a specific type of life insurance policy that provides coverage for a defined period, known as the 'term'. This term can vary, typically ranging from 10 to 30 years, and it is during this period that the policyholder is protected financially in the event of their death. The primary purpose of this insurance is to offer a cost-effective way to secure financial protection for a family or dependants during a specific time frame.

When you purchase a term life insurance policy, you agree to pay a premium (a regular payment) to the insurance company for the duration of the term. In return, the insurer promises to pay out a lump sum or regular income to your beneficiaries if you were to die during the term period. This financial safety net can help cover various expenses, such as mortgage payments, children's education, or daily living costs, ensuring that your loved ones are financially secure even if you are no longer around.

The key feature of term life insurance is its simplicity and affordability. It is designed to be a straightforward product, offering pure insurance coverage without any investment or savings components. This means that the policy's sole function is to provide financial protection for a specified period, making it an excellent choice for those seeking temporary coverage at a lower cost.

In Singapore, term life insurance is often preferred by individuals who want to protect their families without the complexity of permanent life insurance policies. It is a popular choice for young families, homeowners, or those with financial obligations that need to be covered for a specific duration. For instance, a young couple with a mortgage and a child's education fund might opt for a 20-year term policy to ensure their financial commitments are secure during this period.

Understanding the term duration is crucial when choosing a term life insurance policy. The term length should align with your specific needs and financial goals. Longer terms provide more comprehensive coverage but may come with higher premiums, while shorter terms offer lower premiums but less long-term protection. It is essential to assess your financial obligations and life stage to determine the most suitable term duration for your situation.

Sun Life Insurance and IVF: What's Covered?

You may want to see also

Cost: Premiums are typically lower than permanent life insurance

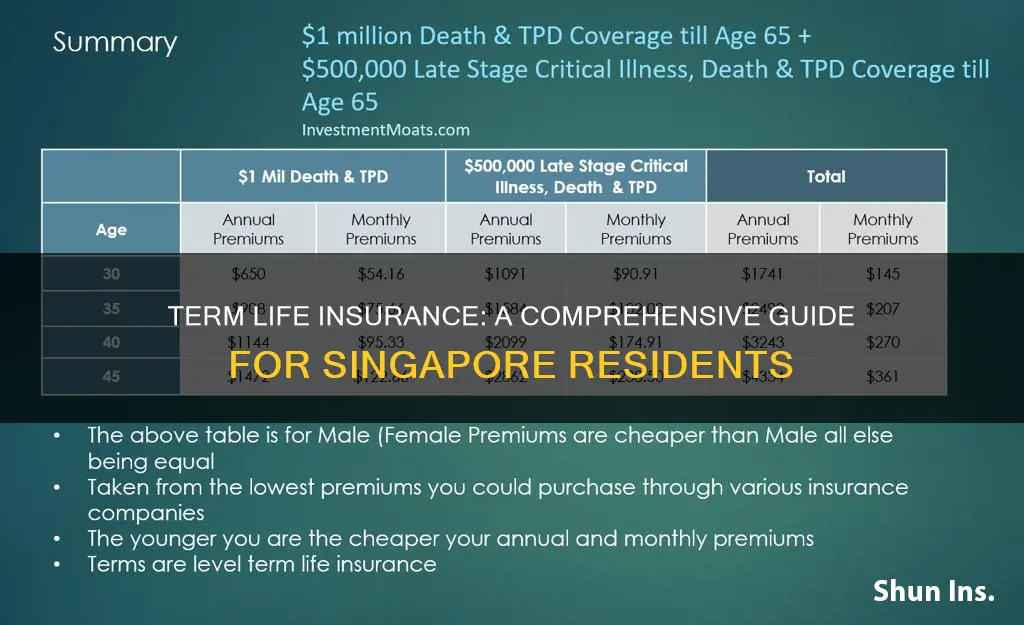

Term life insurance in Singapore is a cost-effective solution for individuals seeking temporary coverage for a specific period. The primary advantage of this type of insurance is its affordability, especially when compared to permanent life insurance. The lower premiums are a result of the insurance's straightforward nature and the fact that it is designed to provide coverage for a defined term, typically 10, 20, or 30 years. This structured approach allows insurers to offer competitive rates as they don't have to account for the long-term financial obligations associated with permanent policies.

When considering term life insurance, it's essential to understand that the cost is directly tied to the duration of the policy. The longer the term, the higher the premium, as the insurer takes on a more significant risk by committing to coverage for an extended period. For instance, a 30-year term policy will generally have higher monthly or annual premiums compared to a 10-year term policy. This flexibility in terms allows individuals to choose a coverage period that aligns with their specific needs and financial goals.

The lower cost of term life insurance is particularly appealing to those who want to secure their family's financial future without incurring substantial expenses. It provides a safety net during the years when children are growing up and when significant financial commitments, such as a mortgage, are typically at their highest. By opting for a term policy, individuals can ensure that their loved ones are protected without the long-term financial burden that permanent insurance may entail.

Furthermore, the affordability of term life insurance makes it an attractive option for those who may not yet be in a position to afford more comprehensive coverage. Young professionals or individuals starting their families can benefit from the cost-efficiency of term life insurance, allowing them to build their financial security gradually. As their financial situation improves, they can consider transitioning to a permanent policy or increasing the coverage amount within their term policy.

In summary, term life insurance in Singapore offers a budget-friendly alternative to permanent life insurance, providing a practical solution for individuals seeking temporary coverage. The lower premiums are a result of the policy's defined term, allowing insurers to offer competitive rates. This type of insurance is ideal for those who want to secure their family's financial future without incurring excessive costs, providing a valuable tool for managing personal finances and ensuring peace of mind.

Life Insurance: Another Check in the Mail?

You may want to see also

Coverage: It provides a death benefit if the insured dies during the term

Term life insurance in Singapore is a type of life insurance that offers coverage for a specific period, known as the "term." This term can vary, ranging from a few years to several decades, depending on the policyholder's needs and preferences. The primary purpose of term life insurance is to provide financial protection and peace of mind to the insured individual and their loved ones in the event of their untimely death during the specified term.

When it comes to coverage, term life insurance is straightforward and focused. It guarantees a death benefit, which is a lump sum payment, if the insured individual passes away during the term of the policy. This death benefit is typically paid out to the policyholder's beneficiaries, who can use the funds to cover various expenses, such as mortgage payments, children's education, or any other financial obligations that the deceased individual was responsible for. The amount of the death benefit is predetermined and agreed upon when the policy is purchased.

The beauty of term life insurance lies in its simplicity and cost-effectiveness. Since the coverage is limited to a specific term, the premiums are generally lower compared to permanent life insurance policies. This makes term life insurance an attractive option for individuals who want to secure their family's financial future without incurring high insurance costs. It provides a safety net during the years when financial responsibilities are most significant, ensuring that loved ones are protected even if the primary breadwinner is no longer around.

In Singapore, term life insurance policies often offer flexibility in choosing the term length, death benefit amount, and other policy features. Policyholders can select a term that aligns with their specific needs, such as covering a mortgage term or a child's education period. Additionally, some policies may allow for the conversion to a permanent policy after the initial term, providing long-term coverage if desired.

Understanding the coverage of term life insurance is crucial for making informed decisions about personal financial planning. It ensures that individuals and families can navigate life's uncertainties with the knowledge that their financial well-being is protected. By providing a death benefit during the specified term, term life insurance offers a valuable layer of security, allowing policyholders to focus on living their lives to the fullest while knowing their loved ones are taken care of.

Canceling Aflac Life Insurance: A Step-by-Step Guide

You may want to see also

Flexibility: Policies can be tailored to specific needs and often offer convertible options

Term life insurance in Singapore offers a unique level of flexibility that sets it apart from other insurance products. This flexibility is a key advantage for individuals seeking a tailored and personalized insurance solution. When purchasing term life insurance, policyholders have the freedom to customize their coverage to align with their specific needs and financial goals.

One of the primary ways this flexibility is achieved is through the ability to tailor the policy duration. Term life insurance typically provides coverage for a specified period, often ranging from 10 to 30 years. This allows individuals to choose a term length that matches their current and future financial obligations. For instance, a young professional might opt for a 20-year term to cover the costs associated with raising a family and paying off a mortgage. As their circumstances change, they can adjust the policy term accordingly, ensuring they always have the right level of protection.

Moreover, term life insurance policies often come with convertible options, adding another layer of flexibility. Convertibility allows policyholders to change the type of insurance they have without having to reapply for a new policy. For example, a policyholder might start with a term life insurance plan and, as they age, decide to convert it into a permanent life insurance policy, providing lifelong coverage. This option is particularly valuable for those who want the security of long-term insurance but prefer the simplicity and cost-effectiveness of a term policy during their initial years of coverage.

The flexibility of term life insurance in Singapore empowers individuals to make informed decisions about their insurance needs. It allows them to adapt their coverage as their life circumstances evolve, ensuring they remain protected without unnecessary financial burdens. This adaptability is a significant advantage, especially in a dynamic and ever-changing financial landscape.

In summary, term life insurance in Singapore stands out for its adaptability and customization. The ability to tailor policy terms and convert between different types of coverage ensures that individuals can find the perfect fit for their unique situations. This flexibility is a powerful tool for anyone seeking to secure their financial future with an insurance product that can grow and change with them.

Life Insurance: Bequests and Your Legacy

You may want to see also

Renewal: At the end of the term, the policy may be renewed or terminated

Term life insurance is a type of coverage that provides a specific period of protection, typically 10, 20, or 30 years. At the end of this term, the policyholder has two main options: renewal or termination. Understanding these choices is crucial for making informed decisions about your insurance needs.

Renewal: This option allows you to extend your coverage beyond the initial term. When the policy term ends, you can choose to renew it, ensuring that your life insurance remains in effect. Renewal is often straightforward, as the insurance company will typically review your application and health status to determine if you qualify for continued coverage. This process might involve a medical examination or a simple health questionnaire. The premium for the renewed policy may be adjusted based on your age and any changes in your health or lifestyle.

Term life insurance is particularly attractive because of its simplicity and cost-effectiveness. It provides a clear and defined period of coverage, making it easier to plan and budget for insurance expenses. During the term, the policyholder pays a fixed premium, and in return, the insurance company promises to pay a death benefit to the policy's beneficiaries if the insured individual passes away during that term.

Term insurance is often a preferred choice for those seeking short-term coverage, such as individuals with a specific financial goal or a temporary need, like covering a mortgage or providing for a family's short-term financial obligations. It offers a straightforward and affordable way to protect your loved ones during a defined period.

Termination: Alternatively, you can choose to terminate the policy at the end of the term. This decision might be made if your insurance needs have changed, or you no longer require the coverage. Terminating the policy will result in the loss of the death benefit, and you will no longer have the insurance in place. It's essential to carefully consider your future needs and financial goals before making this decision.

In summary, at the end of the term, term life insurance offers a straightforward choice between renewal and termination. Renewal ensures continued coverage, while termination allows for a re-evaluation of your insurance needs. Understanding these options is vital for making the right decision regarding your life insurance coverage in Singapore.

Accessing Your Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the "term." It offers financial protection to your beneficiaries if you pass away during this term. The policy is straightforward and offers coverage at a fixed rate, making it a popular choice for those seeking affordable and flexible insurance.

In Singapore, term life insurance policies typically offer coverage for a set period, such as 10, 20, or 30 years. You pay regular premiums to the insurance company, and in return, they promise to pay out a death benefit to your chosen beneficiaries if you die during the term. The policy ends when the term expires, and you can choose to renew it or purchase a new policy if needed.

Term life insurance in Singapore offers several advantages. Firstly, it is generally more affordable than permanent life insurance because it only provides coverage for a specific period. This makes it an excellent option for those who want insurance coverage for a particular goal, such as covering mortgage payments or providing financial security for children's education. Additionally, term life insurance can be easily converted to permanent coverage if desired.

Yes, it is possible to obtain term life insurance in Singapore even with pre-existing medical conditions. However, the terms and conditions, as well as the premium rates, may vary depending on the severity of the condition. Some insurance companies may offer guaranteed acceptance for certain conditions, while others might require a medical examination and may adjust the premium accordingly. It's best to compare policies from different insurers to find the best coverage for your situation.

Selecting the appropriate term life insurance policy involves considering several factors. These include the desired coverage amount, the term length, and your personal financial goals. It's essential to assess your risk tolerance and choose a term that aligns with your needs. Additionally, compare policies from various insurance providers, considering their reputation, customer service, and any additional benefits they offer. Seeking professional advice from a licensed insurance advisor can also help you make an informed decision.