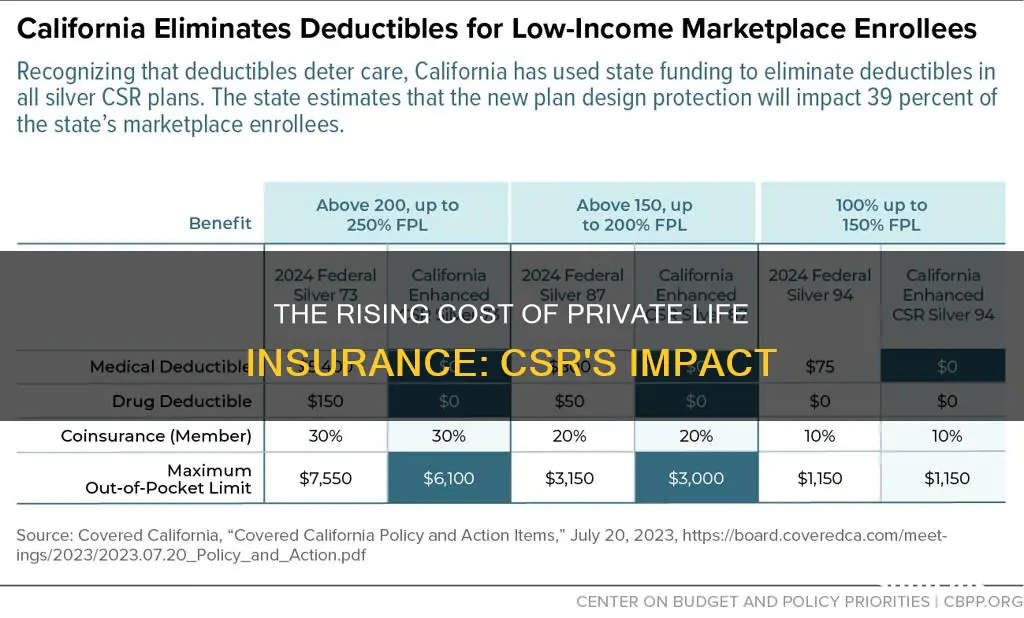

The cost of term private life insurance has been a topic of concern for many consumers, especially with the rise of corporate social responsibility (CSR) initiatives. This paragraph aims to explore the reasons behind the increasing prices of term private life insurance policies, considering the impact of CSR practices and the evolving insurance market dynamics. It will delve into how CSR activities, such as community investments and environmental sustainability efforts, can influence insurance premiums, and how these factors contribute to the overall cost of providing coverage. Understanding these factors is crucial for individuals and businesses seeking to navigate the complexities of the insurance market and make informed decisions regarding their insurance needs.

What You'll Learn

- Affordability: Private life insurance CSR pricing is affordable for individuals and businesses

- Customization: Tailored policies offer flexibility and meet specific needs

- Transparency: Clear pricing structures build trust and confidence in CSR insurance

- Value Proposition: CSR insurance provides long-term benefits and value to policyholders

- Market Competition: Competitive pricing drives market growth and innovation

Affordability: Private life insurance CSR pricing is affordable for individuals and businesses

Private life insurance, particularly term life insurance, has become increasingly accessible and affordable for individuals and businesses due to several key factors. Firstly, the rise of online insurance platforms and digital marketplaces has revolutionized the way people purchase insurance. These platforms offer a wide range of options, allowing consumers to compare prices and policies from various insurers easily. As a result, individuals can find competitive rates and choose plans that suit their specific needs and budgets. This accessibility has been further enhanced by the ability to customize policies, ensuring that the coverage is tailored to the individual's requirements, which often leads to lower premiums.

Secondly, the increasing competition in the insurance market has driven down prices. With more insurers entering the space, especially those offering digital-first solutions, there is a greater incentive to provide competitive pricing. This competition encourages insurers to innovate and offer affordable products, knowing that consumers have multiple options available. As a result, individuals can benefit from lower rates, especially when purchasing term life insurance, which typically has a fixed premium period.

For businesses, private life insurance CSR (Corporate Social Responsibility) pricing can be a strategic investment. Many companies offer group life insurance policies to their employees, which can be priced affordably. By providing this benefit, businesses not only show their commitment to employee welfare but also attract and retain talent. The affordability of such policies allows companies to offer competitive compensation packages without incurring excessive costs. This practice can lead to a happier, more productive workforce and contribute to the company's long-term success.

Furthermore, the use of technology in insurance has played a significant role in making private life insurance more affordable. Advanced algorithms and data analytics enable insurers to assess risk more accurately, leading to more precise pricing. This technology-driven approach allows for personalized policies, ensuring that the coverage is appropriate for the individual's circumstances. As a result, individuals can find affordable options without compromising on the level of protection they receive.

In summary, the affordability of private life insurance, especially term life insurance, is a result of various factors. The digital transformation in the insurance industry, increased competition, and the use of technology have all contributed to making insurance more accessible and cost-effective. Individuals and businesses can now find competitive rates, customize policies, and benefit from the financial security that life insurance provides, all while keeping costs manageable. This trend is likely to continue as the industry adapts to meet the evolving needs of consumers.

Whole Life Insurance: Dave Ramsey's Investment Advice

You may want to see also

Customization: Tailored policies offer flexibility and meet specific needs

In the realm of insurance, one of the most appealing aspects of term life insurance is its flexibility and ability to be tailored to individual needs. This customization is a key differentiator, allowing policyholders to design a plan that perfectly suits their unique circumstances and financial goals. By offering a range of options and features, term life insurance provides a level of personalization that is often lacking in other insurance products.

When considering term life insurance, individuals can choose the duration of the policy, which is a critical factor in aligning the coverage with their specific needs. For instance, a young professional might opt for a 10-year term policy to cover a critical period, such as the time when a mortgage or a child's education expenses are at their highest. This short-term commitment provides a sense of security without the long-term financial burden. Conversely, a family with a long-term mortgage might prefer a 20-year or even a 30-year term to ensure that the entire loan period is covered.

The customization doesn't end with the term length. Policyholders can also select the amount of coverage, which is a critical decision that reflects an individual's financial obligations and goals. For example, a person with a substantial mortgage, children's education costs, and other financial commitments might opt for a higher coverage amount to ensure that their loved ones are financially secure in the event of their passing. On the other hand, someone with fewer financial ties might choose a lower coverage amount, opting for a more affordable premium.

Furthermore, term life insurance policies can be enhanced with additional riders and benefits, providing further customization. These riders might include options like accelerated death benefits, which allow policyholders to receive a portion of their death benefit if they are diagnosed with a terminal illness, providing financial security and peace of mind. Other riders could offer waiver of premium benefits, ensuring that payments are waived if the insured becomes unable to work due to illness or injury. These customizable features allow individuals to create a policy that not only meets their current needs but also adapts to potential future changes in their lives.

The flexibility of term life insurance is a powerful advantage, especially in an ever-changing world. It allows individuals to make informed decisions based on their current circumstances and future projections, ensuring that their insurance coverage remains relevant and effective. This level of customization is a key reason why term life insurance is increasingly becoming a popular choice for those seeking a comprehensive and adaptable financial protection plan.

Life Insurance Beneficiaries: Minors and Money

You may want to see also

Transparency: Clear pricing structures build trust and confidence in CSR insurance

In the realm of Corporate Social Responsibility (CSR), transparency is a cornerstone, especially when it comes to insurance products like term private life insurance. Clear and transparent pricing structures are essential to building trust and confidence among customers, employees, and stakeholders. When a company offers CSR insurance, it is crucial to provide a detailed breakdown of the costs and benefits to ensure that the product is not only appealing but also ethically sound.

The first step towards achieving transparency is to simplify the pricing model. Many insurance products, especially in the CSR space, can be complex and confusing for the average consumer. By breaking down the costs into easily understandable components, companies can ensure that their pricing is fair and competitive. This includes clearly stating the base premium, any additional charges for specific benefits or add-ons, and the overall value proposition. For instance, a company might offer a basic term life insurance policy with a straightforward premium, and then provide optional add-ons like critical illness coverage or accidental death benefits, each with a clearly defined cost.

Additionally, providing detailed explanations of the pricing factors can further enhance transparency. This could include a breakdown of how the premium is calculated, the role of risk assessment, and the impact of various factors like age, health, and lifestyle on the final cost. By educating customers about these aspects, the company empowers them to make informed decisions, ensuring they understand the value they are paying for. This level of transparency can also help in building a positive brand image, as it demonstrates a commitment to honesty and customer satisfaction.

In the context of CSR, transparency in pricing can have a significant impact on employee morale and engagement. When employees understand the financial implications of the company's CSR initiatives, they are more likely to feel invested in the cause. Clear pricing structures can help in communicating the financial burden or benefit of the insurance product to the workforce, fostering a sense of fairness and trust. This, in turn, can lead to higher employee retention and a more positive company culture.

Furthermore, transparency in pricing can attract and retain customers in a competitive market. In the insurance industry, where products can be highly similar, clear and honest pricing is a powerful differentiator. Customers are increasingly conscious of the value they receive for their money, and a transparent pricing strategy can be a compelling reason to choose one insurance provider over another. By building trust through transparency, companies can establish long-lasting relationships with their customers, ensuring a steady stream of business and a positive reputation.

Understanding Credit Life Insurance: Do You Have It?

You may want to see also

Value Proposition: CSR insurance provides long-term benefits and value to policyholders

Corporate Social Responsibility (CSR) insurance is a concept that has gained traction in the financial industry, offering a unique value proposition to policyholders. This type of insurance goes beyond traditional coverage, focusing on the long-term benefits and value it brings to individuals and communities. Here's an exploration of how CSR insurance provides lasting advantages:

Long-Term Financial Security: CSR insurance policies are designed with a forward-thinking approach. They offer comprehensive coverage that extends beyond the immediate risks. For instance, term life insurance with CSR elements can provide financial security for a specified period, ensuring that the policyholder's loved ones are protected even after the policy term ends. This long-term perspective allows individuals to plan for various life events, such as retirement, education funds, or business ventures, ensuring financial stability.

Community Impact: One of the key advantages of CSR insurance is its potential to create a positive societal impact. When policyholders purchase these insurance products, a portion of the proceeds can be directed towards community development projects. These initiatives may include funding for local schools, healthcare facilities, or environmental conservation efforts. By supporting such projects, CSR insurance encourages a culture of giving back, fostering a sense of community and long-term social responsibility.

Risk Mitigation and Peace of Mind: The value of CSR insurance lies in its ability to provide peace of mind to policyholders. By offering extended coverage and additional benefits, it ensures that individuals are protected against unforeseen circumstances. For example, critical illness coverage as part of a CSR insurance package can provide financial support during challenging times, helping policyholders manage medical expenses and maintain their standard of living. This risk mitigation aspect is invaluable, allowing individuals to focus on their personal and professional growth without constant worry.

Personalized Benefits: CSR insurance policies can be tailored to meet individual needs. This customization ensures that policyholders receive value-added benefits that align with their specific requirements. For instance, a policy might include additional riders for disability coverage, accidental death benefits, or even educational savings plans. By offering personalized options, CSR insurance providers empower individuals to create a comprehensive financial safety net, ensuring long-term security and peace of mind.

In summary, CSR insurance presents a compelling value proposition by offering long-term financial security, community impact, risk mitigation, and personalized benefits. It encourages individuals to take a proactive approach to their financial well-being while contributing to the betterment of society. As the market for ethical and sustainable financial products grows, CSR insurance is likely to play a significant role in shaping the future of insurance, providing both immediate and lasting value to policyholders.

Fafsa and Life Insurance: What You Need to Know

You may want to see also

Market Competition: Competitive pricing drives market growth and innovation

In the highly competitive insurance market, pricing strategies play a pivotal role in driving growth and fostering innovation. When insurance companies engage in competitive pricing, it creates a dynamic environment that benefits both consumers and the industry as a whole. This competitive pricing strategy is a powerful tool to attract and retain customers, ultimately leading to market expansion.

One of the primary effects of competitive pricing is the stimulation of market growth. When insurance providers offer their products at competitive rates, it becomes an attractive proposition for consumers. Lower prices encourage more people to purchase insurance, especially those who might have been hesitant due to cost concerns. As a result, the market experiences an influx of new customers, leading to increased sales and revenue for insurance companies. This growth is particularly significant in the term life insurance sector, where consumers often compare prices to find the best value.

Moreover, competitive pricing drives innovation within the industry. Insurance companies, when faced with the challenge of keeping prices competitive, are compelled to explore new ways of reducing costs and improving efficiency. This might involve streamlining processes, negotiating better deals with suppliers, or adopting advanced technologies to automate tasks. By doing so, they can offer more affordable products without compromising on quality. For instance, a company might invest in data analytics to identify and target high-risk areas, allowing them to price policies more accurately and competitively. This not only benefits the company's bottom line but also enhances the overall customer experience.

In a competitive market, insurance providers must continuously innovate to stay ahead. They might introduce new policy features, such as customizable coverage options or additional benefits, to differentiate themselves. These innovations not only attract customers but also create a unique selling point, ensuring that the company remains competitive in the long term. As a result, the market becomes a breeding ground for creativity and improvement, ultimately benefiting consumers who have a wider range of choices.

Additionally, competitive pricing encourages insurance companies to focus on customer satisfaction. To maintain their market position, companies must ensure that their pricing strategies are transparent and fair. This transparency builds trust with customers, who are more likely to remain loyal and recommend the company to others. Word-of-mouth referrals and positive reviews can significantly contribute to market growth, as satisfied customers become brand advocates.

In summary, competitive pricing in the insurance market is a powerful catalyst for growth and innovation. It encourages companies to offer better products at lower prices, attracting new customers and driving industry-wide improvements. This dynamic pricing strategy not only benefits consumers by providing affordable insurance options but also fosters a healthy competitive environment, ensuring the long-term sustainability and development of the insurance sector.

Borrowing Against Your Aflac Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

The rise in insurance premiums can be attributed to several factors. Firstly, insurance companies often adjust rates based on the risk they assess for each policyholder. If there's an increase in life expectancy or a shift in the overall health and lifestyle trends of the population, it may lead to higher premiums. Additionally, changes in the insurance market, such as new regulations or increased competition, can impact pricing. It's important to note that insurance providers regularly review and update their rates to ensure they can adequately cover potential claims and maintain financial stability.

The cost of living, which includes factors like inflation, rising healthcare costs, and increased consumer spending, can indirectly influence insurance premiums. As the cost of living increases, insurance companies may adjust their rates to account for the potential financial impact on policyholders. Higher living expenses can lead to increased stress and financial strain, which might affect an individual's ability to manage their insurance policy. Insurance providers consider these economic factors when setting premiums to ensure they can meet the evolving needs of their customers.

Yes, demographic and lifestyle factors play a significant role in determining insurance premiums. Age is a critical factor, as younger individuals typically pay lower premiums due to a longer life expectancy and a reduced risk of health issues. Smoking, excessive alcohol consumption, or engaging in high-risk activities can lead to higher premiums as these behaviors increase the likelihood of health-related claims. Additionally, occupation and hobbies might also be considered, as certain professions or activities may pose higher risks. Insurance companies use these factors to assess risk and set appropriate premium rates.