The AAA Life Insurance policy includes a suicide clause, a critical aspect of the insurance contract. This clause stipulates that if the insured individual commits suicide within the first two years of taking out the policy, the insurance company may not pay out the full death benefit. Understanding the implications of this clause is essential for anyone considering AAA Life Insurance, as it can significantly impact the value of the policy and the financial security of beneficiaries.

What You'll Learn

- Definition: The suicide clause is a provision in AAA life insurance policies that excludes coverage if the insured dies by suicide within a specified period, often two years

- Exclusions: Suicide is generally not covered under AAA life insurance policies, with exceptions for those with pre-existing mental health conditions

- Waiting Period: AAA may have a waiting period before the suicide clause takes effect, allowing for a review of the insured's mental health history

- Mental Health: Pre-existing mental health conditions can impact the interpretation of the suicide clause, requiring careful assessment by AAA

- Policy Variations: Different AAA life insurance policies may have varying interpretations of the suicide clause, affecting coverage and exclusions

Definition: The suicide clause is a provision in AAA life insurance policies that excludes coverage if the insured dies by suicide within a specified period, often two years

The suicide clause is a critical aspect of AAA life insurance policies, designed to manage the risk associated with insuring individuals who may have a higher propensity for suicide. This clause is a stipulation within the policy that explicitly states the insurance company's position on coverage in the event of the insured's death by suicide.

When an individual purchases AAA life insurance, the policy will typically include a suicide clause, which serves as a safeguard for the insurance provider. The clause states that if the insured person dies as a result of suicide within a specified period, usually two years from the date of the policy, the insurance company will not be obligated to pay the death benefit to the policyholder or beneficiaries. This period is often referred to as the "exclusionary period" or "suicide exclusion."

The purpose of this clause is to protect the insurance company from potential financial losses that may arise from insuring individuals with a higher risk profile. Suicide is considered a high-risk behavior, and by excluding coverage for a specified period, the insurance company manages the risk and ensures that the policy remains financially viable. It's important to note that the specific terms and conditions of the suicide clause can vary depending on the insurance company and the policy purchased.

For individuals considering AAA life insurance, understanding the implications of the suicide clause is crucial. If someone commits suicide within the specified period, the policyholder may not receive the intended financial support, which could have significant consequences for their family or beneficiaries. However, it's also worth mentioning that many insurance companies offer options to waive or reduce the impact of the suicide clause, especially for long-term coverage.

In summary, the suicide clause is a standard provision in AAA life insurance policies, ensuring that the insurance company can manage risks associated with suicide and maintain the financial integrity of the policy. Policyholders should carefully review the terms of their insurance to understand the implications and potential exclusions.

Group Term Life Insurance: What You Need to Know

You may want to see also

Exclusions: Suicide is generally not covered under AAA life insurance policies, with exceptions for those with pre-existing mental health conditions

The suicide clause is a critical aspect of life insurance policies, and understanding its implications is essential for anyone considering AAA life insurance. When it comes to AAA life insurance, it's important to note that suicide is generally not covered under the policy, which means that if the insured individual takes their own life within a specified period (often two years) after the policy's inception, the insurance company may not pay out the death benefit. This exclusion is a standard feature in many life insurance policies to mitigate the risk associated with insuring individuals with potential mental health issues.

However, there are exceptions to this rule, and these exceptions are particularly relevant for individuals with pre-existing mental health conditions. For those who have a history of mental health struggles or have been diagnosed with a mental illness, the insurance company may offer a reduced death benefit or exclude certain types of suicide attempts. This is done to balance the risk and ensure that the policy remains financially viable. For instance, if an individual with a history of depression or anxiety has a policy with AAA, and they attempt suicide but do not die, the insurance company might still cover the death benefit, recognizing the individual's struggle and the potential for recovery.

The specific terms and conditions regarding the suicide clause can vary depending on the policyholder's medical history and the insurance company's underwriting guidelines. It is crucial for individuals to disclose any pre-existing mental health conditions accurately during the application process to ensure they receive the appropriate coverage. Misrepresentation or non-disclosure of such information could lead to a denial of benefits when a claim is made.

Furthermore, the two-year waiting period after the policy's inception is a standard clause in many life insurance policies. This period allows the insurance company to assess the insured individual's mental health stability before providing full coverage. During this time, if the insured individual takes their own life, the policy may not pay out, but once the waiting period is over, the policy becomes fully effective, and suicide is generally not covered unless it is deemed a result of a pre-existing mental health condition.

In summary, AAA life insurance policies typically exclude coverage for suicide within the first two years, but they may offer exceptions for individuals with pre-existing mental health conditions. It is vital for policyholders to be transparent about their medical history to ensure they receive the appropriate coverage and avoid any potential issues when making a claim. Understanding these exclusions and exceptions is key to making informed decisions about life insurance.

Understanding Term Life Insurance: Unveiling the Face Value

You may want to see also

Waiting Period: AAA may have a waiting period before the suicide clause takes effect, allowing for a review of the insured's mental health history

The suicide clause is a critical aspect of life insurance policies, and AAA, as a prominent insurance provider, has specific guidelines regarding this clause. When considering AAA life insurance, it's essential to understand the waiting period associated with the suicide clause. This waiting period is a crucial feature that provides a safety net for both the insurance company and the policyholder.

During the initial stages of a life insurance policy with AAA, there is often a specified waiting period before the suicide clause comes into effect. This waiting period typically lasts for a certain number of days or months, during which AAA conducts a thorough review of the insured's mental health history. The primary purpose of this waiting period is to assess the insured's stability and overall mental well-being. It allows AAA to gather information about any pre-existing mental health conditions, previous suicide attempts, or related behaviors that could potentially impact the risk assessment.

Within this waiting period, AAA may request detailed medical records, including psychiatric evaluations, therapy notes, and any relevant documentation related to the insured's mental health. This comprehensive review ensures that AAA has a comprehensive understanding of the insured's history, enabling them to make an informed decision regarding the policy. The waiting period provides an opportunity to identify any red flags or concerns that might have been overlooked during the initial application process.

For individuals with a history of mental health issues or those who have recently undergone significant changes in their personal or professional lives, this waiting period can be particularly important. It allows AAA to consider the insured's current state and make a more accurate determination of their risk profile. By implementing this waiting period, AAA demonstrates its commitment to responsible underwriting practices and ensures that the insurance policy is fair and beneficial for all parties involved.

Understanding the waiting period and its implications is crucial for anyone considering AAA life insurance. It highlights the importance of transparency and thorough evaluation in the insurance process. During this period, policyholders should be prepared to provide comprehensive medical information to facilitate a smooth and efficient review process.

Life Insurance Agents: How Many Are There in the US?

You may want to see also

Mental Health: Pre-existing mental health conditions can impact the interpretation of the suicide clause, requiring careful assessment by AAA

Pre-existing mental health conditions can significantly influence the interpretation and application of the suicide clause in AAA life insurance policies. When an individual with a mental health history purchases life insurance, the insurance company must carefully assess their risk profile, especially in the context of the suicide clause. This clause typically excludes coverage if the insured individual commits suicide within a specified period after the policy's inception. However, the presence of a pre-existing mental health condition adds complexity to this assessment.

For AAA, or any insurance provider, the challenge lies in determining whether the individual's mental health condition was pre-existing at the time of policy issuance or if it developed subsequently. If the condition was present before the policy, it may impact the interpretation of the suicide clause. For instance, if an individual has a history of depression or anxiety and later experiences a relapse, leading to a suicide attempt, the insurance company might argue that the relapse was a pre-existing condition, potentially excluding coverage under the suicide clause.

In such cases, AAA and other insurers often require a thorough medical evaluation to understand the individual's mental health history and current state. This assessment helps determine if the suicide was a result of a pre-existing condition or a new onset of mental health issues. The evaluation may include psychological assessments, medical records review, and consultations with mental health professionals. A comprehensive understanding of the individual's mental health journey is crucial to making an informed decision regarding the application of the suicide clause.

Furthermore, the interpretation of the suicide clause can vary depending on the specific terms and conditions of the insurance policy. Some policies may have exclusions or limitations for individuals with mental health histories, which could affect the coverage. AAA, as a responsible insurer, should carefully review the policy language and consider the individual's overall health and stability when making coverage decisions.

In summary, pre-existing mental health conditions require a nuanced approach when interpreting the suicide clause in AAA life insurance. Insurance providers must conduct thorough assessments to differentiate between pre-existing and new-onset conditions to ensure fair and accurate coverage decisions. This process involves medical evaluations, policy reviews, and a comprehensive understanding of the individual's mental health history to provide appropriate insurance coverage while managing risk effectively.

Ladder Life Insurance: Interest Growth and You

You may want to see also

Policy Variations: Different AAA life insurance policies may have varying interpretations of the suicide clause, affecting coverage and exclusions

The suicide clause is a critical aspect of AAA life insurance policies, and its interpretation can vary significantly across different insurance providers. This variation in interpretation directly impacts the coverage and exclusions of the policy, which can be crucial for policyholders to understand. When considering AAA life insurance, it's essential to recognize that the terms "suicide" and "suicidal act" are often subject to specific definitions and conditions set by the insurance company.

One of the primary variations in policy interpretation lies in the timing of the suicide. Some AAA life insurance policies may exclude coverage if the insured individual commits suicide within a certain period after purchasing the policy, often referred to as the "waiting period." During this waiting period, which can range from a few months to a few years, the insurance company may not provide benefits if the insured dies by suicide. This exclusion is designed to prevent fraud and ensure that the insurance company is not providing coverage for a risk that was not fully assessed during the initial underwriting process.

Another policy variation is the distinction between "imminent danger" and "pre-meditated" suicide. Some insurers may interpret the suicide clause to exclude coverage only in cases where the suicide was pre-meditated and planned. In contrast, they may provide coverage if the insured individual acted under imminent danger or extreme emotional distress. This interpretation can significantly impact the policyholder's ability to receive benefits, especially in tragic circumstances. For instance, if an individual makes a sudden and impulsive decision to end their life due to a severe mental health crisis, the policy might still provide coverage, whereas a carefully planned act of suicide may be excluded.

Furthermore, the specific language used in the policy document is crucial. Different AAA life insurance policies may use varying terms to describe the suicide clause, such as "suicide exclusion," "suicide provision," or "suicide clause." Each term might have a slightly different meaning or implication, affecting how the policy is interpreted in legal and insurance contexts. For instance, some policies may explicitly state that the exclusion applies only to "intentional self-inflicted death," while others might use broader language that could potentially cover a wider range of situations.

Understanding these policy variations is essential for individuals purchasing AAA life insurance. Policyholders should carefully review the terms and conditions of their specific policy to know their coverage and any potential exclusions. Consulting with insurance professionals or legal experts can also provide valuable guidance in navigating the complexities of the suicide clause and ensuring that the policyholder's interests are protected.

Foreign Life Insurance: Taxable Payouts Explained

You may want to see also

Frequently asked questions

The suicide clause is a provision in life insurance policies that can affect the validity of the coverage in certain circumstances. If the insured individual commits suicide within a specified period after the policy is issued or renewed, the insurance company may deny a claim for the death benefit. This clause is in place to manage the risk associated with insuring individuals with potentially high-risk behaviors.

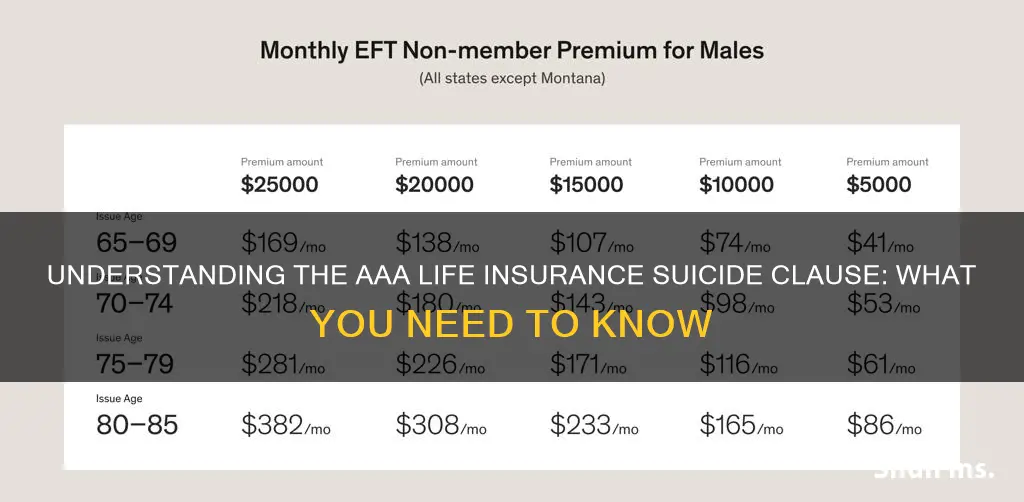

The duration of the suicide clause varies by insurance company and policy type. Commonly, it applies for a period of one to two years from the date the policy is issued or renewed. During this time, the insurance company considers the insured individual as high-risk, and any suicide during this period may result in a claim denial.

Yes, there can be exceptions depending on the insurance company's policies and the specific circumstances. Some insurers may offer a "reinstatement" option, allowing the policy to continue in force if the insured individual can prove a change in behavior or health. Additionally, certain policies might have a "waiting period" clause, which provides coverage for a limited time after the policy is issued before the suicide clause takes effect.

In some cases, the suicide clause can be removed or waived, especially for individuals with pre-existing conditions or specific health factors. The insurance company may require a medical examination or additional information to assess the risk accurately. Removing the clause might involve a higher premium or other conditions set by the insurer.