Life insurance is an essential tool for families to ensure financial security and peace of mind. When a family's income is protected by life insurance, it provides a safety net in the event of the primary breadwinner's untimely death. This financial protection can help cover essential expenses, such as mortgage payments, school fees, and daily living costs, ensuring that the family's standard of living is maintained and that the remaining family members are cared for. Additionally, life insurance can provide a lump sum payment, allowing the family to invest in their future, whether it's starting a new business, paying for a child's education, or building a nest egg for retirement. By having life insurance, families can avoid the financial strain and stress that can arise from unexpected losses, allowing them to focus on honoring the memory of their loved one and moving forward with confidence.

| Characteristics | Values |

|---|---|

| Financial Security | Provides a safety net for the family in the event of the primary breadwinner's death, ensuring their financial needs are met. |

| Debt Management | Helps cover existing debts, such as mortgages, loans, and credit card balances, preventing financial strain on the surviving family. |

| Income Replacement | Replaces the lost income of the deceased, allowing the family to maintain their standard of living and cover daily expenses. |

| Children's Education | Ensures the financial resources are available to fund children's education, enabling them to pursue their academic goals. |

| Healthcare Costs | Covers medical expenses, especially for long-term care or chronic conditions, which can be financially devastating without insurance. |

| Daily Expenses | Helps with everyday costs like groceries, utilities, and transportation, ensuring the family can maintain a stable lifestyle. |

| Emotional Peace | Offers peace of mind, knowing that the family is protected and their future is secure, reducing stress and anxiety. |

| Long-Term Financial Goals | Supports the family's ability to achieve long-term financial goals, such as saving for retirement or future investments. |

| Survivor's Income | Provides an income stream for the surviving spouse or partner, allowing them to focus on adjusting to life without the primary income. |

| Customizable Policies | Life insurance policies can be tailored to individual needs, offering flexibility in coverage and benefits. |

What You'll Learn

- Financial Security: Life insurance ensures family's financial stability in the event of the breadwinner's death

- Debt Management: It helps pay off debts, preventing financial strain on the family

- Education Funding: Insurance can cover education costs, ensuring children's future

- Healthcare Coverage: It provides funds for medical expenses, a critical family need

- Lifestyle Maintenance: Life insurance ensures the family can maintain their standard of living

Financial Security: Life insurance ensures family's financial stability in the event of the breadwinner's death

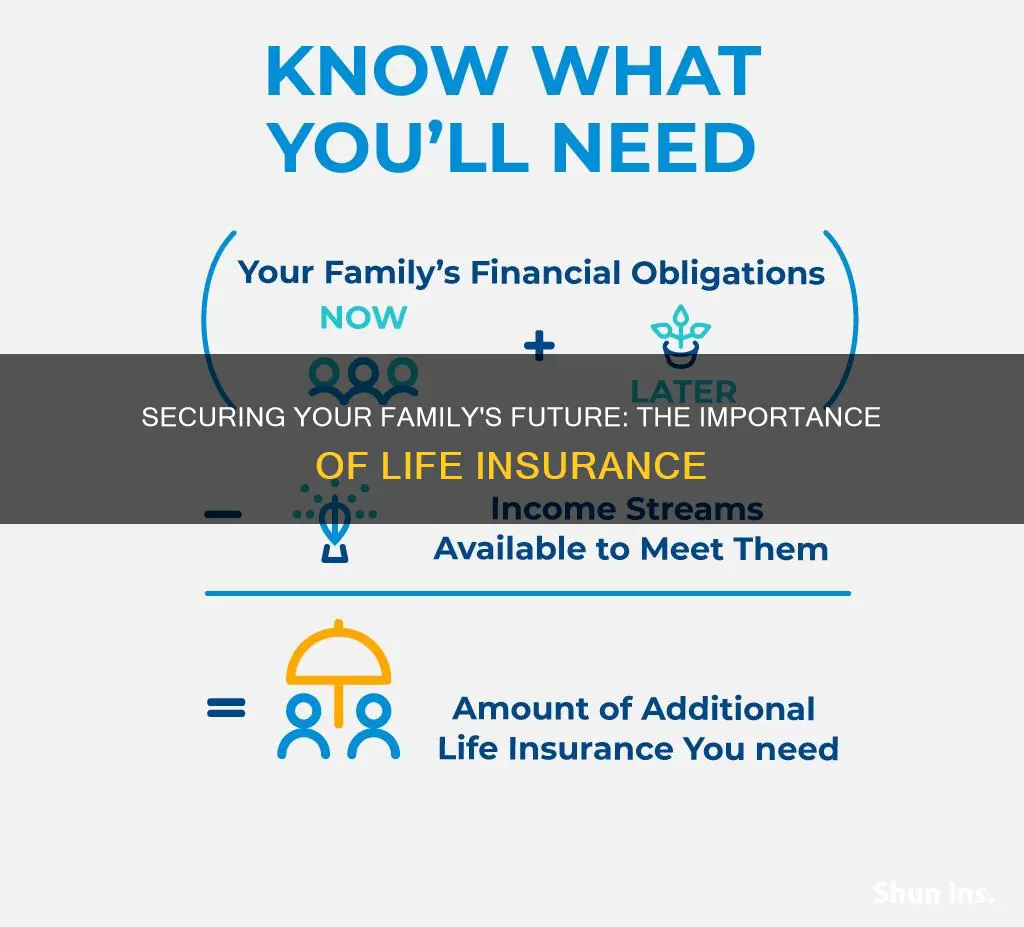

Life insurance is a vital tool for ensuring financial security and stability for a family, especially in the event of the primary breadwinner's death. It provides a safety net that can help ease the financial burden and stress that often accompanies the loss of a loved one. When a family's income is protected by life insurance, it means that the financial responsibilities and obligations of the deceased individual are covered, allowing the family to maintain their standard of living and meet their essential needs.

In the unfortunate scenario where the primary earner passes away, the surviving family members may face numerous financial challenges. Without adequate life insurance, the family might struggle to cover daily expenses, mortgage or rent payments, utility bills, and other essential costs. This can lead to a rapid decline in their financial situation, potentially causing long-term financial hardship. Life insurance steps in to prevent this by providing a lump sum payment or regular income to the beneficiaries, ensuring that the family's financial obligations are met.

The financial stability provided by life insurance is particularly crucial for families with children, as it ensures that the children's needs are cared for and their future is secured. It covers educational expenses, provides funds for their upbringing, and ensures that they have the necessary resources to build a secure future. For example, if a parent dies, the life insurance payout can be used to cover the child's tuition fees, extracurricular activities, and other educational costs, allowing them to pursue their dreams without financial constraints.

Moreover, life insurance can also help maintain the family's long-term financial goals. It enables the family to keep their house, invest in their children's future, and plan for retirement. The financial security provided by life insurance allows the family to make significant purchases, such as a new home or a business venture, without worrying about the financial implications of the breadwinner's absence. This peace of mind is invaluable, knowing that the family's financial future is protected.

In summary, life insurance is an essential component of a family's financial plan. It provides the necessary financial protection to ensure that the family's income is secure, even in the worst-case scenario. By having adequate life insurance coverage, families can navigate the challenges of losing a loved one with greater confidence, knowing that their financial stability is protected and their long-term goals remain achievable. It is a wise investment that offers peace of mind and financial security for the entire family.

Understanding Life Insurance: Free Look Period Explained

You may want to see also

Debt Management: It helps pay off debts, preventing financial strain on the family

Life insurance is a crucial financial tool that can provide a safety net for families, especially in the context of debt management. When a family's income is protected by life insurance, it offers a layer of security that can help alleviate financial strain and ensure that debts are managed effectively. Here's how it works:

In the event of a family member's untimely death, life insurance provides a financial benefit or payout to the beneficiaries. This payout can be a significant source of funds that can be utilized to settle any outstanding debts. For instance, if a family has accumulated credit card debt, a mortgage, or other financial obligations, the life insurance proceeds can be directed towards paying off these debts. By doing so, the insurance policy ensures that the family is not burdened with the additional stress of managing financial liabilities, especially during a difficult time. This is particularly important as debt can quickly spiral out of control if not addressed promptly.

The process of debt management becomes more manageable when life insurance is involved. The insurance company typically provides a lump sum or regular payments to the designated beneficiaries, allowing the family to tackle their debts head-on. This financial support can cover the minimum payments on various debts, ensuring that they remain current and avoid late fees or penalties. Moreover, the insurance payout can be strategically allocated to prioritize high-interest debts first, which can significantly reduce the overall cost of borrowing.

By taking out life insurance, families can proactively plan for the future and ensure that their financial obligations are met. This is especially beneficial for those with large debts, as it provides a means to protect their loved ones from potential financial hardship. The peace of mind that comes with knowing debts are covered can reduce stress and allow the family to focus on other important aspects of their lives.

In summary, life insurance plays a vital role in debt management by offering a financial safety net. It empowers families to tackle debts effectively, preventing financial strain and potential long-term consequences. With the right insurance policy, families can secure their future and provide a stable environment for their loved ones, even in the face of unexpected circumstances. This aspect of life insurance is often overlooked but can be a powerful tool in maintaining financial stability.

The Evolution of Life Insurance: When Maturity Meets Security

You may want to see also

Education Funding: Insurance can cover education costs, ensuring children's future

The importance of safeguarding a family's income through life insurance cannot be overstated, especially when considering the long-term financial security of one's children. Education is a significant expense, and ensuring that your children have the means to pursue their academic goals is a crucial aspect of responsible parenting. Life insurance can play a pivotal role in this regard by providing a financial safety net that covers education costs, thereby securing a brighter future for your offspring.

When a family's primary breadwinner passes away, the financial stability of the family can be significantly impacted. Without adequate insurance coverage, the remaining family members may struggle to maintain their standard of living, let alone afford the rising costs of education. This is where life insurance steps in as a vital tool. By purchasing a suitable life insurance policy, you can ensure that your family's income is protected, and the financial burden of education is shared, if not eliminated entirely.

Education costs can vary widely depending on the type of institution, location, and individual needs. From primary school to university, and even further education or vocational training, the expenses can accumulate quickly. Life insurance can provide a comprehensive solution by offering a lump sum payment or regular income stream to cover these expenses. This financial support can ensure that your children have access to quality education, without the worry of financial constraints affecting their opportunities.

The peace of mind that comes with knowing your family's future is secure is invaluable. With life insurance, you can rest assured that your children's education will be funded, even in your absence. This financial security allows your children to focus on their studies, pursue their passions, and develop the skills they need to succeed in life. It empowers them to make the most of their educational journey and build a foundation for a successful future.

In summary, life insurance is a powerful tool for protecting a family's income and ensuring the financial well-being of children. By covering education costs, it provides a safety net that enables children to access quality education and pursue their dreams. This financial security is a gift that keeps on giving, as it empowers the next generation to build a brighter future. It is a wise investment that demonstrates a parent's commitment to their family's long-term prosperity.

Life Insurance: Payouts, Payments, and Your Money

You may want to see also

Healthcare Coverage: It provides funds for medical expenses, a critical family need

Life insurance is a crucial financial tool that offers a safety net for families, ensuring their well-being and financial stability in the face of unforeseen circumstances. One of the most significant benefits of having life insurance is the provision of healthcare coverage, which can be a lifeline for families facing medical emergencies or chronic illnesses.

Healthcare costs can be overwhelming and often unexpected, and they can quickly deplete a family's savings. When a family member falls ill or suffers an accident, the last thing they need is the added stress of financial burdens. This is where life insurance steps in as a vital safeguard. By providing funds specifically for medical expenses, it ensures that families can access the necessary treatment without worrying about the financial implications. This coverage is particularly essential for families with a history of chronic illnesses or those with a higher risk of developing such conditions.

The importance of healthcare coverage becomes even more apparent when considering the long-term financial implications. Serious illnesses or injuries can result in extended periods of medical care, rehabilitation, and follow-up treatments. Without adequate financial resources, families may be forced to make difficult choices, such as delaying or forgoing treatment, which can have severe consequences for the affected individual's health and the family's overall well-being. Life insurance, with its dedicated healthcare funds, empowers families to make informed decisions regarding their medical care, ensuring that they receive the best possible treatment without financial constraints.

Moreover, life insurance with healthcare coverage can provide peace of mind, knowing that your family is protected. It allows you to focus on your loved ones' recovery and well-being, knowing that the financial aspect is taken care of. This coverage is especially valuable for families with young children or elderly dependents, as it ensures that their healthcare needs are met, regardless of the primary breadwinner's absence.

In summary, healthcare coverage as part of life insurance is a critical aspect of financial planning for families. It provides the necessary funds to manage medical expenses, ensuring that families can access the best healthcare without financial hardship. By prioritizing this aspect of life insurance, individuals can safeguard their families' well-being and financial security, making it an essential consideration for anyone looking to protect their loved ones.

Axis Bank Life Insurance: Protecting Your Future

You may want to see also

Lifestyle Maintenance: Life insurance ensures the family can maintain their standard of living

Life insurance is a crucial financial tool that plays a vital role in safeguarding a family's financial well-being and ensuring a stable lifestyle. When a primary earner in a family passes away, the sudden loss of income can significantly impact the family's standard of living. This is where life insurance steps in as a protective measure, providing a financial safety net to maintain the family's lifestyle and cover essential expenses.

The primary purpose of life insurance is to provide financial security and peace of mind. It offers a way to protect the family's financial future by ensuring that their basic needs and wants are met, even in the absence of the primary breadwinner. This is especially important for families with children, as the loss of income can disrupt education, healthcare, and overall well-being. By having life insurance, families can ensure that their children's education is funded, their healthcare needs are met, and their overall quality of life is preserved.

In the event of a tragic death, life insurance policies provide a lump sum payout or regular income payments to the beneficiaries. This financial support can cover various expenses, such as mortgage or rent payments, utility bills, groceries, transportation costs, and even everyday living expenses. With this financial backing, the family can continue to live in their home, maintain their current standard of living, and avoid the financial strain of sudden income loss.

Moreover, life insurance can also help with long-term financial goals. The policy's death benefit can be used to pay for a child's college education, fund a business venture, or even be invested to grow over time. This ensures that the family's financial future is secure, and their long-term aspirations remain intact. By providing this financial security, life insurance empowers families to make decisions and plan for the future with confidence.

In summary, life insurance is an essential tool for lifestyle maintenance. It ensures that families can continue to live comfortably, meet their daily needs, and plan for the future. With the financial security provided by life insurance, families can navigate life's challenges and unexpected events with greater peace of mind, knowing that their loved ones' well-being is protected. It is a wise investment that offers long-term benefits and helps build a resilient financial foundation for the family.

Should Employees Decline Life Insurance Over $50k?

You may want to see also

Frequently asked questions

Life insurance is a crucial financial tool that ensures the financial stability and security of a family in the event of a breadwinner's untimely death. It provides a financial safety net, allowing the family to maintain their standard of living and cover essential expenses, such as mortgage payments, utility bills, education costs, and daily living expenses. This protection is especially vital for families with dependents, as it ensures that the financial responsibilities of the deceased are met, providing peace of mind and long-term financial security.

The long-term benefits of life insurance are significant. It enables families to plan for the future, such as saving for their children's education or building a nest egg for retirement. With the financial burden of unexpected expenses lifted, the family can focus on long-term financial goals and investments. Additionally, life insurance can provide a tax-free death benefit, which can be used to pay off debts or leave a legacy for beneficiaries, ensuring a more secure future for the entire family.

No, life insurance should not be considered a replacement for other financial planning strategies. While it provides essential protection, it is just one part of a comprehensive financial plan. Other forms of financial planning, such as savings accounts, retirement plans, and investment portfolios, are crucial to building wealth and achieving long-term financial goals. Life insurance complements these strategies by offering immediate financial support during challenging times, ensuring that the family's financial well-being is protected.

There are several types of life insurance policies that can provide income protection for a family. Term life insurance offers coverage for a specific period, typically 10, 20, or 30 years, and is ideal for covering short-term financial obligations. Permanent life insurance, such as whole life or universal life, provides lifelong coverage and includes a savings component, allowing for potential cash value accumulation. Additionally, whole life insurance offers guaranteed death benefits and fixed premiums, making it a reliable choice for long-term income protection.