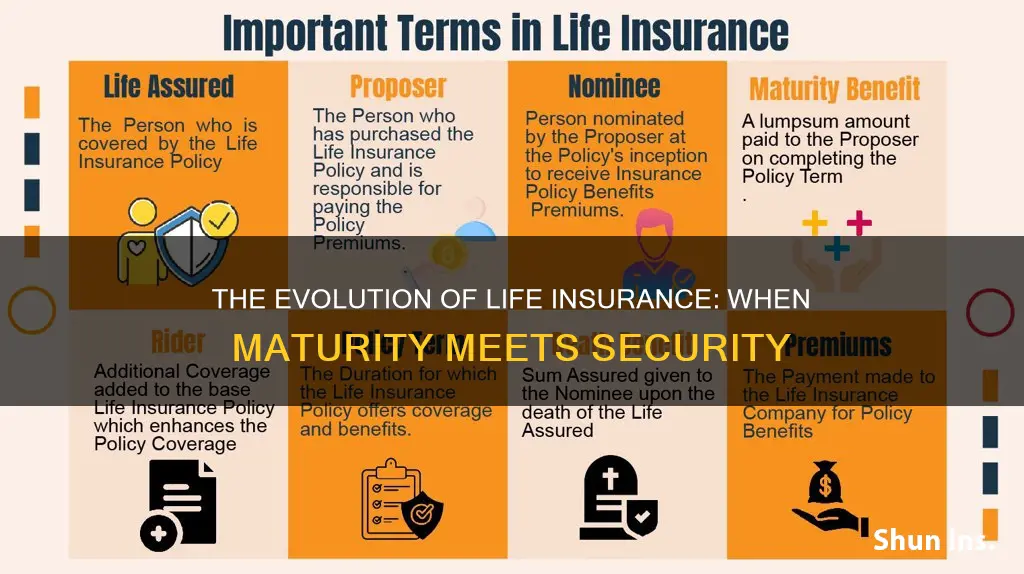

When life insurance matures, it means that the policyholder has reached the end of the term or the specified period for which the insurance was taken out. At this point, the insurance company pays out the death benefit to the beneficiaries named in the policy. This payout can provide financial security and peace of mind for the loved ones left behind, ensuring that their financial obligations are met and their future needs are taken care of. Understanding the maturity process and the options available can help individuals make informed decisions about their life insurance coverage and ensure that their loved ones are adequately protected.

What You'll Learn

- Payout Process: The steps and documentation required to receive the insurance payout

- Tax Implications: How the maturity of life insurance affects tax obligations

- Beneficiary Selection: The importance of choosing beneficiaries and their rights

- Policy Termination: Conditions under which a policy can be terminated

- Maturity Payout Options: The various ways the payout can be received

Payout Process: The steps and documentation required to receive the insurance payout

When a life insurance policy matures, it means the policyholder has passed away, and the beneficiary or beneficiaries are entitled to receive the insurance payout. The payout process can vary slightly depending on the insurance company and the type of policy, but there are generally a few key steps and documents involved. Here's a detailed breakdown of the process:

Step 1: Notification and Claim Filing: The first step is to notify the insurance company of the policyholder's death. This can typically be done by the beneficiary or the designated representative. The insurance company will then request specific documentation to initiate the claim process. This usually includes a certified copy of the death certificate, which is a legal document confirming the individual's passing. Other documents may include the original insurance policy, the beneficiary's identification, and any additional paperwork the insurance company requires.

Step 2: Claim Review and Verification: Upon receiving the documents, the insurance company will review the claim to ensure all the information is accurate and complete. They will verify the policyholder's identity, the cause and date of death, and the beneficiary's details. This step is crucial to prevent fraud and ensure the payout goes to the rightful person(s). The insurance company may also contact the beneficiary to confirm the details and provide an opportunity to ask questions or provide additional information.

Step 3: Payout Processing: If the claim is approved, the insurance company will proceed with the payout. The process can vary depending on the policy type. For term life insurance, the payout is often a lump sum payment. For whole life or universal life policies, the payout might include a combination of a death benefit and any accumulated cash value. The insurance company will notify the beneficiary of the payout amount and the method of payment, which could be via bank transfer, check, or another agreed-upon method.

Step 4: Distribution of Payout: The beneficiary has the right to choose how the payout is distributed. This could be a single lump sum payment, an annuity providing regular payments over time, or a combination of both. The insurance company will work with the beneficiary to set up the distribution according to their preferences. It's important to note that tax implications may apply, and the beneficiary should consult a financial advisor or tax professional for guidance.

Documentation Required: Throughout this process, maintaining proper documentation is essential. The beneficiary should keep all original documents, including the death certificate, insurance policy, and any communication from the insurance company. These records will be necessary for future reference, especially if there are any disputes or questions regarding the payout. Additionally, keeping a copy of the payout distribution plan and any financial advice received is advisable.

Remember, the specific steps and requirements may vary, so it's essential to review your insurance policy and consult with the insurance company's customer service or a financial advisor to understand the process better and ensure a smooth payout experience.

Understanding Life Insurance Escheats and Their Timelines

You may want to see also

Tax Implications: How the maturity of life insurance affects tax obligations

When life insurance matures, it means the policy has reached the point where the death benefit is paid out to the beneficiaries. This event can have significant tax implications for the policyholder and the beneficiaries. Understanding these tax considerations is crucial to ensure compliance with the law and to make informed financial decisions.

The tax treatment of life insurance proceeds depends on the type of policy and the beneficiary status. Generally, life insurance death benefits are not subject to income tax for the beneficiaries. This is because the proceeds are considered a form of insurance compensation, which is typically exempt from taxation. However, there are some exceptions and nuances to consider.

For instance, if the policyholder is the sole beneficiary and the policy is owned by an individual, the proceeds are generally tax-free. But if the policy is owned by a trust or an entity, the tax treatment can vary. In some cases, the trust or entity may be taxed on the income generated from the policy, and the death benefit may be subject to estate tax. It's important to note that the tax laws regarding life insurance can be complex and may vary depending on the jurisdiction.

Additionally, if the policyholder is not the sole beneficiary, the tax implications can change. For example, if the policy has multiple beneficiaries or if the policy is part of a retirement plan, the tax rules become more intricate. In such cases, the proceeds may be subject to income tax for the beneficiaries, and the policyholder may need to consider gift tax implications if the policy is gifted to beneficiaries.

Furthermore, the maturity of life insurance can also impact the tax obligations of the policyholder. If the policyholder has paid significant premiums over the years, the cash value of the policy may grow. When the policy matures, the cash value can be withdrawn tax-free, providing financial flexibility. However, if the policyholder has not paid sufficient premiums, the policy may not have a substantial cash value, and the tax implications may be less favorable.

In summary, the maturity of life insurance can have various tax implications, including the tax-free status of death benefits for beneficiaries, potential tax obligations for trusts or entities, and the impact on the policyholder's tax obligations, especially regarding the cash value of the policy. It is essential to consult with tax professionals and insurance advisors to navigate these complexities and ensure compliance with tax laws.

KeyBank's Life Insurance Offerings: What You Need to Know

You may want to see also

Beneficiary Selection: The importance of choosing beneficiaries and their rights

When life insurance matures, it means the policyholder has passed away, and the insurance company is now obligated to pay out the death benefit to the designated beneficiaries. The selection of beneficiaries is a critical aspect of life insurance, as it determines who receives the financial support and assets provided by the policy. This process can be complex, and it's essential to understand the rights and considerations involved to ensure a smooth and fair distribution of the insurance proceeds.

Choosing beneficiaries is a personal decision that requires careful thought and planning. The policyholder has the freedom to select anyone they wish, including family members, friends, charities, or even themselves. It is a way to provide financial security and support to those who depend on the policyholder or to those causes they believe in. However, it is crucial to consider the potential legal and emotional implications of this choice. For instance, if a beneficiary is a minor, a trust may be required to manage the funds until they reach adulthood. Similarly, choosing a charity or a non-profit organization as a beneficiary can have tax benefits and ensure the policyholder's legacy continues in a meaningful way.

The rights of beneficiaries are protected by law, and insurance companies must adhere to these regulations. Once the policy is in force and the policyholder has passed away, the insurance company is legally obligated to pay the death benefit to the beneficiaries named in the policy. This process is often referred to as the 'maturity' of the policy. The beneficiaries have the right to receive the full amount specified in the policy, and they can claim the payout without any additional legal processes. It is the insurance company's responsibility to ensure a smooth and timely distribution of the funds.

In some cases, the policyholder may have the option to change or add beneficiaries, especially if the policy is flexible and allows for modifications. This can be useful if the policyholder's relationships or financial circumstances change. However, it is essential to understand the insurance company's policies regarding beneficiary changes and any potential fees or penalties associated with such modifications.

Lastly, it is worth noting that the selection of beneficiaries should be a well-informed decision. Beneficiaries should be chosen with a clear understanding of the potential impact of the choice. This includes considering the emotional and financial implications for the chosen individuals or entities. Proper planning and communication with legal and financial advisors can help ensure that the policyholder's wishes are respected and that the beneficiaries' rights are protected.

Maximizing Cash Value in Veterans Group Life Insurance

You may want to see also

Policy Termination: Conditions under which a policy can be terminated

When it comes to life insurance policies, understanding the conditions under which a policy can be terminated is crucial for both the policyholder and the insurance company. Termination of a life insurance policy can occur under various circumstances, and being aware of these conditions can help individuals make informed decisions regarding their insurance coverage. Here are some key points to consider:

Policyholder's Option to Terminate: In many cases, the policyholder has the right to terminate the policy at any time. This is often referred to as the "right of surrender." If the policyholder decides to terminate, they can return the policy to the insurance company and receive a cash value, which is the accumulated value of the premiums paid minus any outstanding loans or interest. This option provides flexibility, especially if the policyholder's financial situation changes or if they no longer require the insurance coverage.

Insurance Company's Right to Terminate: Insurance companies also have the authority to terminate a policy under certain conditions. One common reason is non-payment of premiums. If the policyholder fails to make the required premium payments on time, the insurance company may terminate the policy. Additionally, if the insured individual's health condition significantly deteriorates, making them a higher risk, the insurance company might choose to terminate the policy to avoid potential financial losses.

Maturity and Lapse: Life insurance policies typically have a maturity date, which is the date when the policy's coverage ends. If the insured individual passes away before the maturity date, the policy matures, and the death benefit is paid out. However, if the policyholder does not pay the required premiums, the policy can lapse. Lapse occurs when the policy is no longer in force due to non-payment, and the coverage ends. In such cases, the policyholder may have the option to reinstate the policy, but it often comes with additional costs and medical examinations.

Policy Termination and Benefits: When a policy is terminated, the insurance company usually returns the cash value to the policyholder. This amount can be used for various purposes, such as paying off debts, investing, or simply keeping it as savings. It's important to note that the cash value grows over time, and the earlier the termination, the lower the cash value may be. Additionally, some policies offer the option to convert the cash value into a different type of insurance or investment product.

Understanding the conditions of policy termination is essential for managing and optimizing one's life insurance coverage. It allows individuals to make informed decisions regarding their insurance needs and ensures that they are aware of their rights and options as policyholders.

Understanding Guaranteed Issue Life Insurance: A Comprehensive Guide

You may want to see also

Maturity Payout Options: The various ways the payout can be received

When a life insurance policy matures, it means the policy has reached the end of its term, and the beneficiary is entitled to receive the death benefit or maturity payout. This payout is a significant financial sum and can be received in various ways, each with its own set of advantages and considerations. Here are some of the common maturity payout options:

Lump Sum Payment: This is the most straightforward option, where the entire maturity amount is paid out as a single, large sum to the beneficiary. A lump sum provides immediate access to the full financial value, allowing the recipient to make significant investments, pay off debts, or plan for the future. It offers flexibility and can be a substantial financial boost, especially if the policyholder has accumulated a substantial death benefit. However, the lump sum may be subject to income tax, and the timing of the tax payment can impact the overall value received.

Regular Income Stream: Some life insurance policies offer the option to receive the maturity payout over a period as a regular income stream. This can be structured as an annuity, providing a steady income for a specified number of years or for the policyholder's lifetime. Regular income streams are particularly useful for those seeking financial security and a consistent income source. It can be an attractive choice for retirees or individuals looking for long-term financial planning. The amount paid out each period is typically calculated based on the policy's terms and the insured individual's life expectancy.

Partial Payout and Savings Option: Another strategy is to take a partial payout and reinvest the remaining amount to grow over time. This approach allows the beneficiary to access a portion of the funds immediately while also building a savings or investment portfolio. The reinvested amount can be invested in various financial instruments, such as stocks, bonds, or mutual funds, potentially generating returns over the long term. This option provides a balance between accessing funds and preserving wealth for future generations.

Loan or Advance against Future Payout: In some cases, policyholders can opt to borrow against the maturity payout. This involves taking a loan, typically at a low-interest rate, secured by the future maturity amount. The loan can be used for various purposes, such as business ventures, home improvements, or education expenses. However, it's essential to carefully consider the terms and potential risks associated with this option, as defaulting on the loan could result in the insurance company taking a lien on the policy's value.

Understanding these maturity payout options is crucial for policyholders and beneficiaries to make informed decisions about their financial future. Each option has its own tax implications, benefits, and potential drawbacks, so seeking professional advice is recommended to choose the most suitable approach based on individual circumstances and financial goals.

Is California's Life Insurance Exam a Breeze?

You may want to see also

Frequently asked questions

Life insurance typically matures, or becomes payable, upon the death of the insured individual. The maturity of the policy is contingent on the fulfillment of the policy's terms and conditions, including the payment of premiums and the satisfaction of any other requirements specified by the insurance company.

If the insured individual is still alive when the policy matures, the life insurance policy will not pay out any death benefit. The policy may continue to be in force, and premiums may still need to be paid, but the maturity of the policy does not trigger a payout in this scenario.

Yes, in some cases, the maturity date can be altered. This often requires the consent of the insured person and may involve additional fees or adjustments to the policy terms. Changing the maturity date can be useful for those who want to align the policy's payout with specific financial goals or life events.

The maturity amount is typically the death benefit specified in the policy. This is the amount that the beneficiaries of the policy will receive upon the insured's death. The death benefit can be a fixed sum, a percentage of the policy's cash value (if any), or an amount based on the insured's age and health at the time of policy issuance.

The tax treatment of a life insurance payout can vary depending on the jurisdiction and the type of policy. In many cases, the death benefit received by beneficiaries is generally tax-free. However, if the policy has a cash value component and is surrendered for a payout before maturity, there may be tax consequences, especially if the policy has been in force for a significant period. It's advisable to consult tax professionals for specific guidance.