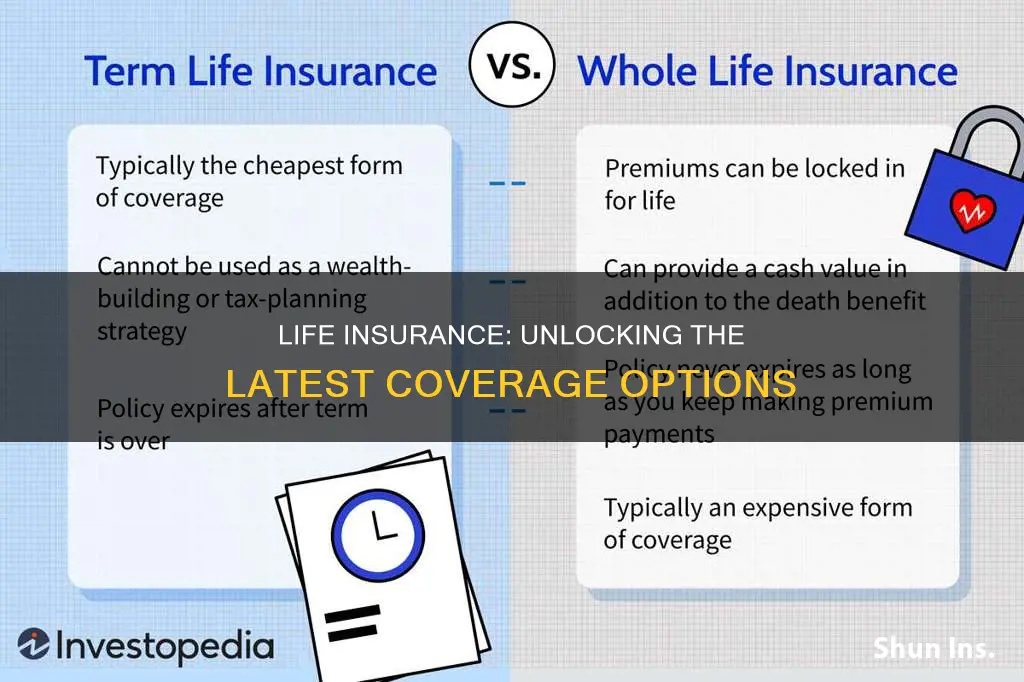

Life insurance is a crucial financial tool, and understanding the latest coverage options is essential for making informed decisions. The term of life insurance is a popular choice, offering coverage for a specified period, typically 10, 15, 20, or 30 years. Recent developments in the insurance industry have led to innovative products and features, allowing individuals to tailor their coverage to their specific needs. This paragraph will explore the latest trends and advancements in term life insurance, highlighting the benefits and considerations for those seeking comprehensive protection during their chosen term.

What You'll Learn

- Policy Duration: Understand how long a term life insurance policy lasts

- Renewal Options: Learn about extending coverage after the initial term

- Conversion Features: Discover how to convert term life to permanent insurance

- Rate Increases: Explore factors affecting premium increases over time

- Term Lengths: Compare different term lengths and their benefits

Policy Duration: Understand how long a term life insurance policy lasts

When considering term life insurance, understanding the policy duration is crucial as it defines the length of time the insurance coverage is in effect. This duration is typically a specified period, often ranging from 10 to 30 years, and it's essential to choose a term that aligns with your financial goals and obligations. The primary purpose of term life insurance is to provide financial security during a specific period, ensuring that your loved ones are protected in the event of your untimely passing.

The policy duration is a critical factor in determining the cost of the insurance. Longer-term policies generally come with higher premiums, as the insurance company assumes a greater risk over an extended period. Conversely, shorter-term policies offer more affordable premiums, but the coverage may not be as comprehensive. It's a trade-off between cost and the level of protection provided. For instance, a 10-year term policy might be suitable for those with short-term financial obligations, while a 30-year term could be ideal for individuals with long-term commitments like mortgage payments or children's education expenses.

When selecting a policy duration, consider your personal circumstances and future plans. If you have a mortgage or other long-term debts, a longer term might be necessary to ensure your family can pay off these obligations in your absence. Additionally, if you have young children, a longer term could provide financial security until they become financially independent. It's a strategic decision that requires careful thought and an understanding of your family's needs.

It's worth noting that term life insurance policies often offer flexibility in terms of policy duration. Some insurers provide the option to convert a term policy into a permanent life insurance policy after a certain period, allowing you to extend coverage indefinitely. This conversion privilege can be valuable if you decide to increase your coverage or want to ensure long-term protection.

In summary, the policy duration is a critical aspect of term life insurance, impacting both the cost and the level of protection. It requires careful consideration of your financial obligations and future plans. By understanding the various term lengths available and their implications, you can make an informed decision to ensure your loved ones are adequately protected.

Discontinuing Colonial Life Insurance: A Step-by-Step Guide

You may want to see also

Renewal Options: Learn about extending coverage after the initial term

When it comes to life insurance, understanding the renewal options is crucial, especially if you've chosen a term policy. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. After this initial term, the policy may or may not offer the option to renew, depending on the insurance company's policies and your overall health and lifestyle.

Renewing your life insurance policy is a way to maintain coverage beyond the initial term. This process is often straightforward and can be an excellent way to ensure your loved ones are protected even after the initial coverage period ends. Here's a breakdown of what you need to know about renewal options:

Review the Policy Documents: Before the initial term ends, carefully review your policy documents. These documents will outline the terms and conditions, including the renewal process. Look for information on whether the policy is convertible to a permanent life insurance plan or if there are specific conditions for renewal. Understanding these details early on can help you make informed decisions.

Health and Lifestyle Considerations: Insurance companies often require a medical examination or health questionnaire before renewing a policy. This is because your health and lifestyle factors can impact the renewal terms. If you've made positive changes to your lifestyle, such as quitting smoking or improving your diet, you may be eligible for better renewal rates. Conversely, significant health changes or lifestyle risks might require additional medical assessments.

Renewal Process: The renewal process typically involves contacting your insurance provider and expressing your intention to renew. They will guide you through the necessary steps, which may include a medical examination or providing updated health information. The insurance company will then assess your eligibility and determine the new premium rates. It's essential to be transparent about any changes in your health or lifestyle during this process.

Conversion to Permanent Insurance: In some cases, term life insurance policies offer the option to convert to a permanent life insurance plan after the initial term. This conversion allows you to maintain coverage for the rest of your life, providing long-term financial security. If this option is available, it can be a valuable way to ensure your loved ones are protected indefinitely.

Negotiation and Comparison: When it comes to renewal, it's a good idea to shop around and compare offers from different insurance providers. Insurance companies may have varying renewal rates and policies, so negotiating and comparing can help you secure the best terms. Additionally, consider your current financial situation and whether you can afford the renewed premium rates.

Understanding the renewal process and options is essential for maintaining long-term life insurance coverage. It allows you to make informed decisions about your future and ensures that your loved ones remain protected. Remember to review your policy documents, stay transparent about your health, and explore the various renewal and conversion options available to you.

Choosing Life Insurance: Finding the Most Trustworthy Option

You may want to see also

Conversion Features: Discover how to convert term life to permanent insurance

Term life insurance is a popular and affordable way to protect your loved ones financially during a specific period, typically 10, 20, or 30 years. It provides a death benefit if you pass away during the term, offering peace of mind and financial security for your family. However, as your life circumstances change, you might find that you no longer need the same level of coverage or that your needs have evolved. This is where the concept of converting term life insurance to permanent insurance comes into play, allowing you to adapt your policy to your changing needs.

Converting your term life insurance policy to a permanent one offers several advantages. Firstly, it provides lifelong coverage, ensuring that your loved ones are protected even after the initial term has expired. Permanent insurance, such as whole life or universal life, builds cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. This feature is particularly useful if you want to build a substantial nest egg for your retirement or other long-term financial goals. Additionally, permanent insurance policies often offer a fixed interest rate, providing stability and predictability in your premiums.

The conversion process is straightforward and typically involves the following steps. First, review your current term life insurance policy to understand its terms and conditions, including any conversion options. Contact your insurance provider to discuss your options and express your interest in converting to a permanent policy. They will guide you through the process, which may involve a medical examination to assess your current health and determine the new policy's terms. Once approved, the conversion will be processed, and you'll start paying premiums for your new permanent insurance policy.

When considering a conversion, it's essential to evaluate your current financial situation and future goals. Permanent insurance can be a significant long-term commitment, so ensure that the increased premiums align with your budget and that the coverage meets your evolving needs. It's also a good idea to compare different types of permanent insurance to find the best fit for your requirements. By converting your term life insurance, you can ensure that your financial protection remains in place while also building a valuable asset that can grow over time.

In summary, converting term life insurance to permanent coverage is a strategic decision that allows you to adapt to changing life circumstances while maintaining financial security. It provides lifelong protection, builds cash value, and offers stability in premiums. By understanding the conversion process and evaluating your needs, you can make an informed choice, ensuring that your insurance policy remains a valuable asset throughout your life's journey.

Binding Receipts: Life Insurance's Essential Document

You may want to see also

Rate Increases: Explore factors affecting premium increases over time

The cost of life insurance premiums can fluctuate over time, and understanding the factors that influence these rate increases is essential for both insurers and policyholders. One of the primary drivers of premium increases is the changing demographics and health trends of the insured population. As people age, the risk of developing health issues increases, and this is reflected in the insurance rates. For instance, older individuals are generally considered higher-risk for insurers, leading to higher premiums. This is especially true for those with pre-existing medical conditions, as their life expectancy and potential healthcare costs may be higher.

Another critical factor is the overall health and lifestyle of the insured. Insurers often consider factors such as smoking, excessive alcohol consumption, and a sedentary lifestyle when determining rates. These behaviors can significantly impact an individual's health and longevity, thereby affecting the insurer's financial risk. For example, a recent study revealed that smokers pay, on average, 50% more in life insurance premiums compared to non-smokers, as smoking is a major risk factor for various health issues.

Additionally, the economic environment plays a significant role in rate increases. During periods of economic downturn or financial instability, insurers may adjust their rates to account for the potential increase in mortality rates and the cost of providing financial security. Economic factors can also influence the investment returns of insurance companies, which directly impact their ability to offer competitive rates. When investment returns are low, insurers might need to increase premiums to maintain their financial stability.

Furthermore, advancements in medical technology and healthcare can also contribute to rate changes. Improved medical treatments and a better understanding of health conditions can lead to longer life expectancies, which may prompt insurers to reassess their risk assessments and adjust rates accordingly. For instance, the development of new drugs or treatments for previously incurable diseases can reduce the overall risk profile of a population, potentially leading to lower insurance premiums.

In summary, rate increases in life insurance are influenced by a multitude of factors, including demographics, health trends, lifestyle choices, economic conditions, and medical advancements. Insurers must carefully consider these factors to ensure they can provide adequate coverage while maintaining financial stability. Policyholders should also be aware of these influences to make informed decisions when selecting and reviewing their life insurance policies. Staying informed about these trends can help individuals navigate the complex world of life insurance and ensure they receive the best value for their premium dollars.

Get Your Illinois Life Insurance License: A Guide

You may want to see also

Term Lengths: Compare different term lengths and their benefits

When considering term life insurance, the duration of coverage, or term length, is a critical factor to evaluate. The term length determines how long the policy will provide financial protection for your loved ones in the event of your passing. Here's a breakdown of various term lengths and their advantages:

Long-Term Coverage (30 Years or More):

Choosing a longer term length, such as 30 years or more, offers comprehensive protection for your beneficiaries. This option ensures that your loved ones are covered for an extended period, providing a safety net during their most significant financial commitments, such as raising children, paying off a mortgage, or funding education. The longer term also allows for potential savings, as the premiums might be lower compared to shorter terms, especially if you're young and in good health. Over time, the policy can accumulate cash value, which can be borrowed against or withdrawn, providing additional financial flexibility.

20-Year Term:

A 20-year term is a popular choice for those seeking a balance between coverage and cost. This term length is often chosen by individuals who want to protect their families during specific life stages, such as when they have young children or are paying off a mortgage. The 20-year term provides a clear end date, ensuring that the coverage aligns with your specific needs. As the term progresses, the premiums may increase, but it offers a more affordable option compared to longer terms.

10-Year Term:

A 10-year term is ideal for those who want temporary coverage or have a short-term financial obligation. This term length is often selected by individuals who want to protect their families during a specific project or goal, such as starting a business or paying off a debt. The 10-year term provides a defined period of coverage, and after the term ends, the policy may be renewed or converted to a permanent life insurance policy if needed.

5-Year Term:

The 5-year term is the shortest term length available and is suitable for those who want temporary coverage with the lowest possible cost. This option is often chosen by individuals who want to test the waters with life insurance or have a short-term financial need. After the 5-year term, the policy may be renewed, and the coverage can be adjusted based on changing circumstances.

Renewable Terms:

Many term life insurance policies offer renewable terms, allowing policyholders to extend coverage beyond the initial term. This feature provides flexibility, especially for those who want to ensure long-term protection. Renewable terms often come with the option to increase coverage amounts as needed, ensuring that your loved ones are always adequately protected.

When selecting a term length, it's essential to consider your financial situation, life goals, and the level of coverage required. Longer terms provide more comprehensive protection, while shorter terms offer flexibility and lower costs. Assessing your specific needs will help you choose the most suitable term length for your term life insurance policy.

Understanding Conversion Privilege in Life Insurance Policies

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance that provides coverage for a specific period, or "term," typically ranging from 10 to 30 years. It offers a straightforward way to protect your loved ones financially during a defined period.

The latest term life insurance policies offer coverage for a predetermined period, and the premium remains consistent throughout the term. If the insured individual passes away during the term, the beneficiary receives the death benefit. After the term ends, the policy may lapse unless renewed or converted to a permanent life insurance policy.

The latest term life insurance policies often offer coverage terms of 10, 15, 20, 25, or 30 years. Some insurers may provide even longer terms, but the most common and popular options are the above durations.

Yes, many term life insurance companies offer the option to renew your policy after the initial term ends. This process is known as conversion, and it allows you to continue your coverage without a medical examination. However, the premium may increase, and the coverage amount might be adjusted based on your age and health at the time of renewal.

Term life insurance has evolved over time, and recent changes include more flexible coverage options, improved underwriting processes, and the introduction of digital applications. Some insurers now offer guaranteed acceptance for certain coverage amounts, making it more accessible for individuals with pre-existing conditions. Additionally, the availability of term life insurance with no medical exam has increased, providing convenience for policyholders.