Whole life insurance is a type of insurance policy that has both a death benefit and a cash value. While Quicken does not provide a way to track whole life insurance, there are some workarounds that can be used. One suggestion is to create an asset account and set the opening balance to the value of the policy. Another option is to track it as a savings or checking account, allowing you to transfer money to it and track the balance and any transactions. It is important to note that term life insurance policies, which do not have a cash value, would typically not be tracked in Quicken.

| Characteristics | Values |

|---|---|

| How often to track whole life insurance | Depends on the type of policy. Term insurance policies typically have no value and would not be tracked. Whole life policies have a cash value that can be tracked. |

| How to track whole life insurance | Track as an asset account or a savings account. |

| How to track premium payments | Track as an expense item. |

| How to track the death benefit | The death benefit is not relevant to the policyholder but their heirs. It can be added to the will and other important paperwork. |

What You'll Learn

Tracking whole life insurance as an asset

Whole life insurance is a type of insurance policy that covers the insured for their entire life, rather than for a specific term. These policies often have a cash surrender value, which means they can be considered an asset and should be tracked as their value changes.

Quicken for Windows

If you are using Quicken for Windows, you can track your whole life insurance policy as an asset by creating an Other Asset and Liability account. Within this category, you can select Property, Vehicle, or Assets as the specific type of account. You can then set the opening balance of this account to the value of your whole life insurance policy.

Quicken for Mac

For Quicken for Mac users, the best way to track a whole life insurance policy may be to create a savings or checking account. By doing so, you can transfer money to the account (representing your premium payments) and track the balance as it accumulates (representing the cash value of the policy). You can also track withdrawals, interest payments, fees, and other transactions associated with the policy.

Tracking Expenses

Regardless of the type of Quicken you are using, it is important to note that premium payments made towards your whole life insurance policy should be tracked separately as expenses. These payments do not typically add to the value of the policy itself.

Tracking Death Benefit

While the cash value of a whole life insurance policy can be considered an asset, the death benefit or face value of the policy is typically not included in the policyholder's net worth. This is because the death benefit is only payable upon the death of the insured and is usually received by the policyholder's heirs.

Tracking Expiration Date

Currently, Quicken does not have a built-in feature to track the expiration date of insurance policies. However, you can set up a reminder in the Alert Center under the Tools Menu or create a Scheduled Reminder in one of your Cash accounts to remind you when the policy is nearing its expiration date.

Life Insurance Interest: Myth or Reality?

You may want to see also

Adding whole life insurance to Quicken

Whole life insurance is a type of insurance policy that covers the insured for their entire life, rather than for a specific term. It has both a cash value and a death benefit. The cash value is the amount of money that the policyholder can access during their lifetime, while the death benefit is the amount that will be paid out to beneficiaries upon the insured's death.

When it comes to adding whole life insurance to Quicken, there are a few different approaches that users have suggested. One common suggestion is to treat the policy as an asset, as the cash value can be treated as cash at any time. To do this, you can add the policy as an asset account and set the opening balance to the current cash value of the policy. You can then track any premium expenses in your spending accounts under the "Insurance: Life" category. It is important to note that the death benefit should not be included as an asset, as it will only be paid out to your heirs upon your death.

Another approach is to treat the policy as an investment account. This can be done by adding the total amount tracked or creating a single asset. You can then withdraw the decrease in cash value over time as premiums. This method may be more suitable if you are making regular payments into the policy.

Alternatively, some users have suggested tracking the policy as a checking or savings account. This allows you to transfer money into the account (representing your payments) and see the balance accumulate (representing the cash value). You can also track withdrawals, loans, interest payments, and fees.

It is worth noting that Quicken does not currently have a specific feature for tracking life insurance policies, and you may need to manually update the values periodically. Additionally, it is important to seek professional financial advice before making any decisions regarding your insurance policies.

Teamsters Life Insurance: Interest Included or Excluded?

You may want to see also

Whole life insurance as an investment account

Whole life insurance is a type of permanent life insurance that offers coverage and accumulates a cash value over time. This type of insurance is not suitable for everyone due to its high cost and low rate of return. However, it can be a good investment for individuals who have maxed out their retirement accounts and are looking for additional tax-deferred savings. It is also a good option for those with lifelong financial dependents, such as parents of children with disabilities, as it provides lifelong coverage and financial stability. Additionally, the cash value component makes it a form of "forced savings," which can help loved ones pay estate taxes without dipping into other accounts.

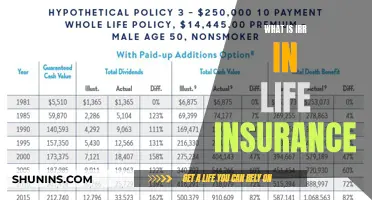

When considering whole life insurance as an investment account, it is important to understand how it works. Whole life insurance provides permanent coverage and accumulates a cash value. When you pay your premium, a portion of it is invested by the insurer to give your policy a cash value. This cash value grows over time at a fixed rate guaranteed by the insurer and is tax-deferred, meaning any interest earned is not taxed as long as the funds remain in the policy. You can take out loans against your policy once you have accumulated enough cash value. While you don't have to pay back these loans, your insurer will subtract any outstanding amount from the payout upon your death.

Whole life insurance can be a valuable addition to your financial portfolio for several reasons. Firstly, it offers death benefit protection, providing financial security for your family in the event of your passing. Secondly, it allows you to pursue cash value growth that is not subject to market risk, complementing fixed-income investments. Thirdly, it serves as a replacement for your human capital, ensuring your family's financial stability even if you're no longer around. Fourthly, it is a good solution for retirement and asset safeguarding, as the cash value can help pay for significant expenses such as a new home or starting a business. Finally, whole life insurance is excellent for "reinvesting" dividends, allowing you to purchase additional coverage, providing more death benefit protection and increasing cash value accumulation.

While whole life insurance has its advantages, there are also some drawbacks to consider. The premiums tend to be much higher than term life insurance, making it expensive for some individuals. Additionally, the cash value takes time to grow, and it may take 10 to 15 years or longer to accumulate enough to borrow against. The rate of return on the cash value is also relatively low, typically ranging from 1% to 3.5%. Furthermore, you cannot control your investment portfolio, as the insurance company declares the dividend or interest rate and manages the investments. Lastly, there can be tax implications if you withdraw cash from your policy, and you may be subject to income tax on the amount that exceeds the policy basis.

AIG Life Insurance: Is It a Smart Choice?

You may want to see also

Tracking whole life insurance premiums

Quicken does not provide a straightforward way to track whole life insurance policies. However, there are a few workarounds that you can use to track your premiums and policies.

Firstly, it is important to distinguish between term life policies and whole life policies. Term life policies typically have no value and would not be tracked in Quicken, whereas whole life policies have a cash surrender value and should be tracked as an asset in Quicken.

If you have a whole life policy, you can create an asset account in Quicken specifically for your life insurance. You can name it "Life Insurance" or something similar. When you make a premium payment, transfer the portion that goes towards the cash value of the policy to this asset account. This will help you track the value of your policy over time.

Additionally, you can use the comments or memo section of the account to record important information such as the current death benefit or any other relevant details.

For term life policies, you can still track your premium expenses in your spending accounts under the "Insurance: Life" category. This will help you keep a record of your payments without including the policy as an asset.

It is worth noting that some users have suggested tracking term life policies as an asset account with a value equal to the policy's face value. However, this may distort your net worth, as the face value is typically only payable upon death and is not an asset you currently own.

By using these methods, you can effectively track your whole life insurance premiums and policies in Quicken, even though it does not have a built-in feature for this specific purpose.

Life Insurance Beneficiaries: Aliens and Legal Status

You may want to see also

Tracking whole life insurance cash value

Quicken does not provide a straightforward way to track whole life insurance policies. However, there are a few workarounds that users have suggested.

One approach is to create an Asset account for each policy and use the register to track the cash value. To do this, go to "Account Details > Display Options" and check the box for "Keep this account separate." This will ensure that the account does not show up in your net worth calculations. You can then update the balance via a split transaction to include any increase in cash value, dividends, or paid-up additions. Categorize these transactions as something like "DO NOT INCLUDE" so that they are excluded from your net worth calculations.

Another suggestion is to track the policy as a checking or savings account. This way, you can transfer money to it (your payments) and the balance will accumulate (cash value). You can also track withdrawals (loans), interest payments, fees, etc.

It is important to note that the face value of the insurance policy should not be included in your Quicken records as it will distort your net worth. Instead, focus on tracking the current cash value, which can be found in your policy documents. Additionally, premiums paid should be tracked as expenses.

Users have also suggested that it would be beneficial to have alerts for policy expiration dates and a way to track term life insurance policies separately from whole life insurance policies.

Understanding Life Insurance Dividends Calculation Process

You may want to see also

Frequently asked questions

You can track the cash value of a whole life insurance policy as an asset account. You can also track premium expenses in your spending accounts as an Insurance: Life category.

The death benefit of a whole life insurance policy should not be included in your net worth calculation as it will not be paid out to you.

Term life insurance policies typically have no value and therefore do not need to be tracked in Quicken. However, you can track the fees (premiums) paid as expense items.