Life insurance is a contract between the policyholder and the insurance company. The policyholder pays premiums, and the insurer pays a fixed amount, called a death benefit, to the policy beneficiaries after the policyholder's death. The cost of life insurance depends on several factors, including age, gender, health, occupation, and lifestyle. The average cost of life insurance is $26 a month for a 40-year-old with a 20-year, $500,000 term life policy. However, rates can vary based on the type of policy, coverage amount, and length of coverage. Term life insurance is generally the most affordable option, while whole life insurance and universal life insurance are more expensive due to their lifelong coverage and investment components.

| Characteristics | Values |

|---|---|

| Average cost of life insurance | $26 a month |

| Average cost of term life insurance | $160 a year |

| Average cost of permanent life insurance | More than term life insurance |

| Average cost of whole life insurance | $1,003 per month for a $1 million policy (40-year-old woman) |

| Average cost of universal life insurance | $674 per month for a $1 million policy (40-year-old man) |

| Average cost of life insurance without a medical exam | $197 a year |

| Average cost of term life insurance by risk class | Varies depending on risk factors |

| Average cost of life insurance by term length | Varies depending on term length |

| Average cost of life insurance for a 30-year-old | $14 a month ($162 a year) for a 20-year, $250,000 term life insurance policy |

| Average cost of life insurance for a 40-year-old | $19 a month ($227 a year) for a 20-year, $250,000 term life insurance policy |

| Average cost of life insurance for a 50-year-old | $40 a month ($485 a year) for a 20-year, $250,000 term life insurance policy |

| Average cost of life insurance for a 65-year-old | $266 monthly for a policy with $250,000 in coverage |

| Average cost of life insurance for a 70-year-old | $817 per month for a 10-year, $1 million term policy |

What You'll Learn

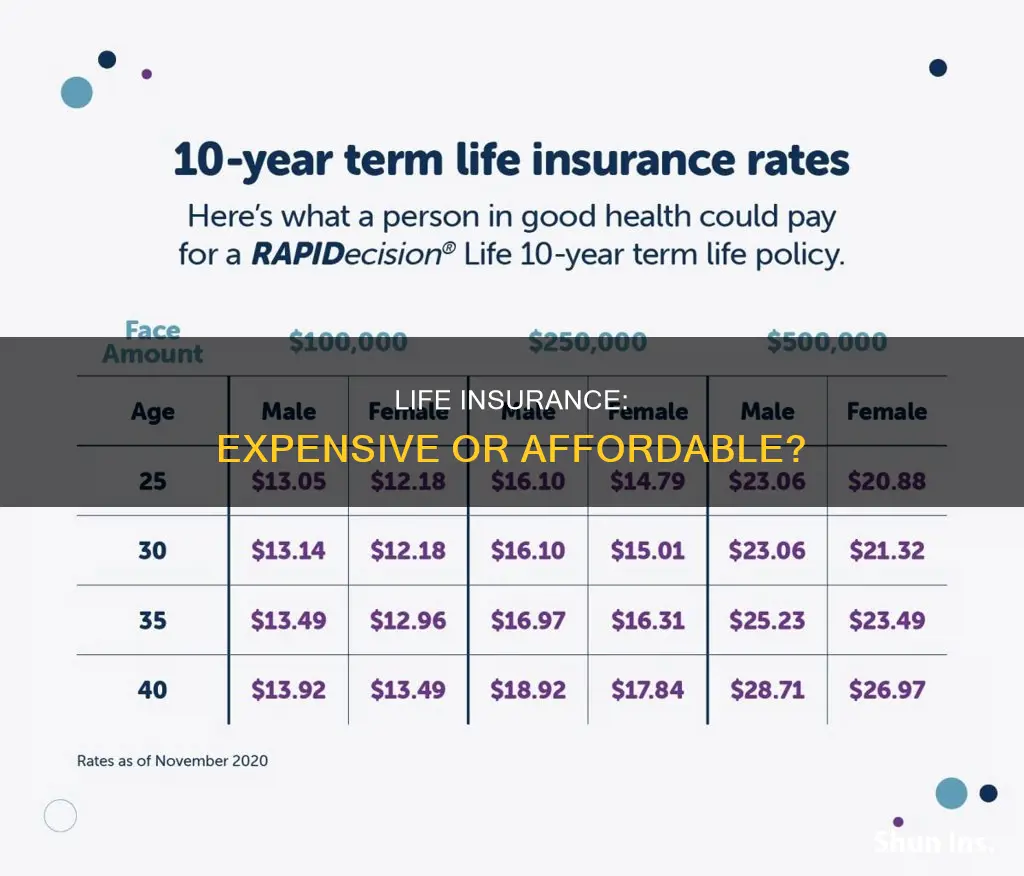

Life insurance costs for men vs women

The cost of life insurance is influenced by a variety of factors, including age, gender, health, and lifestyle choices. While age is typically the most significant predictor of life expectancy, gender is the second most important factor. Men and women tend to pay different rates for insurance, and this difference is particularly notable when it comes to life insurance.

On average, women have longer life expectancies than men. According to data from the U.S. Census Bureau, a female born in 2010 is expected to live to 81.4 years, while a male is expected to live to 75.6 years. This difference in life expectancy is reflected in the cost of life insurance, with women typically paying lower premiums than men. The gap in premiums may be relatively small at a younger age, but it becomes more significant as individuals get older. For example, at age 25, the difference in premiums is about 7%, while at age 65, it increases to 80%.

Several factors contribute to the gender disparity in life insurance costs. Firstly, men are generally more prone to certain health conditions that increase mortality risk, such as heart disease and hypertension. Secondly, men are more likely to work in high-risk industries, such as construction, mining, or logging, which increases the likelihood of accidents and fatalities. Additionally, men are more likely to engage in risky behaviours, such as smoking, heavy alcohol consumption, drug use, and extreme sports, which can also impact their life expectancy.

It is important to note that the difference in life insurance rates between men and women is not solely due to biological factors. Social and cultural factors, such as occupational hazards and lifestyle choices, also play a significant role. Furthermore, insurance companies use statistical data and risk assessment to determine premiums, and they are not allowed to set premiums based on factors such as race or religion.

While the cost of life insurance can vary depending on the insurance company and the individual's circumstances, it is generally more affordable than most people expect. The average cost of a term life insurance premium is around $160 per year, and even older individuals can find affordable options.

Whole Life Insurance: Living Benefits for Peace of Mind

You may want to see also

How age affects life insurance costs

Age is one of the most influential factors affecting life insurance premiums. The older you are, the more likely you are to fall ill or pass away, so the cost of insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The closer you are to your life expectancy, the more expensive it is to insure you.

The premium amount typically increases by an average of 8% to 10% for every year of age. This can be as low as 5% annually in your 40s and as high as 12% annually if you're over 50. The older you get, the steeper the increase in insurance costs becomes.

- A healthy 30-year-old woman can get a $20,000 term life insurance policy for less than $8 per month, while a 55-year-old woman might pay around $25.50 per month for the same coverage.

- A $50,000 policy for a healthy 25-year-old woman will cost approximately $14 per month, while a 55-year-old woman would pay $60 per month for the same coverage. For men, the same $50,000 policy would cost a 25-year-old male about $22.50 per month and a 55-year-old male $86.50 per month.

- The average monthly rate for life insurance is $22 for a 30-year-old, $32 for a 40-year-old, and $80 for a 50-year-old.

- A 35-year-old couple with a child might consider purchasing term life insurance policies with $500,000 in coverage over a 30-year term. This would provide financial support for the surviving spouse and child if one policyholder passes away.

- A middle-aged adult might opt for a 10-year term life insurance policy if they're close to retirement instead of a longer-term policy.

- Older adults may find it challenging to purchase life insurance, and many insurers stop issuing new policies to seniors over a certain age, typically around 80.

In summary, age significantly impacts life insurance costs, with premiums increasing as individuals get older due to the higher likelihood of health issues and shorter life expectancy.

Life Insurance: Who Gets the Payout?

You may want to see also

How health impacts life insurance costs

Health is one of the most significant factors in determining life insurance costs. Insurers typically assess an applicant's health by checking their medical records, collecting blood and urine samples for lab testing, or requiring them to undergo a medical examination. The healthier an individual is, the more affordable their policy will be.

Health factors that influence life insurance costs include:

- Pre-existing conditions: Applicants with serious or life-threatening conditions may be denied coverage or charged higher premiums.

- Medical history: Insurers consider past and current health problems, treatments, and prescription medications.

- Height and weight: Insurers often use Body Mass Index (BMI) as a measure of body fat. Being overweight is linked to higher mortality rates and may result in higher premiums.

- Blood pressure, cholesterol, and anxiety or depression: Managing these conditions through doctor-recommended treatments can help lower life insurance rates.

- Smoking and nicotine use: Any form of nicotine use, including cigarettes, smokeless tobacco, pipes, chewing tobacco, nicotine patches, e-cigarettes, and vaping, can result in higher rates.

- Family medical history: A history of hereditary or serious health conditions in the immediate family can affect premiums, especially if multiple family members have the same issue.

It is important to note that life insurance companies may deny coverage or increase rates if they discover any health issues during the underwriting process or if underwriting raises other concerns. Additionally, improving one's health through weight management, blood pressure control, or smoking cessation can help lower life insurance costs.

Term Rider: Life Insurance's Essential Add-On

You may want to see also

How risky hobbies affect life insurance costs

The cost of life insurance is influenced by a variety of factors, including age, gender, health, and lifestyle choices. While some factors, such as age and gender, are beyond an individual's control, lifestyle choices, including hobbies, can significantly impact the cost of life insurance. Engaging in risky hobbies can result in higher premiums or even exclusion from coverage by life insurance companies. These activities are often classified as "hazardous avocations," indicating a higher risk of injury or death, which increases the financial liability for insurers.

Some of the risky hobbies that can affect life insurance costs include:

- Skydiving: Insurance premiums and flat fees can increase for skydivers, especially those who jump more frequently. However, occasional jumps may only result in a modest additional fee.

- Rock climbing/Mountain climbing: Scaling walls within gyms is considered low risk, but outdoor climbing, especially at high altitudes, is deemed high-risk by most insurers.

- Racing (auto, motorcycle, boat): Racing is considered a hazardous activity, and insurers will consider factors such as frequency, speed, type of vehicle, and safety record when assessing the risk.

- Scuba diving: While the fatality rate for scuba diving is relatively low, some insurers view it as a high-risk activity. The depth of dives, frequency, and certification level can impact the insurance rates.

- Aviation (small, private plane amateur pilots): Recreational aviation is considered safer than commercial travel, but it still carries risks. Insurers will consider flight time, pilot licensure, and aircraft type when determining coverage and premiums.

- Hang gliding/Paragliding: While many enthusiasts are able to obtain life insurance, the type of aircraft, frequency of flights, and altitude can impact the cost of coverage.

- Big wave surfing: Surfing itself is not considered high-risk, but taking on sizable waves increases the risk significantly, leading to higher insurance rates for those who engage in this activity.

It is important to note that the impact of these risky hobbies on life insurance costs can vary depending on the insurer and the individual's circumstances. Some insurers may offer coverage with higher premiums, while others may exclude certain activities from their policies. Additionally, being honest about your hobbies when applying for life insurance is crucial, as misrepresenting your activities could invalidate your policy or result in a denied claim.

To obtain the most suitable coverage at a reasonable cost, it is recommended to consult with a knowledgeable insurance agent who can guide you in choosing the right insurer based on your specific hobbies and lifestyle.

Life Insurance and Marijuana: What You Need to Know

You may want to see also

How to lower life insurance costs

The cost of life insurance is determined by several factors, including age, gender, health, lifestyle, and the type of policy chosen. While some of these factors are uncontrollable, there are ways to lower the cost of life insurance. Here are some tips to help reduce your premiums:

Maintain a Healthy Weight:

Being overweight is associated with a higher risk of developing certain medical conditions, which can increase mortality rates. By staying within a healthy weight range, you can present yourself as a lower-risk individual to insurers, potentially qualifying for lower premiums. Most insurance companies use standard height and weight tables to determine what is considered a healthy weight.

Quit Smoking:

Smoking is a high-risk factor that significantly increases premiums. Insurers view the use of e-cigarettes and other nicotine-based products in the same light as smoking. The longer it has been since you last smoked, the better your rating will be. For example, not smoking for five or more years may qualify you for a "Preferred Plus" rating.

Manage Existing Medical Conditions:

If you have pre-existing medical conditions, such as high cholesterol, asthma, or high blood pressure, it's important to manage them effectively. Regular follow-ups with your doctor, adherence to prescribed medication, and compliance with your doctor's advice can help you secure better rates, even with a health issue.

Avoid High-Risk Hobbies and Occupations:

Engaging in hazardous hobbies like rock climbing, scuba diving, or skydiving can result in higher premiums. Similarly, occupations considered hazardous or high-risk, such as piloting, firefighting, commercial fishing, or logging, will typically lead to higher life insurance rates.

Apply Early:

Age is a significant factor in determining life insurance rates. The older you get, the higher the probability of developing health conditions, leading to higher premiums. Applying for life insurance at a younger age can help you secure lower rates for the duration of the policy.

Reduce the Face Value of Your Policy:

If you're facing financial difficulties, consider reducing the face value of your policy. Many term and permanent life insurance carriers allow you to do this once, helping you lower your premiums without losing all the benefits of your life insurance.

Reduce Your Premiums:

If you have a universal life or whole life policy with built-up cash value, you may be able to reduce your premiums without affecting the policy's guarantees. In some cases, this can allow you to skip payments or even stop making them for a period if you have sufficient cash value.

Purchase a Less Expensive Policy:

Term life insurance prices have been decreasing, so you may be able to find a new policy with similar benefits at a lower cost. If you have a whole life policy, consider a 1035 exchange, which allows you to transfer your cash value to another permanent policy, potentially cutting your premiums in half.

Compare Quotes:

Don't settle for the first quote you receive. Compare rates from multiple insurers to find the most affordable option for your needs. The more quotes you consider, the better your chances of finding a lower premium.

Haven Life vs AAA: Which Insurance is the Best?

You may want to see also

Frequently asked questions

The cost of life insurance depends on various factors, including age, gender, health, and occupation. The average cost is $26 a month for a 40-year-old with a 20-year, $500,000 term life policy.

The primary factors that influence the cost of life insurance are age and gender, with younger people generally paying less than older individuals, and women paying less than men due to longer life expectancies. Other factors include health, smoking status, occupation, and hobbies.

Term life insurance is typically more affordable than permanent life insurance, with an average cost of around $160 per year for a healthy 30-year-old. The cost varies based on the length of the term, the coverage amount, and individual factors.

Permanent life insurance, which includes whole life and universal life policies, is more expensive than term life insurance due to its lifelong coverage and investment component. The cost depends on factors such as age, gender, and coverage amount, with rates varying across providers.

To lower your life insurance premiums, you can improve your health, quit smoking, engage in fewer high-risk activities, choose the appropriate coverage amount, and compare rates from multiple insurers.