Life insurance is a financial vehicle that provides liquidity for individuals and businesses. Liquidity refers to how easily an asset can be converted into cash. Life insurance policies with a cash value component, such as whole life insurance, are considered liquid assets because the policyholder can withdraw money or surrender the policy for cash. This liquidity can be valuable for those with complex financial needs, such as retirement or emergency funds. Additionally, life insurance companies themselves are assessed based on their liquidity ratios, indicating their ability to meet financial obligations with liquid assets.

| Characteristics | Values |

|---|---|

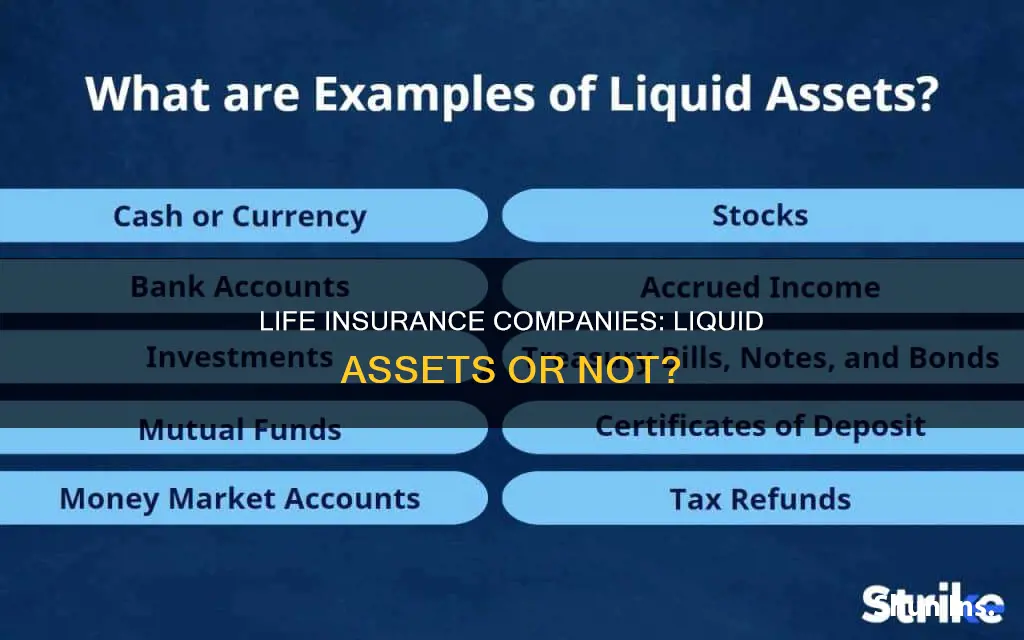

| Definition of liquid assets | Anything you own that can be easily converted into cash |

| Examples of liquid assets | Money in a checking or savings account, shares |

| Life insurance as a liquid asset | Depends on the type of life insurance |

| Types of life insurance with liquidity | Whole life insurance, universal life insurance, variable life insurance, permanent life insurance |

| Types of life insurance without liquidity | Term life insurance |

| How to increase liquidity of life insurance | Convertible term policies can be converted into permanent policies that have liquidity |

| Advantages of life insurance as a liquid asset | Provides instant liquidity to family members in case of the death of a breadwinner, can be used to offset settlement costs, provides liquidity to businesses in case of the death of a key person or partner |

| Disadvantages of life insurance as a liquid asset | Takes a long time to build cash value, not the best way to build assets, policy sale or surrender would earn less than what you've paid into the policy |

What You'll Learn

Life insurance as a liquid asset

Life insurance is a simple arrangement in which a person with an insurable interest pays a premium to a life insurance company in exchange for the promise of a death benefit to be paid to the insured’s beneficiary. Permanent life insurance, such as whole life insurance, also offers a cash value component, allowing the accumulation of the premium portions not used to cover insurance costs. This cash value can be accessed and withdrawn, or the policy can be surrendered for money, making it a liquid asset.

The death benefit of a life insurance policy is not considered an asset, so only policies with cash value are considered assets. Policies that have cash value and would be considered assets include whole life, universal, variable, and indexed universal. Term life insurance policies do not build cash value and are not liquid assets, but some can be converted into permanent policies that would accumulate cash value and be considered assets.

Liquidity refers to the ability of an asset to be easily converted into cash. Liquid assets are important because they can be used to cover living expenses or fund insurance deductibles in the case of an emergency. They are also important for businesses to be able to meet their financial obligations. The life insurance industry has historically shown incredible resilience in the face of economic downturns, due in part to strong liquidity measurements.

While life insurance can be a liquid asset, it is not usually the best way to build assets. A policy sale or surrender would earn less than what has been paid into the policy, and cash value investments have low interest rates. However, life insurance can be valuable if other investment options have been maxed out or as a way to raise cash in an emergency.

Nicotine Detection in Life Insurance Blood Tests

You may want to see also

Liquidity in life insurance policies

Liquidity in life insurance refers to how easily you can access cash from your policy. Liquidity is important as it allows you to cover short-term costs, such as living expenses or insurance deductibles, without having to sell your fixed assets, like your home or car.

Life insurance policies with a cash value component, such as whole life insurance, are considered to have liquidity because you can easily withdraw from them or surrender the policies for money. The cash value component allows the accumulation of premium portions not used to cover insurance costs. You can access this cash value through withdrawals or loans on the policy, usually on a tax-free basis.

Different types of permanent life insurance have varying degrees of liquidity. For example, a whole life policy may hold your cash value in actual cash, where it grows at a set interest rate, and you, as the policyholder, would have the right to withdraw some of those funds periodically. On the other hand, variable life insurance invests your accumulated cash in funds tied to the financial markets, which would need to be sold before taking a loan or withdrawal, potentially exposing you to losses.

Term life insurance policies, which only provide a death benefit and do not accumulate cash value, are not considered liquid assets. However, some term policies can be converted into permanent policies that would accumulate cash value and be considered liquid assets.

Gulf Shrimpers: Life Insurance Options and Availability

You may want to see also

Life insurance and tax advantages

Life insurance, especially permanent life insurance, can offer several tax advantages to the policyholder and their beneficiaries. Here are some of the key tax benefits:

Tax-Free Death Benefit:

The death benefit paid out to heirs or beneficiaries is generally free of federal income tax. This provides a tax-efficient way to ensure financial protection for loved ones and can help them maintain their standard of living, pay off debts, or fund education plans.

Tax-Deferred Cash Value Growth:

Permanent life insurance policies accumulate a cash value that grows tax-deferred. This means the cash value increases without being reduced by taxes annually, allowing for potentially higher savings over time. This can be particularly beneficial for those in higher tax brackets during their working years, as withdrawals during retirement may be taxed at a lower rate.

Tax-Advantaged Withdrawals and Loans:

Policyholders can access the cash value of their permanent life insurance policies through withdrawals or loans without immediate tax consequences. These funds can be used for various purposes, such as supplementing retirement income, paying for medical expenses, or funding education. However, it's important to note that loans against the policy will have interest charged by the insurance company, and withdrawals or loans may reduce the death benefit and require additional premiums.

Dividends from the Insurance Company:

Whole life insurance policies may receive annual dividend payments from mutual insurance companies, which are generally not taxable. These dividends contribute to the overall growth of the cash value and provide additional financial benefits to the policyholder.

Quick Payout to Beneficiaries:

Life insurance payouts to beneficiaries are typically received within weeks, much faster than the process of probating an estate. This provides a timely source of financial support for loved ones and ensures they receive the benefits without delay.

While life insurance offers these tax advantages, it's important to consult with financial and tax professionals to navigate the complexities of tax regulations and make informed decisions regarding your specific situation.

Retrieving Life Insurance: A Guide to Claiming Your Benefits

You may want to see also

Life insurance for businesses

Life insurance is a valuable tool for businesses of all sizes, offering a financial safety net and a range of benefits.

Firstly, life insurance can help businesses attract and retain top talent. By offering additional life insurance benefits to key employees, a business can set itself apart from competitors and build employee loyalty. This is especially important for executives, who often require larger death benefit protection than what is typically offered by standard group benefit programs.

Life insurance also serves as a vital source of capital for businesses when a key person or partner passes away. The death of a key employee can have a significant impact on revenue and operations. Life insurance provides the necessary liquidity to cover financial losses, find a suitable replacement, and ensure a smooth transition.

Additionally, life insurance can be used to fund a buy-sell agreement. In this arrangement, business partners own policies covering each other's lives. When one partner passes away, the other receives a death benefit, which can be used to buy the remaining share of the business. This provides a cash payment to the deceased's family and ensures the business can continue operating.

Life insurance can also play a crucial role in a business's succession plan. The death benefits from a life insurance policy can be used by the chosen successor to purchase the company from the owner upon retirement. This helps reduce conflicts and ensures a smooth transition of ownership.

Furthermore, life insurance can be used to fund deferred compensation programs, providing additional retirement benefits to key employees. In this arrangement, the company owns the policy on the executive. Upon retirement, the policy's cash value is used to supplement the employee's retirement income.

Lastly, life insurance can be a valuable incentive for key employees, with plans such as Split Dollar, Executive Bonus, and Non-Qualified Deferred Compensation allowing businesses to select specific employees to participate and vary the benefits accordingly.

In summary, life insurance for businesses is a versatile tool that helps attract and retain talent, ensures a smooth transition during challenging times, and provides financial security for both the business and the families of key personnel.

Converting Whole Life Insurance to Irrevocable: What You Need to Know

You may want to see also

Life insurance for estate planning

Life insurance can be a valuable tool for estate planning, helping to ensure your heirs are able to address challenges without having to break up the estate. It can also provide immediate liquidity for your heirs to cover any outstanding estate fees or necessary expenses.

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a fixed period, typically between 10 and 30 years, and is suitable for those with finite insurance needs. Permanent life insurance, on the other hand, provides lifetime coverage and is more expensive, typically five to 15 times the cost of a term policy. It is generally recommended only if your estate is large or complex.

Permanent life insurance can be particularly beneficial for those who want or need to:

- Pay estate taxes: Life insurance can help heirs cover the cost of estate taxes, which can pose a burden on beneficiaries who inherit illiquid assets such as real estate or a business.

- Eliminate inheritance inequities: Life insurance can offset any inheritance inequities, allowing you to leave bigger assets to certain heirs while providing a policy of similar value to others.

- Provide for an heir with disabilities: Life insurance can provide specific financial support for an heir with disabilities, while leaving the rest of the estate intact.

When incorporating life insurance into your estate plan, it is important to consult with an estate attorney and a tax professional. It is also recommended to review and update your beneficiaries regularly, especially as your life circumstances change.

In addition, there are different types of permanent life insurance policies that can be used for estate planning, including whole life insurance and universal life insurance. Whole life insurance offers permanent coverage with level premiums and a cash value component that grows tax-deferred. Universal life insurance provides flexible premiums, death benefits, and a cash value component, but it comes with more risk as the cash value growth depends on market conditions.

Life Insurance Users: Customers or Policyholders?

You may want to see also

Frequently asked questions

Only some types of life insurance have liquidity. A liquid asset is something that you own that can be easily liquidated or turned into cash. Your life insurance policy is a liquid asset if it has a cash value, if you can surrender your policy for cash, or if you are able to sell your life insurance.

Life insurance provides cost-effective liquidity for both individuals and businesses. It can be used to cover final expenses, pay off debt, or replace lost income. It can also be used to offset settlement costs, including estate taxes, and to preserve assets for future generations.

Liquidity in life insurance most frequently applies to permanent life insurance policies with a cash value, including whole, universal, and variable life insurance.