Retrieving a life insurance policy can be challenging, especially if you don't know the name of the insurer or whether the deceased had a policy. However, there are several steps you can take to locate a lost policy and get the information you need to file a claim. Start by searching through the deceased's documents, including paper and digital files, bank statements, tax returns, and email. Check for any payments to insurance companies and contact their former employers or professional associations to inquire about group insurance policies. You can also use online tools such as the National Association of Insurance Commissioners' (NAIC) Life Insurance Policy Locator Service, which helps beneficiaries find policies and claim their benefits. Additionally, each state has an Unclaimed Property Office where insurance companies turn over death benefits if they are unable to locate the beneficiary.

| Characteristics | Values |

|---|---|

| What to do if you know the name of the insurance company | Contact the company with your ID, a copy of the policyholder's death certificate, and details about the deceased |

| What to do if you don't know the name of the insurance company or if there is a policy | Go through the deceased's documents, digital files, bank statements, tax returns, email, and contact lists |

| How to find an unclaimed life insurance policy | Use the National Association of Insurance Commissioners' (NAIC) Life Insurance Policy Locator tool, contact the state's unclaimed property department, or use the National Association of Unclaimed Property Administrators' Missing Money site |

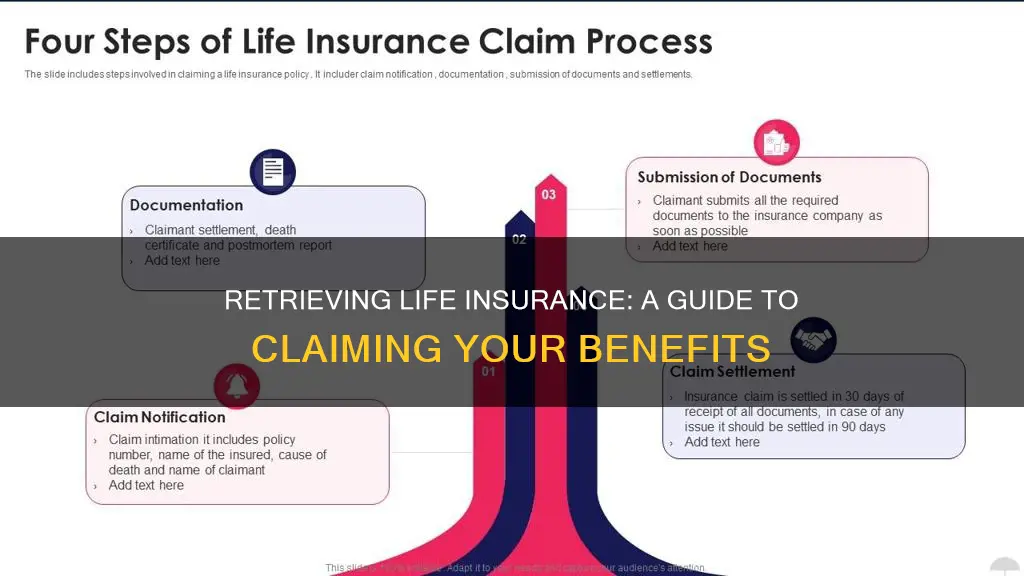

| How to file a life insurance claim | Contact an insurance agent or the insurer directly with the person's death certificate, identification, and details about yourself |

What You'll Learn

- Search the deceased's documents and correspondence

- Submit a request to the National Association of Insurance Commissioners' (NAIC) Life Insurance Policy Locator Service

- Contact the state's Unclaimed Property Office

- Be aware of special challenges, such as name changes or bankruptcy

- Ask financial advisors, accountants, bankers or lawyers

Search the deceased's documents and correspondence

When a loved one passes away, locating a life insurance policy can be a challenging and time-consuming task. However, there are several steps you can take to find the information you need. Here are some tips to guide your search through the deceased's documents and correspondence:

Firstly, search through paper and digital files, bank safe deposit boxes, and other storage spaces for insurance-related documents. Check the deceased's mail and email for premium or dividend notices. If policy payments are up to date, there may be no notice of premium payments due, but the company may still send an annual notice regarding the status of the policy or a statement of a dividend.

Secondly, review the deceased's bank statements for the last few years. Life insurance payments are typically made monthly, so look for regular payments to insurance companies. If the deceased was very elderly, you may need to check older bank statements, as some policies remain valid after a final payment has been made. Additionally, check for any checks or drafts made out to insurance companies.

Thirdly, review the deceased's tax returns for the past two years. Look for any records of interest income or expenses paid to life insurance companies. Life insurance companies pay interest on accumulations on permanent policies and chart interest on policy loans. This is especially relevant if the deceased had permanent life insurance, as the policy may have begun to earn cash value, or they may have taken out loans against the policy.

Lastly, check the applications for any life insurance policies you find. This document, typically attached to the policy, will list any other life insurance policies owned at the time of the application. If you find any policies, contact the insurer directly. They will be able to tell you if you were named as a beneficiary and help you file a claim. Remember to have the deceased's name, date of birth, date of death, and death certificate ready.

UFG: Life Insurance Options and Benefits

You may want to see also

Submit a request to the National Association of Insurance Commissioners' (NAIC) Life Insurance Policy Locator Service

When a loved one passes away, locating their life insurance policy can be challenging. If you are struggling to find the relevant documents, you can submit a request to the National Association of Insurance Commissioners (NAIC) Life Insurance Policy Locator Service. This is a free online tool that can help you locate life insurance policies and annuity contracts.

To submit a request, you will need to visit the NAIC website and follow these steps:

Step 1:

First, navigate to the NAIC website at naic.org. Once the webpage has loaded, hover your cursor over the "Consumer" tab and then click on "Life Insurance Policy Locator" under the "Tools" section.

Step 2:

On the welcome page, you will need to review and agree to the terms of use. This is an important step, as it outlines the conditions of using the service and how your information will be handled.

Step 3:

After agreeing to the terms, you will be asked to enter your personal information, including your name, mailing address, and email address. This information is necessary to create an account and securely submit your request.

Step 4:

Now, you can submit a search request by entering the deceased's information from their death certificate. The required fields include the deceased's social security number, date of birth, date of death, and legal first and last name. Additionally, you may be asked to provide the deceased's veteran status and your relationship to them.

Step 5:

Once you have completed all the required fields, click on the “Submit” button. Your request will be securely stored in an encrypted database. Participating life insurance and annuity companies can access this database through a secure portal to search for matching policies.

After submitting your request, you will receive a "Do Not Reply" confirmation email with the details of your request. If a policy is found and you are the designated beneficiary or authorized to receive the information, the insurance company will contact you directly. This process can take some time, and it may be several months before you receive a response.

It is important to note that the NAIC does not have access to policy or beneficiary information. If no policy is found or you are not the beneficiary, you will not be contacted. However, you can always reach out to the NAIC Help Desk or your state department of insurance for assistance or further clarification.

Mercury's Life Insurance: What's the Verdict?

You may want to see also

Contact the state's Unclaimed Property Office

If you are a beneficiary, a legal representative, or the executor of someone's will or estate, you can try to find an unclaimed life insurance policy. To do this, you will need to provide the deceased person's dates of birth and death, their Social Security number, their most recent and former addresses, and your own ID for verification.

Each state has different rules on how long it takes for a policy to be considered dormant. In most states, it takes between three and five years, but in Arizona and North Dakota, the dormancy period is one year. If it's been that long, you can search for unclaimed funds in the state where the deceased last resided or where they bought their policy.

To find your state's unclaimed property office, use the free tool provided by the National Association of Unclaimed Property Administrators (NAUPA). NAUPA has a free tool to locate lost or unclaimed insurance money and other property. Select your state, and you can see if there's a record of any insurance benefits or money owed to you.

If you think your benefit may have already been moved to the deceased's state, contact that state's comptroller's office.

Whole Life Insurance: Asset or Not for FAFSA?

You may want to see also

Be aware of special challenges, such as name changes or bankruptcy

Retrieving life insurance can be challenging, especially when facing special circumstances such as name changes or bankruptcy. Here are some detailed instructions to help you navigate these challenges:

Name Changes

If the policyholder's name has changed, perhaps due to marriage or divorce, it is crucial to update the insurance provider. Most companies allow policyholders to change their beneficiaries at any time without penalties. Contact your insurance company to initiate the process. They will guide you through the necessary steps, which typically involve filling out a change of beneficiary form. This form will require information such as the policyholder's original name, the new legal name, and the reason for the change. It is essential to keep your life insurance policy up to date, especially when your life circumstances change, to ensure that your intentions are honoured.

Bankruptcy

Bankruptcy can significantly impact your ability to retrieve life insurance. The consequences depend on the type of bankruptcy and the specifics of your policy. Here are some key considerations:

- Types of Bankruptcy: There are two common types of bankruptcy for individuals: Chapter 7 and Chapter 13. Chapter 7, or liquidation bankruptcy, involves selling assets to pay off creditors, while Chapter 13, or reorganization bankruptcy, allows for a repayment plan over three to five years. Understanding which type of bankruptcy you are filing for is crucial, as it will determine the fate of your life insurance policy.

- Impact on Life Insurance: If you have a term life insurance policy, it typically does not accumulate cash value, so it cannot be used to repay creditors. Your policy will likely remain in place as long as you can continue making premium payments. On the other hand, if you have a whole life insurance policy or another type of permanent life insurance, it likely has a cash value that can be used to repay creditors. There is a federal exemption of $14,875, meaning any value over that amount may be seized.

- Applying for New Policies: Bankruptcy can make it more challenging to obtain new life insurance policies. Insurers may view your financial situation as riskier, leading to higher premiums or more stringent requirements. You may need to wait for a specific period after bankruptcy before insurers will consider offering you a new policy.

- Consultation: Given the complex nature of bankruptcy and its interaction with life insurance, it is highly recommended to consult with a bankruptcy attorney or financial advisor. They can guide you through the process, protect your interests, and help you understand your options.

Contacting American Amicable Life Insurance: A Step-by-Step Guide

You may want to see also

Ask financial advisors, accountants, bankers or lawyers

If you are unsure whether your loved one had life insurance, it may be worth reaching out to their financial advisors, accountants, bankers, or lawyers. These professionals might know if your relative had a life insurance policy in place.

Financial advisors, accountants, and bankers, in particular, are likely to have insights into your loved one's financial situation and may be able to provide valuable information about any existing policies. They can also review financial paperwork, such as income tax returns and bank records, which can provide clues about the existence of a life insurance policy.

Additionally, if your loved one had a relationship with a specific bank, the bankers there may be able to check their records for any indications of life insurance payments or policies. They can also provide access to safe deposit boxes, which are commonly used to store important documents like life insurance policies.

Lawyers, especially those who have worked with your loved one on their will or estate planning, may also have relevant information. They can guide you on the legal aspects of retrieving the life insurance policy and ensure that you are taking the correct steps in the process.

It is important to note that these professionals will be bound by confidentiality agreements with their clients. However, with proper authorisation or proof of death, they may be able to assist you in your search for a lost life insurance policy.

Lightning McQueen's Life Insurance: What's the Deal?

You may want to see also

Frequently asked questions

Contact the insurer and be ready to provide proof of identity, such as your Social Security number or driver's license, as well as a certified copy of the policyholder's death certificate. You'll also need to provide details about the deceased, such as their Social Security number and date of birth.

There are several ways to find evidence of a life insurance policy. You can search through the deceased's documents, including paper and digital files, bank statements, tax returns, mail, and email. Look for payments to insurance companies, premium payment reminders, annual statements, dividend notices, or marketing materials. You can also contact the deceased's employer, as they may have had group life insurance through their workplace.

The National Association of Insurance Commissioners (NAIC) offers a free Life Insurance Policy Locator tool. You'll need to provide the deceased's legal name, Social Security number, and dates of birth and death. The NAIC will then ask participating insurers to search their databases, and if a match is found, the insurer will contact you with next steps. You can also try using state-specific search tools or checking with the state's Unclaimed Property Office, as life insurance companies turn over unclaimed benefits to the state where the policy was purchased.