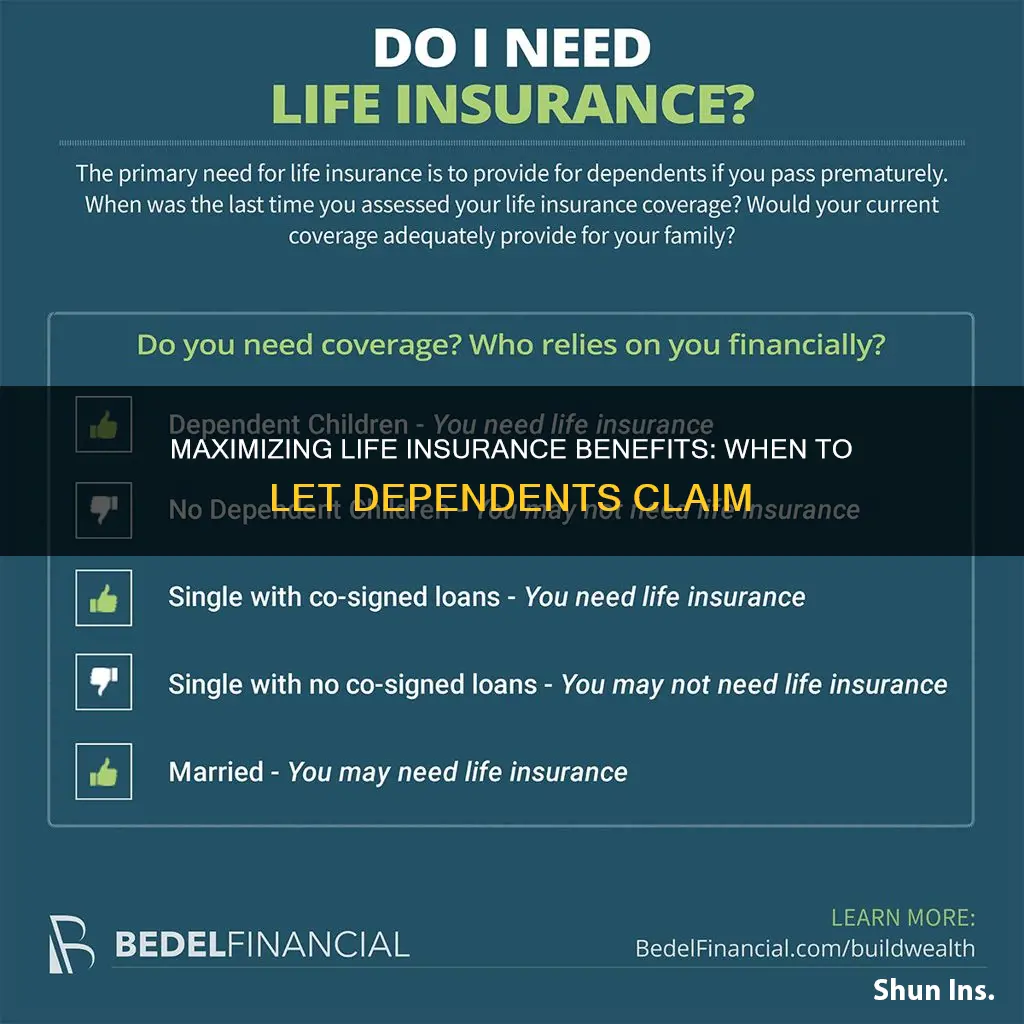

When it comes to life insurance, it's crucial to understand the timing of beneficiary designation. This decision is especially important for those with dependents, as it ensures financial security for their loved ones in the event of the insured's passing. The process involves identifying and notifying the insurance provider of the specific individuals or entities who should receive the death benefit. This step is vital to guarantee that the intended beneficiaries, such as a spouse, children, or other dependents, receive the financial support they need during a challenging time. By carefully selecting and updating beneficiaries, individuals can provide peace of mind and financial stability for their dependents, ensuring their well-being and long-term financial health.

What You'll Learn

- Age and Marital Status: Dependents' eligibility may vary based on age and marital status

- Financial Dependence: Insurance payout criteria often consider financial reliance on the insured

- Health and Lifestyle: Pre-existing conditions or risky behaviors can impact dependent coverage

- Legal Relationships: Only recognized legal dependents are eligible for benefits

- Policy Terms: Specific policy conditions dictate who qualifies as a dependent

Age and Marital Status: Dependents' eligibility may vary based on age and marital status

Age and marital status play a significant role in determining the eligibility of dependents for life insurance benefits. When it comes to dependents, the insurance company often considers the relationship between the insured individual and the dependent, as well as the dependent's age and marital status.

For minors, life insurance policies typically name parents or legal guardians as primary beneficiaries. This is because the primary focus is on providing financial support for the child's upbringing and well-being. Minors are generally considered dependents until they reach a certain age, after which they may no longer qualify for dependent benefits. The age threshold can vary, but it is common for policies to specify that dependents must be under a certain age, such as 25 or 30, depending on the insurance provider's guidelines.

As individuals age, the concept of dependency evolves. Young adults who have become financially independent may no longer be considered dependents. For example, a child who has started their career, purchased a home, and is financially self-sufficient might no longer meet the criteria for dependent coverage. In such cases, the insurance policy may require the dependent to provide evidence of their financial independence, such as tax returns or bank statements, to demonstrate their ability to support themselves.

Marital status also influences dependent eligibility. Unmarried individuals, including those in common-law relationships, may have different considerations compared to married couples. For instance, a life insurance policy might offer higher benefits to married dependents, recognizing the financial interdependence and shared responsibilities within a marriage. Additionally, the insurance company may require unmarried dependents to provide proof of their relationship, such as a marriage certificate or a signed affidavit, to establish their eligibility for benefits.

It is essential to review and update the list of dependents regularly, especially when significant life events occur, such as marriages, divorces, or the birth of a child. These events can impact the dependent's eligibility and the distribution of benefits. Insurance companies often provide guidelines and forms to help policyholders manage these changes effectively, ensuring that the coverage remains appropriate and relevant to the current circumstances.

Middle-Class Life Insurance: How Big Is Too Big?

You may want to see also

Financial Dependence: Insurance payout criteria often consider financial reliance on the insured

When it comes to life insurance, the concept of financial dependence is crucial, especially in determining the eligibility of dependents for insurance payouts. Insurance companies recognize that individuals rely on the financial support of the insured, whether it's for their daily expenses, long-term goals, or even their basic needs. This financial reliance is a key factor in deciding when and how to distribute the insurance proceeds.

The payout criteria often take into account the extent of financial dependence. Dependents who were financially reliant on the insured for their primary income or essential living expenses are typically considered for a larger portion of the insurance benefit. This is because the insurance policy is designed to provide financial security to those who depend on the insured's income for their livelihood and well-being. For instance, a spouse who was the primary breadwinner or a child who relied on the insured's financial support for education might be entitled to a substantial payout.

In many cases, insurance policies outline specific guidelines regarding financial dependence. These guidelines may include factors such as the duration of the dependency, the nature of the financial support provided, and the financial needs of the dependent. For example, a policy might specify that the payout is based on the percentage of the insured's income that the dependent was receiving, ensuring a fair distribution of the proceeds.

It is essential for dependents to understand their rights and the criteria for receiving insurance payouts. They should be aware of the documentation and evidence required to prove their financial reliance on the insured. This may involve providing financial records, tax returns, or any other relevant documents that demonstrate the extent of their dependence. By doing so, dependents can ensure a smoother process when claiming the insurance benefit.

In summary, financial dependence is a critical aspect of life insurance payouts. Insurance companies consider the financial reliance of dependents to determine the appropriate distribution of proceeds. Dependents should familiarize themselves with the policy's payout criteria and provide the necessary documentation to support their claim. This ensures that the insurance benefit is utilized effectively to provide financial security to those who depend on the insured's income.

Canceling Freedom Life Health Insurance: A Step-by-Step Guide

You may want to see also

Health and Lifestyle: Pre-existing conditions or risky behaviors can impact dependent coverage

When it comes to life insurance, understanding the impact of health and lifestyle factors on dependent coverage is crucial. Pre-existing conditions and risky behaviors can significantly influence the terms and conditions of coverage, potentially affecting the financial security of your loved ones. Here's an overview of how these factors can come into play:

Pre-existing Conditions: Life insurance companies often consider an individual's medical history when evaluating dependent coverage. Pre-existing health issues, such as chronic illnesses, heart disease, diabetes, or certain types of cancer, can lead to higher insurance premiums or even exclusions. For instance, if a parent has a history of severe heart disease, the insurance provider might require a detailed medical examination and may offer coverage with certain limitations or at a higher cost. It is essential to disclose all relevant medical information accurately to ensure that the insurance company has a comprehensive understanding of the applicant's health status.

Risky Behaviors: Engaging in high-risk activities can also impact dependent coverage. These behaviors include extreme sports like skydiving or rock climbing, smoking, excessive alcohol consumption, drug use, or driving recklessly. Insurance providers often view these activities as a higher risk to the insured individual and may adjust the policy accordingly. For example, a policyholder who participates in extreme sports might face higher premiums or even have their coverage limited to certain activities. Similarly, lifestyle choices like smoking can significantly increase insurance rates, as it is associated with various health risks.

In both cases, the insurance company aims to assess the likelihood of future claims and the potential impact on the overall policy. Pre-existing conditions and risky behaviors can influence the insurer's decision to offer coverage, the premium amount, and the extent of coverage provided. It is advisable for individuals to maintain a healthy lifestyle and manage any pre-existing conditions effectively to potentially secure more favorable terms for their dependent coverage.

Additionally, it is worth noting that some insurance policies may offer specific provisions for pre-existing conditions or risky behaviors. These provisions could include waiting periods before coverage begins or specific exclusions related to certain health issues or activities. Understanding these policy details is essential for making informed decisions about dependent coverage.

In summary, health and lifestyle factors play a significant role in determining the terms of dependent coverage under life insurance policies. Pre-existing conditions and risky behaviors can lead to variations in coverage options, premiums, and policy limitations. Being transparent about medical history and making healthy lifestyle choices can contribute to a more comprehensive and affordable insurance plan for your dependents.

Entering Life Insurance Proceeds in HR Block

You may want to see also

Legal Relationships: Only recognized legal dependents are eligible for benefits

When it comes to life insurance, it's crucial to understand the concept of legal dependents and their eligibility for benefits. Life insurance policies often provide financial support to beneficiaries, but only if they meet certain legal criteria. This is an important distinction to make, as it ensures that the intended individuals receive the necessary support.

Legal dependents are typically defined as individuals who have a recognized legal relationship with the insured person. This relationship is often established through marriage, common law partnership, or in some cases, a court-appointed guardianship. For example, a spouse, child, or dependent parent who is financially reliant on the insured individual may fall into this category. It is essential to note that the specific definition of legal dependents can vary depending on the jurisdiction and the insurance company's policies.

The reason for this legal requirement is to provide a clear and fair process for determining who is entitled to the insurance benefits. By recognizing legal dependents, the insurance company can ensure that the financial support goes to those who have a legitimate claim and are directly impacted by the insured's passing. This also helps prevent potential disputes and misunderstandings among family members or individuals who may feel entitled to the benefits.

When reviewing or updating your life insurance policy, it is crucial to identify and list all the recognized legal dependents. This includes providing accurate and up-to-date information about your spouse, children, or any other individuals who rely on you financially. Failing to do so might result in complications and delays when claiming the benefits. Additionally, it is advisable to keep a record of any changes in your legal relationships, such as marriages, divorces, or the birth of a child, to ensure that your policy remains current and relevant.

In summary, understanding the legal relationships that qualify as dependents is essential for maximizing the benefits of your life insurance policy. By adhering to these legal criteria, you can provide financial security to your loved ones in a transparent and efficient manner. It is always recommended to consult with a legal professional or insurance advisor to ensure you are aware of the specific requirements and to make any necessary adjustments to your policy.

Aflac Life Insurance: Borrowing from Your Own Policy?

You may want to see also

Policy Terms: Specific policy conditions dictate who qualifies as a dependent

When it comes to life insurance policies, the term "dependents" is crucial, and understanding who qualifies as a dependent is essential for policyholders. Specific policy conditions and definitions outline the criteria for dependents, ensuring that the insurance company knows who is entitled to benefits in the event of the insured's death. These terms are often detailed in the policy's fine print and can vary depending on the insurance provider and the type of policy.

The definition of a dependent is typically based on a set of criteria that includes family relationships, financial dependence, and sometimes, specific age requirements. For instance, a policy might define a dependent as a spouse, child, or parent who relies on the insured for financial support. It could also specify that only children under a certain age or those with a disability are considered dependents. These conditions are designed to ensure that the insurance company provides benefits to those who genuinely depend on the insured's income or support.

In some cases, the policy may differentiate between different categories of dependents. For example, it might classify a spouse as a primary dependent, with priority in receiving benefits, and children or parents as secondary dependents. This distinction is crucial, especially in policies with limited benefit amounts, as it determines the order in which beneficiaries are paid. Understanding these policy terms is vital for individuals to ensure their loved ones are adequately protected.

Policyholders should carefully review the insurance policy's terms and conditions to identify the specific criteria for dependents. This includes paying attention to any exclusions or special provisions related to dependents. For instance, some policies might exclude stepchildren or domestic partners from the definition of a dependent, while others may have specific requirements for dependent children, such as age limits or educational milestones.

Additionally, it is essential to keep the insurance company updated on any changes in the family structure that could affect dependent status. Life events like marriages, births, or deaths should be promptly reported to the insurance provider to ensure that the policy remains accurate and up-to-date. By being proactive and well-informed about these policy terms, individuals can ensure that their life insurance coverage aligns with their intended beneficiaries.

Does Smoking Pot Affect Your Life Insurance Eligibility?

You may want to see also

Frequently asked questions

It's essential to periodically review and update the beneficiaries of your life insurance policy, especially when significant life events occur. These events include marriage, divorce, the birth of a child, the death of a beneficiary, or a major change in your personal relationships. Regularly reviewing ensures that your policy accurately reflects your current wishes and provides financial security to the intended individuals in the event of your passing.

Yes, you typically have the flexibility to modify the beneficiaries of your life insurance policy whenever you see fit. Most insurance providers allow policyholders to update beneficiaries through a simple administrative process, often involving a form or written request. This change can be made to add new dependents, remove existing ones, or adjust the distribution percentages according to your preferences.

Failing to update the beneficiaries when a new dependent enters your life may result in unintended consequences. If you have not designated a new beneficiary for this dependent, the insurance payout might go to the original beneficiaries named in the policy. It is crucial to promptly add the new dependent as a beneficiary to ensure they receive the intended financial support in the event of your passing.