When it comes to financial aid for college, the Free Application for Federal Student Aid (FAFSA) is a crucial document. It's designed to assess a student's eligibility for need-based financial aid, and one of the key factors in this assessment is the value of their assets. But not all assets are treated equally; some are exempt from reporting, while others are weighed differently depending on whether they are student or parent assets. So, how does whole life insurance fit into this equation?

| Characteristics | Values |

|---|---|

| Does the FAFSA consider whole life insurance as an asset? | No, the FAFSA does not consider whole life insurance as an asset. However, any cash value built up in insurance policies is considered an asset. |

| What is the primary goal of life insurance? | To provide financial stability for your family and/or your beneficiaries after you pass away, through a lump-sum payment called a death benefit or a life insurance benefit. |

| What is an asset? | Anything useful or beneficial to you can be considered an asset. In the financial sense, assets are concrete things of monetary value that you own at a moment in time. Tangible assets include things like a home, a car, or gold, while liquid assets can be money in a bank account, stocks, or holdings in investment accounts. |

| What is the impact of an asset on the FAFSA? | Reportable assets increase the Student Aid Index (SAI) on the FAFSA, reducing eligibility for need-based financial aid. The impact varies depending on whether it is a student or parent asset. |

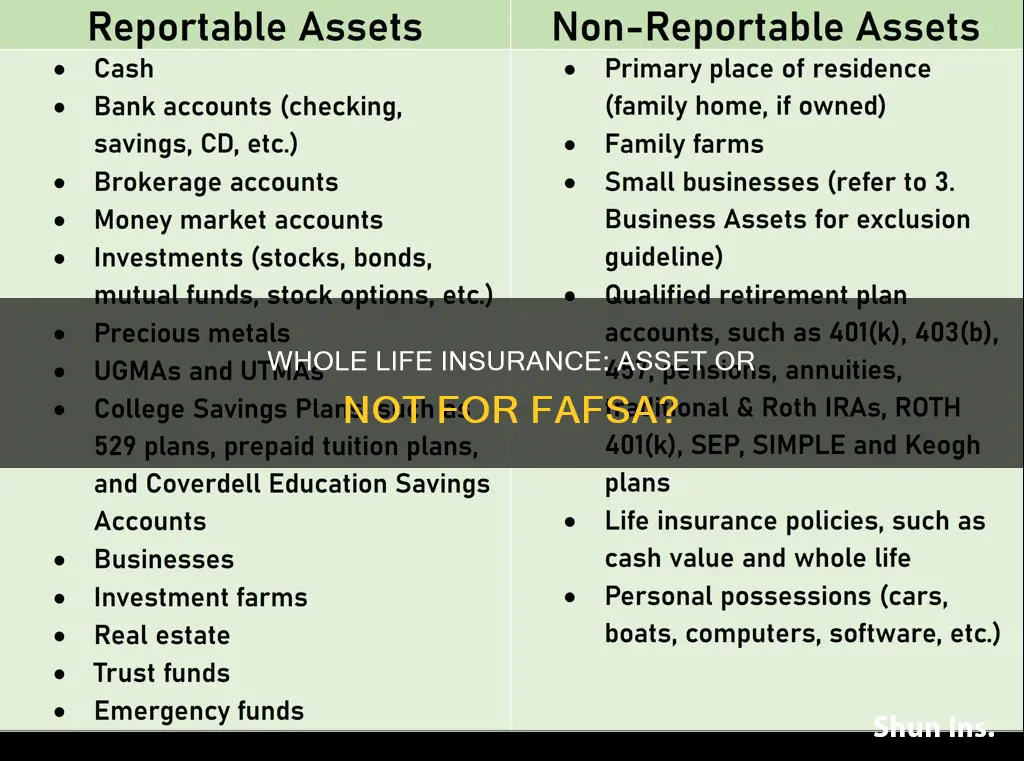

| What are some examples of reportable assets on the FAFSA? | Bank and brokerage accounts, certificates of deposit (CDs), money market accounts, restricted stock units, net worth of small businesses or farms (adjusted), 529 college savings plans, prepaid tuition plans, Coverdell education savings accounts, investment real estate, and UGMA and UTMA accounts. |

| What are some examples of non-reportable assets on the FAFSA? | Qualified retirement plans (e.g., 401(k), IRA, pension plans), family home, and personal possessions/household goods. |

What You'll Learn

Whole life insurance as a financial asset

Whole life insurance is a type of permanent life insurance that can be used as a financial asset. It is different from term life insurance, which is valid for a set number of years and does not offer the ability to grow money in an account that you can tap into.

Whole life insurance policies enable you to invest in conservative investments like mutual funds or exchange-traded funds (ETFs). You can choose how you want to diversify your investments, allowing you to curate your policy to meet your risk tolerance and goals. Because of this, permanent life insurance can serve as a hedge against market risk.

There are several ways to use your whole life insurance as an asset:

- Take a loan from your policy: You can borrow against the cash value of your whole life insurance policy. Just be sure to read the fine print if you go this route, as the interest rate can be fixed or variable and is set by the insurer. Additionally, if you take a loan against your policy and it's not paid off at the time of your death, any outstanding balance that you owe will be subtracted from what your beneficiaries inherit.

- Use your policy as collateral for a loan: In some situations, you can use your whole life insurance policy as collateral for a loan, which can make it easier for you to get approved or get a better rate on the loan. However, keep in mind that if you die before paying it back, whatever you still owe will come off the top before your beneficiaries receive their benefit.

- Withdraw funds: Rather than taking a loan, you can make withdrawals from your whole life insurance policy that are yours to keep. Just note that if your withdrawal dips into your investment gains, you'll need to pay taxes. Additionally, the amount you withdraw is money that won't be paid to your beneficiaries later, as your withdrawal decreases the value of the policy.

- "Accelerated" benefits: Some whole life insurance policies enable you to receive benefits during your lifetime if an unexpected or extreme medical emergency arises, such as cancer, a heart attack, or kidney failure. Most policies with this option allow you to withdraw anywhere from 25% to 100% of your policy's value.

- Surrender the policy (cash out): Surrendering your whole life insurance policy simply means that you are cancelling your coverage. When you do this, you get back the cash value you put in, less any fees your insurance company may charge. Study the fine print carefully, as these fees may be quite high.

While whole life insurance can be a valuable financial asset, it's important to consider the potential drawbacks. Whole life insurance policies typically have higher premiums than term life insurance, and the cash value may grow more slowly than with other policies. Additionally, whole life plans do not offer the flexibility to adjust premiums or the death benefit.

Life Insurance: Death of Owner, What's Next?

You may want to see also

Whole life insurance as a savings vehicle

Whole life insurance is a type of permanent life insurance that covers the insured person for their entire life. It is different from term life insurance, which only provides coverage for a specific number of years. Whole life insurance also has a cash savings component, known as the cash value, which the policy owner can draw on or borrow from. This cash value typically earns a fixed rate of interest, and interest accrues on a tax-deferred basis.

Whole life insurance can be a good savings vehicle for certain individuals. Here are some situations where it may be a worthwhile investment:

- Maxed-out Retirement Accounts: If you are a high-net-worth individual who has already maxed out your contributions to tax-advantaged accounts, such as 401(k) plans or individual retirement accounts, whole life insurance can provide an additional avenue to save and grow your money in a tax-advantaged way.

- Lifelong Dependents: Whole life insurance can be suitable for those with lifelong financial dependents, such as parents with children with disabilities. The lifelong coverage provides financial stability and peace of mind for the family.

- Estate Taxes: The cash value component of whole life insurance can help your loved ones pay estate taxes without dipping into other accounts. The death benefit provided by the policy can offset the taxes levied on assets above the federal tax exemption limit.

- Investment Diversification: Whole life insurance offers a way to diversify your investment portfolio. The cash value grows at a set rate, providing dependable returns that are not subject to market volatility.

However, it's important to consider the drawbacks of whole life insurance as a savings vehicle. The premiums tend to be much higher than term life insurance, and it may take 10 to 15 years or longer to build up enough cash value to borrow against. Additionally, the cash value rate of return can be relatively low compared to other investments, and you have limited control over your investment portfolio. There can also be tax implications if you withdraw cash from the policy or surrender it.

In conclusion, while whole life insurance can be a good savings vehicle for certain individuals, it may not be the best option for everyone. It is important to carefully consider your financial goals, risk tolerance, and other investment options before deciding if whole life insurance is the right choice for you.

Life Insurance: Child Coverage and Your Options

You may want to see also

Whole life insurance as an investment

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life as long as you continue to pay your premiums. While it is not considered an investment, it can be used as a savings vehicle or tool. Here are four to six paragraphs discussing whole life insurance as an investment:

Whole life insurance is a unique product that offers both a death benefit and a savings component. While it is typically purchased for the death benefit, the cash value feature can make it a valuable investment and savings tool. This cash value accumulates over time, providing policyholders with access to funds while they are still alive. This can be particularly useful for major expenses, such as college tuition or a down payment on a house. It is important to note that whole life insurance is not a traditional investment vehicle and has some downsides, including higher costs compared to term policies.

Benefits of Whole Life Insurance as an Investment

One of the main benefits of whole life insurance as an investment is the guaranteed increase in cash value each year. This growth is tax-deferred, providing policyholders with tax advantages. Additionally, the cash value can be accessed without incurring any taxable gain. Whole life insurance policies may also be eligible for dividends, further increasing their value. These policies also offer stable premiums that remain the same throughout the life of the policy, providing predictability and peace of mind.

Ways to Use Whole Life Insurance as an Investment

There are several ways to maximize your investment in a whole life insurance policy:

- Withdrawals or loans: Policyholders can tap into the cash value to pay for expenses or receive regular payments. Withdrawals up to the amount of premiums paid may be tax-free. Taking out a loan against the policy is also an option, but it is important to manage it carefully to avoid potential drawbacks, such as causing the policy to lapse.

- Generational wealth: Whole life insurance can be used as part of estate planning to create generational wealth. By creating an irrevocable life insurance trust (ILIT), the death benefit proceeds can pass to heirs outside of the taxable estate, helping them navigate federal estate taxes.

- Dividends: Some whole life insurance policies offer dividends, which can be used to reduce premiums, pay directly to the policyholder, or purchase additional insurance to increase the cash value and death benefit.

- Surrender the policy: If the policy is no longer needed, it can be surrendered to receive the accumulated cash value, minus any fees and outstanding loan balances. However, this may create a taxable event, and it is important to consider the loss of the death benefit.

Whole life insurance may be a good investment in certain situations:

- Maxed-out retirement accounts: For high-net-worth individuals who have maxed out their tax-advantaged retirement accounts, whole life insurance can provide an additional avenue for tax-deferred savings.

- Lifelong dependents: Whole life insurance can provide lifelong coverage for individuals with lifelong dependents, such as children with disabilities, offering financial stability and peace of mind.

- Estate tax planning: The cash value component of whole life insurance can help loved ones pay estate taxes without dipping into other accounts.

- Investment diversification: The guaranteed and stable returns of whole life insurance can provide diversification to an investment portfolio, especially for those seeking lower-risk options.

Drawbacks of Whole Life Insurance as an Investment

Despite its benefits, whole life insurance may not be the right investment for everyone. The premiums tend to be much higher than term life insurance, and the cash value can be slow to grow, taking 10 to 15 years or more to build up significant value. Additionally, the rate of return on the cash value may be low compared to other investments, and policyholders have limited control over the investment strategy. There can also be tax implications if withdrawals or surrenders exceed the policy basis.

Life Insurance and Suicide: What's Covered?

You may want to see also

Whole life insurance and FAFSA eligibility

The FAFSA, or Free Application for Federal Student Aid, is a form that collects financial information from students and families to determine eligibility for financial aid. The form asks about income, savings, and assets, and the impact of these on eligibility differs depending on whether they are treated as student or parent assets.

When it comes to whole life insurance and FAFSA eligibility, it's important to understand the difference between the death benefit and the cash value of a life insurance policy. The death benefit is the lump-sum payment made to beneficiaries after the insured person passes away. On the other hand, the cash value is an additional living benefit that accumulates over time and can be accessed while the policyholder is still alive.

The death benefit of a life insurance policy, including whole life insurance, is not considered an asset for FAFSA purposes. This is because the primary goal of life insurance is to provide financial stability to beneficiaries after the insured person's death, and the death benefit is not accessible to the policyholder during their lifetime.

However, the cash value of a life insurance policy is considered an asset for FAFSA reporting. Whole life insurance, as a type of permanent life insurance, can build cash value over time. This cash value is accessible to the policyholder and is therefore treated as an asset.

Impact of Whole Life Insurance on FAFSA Eligibility

The treatment of whole life insurance as an asset for FAFSA purposes can have implications for financial aid eligibility. The impact depends on whether the policy is owned by the student or the parent.

If the whole life insurance policy is owned by the student, the cash value is treated as a student asset. Student assets are assessed at a higher rate, with 20% of the asset value expected to be contributed towards educational expenses each year. This can significantly reduce the amount of financial aid offered.

On the other hand, if the policy is owned by the parent, the cash value is treated as a parent asset. Parent assets are assessed on a bracketed scale, with a maximum rate of 5.64%. Additionally, a portion of parent assets may be sheltered by an asset protection allowance based on the age of the older parent. As a result, the impact of parent-owned whole life insurance policies on financial aid eligibility is generally lower compared to student-owned policies.

Strategies for Managing Whole Life Insurance Assets on FAFSA

There are a few strategies that families can consider to manage the impact of whole life insurance assets on FAFSA eligibility:

- Shifting ownership: If the policy is currently owned by the student, transferring ownership to a parent can reduce the impact on financial aid eligibility. This is because parent assets are assessed at a lower rate than student assets.

- Using assets to pay down debt: Instead of holding large amounts of cash or investments, families can use whole life insurance assets to pay down consumer debt. While assets may count against financial aid eligibility, debt is not considered by need-analysis formulas.

- Comparing insurance options: Families may consider alternative insurance options that do not accumulate cash value, such as term life insurance. Since term life insurance does not create cash value, it is not counted as an asset on the FAFSA.

Hostplus Life Insurance: What You Need to Know

You may want to see also

Whole life insurance and FAFSA reporting

The Free Application for Federal Student Aid (FAFSA) is a crucial document for students seeking financial aid for their college education. Understanding what constitutes an asset that needs to be reported on the FAFSA is essential for accurately completing the application. One question that often arises is whether whole life insurance policies are considered an asset for FAFSA purposes.

Understanding Whole Life Insurance

Whole life insurance is a type of permanent life insurance policy that offers lifelong coverage as long as the premiums are paid. One distinguishing feature of whole life insurance is its ability to build cash value over time. This cash value is accessible to the policyholder and can be used for various purposes, such as emergency funds or estate planning.

FAFSA Reporting Requirements for Whole Life Insurance

When it comes to FAFSA reporting, the treatment of whole life insurance depends on its cash value component. The death benefit of a life insurance policy is not considered an asset for FAFSA purposes. However, if a life insurance policy has accumulated cash value, this portion is indeed considered an asset and must be reported on the FAFSA.

Strategies for Managing Whole Life Insurance as an Asset

Families completing the FAFSA may want to consider strategies for managing their assets, including whole life insurance policies, to maximize their eligibility for financial aid. Here are some options to consider:

- Shifting reportable assets into non-reportable assets: One approach is to convert reportable assets, such as whole life insurance policies with substantial cash value, into non-reportable assets. This can be done by increasing contributions to qualified retirement plans or making use of other non-reportable investment options.

- Using reportable assets to pay down debt: FAFSA takes into account both assets and debt. By using reportable assets to pay off non-reportable debt, such as credit card debt or auto loans, you can reduce the overall impact on your financial aid eligibility.

- Timing of distributions: It is important to note that any distributions from a whole life insurance policy's cash value will be considered income on the FAFSA in future years. Therefore, careful consideration should be given to the timing of any withdrawals to minimize the impact on financial aid eligibility.

- Seeking professional advice: Before making any significant changes to your financial portfolio, it is always advisable to consult with a qualified financial advisor or accountant. They can provide personalized guidance based on your specific circumstances and help you navigate the complexities of the FAFSA reporting process.

In conclusion, while whole life insurance policies with cash value are considered an asset for FAFSA reporting purposes, there are strategies available to manage their impact on financial aid eligibility. It is important for families to carefully assess their financial situation and seek professional advice to make informed decisions regarding their assets and the completion of the FAFSA.

Drug Use and Life Insurance: What's the Connection?

You may want to see also

Frequently asked questions

No, the FAFSA doesn't consider cash value life insurance as an asset.

FAFSA stands for Free Application for Federal Student Aid.

Bank and brokerage accounts, certificates of deposit (CDs), money market accounts, restricted stock units, net worth of small businesses or farms, 529 college savings plans, prepaid tuition plans, and Coverdell education savings accounts.

Qualified retirement plans (e.g. 401(k), IRA), the family home, personal possessions and household goods, and certain life insurance policies.

Reportable assets increase the Student Aid Index (SAI) on the FAFSA, reducing eligibility for need-based financial aid. Student assets increase the SAI by 20% of the asset value, while parent assets are assessed on a bracketed scale, increasing the SAI by up to 5.64%.