Life insurance for pets, also known as mortality and theft insurance, is an option for pet owners who want to cover funeral expenses and other costs associated with the loss of their animal companion. While it is not possible to name a pet as a direct beneficiary of a life insurance policy, there are alternative ways to ensure their care in the event of the owner's death or disability. One option is to set up a pet trust, which allows owners to designate a caregiver and a trustee to manage the funds for the pet's care. Another option is to include instructions for pet care in one's will or use a do-it-yourself Pet Protection Agreement. While pet life insurance can provide financial peace of mind, it is important to consider the cost, which can range from $250 to $900 per year, and the specific needs of the pet and owner when deciding whether to purchase such a policy.

| Characteristics | Values |

|---|---|

| Can I legally use child life insurance on my dog? | No |

| Can I leave my money to my dog? | No |

| Can I name my dog as a beneficiary of my life insurance policy? | No |

| Can I set up a trust for my dog? | Yes |

| Can my dog be a beneficiary of the trust? | Yes |

| Can I set up a statutory pet trust? | Yes |

| Can I set up a Pet Protection Agreement? | Yes |

| Can I get life insurance for my dog? | Yes |

| What is life insurance for dogs called? | Mortality and theft insurance |

| What does life insurance for dogs cover? | Funeral expenses, reimbursement for the animal's value, replacement of future income |

| What does pet insurance for dogs cover? | Veterinary treatment, cremation/burial coverage, end-of-life care, euthanasia |

What You'll Learn

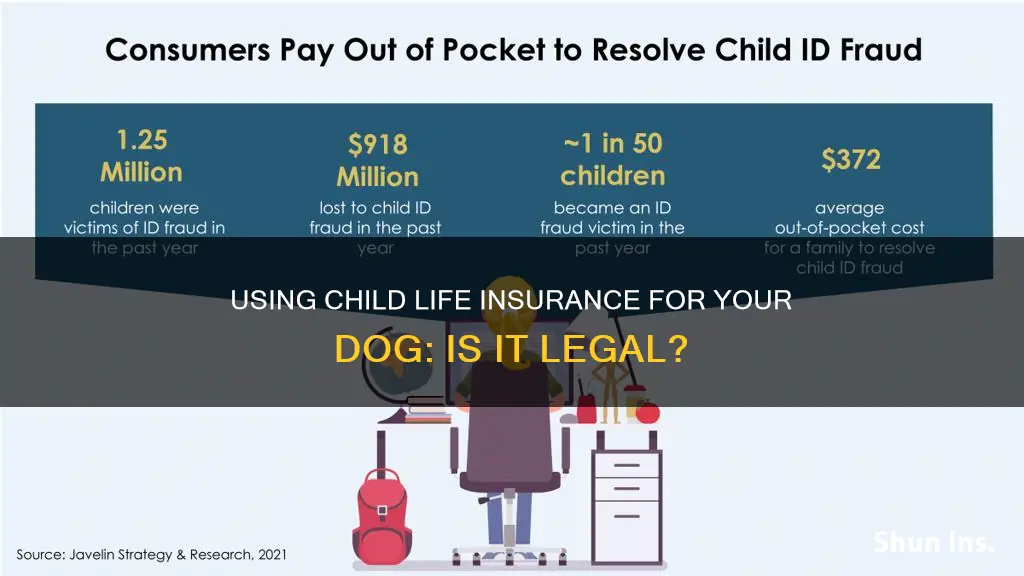

Can you legally use child life insurance on your dog?

Life insurance for pets, also known as mortality and theft insurance, is a real thing. However, it is not the same as life insurance for humans. While you can't take out life insurance on your dog, you can get a specific type of insurance that will pay out in the event of your dog's death. This type of insurance is typically only necessary for specific animals that generate revenue or are considered highly valuable, like show dogs, racehorses, or zoo animals.

Pet life insurance covers the cost of your dog's funeral services, reimburses the value of the dog, and replaces future income. It is important to note that pet life insurance does not cover veterinary expenses, which are covered under regular pet insurance.

The cost of pet life insurance varies depending on factors such as the dog's age, breed, location, deductible amount, and level of benefit. The average cost is between $250 and $900 per year.

If you are unable to take out a life insurance policy on your dog, there are other options to ensure your pet is taken care of in the event of your death. You can set up a pet trust, which is a legally sanctioned arrangement that provides for the care and maintenance of your pet. You can designate a caregiver and a trustee to manage the funds, and you can also leave detailed instructions for your pet's care. Another option is to include instructions for your pet's care in your will.

Life Insurance Proceeds: Texas Probate Exemption

You may want to see also

What is pet life insurance?

Pet life insurance, also known as mortality and theft insurance, is a type of insurance that covers the cost of your pet's death and, in some cases, theft. It is designed for pets that generate income or are considered valuable, such as show dogs, racehorses, and zoo animals. The average dog or cat owner typically does not need this type of insurance.

Pet life insurance policies can range from $250 to $900 per year, depending on factors such as the pet's health, the deductible amount, and the type of policy chosen. A full mortality policy, which covers any cause of death, is more expensive than a limited mortality policy, which only covers specific causes of death listed in the policy.

Pet life insurance is similar to life insurance for humans in that it provides a death benefit that can be used for funeral costs, cremation, or to replace lost income if the pet generated revenue. Most pet life insurance policies also cover theft.

It's important to note that pet life insurance is different from regular pet insurance, which covers veterinary expenses for accidents, illnesses, and, in some cases, end-of-life expenses. While pet life insurance covers the cost of death and theft, it does not cover veterinary care or health issues.

Does Smoking Pot Affect Your Life Insurance?

You may want to see also

What does pet life insurance cover?

While it is not possible to make your pet a life insurance beneficiary, you can take steps to protect your pet in the event of your death or disability. One way to do this is by setting up a pet trust, which is a legally sanctioned arrangement that provides for the care and maintenance of your pet. You can also include instructions for your pet's care in your will.

Pet life insurance, also known as mortality and theft insurance, is designed for pets that generate income or are considered valuable, such as show dogs, racehorses, and zoo animals. It covers the death of the animal from any cause, including accidental death or illness, and may also include theft insurance. The cost of pet life insurance can range from $250 to $900 per year, depending on factors such as the pet's age, breed, species, health, and the type of policy chosen.

In contrast, regular pet insurance, or animal health insurance, covers veterinary bills and may include end-of-life expenses such as euthanasia, burial, and cremation costs. It typically does not cover the pet's value or the cost of burial or cremation in the event of the animal's death. The cost of regular pet insurance depends on factors such as the species, breed, age, and level of coverage chosen.

Cigna's Individual Life Insurance: What You Need to Know

You may want to see also

What does pet life insurance not cover?

While pet insurance can be a valuable investment for pet owners, it's important to understand what it does not cover. Here are the key exclusions from most pet insurance policies:

- Pre-existing conditions: Medical issues that your pet had before the policy began or during the waiting period are typically excluded. However, some companies may cover "curable" pre-existing conditions if they have been symptom-free for a certain period.

- Cosmetic or elective procedures: Unless deemed medically necessary, procedures like declawing, tail docking, or ear cropping are generally not covered.

- Routine and wellness care: Most accident and illness plans do not include routine care such as vaccinations, spaying, neutering, or teeth cleaning unless a wellness add-on is purchased.

- Breeding or pregnancy expenses: Costs associated with breeding or pregnancy are commonly excluded, but you may be able to add a rider for coverage.

- Liability for damage or injury caused by your pet: If your pet damages property or injures someone, pet insurance will not cover it. However, your homeowners or renters insurance may provide liability coverage for such incidents.

- Alternative and rehabilitative treatment: Some plans cover physical therapy and alternative treatments like acupuncture and chiropractic care, while others charge extra for this coverage.

- Behavioral therapies: Coverage for behavioural issues like aggression or compulsive behaviour varies among plans, and some may charge extra for this coverage.

- Congenital or hereditary conditions: While many plans cover congenital or hereditary conditions if symptoms did not appear before the policy began, others may limit or exclude coverage for these conditions.

- Exam fees: Some plans may not include exam fees when your pet is sick or injured, so be sure to check the policy details.

- Prescription diets and supplements: Coverage for prescription food and supplements to treat medical conditions varies among plans, and some may not cover them at all.

- Dental care: Most pet insurance plans do not cover routine dental cleanings unless you have a wellness plan. Coverage for dental issues like broken teeth or congenital conditions may be included, but dental diseases like gingivitis are often excluded.

It's important to carefully review the fine print and understand the exclusions and restrictions of any pet insurance policy before purchasing it.

Life Insurance: Enterprise's Offerings and Employee Benefits

You may want to see also

Is pet life insurance worth it?

Pet insurance is a growing market, with more than 5.6 million US dogs and cats covered in 2023, an increase of 17% from the previous year. However, the decision to purchase pet insurance is a personal one, and there are several factors to consider when deciding if it is worth it for you and your furry friend.

Cost of Pet Insurance

The average annual cost for an accident and illness policy is about $676 for dogs and $383 for cats. If you choose an accident-only policy, the annual cost drops to $204 for dogs and $116 for cats. Premiums may vary based on your pet's age and breed, the cost of veterinary care in your area, and the insurance policy you choose. It is important to note that rates tend to increase as your pet gets older and more prone to health issues.

What Pet Insurance Covers

Pet insurance typically covers unexpected expenses and not routine costs associated with pet ownership. Most policies come with an annual deductible, which is the amount you are responsible for before the insurer starts paying. Once you've met your deductible, most plans pay a certain percentage of your vet bill, usually 70%, 80%, or 90%. There may also be an annual maximum payout.

It is important to understand how your deductible and reimbursement rate are applied. Some insurers apply the deductible first, then pay a percentage of the remaining bill. Others apply the reimbursement rate first, which means you'll need to spend more out of pocket before you're eligible for reimbursement.

Additionally, pet insurance generally does not cover pre-existing conditions. It is designed to cover new injuries or illnesses, not conditions the animal has before the policy takes effect.

Consider buying pet insurance if:

- Your pet is young and healthy.

- You don't have enough savings to cover a hefty vet bill.

- Having insurance coverage gives you peace of mind.

Pet insurance may not be worth it if:

- Your pet is a senior or has health problems.

- A big vet bill wouldn't be a financial hardship for you.

- You'd rather take the risk of an expensive diagnosis than pay for insurance you might never use.

Ultimately, the decision to purchase pet insurance depends on your individual circumstances, including your pet's age and health, your financial situation, and your comfort with risk.

GSK Retirement Benefits: Life Insurance Coverage Explained

You may want to see also

Frequently asked questions

No, you cannot use child life insurance on your dog. However, you can set up a pet trust to ensure your dog is taken care of after you're gone.

A pet trust is a legally sanctioned arrangement that provides for the care and maintenance of your pet in the event of your disability or death. You can designate a caregiver for your pet and a trustee to manage the funds.

You can set up a traditional trust or a statutory pet trust. For a traditional trust, you will need to appoint a caregiver and a trustee to manage the funds. You can also include detailed instructions for your pet's care. For a statutory pet trust, you can put a simple direction in your will, such as "I leave $5,000 in trust for the care of my dog." The probate court will then fill in the gaps by appointing people to provide care and oversee the money.