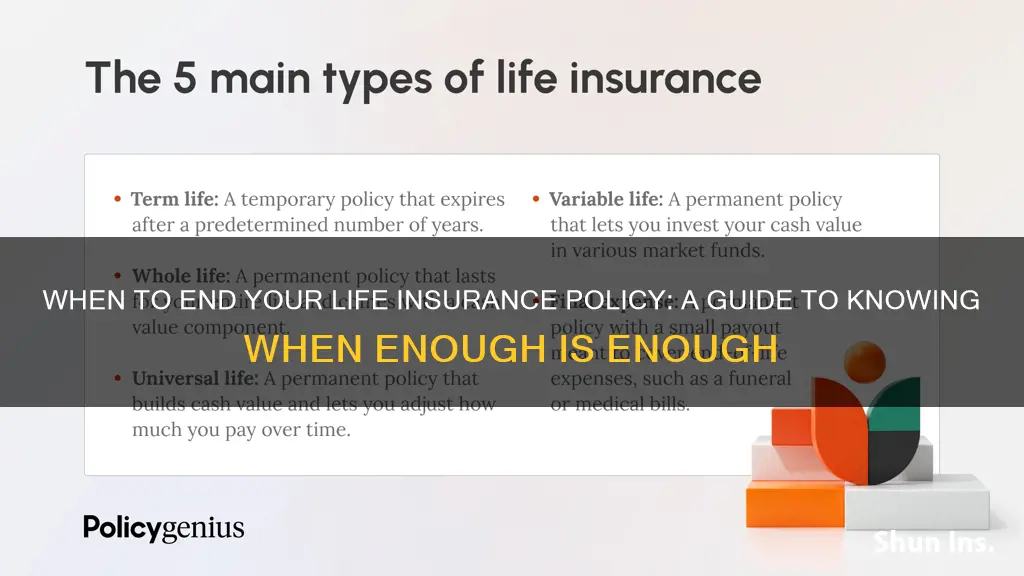

When considering the decision to discontinue life insurance, it's important to evaluate your current financial situation and future goals. Life insurance can provide financial security for your loved ones in the event of your passing, but there may be instances where maintaining a policy is no longer necessary or beneficial. Factors to consider include changes in your family structure, such as the birth of a child or the sale of a home, which may warrant a reevaluation of your insurance needs. Additionally, if you've paid off significant debts or have substantial savings, the need for life insurance may diminish. It's crucial to consult with a financial advisor to determine the most appropriate time to discontinue your policy while ensuring the continued protection of your loved ones.

What You'll Learn

- Age and Health: Discontinue if you're over 70 or have severe health issues

- Financial Needs: Review policy if your financial situation changes significantly

- Alternative Savings: Consider if savings accounts or investments offer better returns

- Tax Implications: Understand tax consequences of keeping or canceling the policy

- Beneficiary Changes: Update beneficiaries if relationships or life circumstances shift

Age and Health: Discontinue if you're over 70 or have severe health issues

Age and health are critical factors when considering whether to discontinue life insurance. As individuals age, the likelihood of developing severe health issues increases, and this is a significant consideration for insurance providers. Generally, if you are over the age of 70, it is often recommended to review your life insurance policy and consider discontinuing it. This is because, with age, the risk of mortality increases, and insurance companies may perceive the policyholder as a higher-risk individual. At this age, the premiums for life insurance can become prohibitively expensive, and the benefits may not be as valuable as they once were.

For those over 70, the decision to discontinue life insurance should be carefully evaluated. While it may seem counterintuitive to remove a safety net at this life stage, it is essential to consider the potential financial burden and the changing needs of the individual. Many older adults may have already built a substantial estate and may not require the same level of insurance coverage as they did in their younger years. Additionally, severe health issues can significantly impact the decision. If you have a pre-existing condition or a serious illness, it is crucial to assess the potential risks and benefits of maintaining a life insurance policy. Severe health issues can lead to higher premiums or even the denial of coverage, making it financially impractical to continue the policy.

When considering discontinuation due to age and health, it is advisable to consult with a financial advisor or insurance specialist. They can provide personalized guidance based on your specific circumstances. For instance, if you have a chronic condition but are generally healthy and active, there may be options to adjust your policy or explore alternative coverage. Alternatively, if your health has deteriorated significantly, you may need to consider other financial planning strategies to ensure your loved ones are protected.

In summary, age and health play a pivotal role in determining when to discontinue life insurance. Individuals over 70 and those with severe health issues should carefully review their policies and consider the potential risks and benefits. Consulting with professionals can help navigate these decisions and ensure that your financial plans align with your changing needs and circumstances. It is a delicate balance between maintaining financial security and adapting to the evolving demands of life.

Life Insurance Licenses: Validity and Renewal Requirements

You may want to see also

Financial Needs: Review policy if your financial situation changes significantly

When it comes to life insurance, one of the most important considerations is ensuring that your policy remains relevant and beneficial to your current financial situation. Life insurance is a long-term commitment, and as your financial circumstances change, it's crucial to periodically review and adjust your policy accordingly. This is especially important if you experience significant financial shifts, as your insurance needs may evolve over time.

One of the primary reasons to review your life insurance policy is to align it with your current financial obligations and goals. As you progress through life, your financial needs can change dramatically. For instance, when you start a family, you might need to increase your coverage to ensure your loved ones are financially secure in the event of your passing. Similarly, if you've paid off your mortgage or reduced your debt, you may no longer require the same level of coverage. Regularly assessing your financial situation allows you to make informed decisions about adjusting your policy limits.

Additionally, significant financial milestones, such as a substantial inheritance, a large promotion, or a business venture, could also trigger a policy review. These events can impact your risk profile and the amount of insurance you need. For example, if you've received a substantial inheritance, you might consider reducing your insurance coverage, as the financial security provided by the policy may be less critical. Conversely, a significant career advancement could lead to increased income and, consequently, a need for higher coverage to protect your family's financial future.

Reviewing your policy regularly also ensures that you're not overinsured or paying for coverage you no longer require. Overinsurance can lead to unnecessary financial strain, while underinsurance may leave your loved ones vulnerable. By staying proactive and reviewing your policy when your financial situation changes, you can make the necessary adjustments to strike the right balance.

In summary, life insurance is a dynamic financial tool that should adapt to your changing circumstances. Regularly reviewing your policy in light of significant financial changes is essential to ensure that your coverage remains appropriate and cost-effective. It empowers you to make informed decisions about your family's financial security and helps you navigate life's milestones with confidence.

Life Touch's Health Insurance: Comprehensive Coverage for Employees

You may want to see also

Alternative Savings: Consider if savings accounts or investments offer better returns

When considering the timing of discontinuing life insurance, it's essential to explore alternative financial strategies that can provide similar benefits or even better returns. One such strategy is to evaluate the potential of savings accounts and investments as viable options. These alternatives can offer individuals a way to secure their financial future and potentially accumulate wealth over time.

Savings accounts are a traditional and relatively safe investment avenue. They provide a simple and accessible way to grow your money. By opening a savings account, you can take advantage of interest earnings, which can accumulate over time. This method is particularly appealing for short-term goals or emergency funds, as it offers liquidity and a guaranteed return. Many financial institutions offer competitive interest rates, allowing your savings to grow steadily without the risks associated with more volatile investments.

In contrast, investments such as stocks, bonds, and mutual funds offer the potential for higher returns but also come with increased risk. These options are suitable for long-term financial planning and wealth accumulation. Investing in the stock market, for instance, can provide the opportunity for significant capital appreciation and dividend income. However, it's crucial to understand the market dynamics and conduct thorough research or seek professional advice before making investment decisions. Diversification is key, as spreading your investments across various assets can help mitigate risks.

When deciding whether to discontinue life insurance, it's worth comparing the benefits of savings accounts and investments. If your primary goal is to ensure financial security for your loved ones, life insurance might still be necessary. However, if you're looking to grow your wealth and have a longer investment horizon, exploring alternative savings options could be advantageous. It's essential to assess your risk tolerance, financial goals, and time frame to make an informed decision.

Additionally, consider the tax advantages and flexibility that certain investment vehicles offer. For example, tax-efficient savings accounts or retirement plans can provide long-term benefits. It's a good practice to regularly review and adjust your investment strategy to align with your evolving financial objectives. By doing so, you can make the most of your savings and investments while potentially discontinuing life insurance as part of a comprehensive financial plan.

Insuring an Ex-Spouse: Is It Possible?

You may want to see also

Tax Implications: Understand tax consequences of keeping or canceling the policy

When considering the tax implications of keeping or canceling a life insurance policy, it's important to understand the potential financial consequences. Here's a detailed breakdown of the tax considerations:

Keeping the Policy:

If you decide to keep your life insurance policy, there are several tax benefits to be aware of. Firstly, the death benefit paid out upon your passing is generally tax-free. This means that the proceeds from the policy will not be subject to income tax for the beneficiary. Additionally, the cash value of the policy, if any, can grow tax-deferred, allowing it to accumulate over time without incurring immediate tax liabilities. This can be particularly advantageous for long-term financial planning.

Canceling the Policy:

Canceling a life insurance policy can have tax implications as well. If you surrender the policy for a cash value, you may be subject to income tax on the amount received. The tax treatment depends on the policy type and its tax status. For instance, if you have a term life insurance policy with no cash value, canceling it might not result in significant tax consequences. However, if you have a permanent life insurance policy with a cash value component, canceling it could trigger a taxable event.

Tax-Free Policy Surplus:

In some cases, life insurance policies can accumulate a surplus, which is the difference between the policy's cash value and its death benefit. If you cancel the policy and the surplus is significant, you may be able to take a tax-free distribution from the policy's surplus account. This can be a strategic move if you need immediate funds without incurring taxes.

Policy Loans and Taxes:

Another aspect to consider is taking out a loan against the cash value of your life insurance policy. While this provides access to funds, it can also have tax implications. Any loan taken against the policy is generally considered a taxable distribution, and you may be subject to income tax on the loan amount. Additionally, interest payments on the loan are typically taxable as well.

Understanding these tax implications is crucial when making decisions about your life insurance policy. Consulting with a tax professional or financial advisor can provide personalized guidance based on your specific circumstances, ensuring you make informed choices regarding your insurance coverage and its tax consequences.

Printing Your Life Insurance License: A Step-by-Step Guide

You may want to see also

Beneficiary Changes: Update beneficiaries if relationships or life circumstances shift

When it comes to life insurance, beneficiaries play a crucial role in ensuring that your policy is utilized according to your wishes. Beneficiaries are the individuals or entities you name as the recipients of your insurance payout in the event of your death. It's essential to regularly review and update your beneficiary information to reflect any changes in your life circumstances or relationships. Here's why:

Life Changes and Relationship Updates: Life is a dynamic journey, and your relationships and life events can evolve over time. Marriage, divorce, the birth of children, or the passing of loved ones are significant life events that may impact your beneficiary choices. For instance, if you get married, you might want to add your spouse as a primary beneficiary. Conversely, if you go through a divorce, updating your beneficiaries to exclude your former spouse is essential to prevent potential legal complications. Similarly, the birth of a child or the passing of a parent might prompt you to reconsider your beneficiary list.

Legal and Tax Implications: Failing to update your beneficiaries can have legal and tax consequences. If you don't specify beneficiaries, the insurance company may follow a default order, which might not align with your intentions. Additionally, not updating beneficiaries after a marriage or divorce could lead to legal disputes among family members, especially if the insurance policy was not properly reviewed and updated. It's also important to consider tax implications; beneficiaries may be subject to different tax treatments, and proper planning can help minimize tax burdens for your chosen recipients.

Peace of Mind: Regularly reviewing and updating your beneficiaries provides peace of mind. It ensures that your loved ones receive the intended financial support during a difficult time. Life insurance is a valuable tool to provide financial security, and by keeping your beneficiary information current, you can rest assured that your policy is effectively protecting your family.

Documentation and Communication: When updating beneficiaries, it's crucial to follow the proper procedures outlined by your insurance provider. This often involves filling out a beneficiary change form, providing valid identification, and notifying the insurance company of any changes. Clear communication with your insurance company is essential to ensure that your updated beneficiary information is accurately recorded.

In summary, beneficiary changes are a critical aspect of managing your life insurance policy. By staying proactive and updating your beneficiaries when relationships or life circumstances shift, you can ensure that your loved ones are protected, and your wishes are honored. Regular reviews and proper documentation will help you maintain control over your insurance benefits and provide financial security for your beneficiaries.

Life Insurance Agents: Sharing Commissions, Is It Allowed?

You may want to see also

Frequently asked questions

There are several reasons why you might want to review and potentially discontinue your life insurance. Firstly, if your financial obligations and dependents have changed significantly, you may no longer need the same level of coverage. For example, if you've paid off your mortgage, have a substantial savings, or your children have moved out, the need for a large death benefit might diminish. Secondly, if you've accumulated a substantial amount of other assets or investments that can provide financial security for your loved ones, you may find that your life insurance is no longer necessary. It's important to regularly assess your financial situation and adjust your insurance coverage accordingly.

Keeping a life insurance policy for an extended period without changes in your circumstances can lead to several drawbacks. Firstly, you might be paying premiums for coverage that no longer suits your needs, resulting in unnecessary financial outlay. Secondly, over time, the initial benefits of the policy might become less valuable as your financial situation improves. Additionally, if you outlive the expected mortality rates for your age group, the policy may not provide the intended security. It's essential to periodically review and adjust your policy to ensure it remains a suitable and cost-effective solution.

Yes, there can be tax considerations when discontinuing a life insurance policy. If you have a cash value component in your policy, withdrawing or surrendering it may result in tax implications. You might be subject to income tax on any cash value withdrawals, and the policy's surrender charge may also apply. It's advisable to consult a financial advisor or tax professional to understand the specific tax rules and potential consequences in your jurisdiction. They can help you make an informed decision and explore alternative options if necessary.

To ensure a smooth transition when discontinuing your life insurance, start by reviewing your policy documents and understanding the terms and conditions. Contact your insurance provider to discuss the process and any associated fees or penalties. They can guide you through the necessary steps, including updating your beneficiaries and adjusting your coverage. Additionally, consider creating a comprehensive financial plan that accounts for the discontinuation of the policy. This plan should outline alternative financial strategies to ensure the continued financial security of your dependents. It's also beneficial to seek professional advice to navigate any tax or investment implications effectively.