Guardian Life Insurance can be expensive for several reasons. Firstly, the company's comprehensive coverage options, including term life, whole life, and universal life policies, often come with higher premiums due to their extensive benefits and flexibility. Additionally, Guardian's focus on providing personalized financial solutions and its extensive network of financial advisors may contribute to higher costs. Another factor is the company's commitment to financial education and customer support, which can result in more detailed and tailored policies, potentially increasing the overall price. Understanding these factors can help individuals make informed decisions about their insurance needs and budget accordingly.

What You'll Learn

- High-Risk Pools: Guardian's extensive coverage attracts sicker individuals, driving up costs

- Medical Advances: New treatments and longer lifespans increase insurance payouts

- Regulatory Compliance: Stringent regulations add to operational and administrative expenses

- Profit Margins: Guardian aims for profitability, which can impact premium prices

- Market Competition: Intense competition in the insurance market influences pricing strategies

High-Risk Pools: Guardian's extensive coverage attracts sicker individuals, driving up costs

The high cost of Guardian Life Insurance can be attributed to the nature of their business model, which involves offering extensive coverage options to a diverse range of customers. One of the primary reasons for the higher premiums is the concept of high-risk pools.

In the insurance industry, high-risk pools are groups of individuals with pre-existing medical conditions or lifestyles that are considered more likely to result in health issues. Guardian Life Insurance, being a comprehensive provider, caters to a wide spectrum of customers, including those with various health concerns. This extensive coverage attracts individuals who may have been previously denied insurance or faced higher premiums due to their medical history. As a result, these policyholders often require more frequent medical interventions and treatments, leading to increased costs for the insurance company.

The high-risk pool effect is a significant factor in the pricing of Guardian Life Insurance. When a large number of individuals with similar health risks are pooled together, the overall risk for the insurance provider increases. This is because these individuals are more prone to health issues, and their collective medical needs can strain the financial resources of the insurance company. Consequently, Guardian Life Insurance must charge higher premiums to ensure they can adequately cover the potential costs associated with this high-risk group.

Furthermore, the extensive coverage options offered by Guardian Life Insurance contribute to the higher costs. These policies often include a wide range of benefits, such as critical illness coverage, disability income protection, and long-term care insurance. While these additional benefits provide comprehensive protection, they also increase the overall price of the policy. Customers who opt for more extensive coverage are essentially paying for a broader safety net, which can be more expensive to maintain.

In summary, the high cost of Guardian Life Insurance is intricately linked to the high-risk pools they attract and the extensive coverage options they provide. By catering to a diverse range of customers with varying health needs, Guardian Life Insurance faces the challenge of managing a higher-risk pool, which ultimately drives up the cost of their policies. Understanding these factors is essential for individuals considering Guardian Life Insurance to make informed decisions about their coverage and premiums.

Life Insurance Beneficiaries: Taxable or Not?

You may want to see also

Medical Advances: New treatments and longer lifespans increase insurance payouts

The rising cost of life insurance, particularly from companies like Guardian, can be attributed to several factors, including medical advances and an aging population. One of the primary reasons is the development of new treatments and therapies that extend life expectancy. As medical science progresses, we now have access to treatments for previously incurable diseases, and the quality of healthcare has significantly improved. While these advancements are undoubtedly beneficial, they also contribute to the higher costs of insurance.

New treatments often require specialized care and frequent medical interventions, which can be expensive. For instance, the development of advanced cancer therapies, gene-based treatments, and personalized medicine has revolutionized patient care. These innovative approaches, while effective, often come with a higher price tag, as they involve complex procedures and extensive research. As a result, insurance companies need to account for these increased costs when setting their premiums.

Additionally, the general increase in life expectancy is a significant factor. With people living longer, the likelihood of insurance payouts increases. Guardian Life Insurance, for example, may have to cover more extended periods of coverage, which can lead to higher overall costs. The longer lifespan also means that individuals are more susceptible to age-related health issues, further impacting insurance expenses.

The impact of medical advances on insurance premiums is further exacerbated by the rising prevalence of chronic diseases. As people live longer, the chances of developing long-term health conditions increase. Conditions like diabetes, heart disease, and Alzheimer's require ongoing management and treatment, which can be costly. Insurance companies must factor in the potential for more frequent and prolonged claims, leading to higher premiums.

In summary, the expensive nature of Guardian Life Insurance can be traced back to the advancements in medical science and the resulting impact on life expectancy and healthcare costs. While these developments have improved our quality of life, they also present challenges for insurance providers, who must adapt to the changing landscape of healthcare and adjust their policies accordingly. Understanding these factors is essential for both consumers and insurance companies to navigate the complexities of life insurance pricing.

Term Life Insurance: Cashing Out and Claiming Your Benefits

You may want to see also

Regulatory Compliance: Stringent regulations add to operational and administrative expenses

The high cost of Guardian Life Insurance can be attributed to several factors, and one significant aspect is the stringent regulatory environment in which insurance companies operate. Insurance is a highly regulated industry, and for good reason. Governments and regulatory bodies impose strict rules and guidelines to protect consumers and ensure fair practices. These regulations are designed to safeguard policyholders and prevent fraudulent activities, but they come at a cost.

Regulatory compliance requires insurance companies to maintain extensive documentation, adhere to complex reporting standards, and implement robust internal controls. These processes are essential to ensure transparency and accountability, but they demand significant resources and expertise. Insurance providers must allocate substantial financial and human capital to navigate the intricate web of regulations. This includes hiring specialized staff, conducting regular audits, and investing in technology to streamline compliance processes. As a result, these operational and administrative expenses are reflected in the overall cost of insurance policies.

Stringent regulations often lead to increased overhead costs. Insurance companies must invest in training and educating their staff to keep them updated on ever-changing regulatory requirements. They also need to develop and maintain comprehensive compliance programs, which can be a significant financial burden. Moreover, the need for frequent reporting and disclosure requirements adds to the administrative workload, requiring additional resources to ensure accuracy and compliance. These expenses are then passed on to policyholders in the form of higher premiums.

The impact of regulatory compliance on insurance costs is further exacerbated by the industry's competitive nature. Insurance providers strive to offer competitive rates, but the need to comply with regulations can limit their ability to reduce prices significantly. Stricter rules may require companies to maintain higher capital reserves, which directly influences the cost of insurance products. As a result, consumers often face higher premiums, especially in a market where competition is intense.

In summary, the stringent regulatory environment is a critical factor contributing to the higher costs of Guardian Life Insurance. While regulations are essential for consumer protection, they impose financial and operational challenges on insurance companies. These challenges ultimately lead to increased operational and administrative expenses, which are then reflected in the premiums paid by policyholders. Understanding this aspect provides insight into the complex pricing structures of insurance products.

Global Life Insurance: Real Fees, Real Coverage?

You may want to see also

Profit Margins: Guardian aims for profitability, which can impact premium prices

Guardian Life Insurance, a prominent player in the insurance industry, has garnered attention for its relatively high premium rates. One of the primary factors contributing to this expense is the company's strategic focus on profitability. Guardian Life Insurance aims to maintain a strong financial position, which often translates to higher costs for policyholders. The insurance provider's commitment to profitability is a double-edged sword. On one hand, it ensures the company's long-term sustainability and ability to honor its financial commitments. However, this pursuit of profit can directly influence the premiums customers pay.

Profit margins are a critical aspect of insurance business models. Guardian Life Insurance, like many other insurers, operates with the goal of generating substantial returns on its investments and operations. To achieve this, they may set higher premium rates to ensure a steady income stream. This approach is especially true for life insurance, where the company needs to account for potential payouts over extended periods, often spanning decades. As a result, the higher profit margins can be a significant factor in the overall cost of policies.

The impact of profit margins on premium prices is twofold. Firstly, a larger profit margin means the company has more financial resources to invest in various aspects of its business, including marketing, customer service, and product development. These investments can contribute to improved customer experiences and a more robust product offering. However, this also means that a significant portion of the premium collected goes towards covering these operational costs and generating profit. Secondly, higher profit margins can indicate a more conservative investment strategy, which may result in a more stable financial position but could also lead to increased premium costs as the company aims to maintain a certain level of profitability.

Guardian Life Insurance's profitability goals can be a double-edged sword for consumers. While it ensures the company's financial stability, it may also lead to higher out-of-pocket expenses for policyholders. This dynamic is particularly relevant for long-term life insurance policies, where the impact of profit margins can be more pronounced over time. As such, understanding the company's profit margin strategies is essential for individuals seeking to make informed decisions about their insurance coverage.

In summary, the high premium rates associated with Guardian Life Insurance can be attributed, in part, to the company's focus on profitability. This strategic approach influences the overall cost of policies, impacting individuals' financial decisions. Consumers should consider the balance between profitability and premium prices when choosing insurance providers, ensuring they receive comprehensive coverage at a reasonable cost.

Dropping Out of Insurance: A Life-Changing Event?

You may want to see also

Market Competition: Intense competition in the insurance market influences pricing strategies

In the insurance industry, the concept of market competition plays a pivotal role in shaping pricing strategies, especially for life insurance providers like Guardian Life. The insurance market is highly competitive, with numerous companies vying for customers' attention and business. This intense competition has a direct impact on the pricing of life insurance policies, often making them more expensive than in less competitive markets.

When multiple insurance companies offer similar products and services, they are forced to differentiate themselves to attract and retain customers. This differentiation often occurs through pricing, where companies may set their rates higher to cover potential risks and ensure profitability. Guardian Life, being a prominent player in the market, must consider the pricing strategies of its competitors to remain competitive. If a rival company offers a more attractive policy at a lower cost, Guardian Life might need to adjust its prices to maintain market share. This dynamic can lead to a cycle of price adjustments, where each company responds to the others' moves, potentially resulting in higher overall costs for consumers.

The competitive nature of the insurance market also encourages companies to invest in marketing and sales strategies to gain a competitive edge. These efforts can contribute to the overall cost of policies. Marketing campaigns, sales incentives, and promotional offers are tools used to attract customers, and these expenses are often reflected in the final price of the insurance product. As a result, consumers may find themselves paying more for life insurance due to the competitive arms race among insurance providers.

Additionally, market competition can influence the speed at which pricing changes are implemented. In a highly competitive environment, companies may be more responsive to market trends and customer demands, leading to quicker adjustments in pricing. This responsiveness can be both a benefit and a challenge, as it may result in more frequent rate changes, which can be concerning for policyholders.

In summary, the insurance market's intense competition significantly impacts the pricing of life insurance policies. Guardian Life, as a market participant, must navigate this competitive landscape, considering the strategies of its rivals to set competitive prices. The resulting pricing dynamics can make life insurance more expensive, reflecting the costs of marketing, sales, and the need to stay ahead in a crowded market. Understanding these market forces is essential for consumers to make informed decisions when choosing life insurance coverage.

Navigating Life Insurance: Your Guide to Parent's Policies

You may want to see also

Frequently asked questions

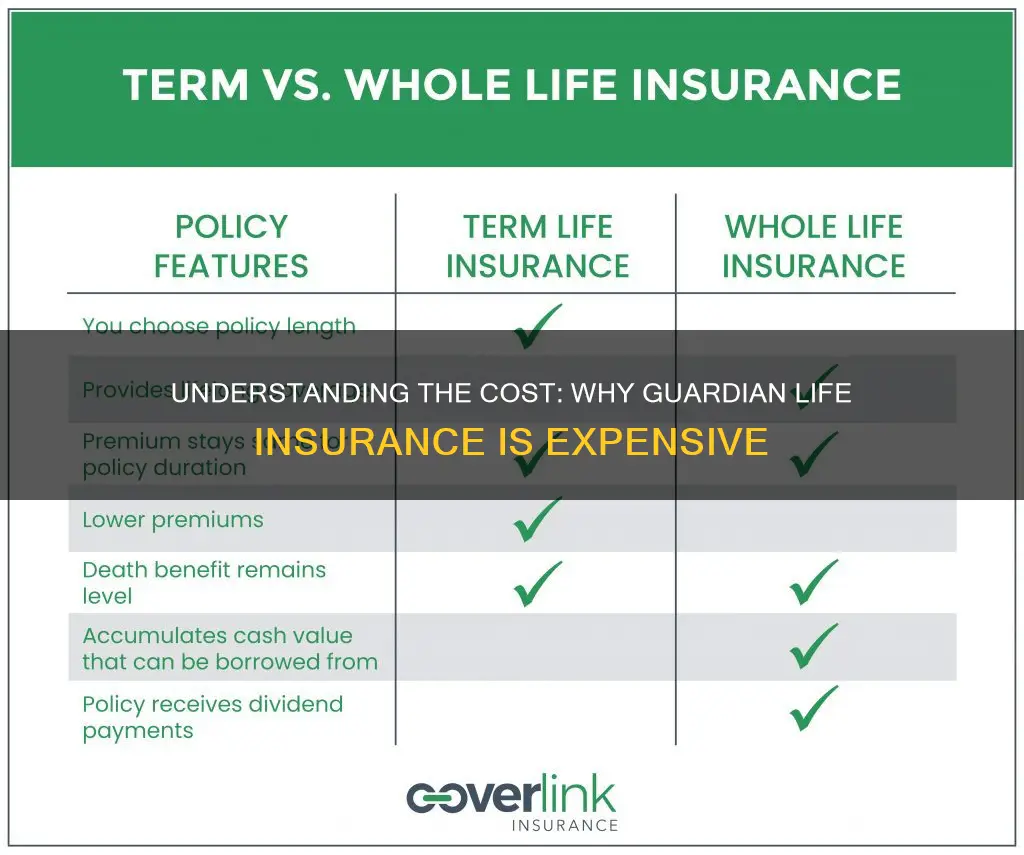

Guardian Life Insurance is often priced higher due to several factors. Firstly, they offer comprehensive coverage options, including term life, whole life, and universal life policies, which provide extensive benefits and flexibility. These policies typically have higher costs due to the extended coverage periods and the potential for cash value accumulation. Additionally, Guardian Life Insurance may have higher operating expenses, which can contribute to the overall cost. They invest in various financial products and services, which can result in more complex and potentially more expensive policies.

Yes, age and health factors play a significant role in determining insurance premiums. Older individuals may face higher rates because they are statistically more likely to require medical attention and have a higher risk profile. Similarly, people with pre-existing health conditions or those who smoke or have unhealthy lifestyles might be considered higher-risk clients, leading to increased insurance costs. Guardian Life Insurance, like many other providers, uses these factors to assess risk and set premiums accordingly.

Absolutely! While Guardian Life Insurance may have higher base rates, there are strategies to potentially lower your premiums. One approach is to maintain a healthy lifestyle, as this can improve your risk profile and lead to better insurance rates. Additionally, bundling multiple policies with Guardian Life Insurance could result in discounts. Reviewing and comparing different policy options, such as term vs. permanent life insurance, can also help you make an informed decision and potentially find more affordable alternatives.