Life insurance management is a crucial aspect of financial planning that involves the strategic oversight and administration of life insurance policies. It encompasses various tasks, including assessing an individual's or family's insurance needs, selecting appropriate coverage, and ensuring the efficient utilization of the policy's benefits. Effective management includes regular policy reviews, premium payments, and claims processing, all aimed at providing financial security and peace of mind to policyholders and their beneficiaries. This process is essential for individuals and families to navigate the complexities of life insurance, ensuring that their policies remain relevant and beneficial throughout their lives.

What You'll Learn

- Policy Administration: Managing policy details, payments, and beneficiary information

- Claims Processing: Handling death claims, verifying documents, and paying out benefits

- Risk Assessment: Evaluating individual risks and setting appropriate coverage levels

- Regulatory Compliance: Adhering to legal and insurance industry standards

- Customer Service: Providing support, answering queries, and assisting policyholders

Policy Administration: Managing policy details, payments, and beneficiary information

Life insurance management is a crucial aspect of the insurance industry, focusing on the efficient handling of policyholder information, payments, and beneficiary details. Effective management ensures that insurance companies can provide accurate and timely services to their clients, which is essential for maintaining trust and loyalty. Policy administration is a core component of this process, involving the meticulous management of various policy-related tasks.

In the context of policy administration, the primary goal is to maintain an organized and up-to-date record of each policyholder's information. This includes personal details such as name, address, contact information, and any relevant medical history. Accurate record-keeping is vital as it enables insurance companies to quickly retrieve policy information, ensuring efficient service delivery. For instance, when a policyholder makes a claim, the insurance provider can swiftly access their policy details, including coverage amounts, premium payments, and any previous adjustments or updates.

Payment management is another critical aspect of policy administration. Insurance companies must ensure that premiums are collected promptly and accurately. This involves setting up payment schedules, sending reminders to policyholders, and processing payments through various methods, such as direct debits, online transfers, or credit card payments. Efficient payment management not only ensures the financial stability of the insurance company but also provides policyholders with a seamless experience, knowing their premiums are being handled securely and on time.

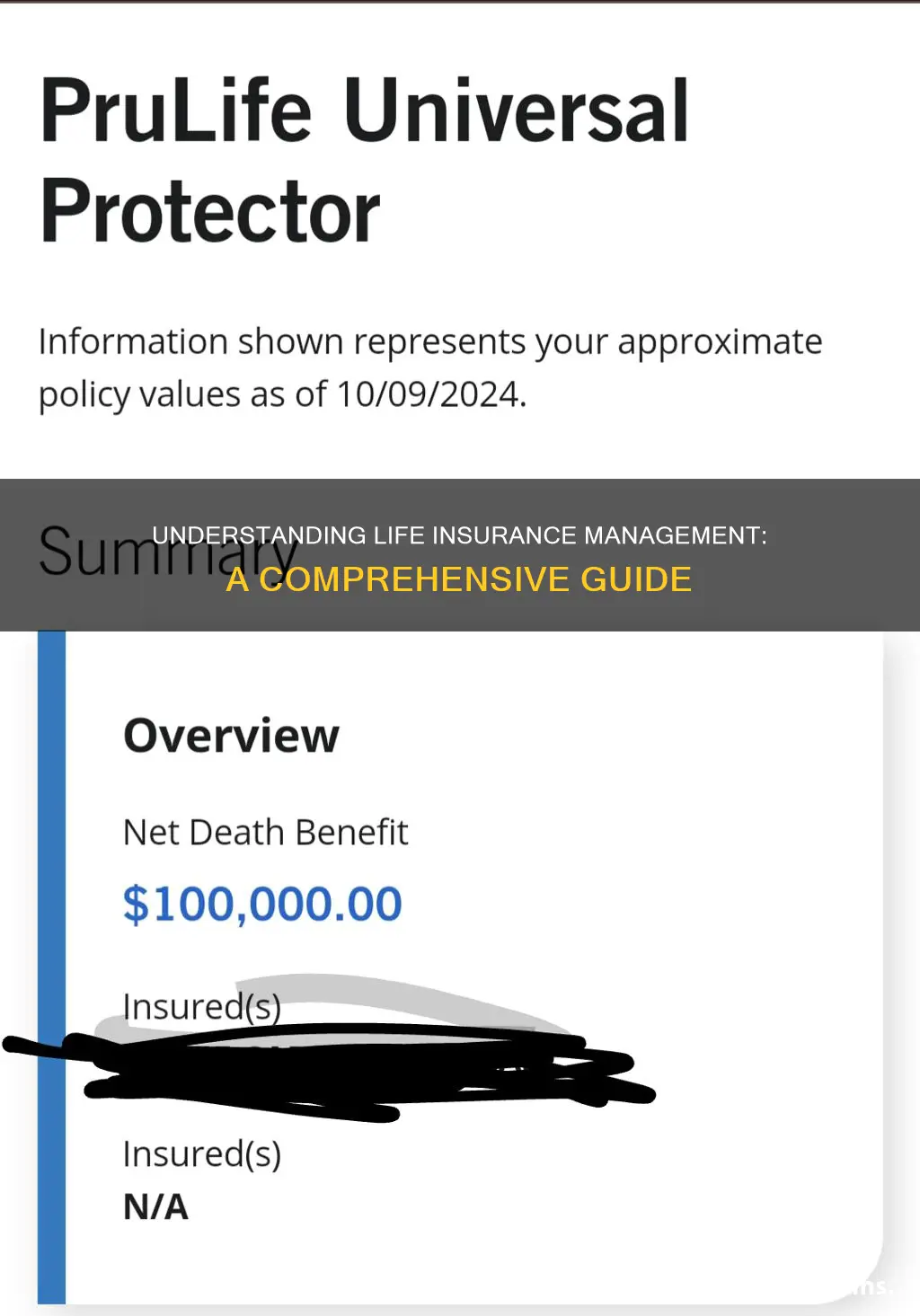

Beneficiary information is also a sensitive and essential part of policy administration. When a policyholder purchases life insurance, they can designate beneficiaries who will receive the death benefit upon their passing. Managing and updating beneficiary details is crucial to ensure that the insurance company can facilitate the distribution of the benefit to the intended recipients. This process may involve verifying and updating beneficiary names, addresses, and relationships, especially during significant life events like marriages, births, or divorces.

Effective policy administration also includes regular policy reviews and updates. Insurance needs can change over time, and policyholders may require adjustments to their coverage. Administration staff should be proactive in reviewing policies, ensuring they remain relevant and adequate for the policyholder's current circumstances. This might involve increasing or decreasing coverage amounts, adding or removing riders, or updating beneficiaries to reflect any changes in the policyholder's life. By staying proactive, insurance companies can provide ongoing value to their clients and ensure that their policies remain a reliable form of financial protection.

Max Life Insurance: Unlocking Bonus Benefits

You may want to see also

Claims Processing: Handling death claims, verifying documents, and paying out benefits

Claims processing is a critical aspect of life insurance management, ensuring that the policyholder's beneficiaries receive the intended financial support upon the insured individual's passing. When a death claim is received, the process involves several meticulous steps to ensure accuracy and fairness. Firstly, the insurance company must verify the insured's death, often by obtaining a certified death certificate from the relevant authorities. This document serves as the primary proof of the individual's demise. The claims adjuster then reviews the policy to understand the coverage and the terms and conditions related to death claims.

Once the death is confirmed, the insurance company initiates the verification process of the policyholder's beneficiaries. This step is crucial to ensure that the benefits are paid to the rightful recipients. The company may contact the policyholder's listed beneficiaries, often through the provided contact information, to confirm their identity and eligibility. In some cases, additional documentation, such as a will or court orders, might be required to establish the validity of the beneficiaries' claims, especially if there are disputes or multiple potential heirs.

After verifying the beneficiaries, the insurance company proceeds with the payment of benefits. This process involves calculating the payout based on the policy's terms, which could include a lump sum, periodic payments, or a combination of both. The amount paid out is typically determined by the policy's coverage, premium payments, and any applicable deductions or adjustments. The insurance company ensures that the beneficiaries receive the financial support they are entitled to, providing a sense of security and financial stability during a challenging time.

Efficient claims processing requires attention to detail and adherence to strict protocols. Insurance companies often have dedicated teams of professionals who specialize in handling death claims, ensuring that the process is handled with sensitivity and expertise. These professionals guide the beneficiaries through the necessary steps, providing support and answering queries to facilitate a smooth claims settlement.

In summary, claims processing in life insurance management is a complex yet essential procedure. It involves verifying the insured's death, confirming the beneficiaries' eligibility, and paying out benefits as per the policy's terms. This process requires careful documentation, attention to detail, and a compassionate approach to ensure that the policyholders' intentions are honored and their beneficiaries receive the financial support they need during difficult times.

Life Insurance Annual Charges: What You Need to Know

You may want to see also

Risk Assessment: Evaluating individual risks and setting appropriate coverage levels

Life insurance management involves a comprehensive process of assessing and managing the risks associated with insuring an individual's life. This critical aspect of the industry ensures that the chosen coverage is adequate and tailored to the specific needs of the policyholder. Risk assessment is at the heart of this process, as it involves a detailed evaluation of various factors that could impact the insured's life and the financial obligations of the insurance company.

The first step in risk assessment is to identify and understand the individual risks associated with the policyholder. These risks can be categorized into several areas: health, lifestyle, financial situation, and environmental factors. For instance, pre-existing medical conditions, such as heart disease or diabetes, can significantly impact the insured's life expectancy and the likelihood of certain health-related claims. Similarly, lifestyle choices like smoking, excessive alcohol consumption, or participation in high-risk sports can also influence risk profiles.

Financial assessments are another crucial aspect of risk evaluation. This includes analyzing the policyholder's income, assets, liabilities, and overall financial stability. A comprehensive financial review helps determine the individual's ability to meet financial obligations and the potential impact of their death on beneficiaries and dependents. For example, a high-income earner with substantial assets and a stable financial history may require different coverage compared to someone with a lower income and significant debts.

Environmental factors also play a role in risk assessment. This includes considering the policyholder's location, occupation, and any potential hazards or risks associated with their daily activities. For instance, individuals living in areas prone to natural disasters or those with occupations involving dangerous work environments may require additional coverage or specific policy adjustments.

Once all these factors are considered, the next step is to set appropriate coverage levels. This involves calculating the potential financial impact of the insured's death and determining the necessary payout to support beneficiaries and dependents. The assessment should also consider the policyholder's age, gender, and overall health, as these factors influence premium costs and coverage amounts. A thorough risk assessment ensures that the chosen coverage is sufficient to provide financial security and peace of mind to the policyholder and their loved ones.

Client ID in IDBI Federal Life Insurance: What's the Significance?

You may want to see also

Regulatory Compliance: Adhering to legal and insurance industry standards

Life insurance management involves a comprehensive set of practices and processes that ensure the smooth operation of life insurance companies and the protection of policyholders' interests. One critical aspect of this management is regulatory compliance, which refers to adhering to legal and industry standards set by governing bodies and insurance regulatory authorities. This compliance is essential to maintain the integrity of the insurance industry and to safeguard the rights of policyholders.

Regulatory bodies establish a framework of rules and guidelines that insurance companies must follow. These regulations cover various aspects of the business, including product design, underwriting practices, claims handling, and customer service. For instance, insurance regulators might mandate that companies provide clear and transparent policy documents, ensuring that policyholders fully understand the terms and conditions of their coverage. Compliance with these standards is crucial to prevent fraudulent activities, protect consumer rights, and maintain market stability.

Adhering to legal and industry standards involves several key practices. Firstly, insurance companies must maintain accurate and up-to-date records of all policy-related information. This includes policy details, customer data, and financial transactions. Proper record-keeping ensures transparency and facilitates compliance audits. Secondly, companies should implement robust internal controls to prevent and detect any potential misconduct or fraudulent activities. This includes regular reviews of underwriting practices, claims processing, and sales activities to identify and rectify any deviations from the established standards.

Furthermore, staying informed about changes in regulations is vital. Insurance industry standards evolve over time, and companies must keep abreast of these changes to ensure ongoing compliance. This may involve regular training for staff, updates to internal policies, and adjustments to operational procedures. By proactively monitoring and adapting to regulatory changes, insurance companies can maintain their compliance and avoid potential legal issues.

In summary, regulatory compliance is a cornerstone of effective life insurance management. It requires a commitment to maintaining high standards of transparency, accuracy, and integrity in all business operations. By adhering to legal and industry standards, insurance companies can build trust with their customers, protect their interests, and contribute to a stable and reliable insurance market. This compliance also helps in avoiding costly legal consequences and maintaining a positive reputation in the industry.

Credit Life Insurance: Can You Cancel Your Policy?

You may want to see also

Customer Service: Providing support, answering queries, and assisting policyholders

Customer service is a critical component of life insurance management, as it directly impacts the satisfaction and loyalty of policyholders. Effective customer service involves providing prompt, accurate, and personalized support to address the needs and concerns of policyholders throughout their insurance journey. Here's an overview of how to excel in this area:

Quick Response and Efficiency: Policyholders often have urgent questions or issues that require immediate attention. Customer service representatives should be trained to respond swiftly to inquiries, ensuring that policyholders receive the necessary assistance without unnecessary delays. Efficient handling of queries can significantly improve customer satisfaction and build trust.

Knowledge and Expertise: Life insurance management professionals must possess a comprehensive understanding of insurance products, policies, and procedures. They should be well-versed in various life insurance types, coverage options, and claim processes. This knowledge enables them to provide accurate information, clarify doubts, and offer tailored solutions to policyholders' unique needs. Regular training and updates on new products or regulations are essential to stay informed.

Empathy and Personalization: Building a strong customer service experience involves demonstrating empathy and understanding towards policyholders. Each customer interaction should be treated as an opportunity to establish a personal connection. By actively listening to their concerns, acknowledging their feelings, and offering personalized advice, customer service representatives can create a positive and memorable experience. This approach fosters a sense of loyalty and encourages long-term relationships with policyholders.

Clear Communication and Transparency: Effective communication is key to successful customer service. Policyholders should receive clear and concise information about their policies, benefits, and any changes or updates. Transparent communication regarding claim processes, policy terms, and fees ensures that customers are well-informed and can make decisions with confidence. Regular updates and notifications can be sent via multiple communication channels to keep policyholders engaged and informed.

Problem-Solving and Issue Resolution: Customer service teams should be equipped with effective problem-solving skills to handle various issues. This includes addressing policy-related concerns, claim disputes, and administrative errors. Representatives should be empowered to make on-the-spot decisions to resolve simple issues promptly. For more complex problems, a well-defined escalation process should be in place to ensure timely and effective resolution, providing policyholders with a sense of security and fairness.

Life Insurance Cancellation: Can You Get a Refund?

You may want to see also

Frequently asked questions

Life insurance management refers to the process of overseeing and maintaining an individual's or family's life insurance policies. It involves ensuring that the insurance coverage is adequate, up-to-date, and aligned with the policyholder's financial goals and needs.

Effective life insurance management is crucial for several reasons. It helps individuals and families prepare for unforeseen circumstances, such as the death of a breadwinner, by providing financial security and peace of mind. Proper management ensures that the insurance benefits are utilized efficiently and according to the policyholder's intentions.

Life insurance management is beneficial for anyone who has life insurance policies, including individuals, families, businesses, and organizations. It is essential for those who rely on insurance as a primary source of financial protection.

Life insurance management encompasses various tasks, including reviewing and assessing existing policies, ensuring coverage adequacy, understanding policy terms and conditions, making premium payments, updating personal and financial information, and periodically reviewing and adjusting coverage as life circumstances change.

It is recommended to review your life insurance policies at least annually or whenever significant life events occur, such as marriage, the birth of a child, purchasing a home, or changes in income. Regular reviews help ensure that your coverage remains relevant and provides the necessary financial protection.