When a loved one passes away, one of the many concerns families face is the process of settling the deceased's affairs, including the claim of any life insurance policies. The question of how long it takes to receive the life insurance payout can vary depending on several factors. These factors include the insurance company's policies, the type of policy (term or whole life), the method of payment chosen, and the complexity of the claim. Typically, the process can be completed within a few weeks to a few months, but it's essential to understand the specific procedures and requirements of the insurance provider to ensure a smooth and timely settlement.

What You'll Learn

- Legal Process: Understanding the legal procedures for claiming insurance after a death

- Policy Details: Knowing the specific terms and conditions of the insurance policy

- Documentation: Gathering and submitting necessary documents for the insurance claim

- Claim Submission: Steps to file a claim and the timeline for processing

- Payout Timeline: Estimating the time from claim submission to receiving the insurance payout

Legal Process: Understanding the legal procedures for claiming insurance after a death

The legal process of claiming life insurance benefits after a loved one's death can be a complex and often emotional journey. It is crucial to understand the steps involved to ensure a smooth and timely settlement. Here's a comprehensive guide to help you navigate this process:

- Gather Information: Begin by collecting all the necessary documentation related to the deceased's life insurance policy. This includes the original policy documents, death certificates, and any other relevant paperwork. Contact the insurance company and request a list of required documents to initiate the claims process. It is essential to act promptly, as there may be time limits for filing a claim.

- Notify the Insurance Company: Inform the insurance provider about the death as soon as possible. They will guide you through the next steps and provide you with the necessary claim forms. Typically, the insurance company will have a dedicated claims department or a specific team to handle such cases. Provide them with the required information and documents to initiate the claims process.

- Determine the Beneficiary: Life insurance policies usually have designated beneficiaries, who are the individuals or entities entitled to receive the death benefit. Review the policy to identify the beneficiaries and their contact information. If the deceased did not specify beneficiaries or if there are disputes, legal procedures may be required to determine the rightful recipients.

- File the Claim: Complete the claim forms accurately and provide all the requested documentation. This may include proof of death, identification of the deceased, and evidence of the relationship between the deceased and the beneficiary. Submit the claim to the insurance company, ensuring that all necessary paperwork is included. Keep copies of all documents for your records.

- Legal Review and Settlement: After receiving the claim, the insurance company will conduct a review to verify the information and ensure compliance with the policy terms. This process may involve additional documentation or interviews. If the claim is approved, the insurance company will settle the death benefit according to the policy's provisions. The time it takes for the settlement can vary, but it is essential to remain patient and follow up with the insurance company if there are delays.

- Legal Disputes and Challenges: In some cases, disputes may arise regarding the validity of the claim or the distribution of benefits. If there are challenges or disagreements, legal proceedings may be necessary to resolve the issue. This could involve court intervention to determine the rightful beneficiaries or the amount of the death benefit. It is advisable to seek legal counsel to navigate such complex situations.

Remember, each insurance company may have its own specific procedures and requirements, so it's essential to follow their guidance. Seeking professional advice from legal or financial experts can also provide valuable support during this challenging time. Understanding the legal process ensures that the insurance claim is handled efficiently and that the beneficiaries receive their rightful benefits.

Life Insurance: Primary, Beneficiary, and You

You may want to see also

Policy Details: Knowing the specific terms and conditions of the insurance policy

When someone passes away, the process of claiming life insurance benefits can be complex and time-sensitive. Understanding the policy details is crucial to ensure a smooth and efficient claims process. Here's a comprehensive guide to navigating the intricacies of life insurance policies:

Review the Policy Documents: Upon receiving the death of a loved one, the first step is to carefully examine the insurance policy documents. These documents typically include the policy contract, beneficiary information, and any additional riders or endorsements. Pay close attention to the policy number, effective date, and coverage amount. These details are essential for initiating the claims process.

Identify the Beneficiary: Life insurance policies usually have a designated beneficiary or beneficiaries who will receive the death benefit. Ensure that the policy's beneficiary information is up-to-date and accurate. If the policy has multiple beneficiaries, the insurance company will need to follow a specific procedure to determine the distribution of the payout.

Understand Policy Exclusions and Limitations: Every insurance policy has certain exclusions and limitations. These are specific events or circumstances that are not covered by the policy. For example, pre-existing conditions, self-inflicted injuries, or acts of war might be excluded. Familiarize yourself with these exclusions to understand what the policy does and does not cover.

Check for Policy Riders or Endorsements: Some life insurance policies offer additional benefits or riders that can extend coverage. These riders might include accidental death benefits, waiver of premium, or critical illness coverage. Reviewing these riders is essential to know if the policy provides any additional protections or benefits beyond the basic coverage.

Contact the Insurance Company: If you have any doubts or require clarification on any policy terms, don't hesitate to reach out to the insurance company. Their customer service team can provide detailed explanations and guide you through the claims process. They can also assist in gathering the necessary documentation to support the claim.

By thoroughly reviewing the policy details, you can ensure that the life insurance claim is processed accurately and efficiently. This knowledge empowers you to make informed decisions and navigate the often-daunting process of dealing with a loved one's passing while also securing their financial future.

Police and Guardian Life Insurance: What's the Connection?

You may want to see also

Documentation: Gathering and submitting necessary documents for the insurance claim

When a loved one passes away, the process of filing an insurance claim can be overwhelming, especially when it comes to the documentation required. This step is crucial as it initiates the financial support process that many families rely on during difficult times. Here's a guide to help you navigate the documentation process for a life insurance claim:

Gathering the Basics: The first step is to collect the essential information and documents. This includes the deceased's death certificate, which is a critical document as it officially confirms the cause and date of death. Obtaining this certificate is typically the first step in the administrative process. You will also need to provide personal details of the deceased, such as their full name, date of birth, and social security number (or equivalent identification number). These details are essential for verifying the identity of the insured individual.

Policy Documents: Every life insurance policy comes with specific requirements and procedures. It is crucial to locate the original policy documents, which may include the insurance contract, beneficiary designation form, and any other relevant paperwork. These documents outline the terms and conditions of the policy, including the coverage amount, premium payments, and any special clauses or exclusions. Reviewing these documents will help you understand the specific requirements for filing the claim.

Supporting Evidence: Along with the policy documents, you will need to collect supporting evidence to substantiate the claim. This may include medical records, especially if the death was due to an illness or accident. Hospital reports, autopsy results, or any other medical documentation related to the cause of death can be essential. Additionally, if the deceased had any ongoing legal or financial matters, gathering relevant documents, such as court orders or financial records, might be necessary.

Beneficiary Information: If the deceased had designated a beneficiary or beneficiaries for the policy, their details should be obtained. The beneficiary is the person or entity entitled to receive the insurance payout. You will need their full name, contact information, and any specific instructions or preferences they may have outlined in the policy. Ensuring that the beneficiary is promptly notified of the claim process is essential to avoid any delays.

Submitting the Claim: Once you have gathered all the necessary documents and evidence, the next step is to submit the claim to the insurance company. This typically involves filling out a claim form, providing detailed information about the insured individual's death, and attaching all the supporting documents. It is advisable to keep copies of all submitted documents for your records. The insurance company will then review the claim, and if approved, they will initiate the payment process according to the policy terms.

Life Insurance and Taxes: What You Need to Know

You may want to see also

Claim Submission: Steps to file a claim and the timeline for processing

When a loved one passes away, the process of filing a life insurance claim can be a challenging and emotional journey. It is important to understand the steps involved and the typical timeline to ensure a smooth and efficient process. Here is a comprehensive guide to help you navigate the claim submission process:

Step 1: Gather Information and Documentation

Start by collecting all the necessary documents and information related to the deceased's life insurance policy. This includes the original policy documents, death certificates, and any other relevant paperwork. Obtain multiple copies of the death certificate, as they are essential for various legal processes. It is advisable to keep a digital copy as well for easy access. Additionally, gather personal information such as the full name, date of birth, and social security number of the deceased to facilitate the claim process.

Step 2: Identify the Beneficiary

Locate the designated beneficiary(ies) mentioned in the life insurance policy. The beneficiary is the person(s) entitled to receive the death benefit. If the policy has multiple beneficiaries, they may need to provide additional documentation to prove their relationship to the deceased. In some cases, the insurance company may require a court order to determine the rightful beneficiaries, especially if there are disputes or complex inheritance situations.

Step 3: Contact the Insurance Company

Reach out to the life insurance company as soon as possible after the death. Most insurance providers have a dedicated claims department that can guide you through the process. Provide them with the collected documentation and answer any questions they may have. The insurance company will typically assign a claims adjuster or a representative to handle your case. They will review the information and initiate the claim settlement process.

Claim Processing Timeline:

The timeline for processing a life insurance claim can vary depending on the insurance company and the complexity of the case. Here is a general overview:

- Initial Review: The insurance company will review the submitted documents and information within a few days to a week. They may contact you for additional details or clarification.

- Investigation (if applicable): In some cases, especially with high-value policies, the insurance company may conduct an investigation to verify the cause and circumstances of the death. This step can take a few weeks.

- Claim Approval or Denial: Once the review and investigation are complete, the insurance company will notify you of their decision. If approved, they will provide instructions on how to receive the death benefit. If denied, they will explain the reasons and give you the option to appeal the decision.

- Payout Process: If the claim is approved, the insurance company will initiate the payout process. The timeline for receiving the funds can vary, but it typically takes a few weeks to a month. The payment method may include direct deposit, check, or other specified options.

Remember, each insurance company may have its own specific procedures and timelines, so it's essential to follow their instructions and maintain open communication with the claims department.

Transamerica Life Insurance: Decades of Business and Counting

You may want to see also

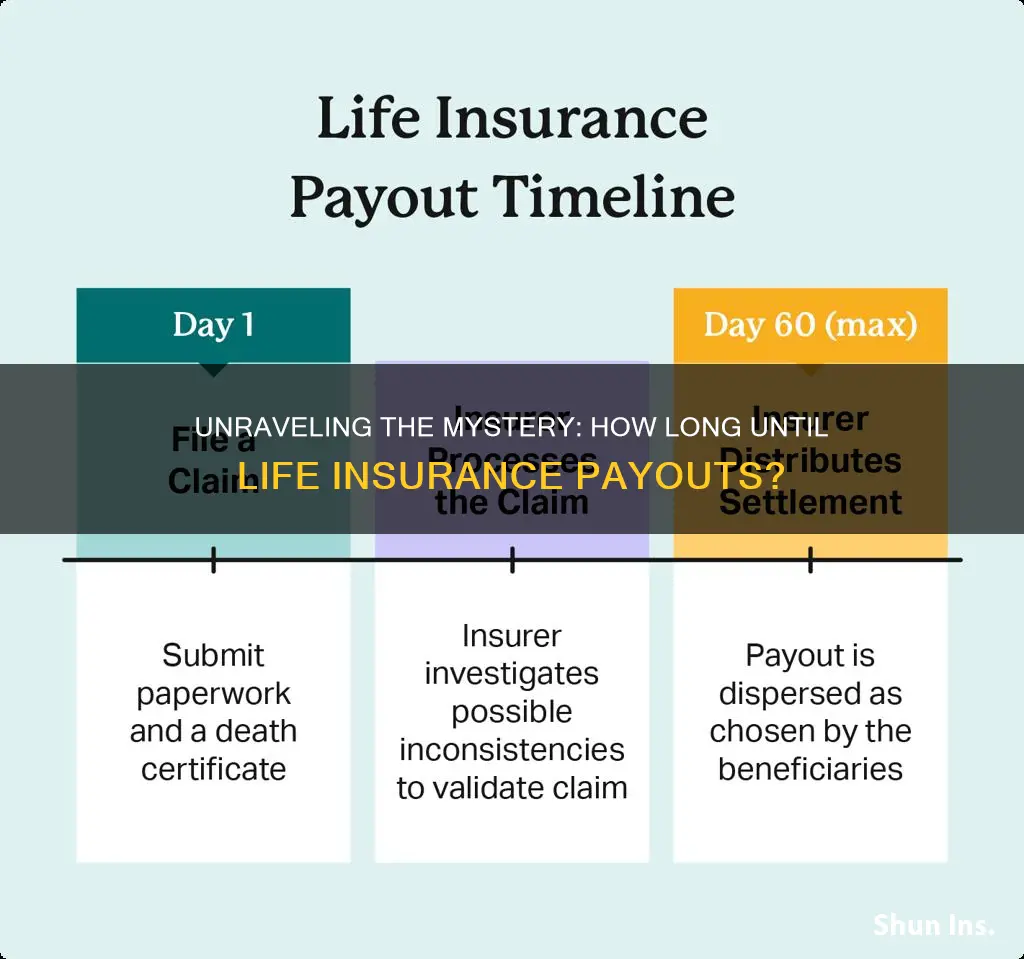

Payout Timeline: Estimating the time from claim submission to receiving the insurance payout

When a loved one passes away, the process of claiming life insurance benefits can be a challenging and emotional journey. Understanding the payout timeline is crucial for those navigating this process, as it provides an estimate of how long it will take to receive the financial support they are entitled to. This timeline can vary depending on several factors, including the insurance company's policies, the type of policy, and the complexity of the claim.

The initial step in receiving the payout is submitting a claim. This typically involves notifying the insurance company of the death and providing them with the necessary documentation, such as a death certificate and proof of the insured's identity. Once the claim is received, the insurance company will initiate an investigation to verify the details. This process can take a few days to a week, depending on the company's procedures. During this time, the insurance provider will review the policy, confirm the beneficiary's information, and assess the validity of the claim.

After the investigation, the insurance company will make a decision regarding the claim. If approved, the next step is to determine the payout amount, which is based on the policy's terms and conditions. This process might involve additional paperwork and verification, especially if the policy has specific beneficiaries or if there are any disputes. Once all the necessary documentation is in order, the insurance company will process the payment.

The time it takes to receive the payout can vary widely. In some cases, the entire process, from claim submission to receiving the funds, can be completed within a few weeks. However, more complex cases or those requiring extensive documentation might take several months. It is essential to maintain open communication with the insurance company during this period to ensure a smooth process and to address any concerns or questions promptly.

In summary, the payout timeline for life insurance claims can range from a few weeks to several months. The key is to be proactive and provide all the required information promptly. While it may be a challenging time, understanding the process and staying informed can help beneficiaries navigate this journey more efficiently.

Employment Status and Life Insurance: What's the Connection?

You may want to see also

Frequently asked questions

The time it takes to receive the life insurance payout can vary depending on several factors. Typically, the insurance company will have a standard process that involves verifying the death, processing the claim, and paying out the benefits. This process usually takes a few weeks to a few months. The insurance provider will often have a dedicated team to handle these claims, and they will guide you through the necessary steps.

Yes, the insurance company will require certain documents and evidence to process the claim. This may include a certified copy of the death certificate, identification documents of the deceased, and sometimes, a medical certificate or autopsy report. The insurance company will provide you with a list of required documents and guide you through the submission process. It's important to gather and submit these documents promptly to avoid any delays in receiving the payout.

In urgent situations, some insurance companies offer expedited claim processing. This may involve additional steps and documentation to verify the claim quickly. You can contact the insurance company's customer service to inquire about their expedited process and any specific requirements. While it may not be possible to receive the funds instantly, the insurance provider can often prioritize the claim and provide a faster resolution compared to the standard processing time.