The government's decision not to tax life insurance payouts is a strategic financial move that offers significant benefits to both individuals and the economy. This policy is rooted in the understanding that life insurance serves as a crucial safety net for families and beneficiaries, providing financial security during times of loss. By exempting these payouts from taxation, the government aims to encourage individuals to purchase life insurance, ensuring that their loved ones are protected in the event of their untimely demise. This approach not only promotes financial stability but also contributes to the overall well-being of society by reducing the financial burden on families and fostering a more secure environment for long-term planning and investment.

What You'll Learn

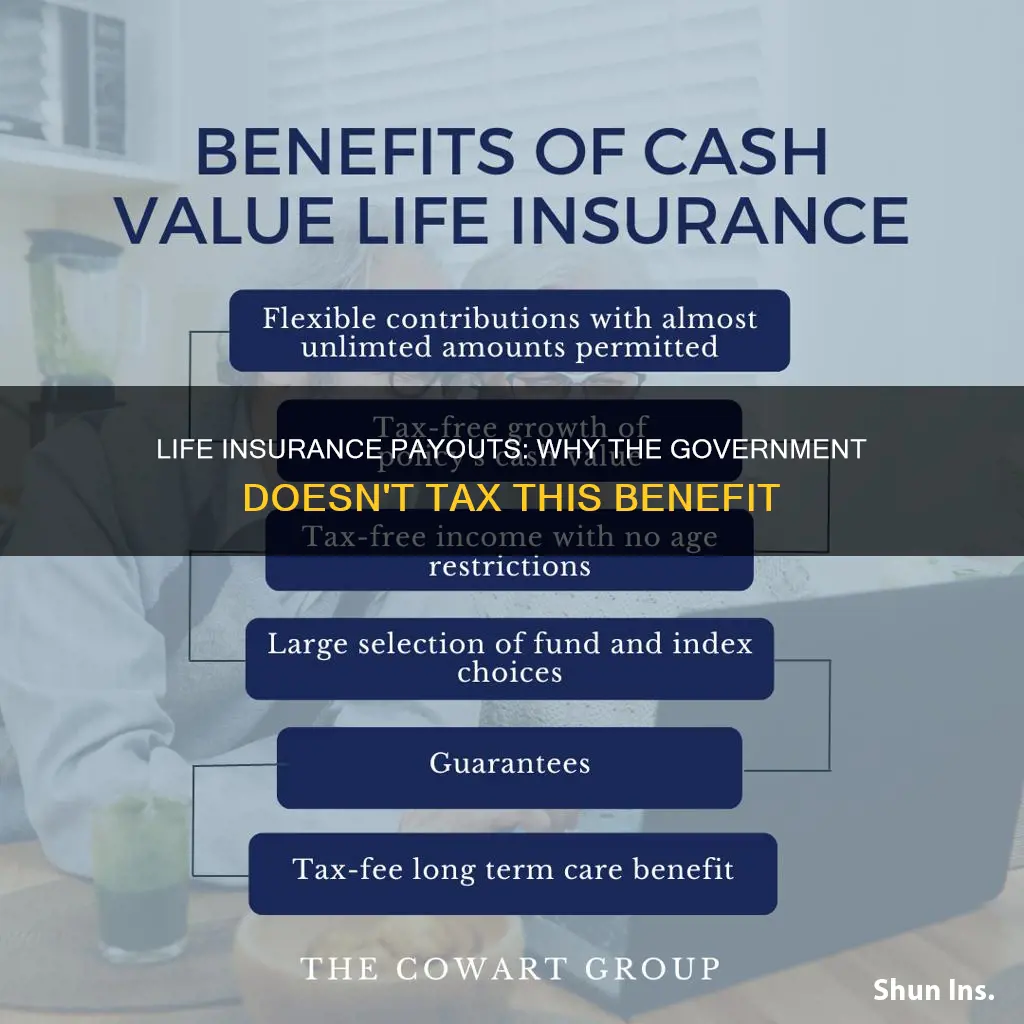

- Legal Exemption: Life insurance payouts are often exempt from taxation due to legal protections

- Income vs. Capital Gains: Payouts are treated as income, not capital gains, avoiding higher tax rates

- Death Benefits: Tax laws recognize death benefits as a form of financial assistance, not income

- Policyholder's Intent: Tax laws consider life insurance as a tool for financial security, not investment

- Regulatory Framework: Government regulations provide tax exemptions for life insurance payouts to encourage savings

Legal Exemption: Life insurance payouts are often exempt from taxation due to legal protections

Life insurance payouts are often exempt from taxation due to legal protections and the specific nature of these financial products. This exemption is a result of careful consideration by governments to ensure that individuals and their beneficiaries are adequately supported in the event of a tragic loss. The legal framework surrounding life insurance is designed to provide financial security and peace of mind, and taxing these payouts could potentially undermine this purpose.

One of the primary reasons for this exemption is the legal status of life insurance policies. When an individual purchases a life insurance policy, they are essentially entering into a contract with an insurance company. This contract specifies the terms and conditions, including the amount to be paid out upon the insured's death. By recognizing this legal agreement, governments acknowledge the unique nature of life insurance and its role in providing financial protection. Taxing the payouts could be seen as interfering with this legally binding contract, potentially discouraging individuals from taking out such policies.

Additionally, life insurance is often seen as a form of savings or investment, where the premiums paid over time accumulate and are then paid out as a lump sum or regular payments. This long-term financial commitment is intended to provide financial security for beneficiaries, especially in the event of the insured's untimely death. Taxing these payouts could be considered a disincentive for individuals to make long-term financial plans, as it might reduce the overall value of the policy.

Furthermore, the legal protections surrounding life insurance payouts extend to the beneficiaries. Governments recognize that these payouts are intended to support the financial well-being of dependents, such as spouses, children, or other family members. By exempting these funds from taxation, governments ensure that the intended recipients can access the full amount without incurring additional financial burdens. This legal exemption is particularly crucial in providing immediate financial relief and stability during challenging times.

In summary, the legal exemption for life insurance payouts is a deliberate policy decision to protect both the insured and their beneficiaries. It ensures that the financial security provided by these policies remains intact, without the burden of taxation. This exemption is a testament to the understanding that life insurance serves a vital purpose in society, offering peace of mind and financial support when it is needed most.

Life Insurance Groups: What You Need to Know

You may want to see also

Income vs. Capital Gains: Payouts are treated as income, not capital gains, avoiding higher tax rates

The treatment of life insurance payouts as income rather than capital gains is a strategic decision by governments to ensure a fair and efficient tax system. When an individual receives a life insurance payout, it is generally considered a form of income, similar to wages or salary. This classification is crucial as it determines the tax rate applied to the payout, which can significantly impact the overall financial outcome for the recipient.

Income tax rates are typically progressive, meaning higher income levels are taxed at higher rates. By treating life insurance payouts as income, governments can apply these progressive tax rates, ensuring that those with larger payouts contribute a larger share of taxes. This approach is in contrast to capital gains tax, which is often applied at a lower rate, especially for long-term gains.

The reason for this distinction lies in the nature of life insurance and its intended purpose. Life insurance is a financial safety net, providing financial security to beneficiaries upon the insured's death. Payouts from these policies are meant to replace lost income and cover various expenses, such as mortgage payments, living costs, or education fees. Treating these payouts as income ensures that the tax system supports individuals in their time of need, providing a more equitable distribution of financial resources.

In contrast, capital gains are realized when an asset, such as property or investments, is sold for a higher price than its purchase value. The tax system recognizes that capital gains often represent the appreciation of an asset's value over time. By taxing capital gains at a lower rate, governments encourage long-term investment and the growth of wealth. However, life insurance payouts do not fit this category, as they are not the result of an asset's appreciation but rather a predetermined financial benefit.

Classifying life insurance payouts as income also simplifies the tax process for individuals. It eliminates the need for complex calculations and distinctions between different types of gains. This simplicity ensures that taxpayers can more easily comply with tax laws, reducing administrative burdens and potential errors. As a result, governments can efficiently collect taxes without imposing higher rates on life insurance recipients, making the tax system more accessible and fair.

Resident Life Insurance License: What You Need to Know

You may want to see also

Death Benefits: Tax laws recognize death benefits as a form of financial assistance, not income

The concept of taxing life insurance payouts is a complex and often misunderstood topic. While it might seem logical to tax the proceeds of a life insurance policy, the government has chosen not to do so for several reasons. One of the primary reasons is that tax laws differentiate between financial assistance and income. When an individual receives a life insurance payout, it is typically considered a form of financial assistance rather than regular income.

Death benefits, as they are known in tax terminology, are payments made to beneficiaries upon the insured individual's death. These benefits are designed to provide financial support to the family or designated recipients, ensuring their financial well-being during a challenging time. Tax authorities recognize that life insurance policies are often purchased to provide security and peace of mind, and the payouts are intended to fulfill that purpose.

The tax treatment of death benefits is based on the principle of providing tax relief to individuals and families facing significant financial losses due to the death of a loved one. By exempting these payouts from taxation, the government aims to ease the financial burden on beneficiaries and allow them to utilize the funds for essential expenses, such as funeral costs, estate administration, and ongoing living expenses. This approach ensures that the financial assistance provided by life insurance policies is not subject to additional taxes, making it more accessible and beneficial to those who need it most.

Furthermore, taxing life insurance payouts could potentially discourage individuals from purchasing such policies, which are essential for financial planning and risk management. The fear of potential tax implications might deter people from taking advantage of a valuable financial tool. By recognizing death benefits as a form of financial assistance, the tax system encourages the use of life insurance as a means to secure one's family's future.

In summary, the government's decision not to tax life insurance payouts is rooted in the understanding that death benefits serve as a critical source of financial support for beneficiaries. Treating these payouts as financial assistance rather than income ensures that individuals can access the funds without incurring additional taxes, providing much-needed relief during difficult times. This approach also promotes the use of life insurance as a valuable tool for financial planning and risk management.

Navigating the Future: Exploring Options for Your Husband's Life Insurance Proceeds

You may want to see also

Policyholder's Intent: Tax laws consider life insurance as a tool for financial security, not investment

The concept of life insurance is rooted in providing financial security to beneficiaries in the event of the insured's death. Tax laws generally recognize this fundamental purpose and treat life insurance payouts as a means of ensuring financial stability rather than a form of investment. This distinction is crucial for policyholders, as it directly impacts their tax obligations and overall financial planning.

When an individual purchases life insurance, the primary intent is to secure their family's financial future in the event of their passing. The insurance company promises to pay out a predetermined amount to the designated beneficiaries upon the insured's death. This payout is often referred to as a "death benefit." Tax authorities view this death benefit as a form of financial assistance, intended to provide immediate relief and long-term financial support to the beneficiaries.

The tax treatment of life insurance payouts is designed to encourage individuals to utilize life insurance as a security measure. By not taxing these payouts, the government aims to promote the use of life insurance as a tool for risk management and financial planning. This approach ensures that individuals can rely on the insurance proceeds to cover essential expenses, such as mortgage payments, education costs, or living expenses, without incurring additional tax liabilities.

In contrast, if life insurance were treated as an investment, policyholders might be incentivized to make tax-deductible premium payments with the expectation of significant tax benefits from the investment gains. However, this would distort the original intent of life insurance, which is to provide security, not to generate tax advantages. Tax laws, therefore, differentiate between life insurance and investment products to maintain the integrity of the financial security system.

Understanding this policyholder intent is essential for individuals to make informed decisions about their life insurance policies. By recognizing that life insurance payouts are primarily intended for financial security, policyholders can better appreciate the tax implications and plan their finances accordingly. This clarity ensures that the tax system supports the intended purpose of life insurance, providing peace of mind and financial stability to individuals and their families.

Spousal Life Insurance: Taxable or Not?

You may want to see also

Regulatory Framework: Government regulations provide tax exemptions for life insurance payouts to encourage savings

The government's decision to exempt life insurance payouts from taxation is a strategic move that has significant implications for both individuals and the economy. This regulatory framework is designed to encourage savings and provide financial security for individuals and their families. By offering tax exemptions, the government aims to incentivize people to purchase life insurance policies, which can serve as a crucial safety net during unforeseen circumstances.

One of the primary reasons for this exemption is to promote long-term savings and financial planning. Life insurance policies often require regular premium payments, and these payments are typically made over an extended period. By allowing tax-free payouts, the government encourages individuals to save consistently, ensuring they have a financial cushion for themselves and their beneficiaries. This is particularly important for those who may not have other substantial savings or retirement plans.

The regulatory framework also considers the potential financial burden on individuals and families in the event of a loved one's passing. When a person dies, their family is already dealing with grief and emotional distress. The last thing they need is the added stress of dealing with complex tax implications and potential financial losses. By exempting life insurance proceeds, the government ensures that beneficiaries can access the funds without incurring unnecessary tax liabilities, providing much-needed financial relief during a challenging time.

Furthermore, this tax exemption has broader economic implications. It encourages individuals to invest in insurance products, which can stimulate the insurance industry and create a more robust financial safety net for the population. A thriving insurance sector can contribute to overall economic growth, as it provides a stable source of revenue and employment opportunities.

In summary, the government's decision to exempt life insurance payouts from taxation is a well-thought-out strategy to promote savings, financial security, and economic stability. This regulatory framework recognizes the importance of insurance as a vital tool for individuals and families, ensuring that they can access the benefits without facing excessive tax burdens. By encouraging savings through life insurance, the government is taking a proactive approach to support individuals and the economy as a whole.

Esurance Life Insurance: Good Option or Not?

You may want to see also

Frequently asked questions

Life insurance payouts, including death benefits, are generally not taxable because they are considered a form of financial assistance provided to the policyholder's beneficiaries upon the insured individual's death. The insurance company pays out the policy amount as a replacement for the loss of the insured's life, and this payment is not subject to income tax.

No, you typically don't need to report life insurance proceeds on your tax return. The proceeds are usually exempt from federal income tax, and there are no specific tax forms required to report them. However, if you receive a large payout, it might be worth consulting a tax professional to ensure compliance with any state-specific tax laws.

A A: Yes, there are a few exceptions. If the life insurance policy is a modified endowment life insurance (MELI) or a universal life insurance with a cash value, the cash surrender value or the policy's investment earnings might be taxable. Additionally, if the policyholder receives regular payments (like monthly premiums) during their lifetime, these payments could be taxable as ordinary income.

No, life insurance premiums are not deductible as medical expenses. However, if you itemize your deductions, you can deduct the premiums as a miscellaneous itemized deduction, but only if they exceed 2% of your adjusted gross income (AGI). This deduction is available for certain types of insurance, including life, health, and disability insurance.

The government benefits from life insurance indirectly through the insurance industry's regulation and oversight. By ensuring the stability and solvency of insurance companies, the government helps protect policyholders' interests. Additionally, life insurance contributes to the economy by providing financial security and supporting various financial products and services.