When a spouse passes away, the beneficiaries of their life insurance policy are faced with a significant financial decision: what to do with the payout. This can be a challenging and emotional process, especially when trying to balance the needs of the family, personal goals, and financial security. This paragraph aims to provide an overview of the key considerations and options available to help guide beneficiaries in making an informed decision about the use of the life insurance money.

What You'll Learn

- Debt Management: Use funds to pay off debts, reducing financial burden

- Education Savings: Invest for children's education, ensuring a secure future

- Emergency Fund: Create a safety net for unexpected expenses

- Retirement Planning: Secure long-term financial stability for both of you

- Charitable Giving: Donate to causes he supported, honoring his legacy

Debt Management: Use funds to pay off debts, reducing financial burden

When it comes to managing your husband's life insurance money, one of the most practical and beneficial uses is to tackle and eliminate any existing debts. This approach can significantly reduce your financial burden and provide long-term financial relief. Here's a detailed guide on how to approach debt management with this financial windfall:

Identify Your Debts: The first step is to take an inventory of all the debts you and your family might have. This includes credit card balances, personal loans, student loans, medical bills, and any other outstanding financial obligations. Make a comprehensive list, ensuring you note the creditor, the outstanding balance, and the interest rate for each debt. This clear overview will help you understand the total financial burden you need to address.

Prioritize High-Interest Debts: Typically, debts with high-interest rates should be prioritized. These debts can quickly accumulate and become more challenging to repay. Focus on paying off these high-interest debts first, as they will cost you the most in the long run due to the accrued interest. By targeting these debts, you can minimize the overall financial impact and free up more money for other essential expenses.

Create a Debt Repayment Plan: Develop a structured plan to tackle your debts systematically. You can consider the debt snowball method, where you start by paying off the smallest debts first to gain momentum and motivation. Alternatively, the debt avalanche method involves targeting high-interest debts first to save on interest costs. Choose a strategy that suits your financial situation and goals. Ensure that your plan includes regular payments and consider increasing the payments if possible to accelerate debt repayment.

Utilize the Life Insurance Proceeds: With the identified debts in mind, use the life insurance money to make substantial payments towards these obligations. By doing so, you can significantly reduce the principal amount owed and minimize the overall interest paid. This strategic approach will help you become debt-free faster and provide a sense of financial security.

Consider Long-Term Financial Planning: After addressing immediate debts, consider using the remaining funds for long-term financial planning. This could include investing in retirement accounts, education funds for your children, or other long-term financial goals. Diversifying your investments and seeking professional advice can help ensure that your husband's life insurance money is utilized effectively and securely.

Managing debt is a crucial step in ensuring financial stability and security for your family. By taking control of your debts, you can reduce financial stress and work towards a brighter financial future. Remember, seeking professional financial advice can provide valuable insights tailored to your specific situation, ensuring that your husband's life insurance money is utilized wisely and efficiently.

Dependent Life Insurance: Worth the Cost?

You may want to see also

Education Savings: Invest for children's education, ensuring a secure future

When it comes to the life insurance money left behind by your husband, one of the most important considerations is how to secure a bright future for your children's education. This money can be a valuable resource to ensure your children have the financial means to pursue their academic goals and achieve their dreams. Here's a detailed guide on how to approach this:

Understand the Funds: Begin by gathering all the necessary information about the life insurance policy. Determine the total amount available and any specific instructions or wishes your husband may have outlined in the policy. This initial step is crucial to understanding the full scope of the financial resources at your disposal.

Create an Education Fund: Consider setting up a dedicated education savings account for your children. This account can be structured to grow the funds over time, ensuring a substantial amount is available when your children start their academic journey. You can explore various investment options to make this fund grow, such as:

- Tax-Advantaged Accounts: Look into education-specific savings plans like a 529 plan or a Coverdell Education Savings Account. These accounts offer tax advantages, allowing the investments to grow tax-free, which can be a significant benefit over time.

- Investment Accounts: Diversify your investments to maximize returns. Consider a mix of stocks, bonds, and mutual funds. Consult a financial advisor to create a portfolio tailored to your risk tolerance and the time horizon for your children's education.

Long-Term Investment Strategy: Education savings often require a long-term investment approach. Here's how you can ensure the funds are utilized effectively:

- Start Early: The power of compound interest is significant over time. The earlier you begin investing, the more time the money has to grow. Even small contributions can add up significantly over the years.

- Regular Contributions: Make regular, consistent investments. This approach, known as dollar-cost averaging, helps reduce the impact of market volatility and ensures a steady growth rate.

- Review and Adjust: Periodically review your investment portfolio to ensure it aligns with your goals. As your children's education timeline approaches, consider rebalancing the portfolio to preserve capital and focus on capital appreciation.

Additional Considerations:

- Consult a Financial Advisor: Given the importance of this financial decision, consider seeking professional advice. A financial advisor can provide personalized guidance, taking into account your family's unique circumstances and goals.

- Explore Education Loans: While not ideal, you might consider taking out education loans to cover any gaps in funding. Ensure you understand the terms and interest rates associated with these loans.

- Regular Education Planning: Stay involved in your children's education planning. Keep track of their academic progress and any financial aid opportunities they may be eligible for.

By taking a proactive approach to education savings, you can ensure that the life insurance money becomes a powerful tool in building a secure and successful future for your children. It is a thoughtful way to honor your husband's memory while providing for your family's long-term goals.

How to Modify an Irrevocable Life Insurance Trust

You may want to see also

Emergency Fund: Create a safety net for unexpected expenses

When it comes to managing your husband's life insurance money, one of the most important considerations is building an emergency fund to provide a safety net for unexpected expenses. This fund can be a crucial tool to ensure financial stability and peace of mind during challenging times. Here's how you can approach creating this essential financial cushion:

Understand the Purpose: An emergency fund is designed to cover unforeseen costs that may arise due to emergencies, medical issues, home repairs, or other unexpected events. It acts as a financial buffer, preventing you from dipping into long-term savings or going into debt to manage these expenses. By allocating a portion of your husband's life insurance money to this fund, you are preparing for potential financial disruptions.

Determine the Amount: The first step is to decide on the size of your emergency fund. A common rule of thumb is to aim for three to six months' worth of living expenses. This amount will vary depending on your family's unique circumstances and financial goals. Consider your monthly expenses, including housing, utilities, groceries, transportation, and other regular outgoings. Multiply this by the number of months you want to cover, providing a realistic estimate of the fund's required size.

Open a Dedicated Account: Set up a separate savings account specifically for this purpose. Look for a high-yield savings account or a money market account that offers a competitive interest rate, allowing your money to grow over time. Ensure that the account is easily accessible so that you can quickly withdraw funds when needed without incurring penalties.

Build the Fund Gradually: Start by contributing a fixed amount regularly, such as a percentage of your husband's life insurance payout or a set amount from your monthly budget. You can also consider increasing the contributions over time as your financial situation improves. The key is to make consistent progress, even if it's a small amount each month. Watch your emergency fund grow, providing a sense of security and financial control.

Prioritize Unexpected Expenses: When using the emergency fund, prioritize unexpected and necessary expenses. This might include medical bills, car repairs, home maintenance, or other unforeseen costs. Avoid using it for non-essential purchases or discretionary spending. By doing so, you ensure that the fund remains a reliable safety net for genuine emergencies.

Creating an emergency fund is a practical way to honor your husband's memory while securing your financial future. It empowers you to take control of your finances and provides a valuable layer of protection against life's unpredictable events. Remember, this fund is not just about the money; it's about the peace of mind and financial security it provides during challenging times.

AIG Life Insurance: What You Need to Know

You may want to see also

Retirement Planning: Secure long-term financial stability for both of you

When you receive a substantial sum of money from your husband's life insurance policy, it's a crucial moment to consider how to best utilize this financial windfall for your future security and that of your family. One of the most important steps is to prioritize retirement planning, ensuring that you and your spouse have a stable and comfortable financial future. Here's a detailed guide on how to approach this significant decision:

Assess Your Current Financial Situation: Begin by evaluating your current financial health. Create a comprehensive list of your assets, including the life insurance payout, any other savings or investments, and your joint and individual bank accounts. Also, consider your liabilities, such as mortgages, loans, or credit card debt. Understanding your net worth and cash flow will help you make informed decisions about retirement planning.

Consult a Financial Advisor: Given the complexity of financial planning, especially when dealing with a significant inheritance, consulting a professional financial advisor is highly recommended. They can provide personalized advice tailored to your unique circumstances. A financial advisor will help you navigate tax implications, investment strategies, and retirement account options to ensure your money works efficiently for your long-term goals.

Create a Retirement Plan: Develop a comprehensive retirement plan that takes into account both your current needs and future goals. Here are some key considerations:

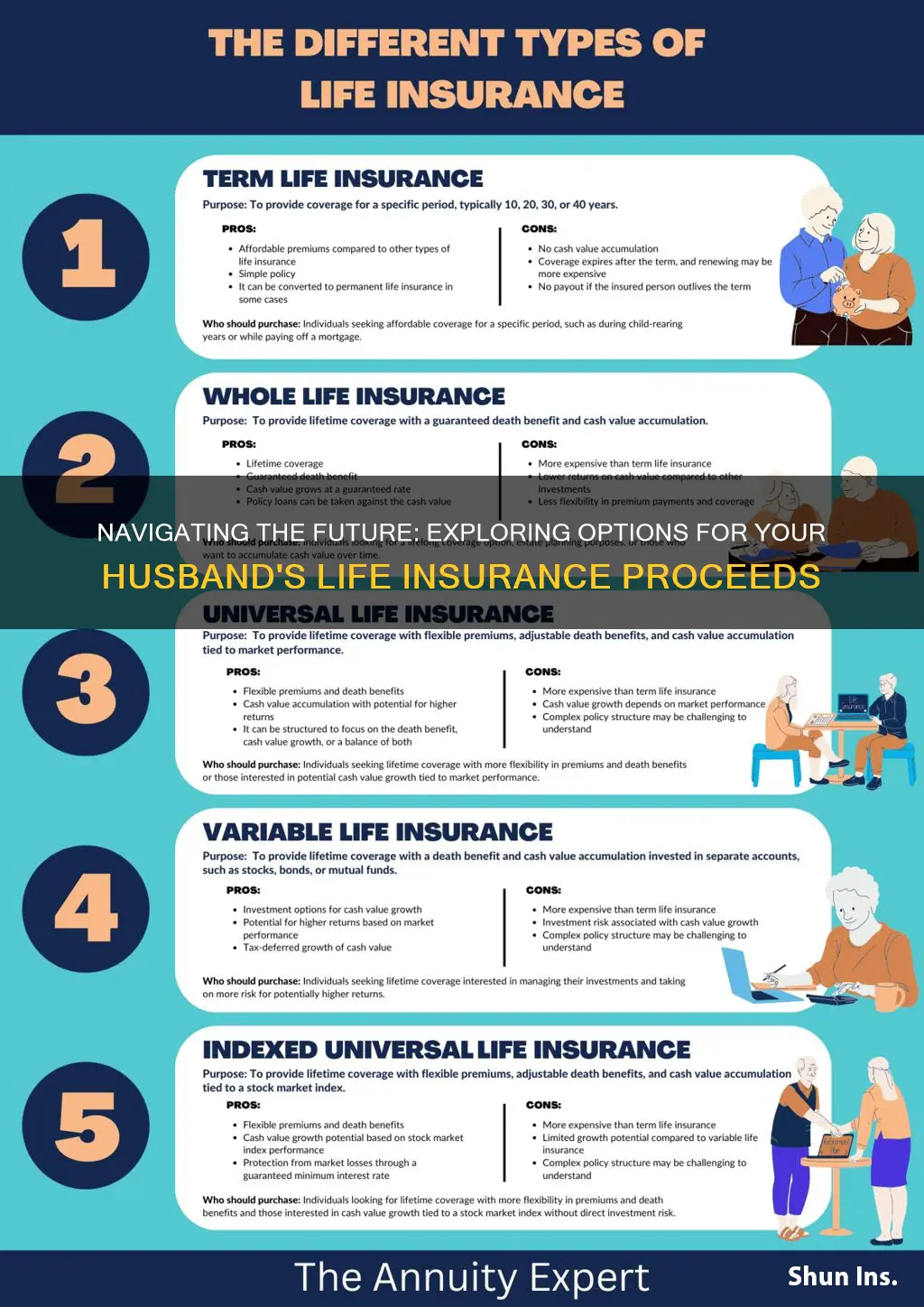

- Retirement Accounts: Consider contributing to retirement accounts such as a 401(k) or an Individual Retirement Account (IRA). These accounts offer tax advantages and can help grow your savings over time. If your husband had a retirement plan, review and understand its options, including any surviving spouse benefits.

- Investment Strategy: Diversify your investments to manage risk. A financial advisor can help you decide on a suitable asset allocation strategy, considering your risk tolerance and time horizon. This might include stocks, bonds, mutual funds, or real estate investments.

- Debt Management: If you have outstanding debts, use this financial boost to pay them off. Reducing debt can significantly improve your financial stability and free up more money for retirement savings.

Consider Long-Term Care: Planning for long-term care is essential, especially as you age. Discuss with your advisor how to allocate funds for potential future medical expenses and long-term care needs. This might involve purchasing long-term care insurance or setting aside a dedicated fund for these expenses.

Regularly Review and Adjust: Retirement planning is an ongoing process. As you and your spouse age, your financial goals and needs will likely change. Schedule regular reviews with your financial advisor to adjust your plan accordingly. This ensures that your retirement strategy remains on track and adapts to any life changes or economic shifts.

By taking a proactive approach to retirement planning, you can secure a financially stable future for both yourself and your husband's legacy. It's a thoughtful and strategic process that requires careful consideration and professional guidance to make the most of this life-changing financial opportunity.

Rest Super: Life Insurance Coverage and Your Options

You may want to see also

Charitable Giving: Donate to causes he supported, honoring his legacy

When considering what to do with the life insurance money left by your husband, one meaningful way to honor his memory is through charitable giving. This approach allows you to contribute to causes that were important to him, ensuring his legacy continues to make a positive impact on the world. Here's how you can make this process both thoughtful and impactful:

Identify His Passions: Begin by reflecting on the causes and charities your husband supported during his lifetime. Did he volunteer for a local shelter, contribute to environmental initiatives, or perhaps donate to a specific health research fund? Understanding his passions will help you choose the right organizations to support. For instance, if he was an avid supporter of animal welfare, consider donating to a reputable animal rescue or conservation group.

Research and Select Organizations: Once you've identified the areas he cared about, research various charities and non-profit organizations within those fields. Look for groups that align with his values and have a strong track record of making a difference. For example, if he was passionate about education, explore scholarship programs or schools that align with his beliefs. Ensure that the organizations are transparent in their operations and have a clear mission statement.

Make a Significant Contribution: Life insurance money can be a substantial amount, and using it to make a substantial donation can have a significant impact. Consider making a one-time donation or setting up a recurring contribution if you wish to continue supporting these causes long-term. Larger donations can often unlock special opportunities, such as naming rights or exclusive events, allowing you to create a lasting connection to your husband's memory.

Honor His Memory Publicly: By donating to causes he supported, you are not only providing financial assistance but also publicly honoring his legacy. Many charities offer ways to acknowledge donors, such as in their annual reports, newsletters, or on their website. This public recognition can be a powerful way to celebrate your husband's life and the values he held dear.

Consider Long-Term Impact: Think about the potential long-term effects of your charitable giving. You might choose to support organizations that provide ongoing services or those with a sustainable model that ensures their work continues for generations. This approach ensures that your husband's legacy endures and that the impact of his life insurance money is felt for years to come.

Remember, charitable giving is a personal decision, and it's essential to choose causes that resonate with your own values and beliefs. By donating to organizations your husband supported, you can create a meaningful tribute, ensuring his memory lives on in a way that brings comfort and positive change.

Uninsured: The Surprising Number of Adults Without Life Insurance

You may want to see also

Frequently asked questions

This is a significant decision, and it's important to consider your financial goals and future plans. You might want to review the policy's terms and conditions to understand the options available. Typically, you can choose to receive the payout as a lump sum or opt for regular payments over time. It's advisable to consult a financial advisor or attorney to explore the best course of action based on your unique circumstances.

Absolutely, paying off debts is a common and often wise decision. Life insurance money can provide a financial cushion to tackle outstanding loans, credit card balances, or any other debts your husband may have had. This can help alleviate financial stress and potentially improve your credit score. However, ensure you have a plan to manage the remaining finances effectively.

The decision to invest or spend the money depends on your personal financial situation and goals. If you have immediate expenses or short-term financial goals, using the funds for those purposes might be more practical. Investing could be a good option if you have long-term financial objectives, such as saving for your children's education or retirement. Consider consulting a financial advisor to create a strategy that aligns with your needs.

Securing your family's financial future is a crucial aspect of managing life insurance proceeds. You might consider setting up a trust to manage the funds, ensuring a steady income for your family. This can provide financial stability and peace of mind. Additionally, you can explore options like investing in a retirement account, purchasing a new home, or starting a business venture to create a more secure financial future for your loved ones.