When you receive a life insurance policy, it's a significant step towards securing your financial future and the well-being of your loved ones. This document is a promise of financial protection, ensuring that your beneficiaries receive the agreed-upon payout in the event of your passing. Understanding the terms, benefits, and implications of the policy is crucial to making the most of this valuable asset. This introduction sets the stage for exploring the various aspects of managing and utilizing life insurance effectively.

What You'll Learn

Policy Details: Understand coverage, beneficiaries, and payout options

When you purchase a life insurance policy, it's crucial to thoroughly understand the details to ensure you and your loved ones are adequately protected. Here's a breakdown of the key aspects to consider:

Coverage Amount: This is the primary component of your policy and represents the financial benefit that will be paid out upon your passing. Carefully assess your financial obligations, including mortgage, loans, education expenses for children, and any other long-term commitments. Choose a coverage amount that comfortably covers these expenses, providing financial security for your family. Remember, it's better to have a slightly higher coverage amount than to underestimate your needs.

Beneficiaries: Life insurance policies allow you to designate beneficiaries, who are the individuals or entities that will receive the death benefit. You can name primary and secondary beneficiaries, ensuring that your wishes are honored even if one beneficiary is unavailable. Consider your close family members, such as a spouse, children, or parents, as primary beneficiaries. You might also want to include charitable organizations or trusts as secondary beneficiaries to support a cause you care about.

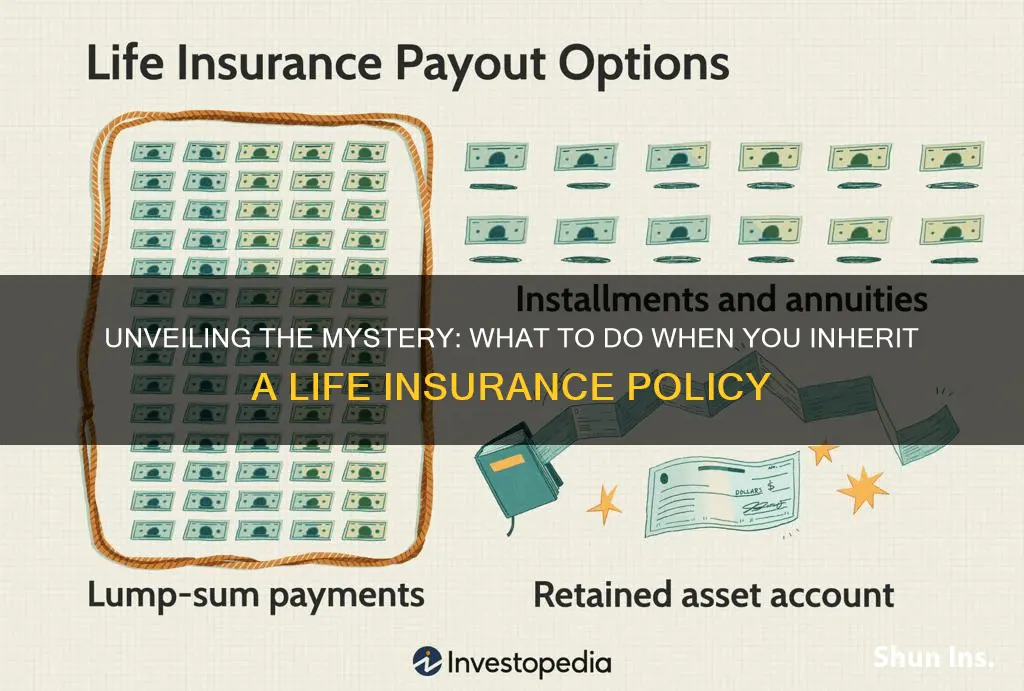

Payout Options: Life insurance companies typically offer various payout options to accommodate different financial needs. These options include:

- Lump Sum: A single, large payment to the beneficiaries, providing a significant financial windfall. This option is suitable for covering large expenses like funeral costs and outstanding debts.

- Period Income: Regular payments over a specified period, such as 10, 15, or 20 years. This option ensures a steady income stream for beneficiaries, helping them maintain their standard of living.

- Flexible Payout: This option allows you to customize the payout structure, providing a combination of lump sum and periodic payments based on your family's unique needs.

Understanding these payout options is essential to ensure that the death benefit is utilized effectively to meet your family's financial goals.

Review and Updates: Life insurance policies are not set in stone. It's advisable to review your policy periodically, especially after significant life events like marriages, births, or substantial financial changes. You can adjust the coverage amount, beneficiaries, and payout options to reflect your evolving circumstances. Regularly reviewing your policy ensures that your life insurance remains relevant and beneficial throughout your life.

Life and Health Insurance Exam: Maine's Question Marathon

You may want to see also

Beneficiary Designation: Ensure proper distribution of funds

When you receive a life insurance policy, one of the most crucial aspects to consider is the beneficiary designation, as it determines how the funds are distributed upon your passing. This process is essential to ensure that your loved ones receive the intended financial support as per your wishes. Here's a detailed guide on how to navigate this important step:

Understanding Beneficiary Designation:

Beneficiary designation refers to the process of naming individuals or entities who will receive the death benefit or proceeds from your life insurance policy. This decision is significant because it allows you to have control over the distribution of your assets, providing financial security for your beneficiaries. When purchasing a policy, you typically have the option to choose the beneficiaries and specify the percentage or amount each should receive.

Steps to Ensure Proper Distribution:

- Review the Policy Documents: Start by carefully reading the insurance policy documents provided by the insurer. These documents will outline the procedure for beneficiary designation and any specific requirements. Understanding the policy's terms is crucial to avoid any potential issues during the claim process.

- Identify Beneficiaries: Determine who you want to receive the life insurance proceeds. This could include your spouse, children, parents, or any other individuals you wish to provide financial support to. Consider the emotional and financial impact on your loved ones and choose beneficiaries who can benefit from the funds.

- Complete the Beneficiary Designation Form: Insurance companies usually provide a beneficiary designation form. This form requires you to provide personal details of the beneficiaries, including their full names, relationships to you, and the percentage or amount they should receive. Double-check the information to ensure accuracy, as any errors may lead to legal complications.

- Keep Records: After completing the form, keep a copy of the signed document for your records. It is essential to have proof of your beneficiary designation in case of any disputes or changes in the future. Store these records securely and inform your insurance provider of any updates to your beneficiary information.

- Review and Update Regularly: Life circumstances can change, and it's important to review and update your beneficiary designation periodically. Major life events like marriages, births, or deaths of beneficiaries may require adjustments to your policy. Stay informed about your beneficiaries' well-being and make changes as needed to ensure the distribution aligns with your current wishes.

By carefully following these steps, you can ensure that your life insurance policy is set up to provide the intended financial support to your chosen beneficiaries. Proper beneficiary designation is a vital aspect of estate planning, offering peace of mind and financial security for your loved ones during a challenging time. Remember, this process allows you to have control over your assets and ensures a smooth distribution according to your preferences.

Financial Advisors and Life Insurance: What's the Real Deal?

You may want to see also

Policy Ownership: Clarify who holds the policy

When you're considering life insurance for a loved one, one of the most important aspects to clarify is the ownership of the policy. This is a crucial step to ensure that the insurance benefits are distributed according to the wishes of the policyholder and the needs of the beneficiaries. Here's a detailed guide on how to navigate this process:

Understanding Policy Ownership:

The first step is to understand the different types of policy ownership. A life insurance policy can be owned in various ways, and the choice depends on the specific circumstances and goals of the policyholder. The most common types of ownership include joint ownership, sole ownership, and trust ownership. In a joint policy, two or more individuals own the policy equally. This can be beneficial for couples or business partners who want to ensure mutual support. Sole ownership, on the other hand, means one person holds the entire policy. This is often chosen by individuals who want to ensure their loved ones are protected without involving others in the decision-making process. Trust ownership involves placing the policy under a trust, which can be a complex legal arrangement but offers additional control and flexibility.

Choosing the Right Ownership Structure:

The decision should be made based on the relationship between the policyholder and the insured individual, as well as the level of involvement desired in the insurance process. For instance, if you are purchasing a policy for your spouse, joint ownership might be appropriate to ensure both parties' interests are represented. However, if you are insuring a child, sole ownership could be more suitable to protect their interests without unnecessary complexity.

Designating Beneficiaries:

Once the ownership is established, the next critical step is to designate beneficiaries. Beneficiaries are the individuals or entities who will receive the death benefit payout when the insured person passes away. You can name primary and secondary beneficiaries, and you have the option to specify the percentage of the payout each should receive. This step is crucial to ensure that the insurance proceeds are distributed according to your wishes and the needs of your loved ones.

Regular Review and Updates:

Life insurance needs may change over time due to various life events, such as marriage, divorce, the birth of children, or significant financial changes. Therefore, it is essential to review and update the policy ownership and beneficiary information periodically. This ensures that the policy remains relevant and beneficial, especially if the ownership structure or relationships change.

By carefully considering policy ownership, you can ensure that your life insurance plan is tailored to your specific needs and provides the necessary protection for your loved ones. It is a critical aspect of the overall insurance strategy, offering control, flexibility, and peace of mind.

Understanding Life Insurance Value: The Long-Term Gain

You may want to see also

Tax Implications: Know tax effects of insurance proceeds

When you receive life insurance proceeds, it's important to understand the tax implications to ensure you're managing your finances effectively. The tax treatment of insurance payouts can vary depending on the type of policy and the circumstances. Here's a detailed breakdown of the tax effects you should be aware of:

Proceeds from Term Life Insurance: For term life insurance policies, the proceeds received upon the insured individual's death are generally tax-free. This means that the amount paid out by the insurance company to the beneficiaries is not subject to income tax. The key factor here is the temporary nature of the policy; term life insurance is designed to provide coverage for a specific period, and the payout is a result of the insured's death during that term. As long as the proceeds are not used for any taxable activities, they remain exempt from taxation.

Tax on Proceeds from Permanent Life Insurance: In contrast, permanent life insurance policies, such as whole life or universal life, have a different tax treatment. The cash value of these policies grows tax-deferred, meaning it accumulates over time without being taxed. However, when you take withdrawals or surrender the policy, the proceeds may be subject to taxation as ordinary income. Additionally, if the policy has been in force for a certain period, any dividends received could be taxable as ordinary income as well. It's crucial to understand the tax implications of these policies to avoid unexpected tax liabilities.

Tax on Annuity Payouts: Annuities, which provide regular payments to the policyholder or beneficiary, also have specific tax considerations. The tax treatment depends on the type of annuity. Fixed annuities, where the payments are predetermined, are typically tax-deferred. This means the income earned within the annuity grows tax-free until it's withdrawn. Variable annuities, on the other hand, may be subject to taxation as ordinary income when distributions are made. Understanding the tax rules for annuities is essential to optimize your financial strategy.

Estate Taxes and Insurance Proceeds: It's worth noting that life insurance proceeds can also have implications for estate taxes. Generally, the proceeds from a life insurance policy are not included in the insured's taxable estate. However, if the policy has a cash value or if the beneficiary is not a spouse or qualified charity, the proceeds may be subject to estate tax. Proper estate planning can help minimize the tax impact on your beneficiaries.

Reporting and Documentation: When dealing with insurance proceeds, proper documentation and reporting are essential. You must report the proceeds on your tax return, and the insurance company will provide a Form 1099-G or similar document to help with this process. It's advisable to consult a tax professional or financial advisor to ensure compliance with tax laws and to understand how specific tax strategies can be employed to manage the tax implications effectively.

Maximizing Life Insurance Benefits: Understanding Spouse Coverage

You may want to see also

Policy Termination: Learn how to cancel or surrender the policy

When you decide to terminate or surrender your life insurance policy, it's important to understand the process and any associated implications. Policy termination refers to the act of canceling or ending your insurance coverage, and it can be a significant decision with financial and legal consequences. Here's a comprehensive guide to help you navigate this process:

Understanding Policy Termination:

Before taking any action, it's crucial to comprehend why you might want to terminate your life insurance. Common reasons include financial constraints, changing life circumstances, or finding more suitable coverage elsewhere. It's essential to evaluate your current needs and ensure that the decision to terminate is aligned with your long-term goals and financial well-being.

Review the Policy Documents:

Start by thoroughly reviewing your insurance policy documents. These documents will outline the terms and conditions, including the surrender or cancellation process. Pay close attention to any fees, penalties, or surrender charges mentioned. Understanding these details will help you make an informed decision and ensure you are aware of any potential costs associated with termination.

Contact Your Insurance Provider:

Reach out to your insurance company or the designated customer service department. Inform them of your intention to terminate the policy. They will guide you through the necessary steps and provide relevant information specific to your policy. Be prepared to provide personal details and policy-related documents to facilitate the process.

Surrender Process:

The surrender process typically involves the following steps:

- Notice of Intent: You will need to notify your insurance provider in writing, expressing your intention to surrender the policy. This notice should include your personal details and policy information.

- Surrender Charge (if applicable): Some policies may incur a surrender charge, which is a fee deducted from the policy's cash value. This charge is usually applied during the initial years of the policy and varies depending on the type of insurance. Ensure you understand the timing and amount of any surrender charges.

- Refund of Premiums: After the surrender process is initiated, the insurance company will calculate and refund any premiums paid, minus any applicable fees or charges.

- Policy Settlement: The insurance provider will settle the policy, which may result in a lump sum payment or a distribution of the policy's value according to the terms agreed upon.

Consider Alternatives:

Before finalizing the termination, consider if there are alternative solutions. You might explore options like policy loans, policy assignments, or converting the policy to a different type of insurance. These alternatives could provide financial flexibility or allow you to retain some level of coverage.

Remember, policy termination is a significant decision, and it's advisable to seek professional advice from financial advisors or insurance experts who can provide tailored guidance based on your specific circumstances. They can help you navigate the process, ensuring you make the best choice for your financial future.

Life Insurance for Sears Retirees: What's the Deal?

You may want to see also

Frequently asked questions

When you receive a life insurance policy, it means you have been granted coverage for a specific amount. This policy is a legal contract between you and the insurance company, where the insurer promises to pay out a sum of money to the designated beneficiaries if the insured individual passes away during the policy term. The policy typically includes details such as the coverage amount, premium payments, and any specific conditions or exclusions.

The primary beneficiary is usually the person named by the insured individual in the policy. It's important to review the policy documents and confirm the beneficiary information with the insurance company or the insured person. You can contact the insurer to request a copy of the policy and verify your status as the primary beneficiary.

Yes, you can typically change the beneficiary of a life insurance policy. The process may vary depending on the insurance company and the policy type. Generally, you'll need to notify the insurer in writing, providing updated beneficiary information and any necessary documentation. It's advisable to consult the insurance company's guidelines or seek professional advice to ensure the changes are made correctly.

If the insured individual passes away before the policy term ends, the insurance company will typically pay out the death benefit to the beneficiaries. The amount paid out is usually the coverage amount specified in the policy. The beneficiaries can then use this payout for various purposes, such as covering funeral expenses, paying off debts, or providing financial support to family members.

Yes, there can be tax implications when receiving life insurance payouts. In many jurisdictions, life insurance proceeds are generally tax-free and not considered taxable income. However, there might be specific tax rules and regulations that apply, especially if the policy has certain features like an investment component. It's recommended to consult a tax professional or financial advisor to understand the tax implications in your specific situation.